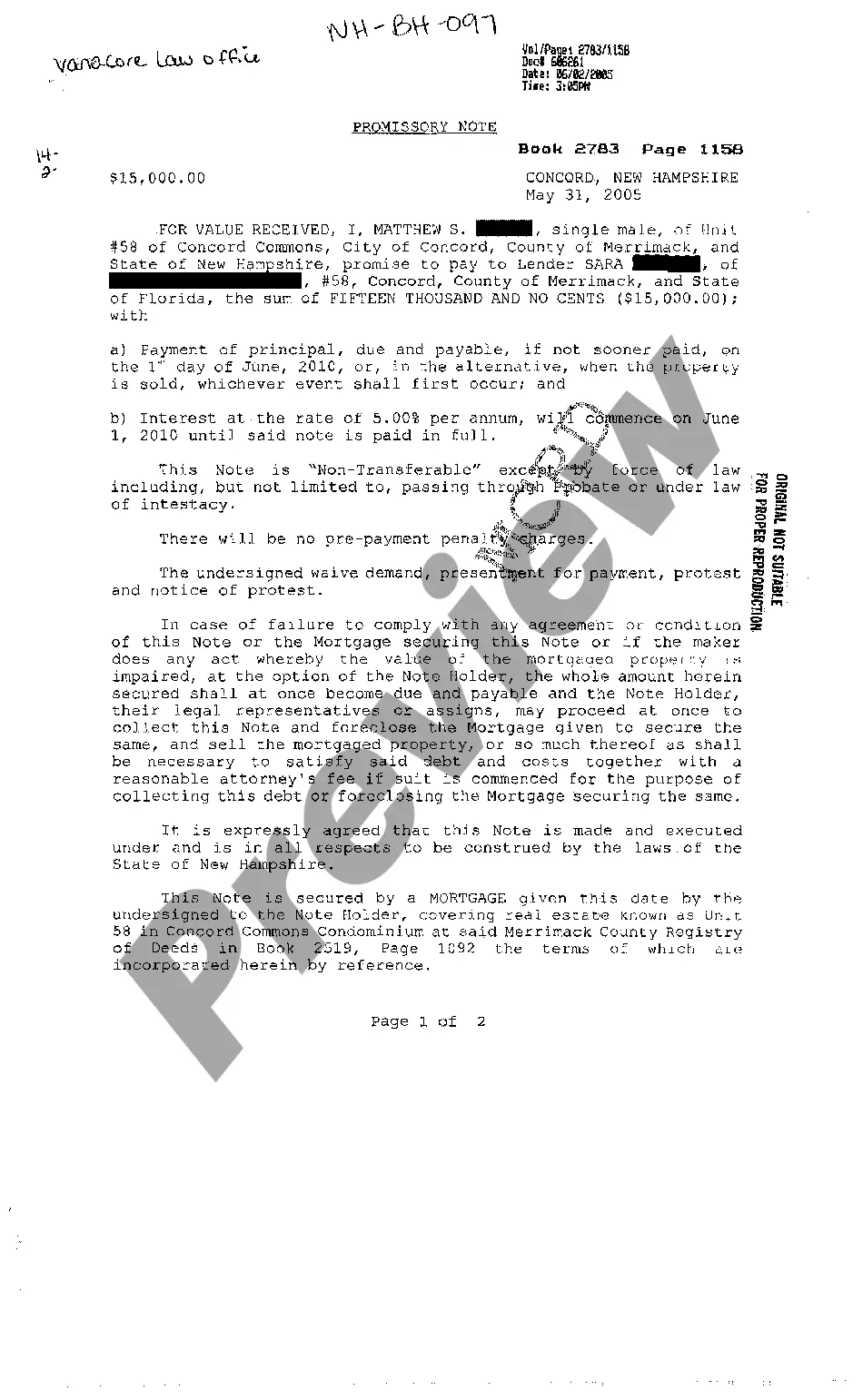

Promissory Note Secured By Mortgage With Collateral

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

Red tape requires exactness and correctness.

Unless you regularly handle the completion of documentation such as Promissory Note Secured By Mortgage With Collateral, it could result in some misinterpretations.

Selecting the appropriate sample initially will guarantee that your document submission proceeds seamlessly and avert any complications from resending a file or starting the same task entirely anew.

Explore the form descriptions and download those you need whenever necessary. If you aren't a registered user, locating the desired sample may require a few additional steps.

- Acquire the suitable sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand templates across various fields.

- You can access the most current and pertinent version of the Promissory Note Secured By Mortgage With Collateral by simply searching it on the platform.

- Locate, preserve, and download templates in your account or review the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can conveniently gather, store in one place, and navigate the templates you save to reach them in just a few clicks.

- When on the site, click the Log In button to authenticate.

- Subsequently, go to the My documents section, where the history of your documents is maintained.

Form popularity

FAQ

A secured promissory note is used when the lender requires collateral for the loan, such as a pledge of business equipment, inventory or accounts receivable. When a default occurs on a secured note, the lender has the option of using the collateral to satisfy the note, often without the need to file a lawsuit.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Collateral is an item of value used to secure a loan. Collateral minimizes the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages and car loans are two types of collateralized loans.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.