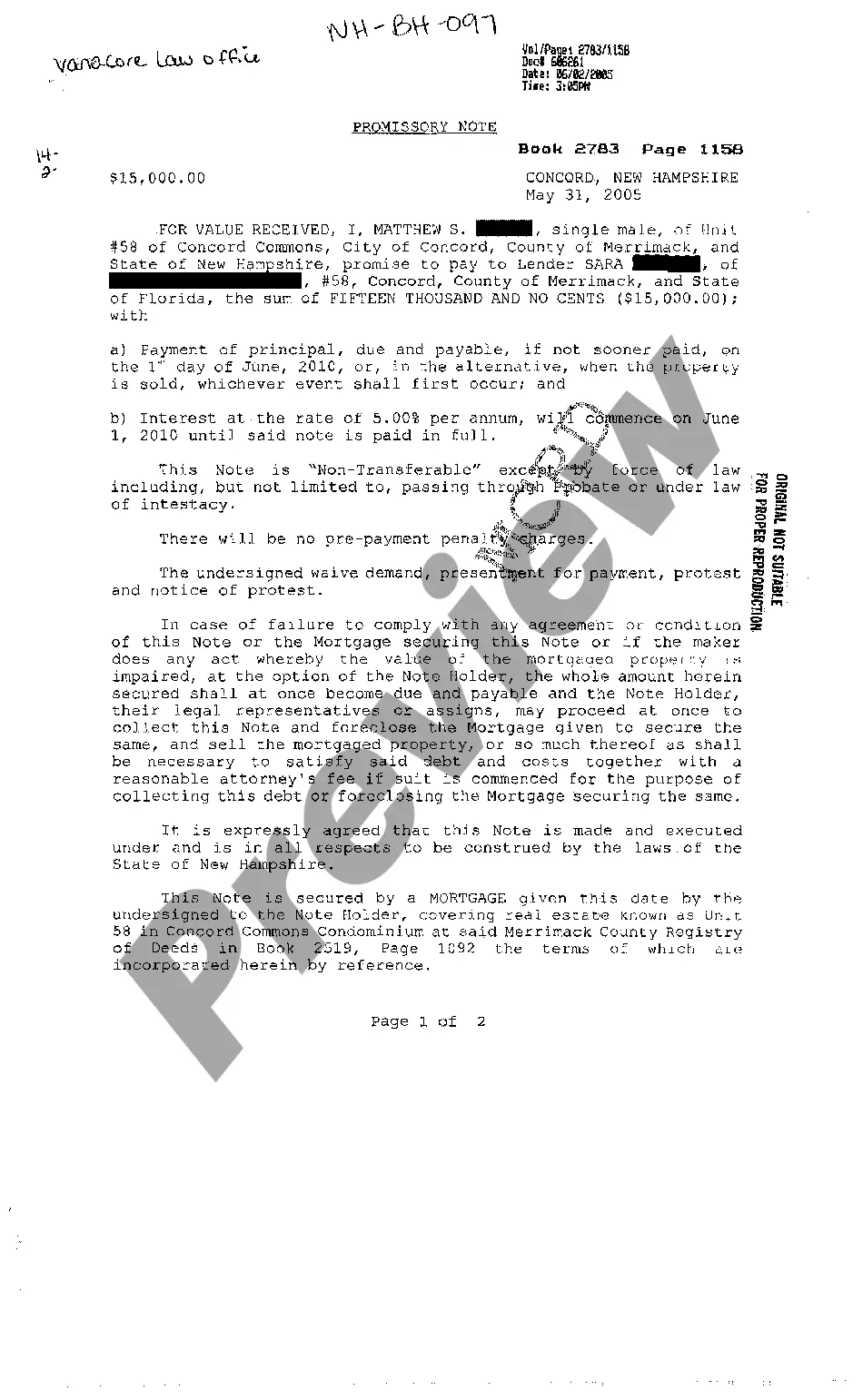

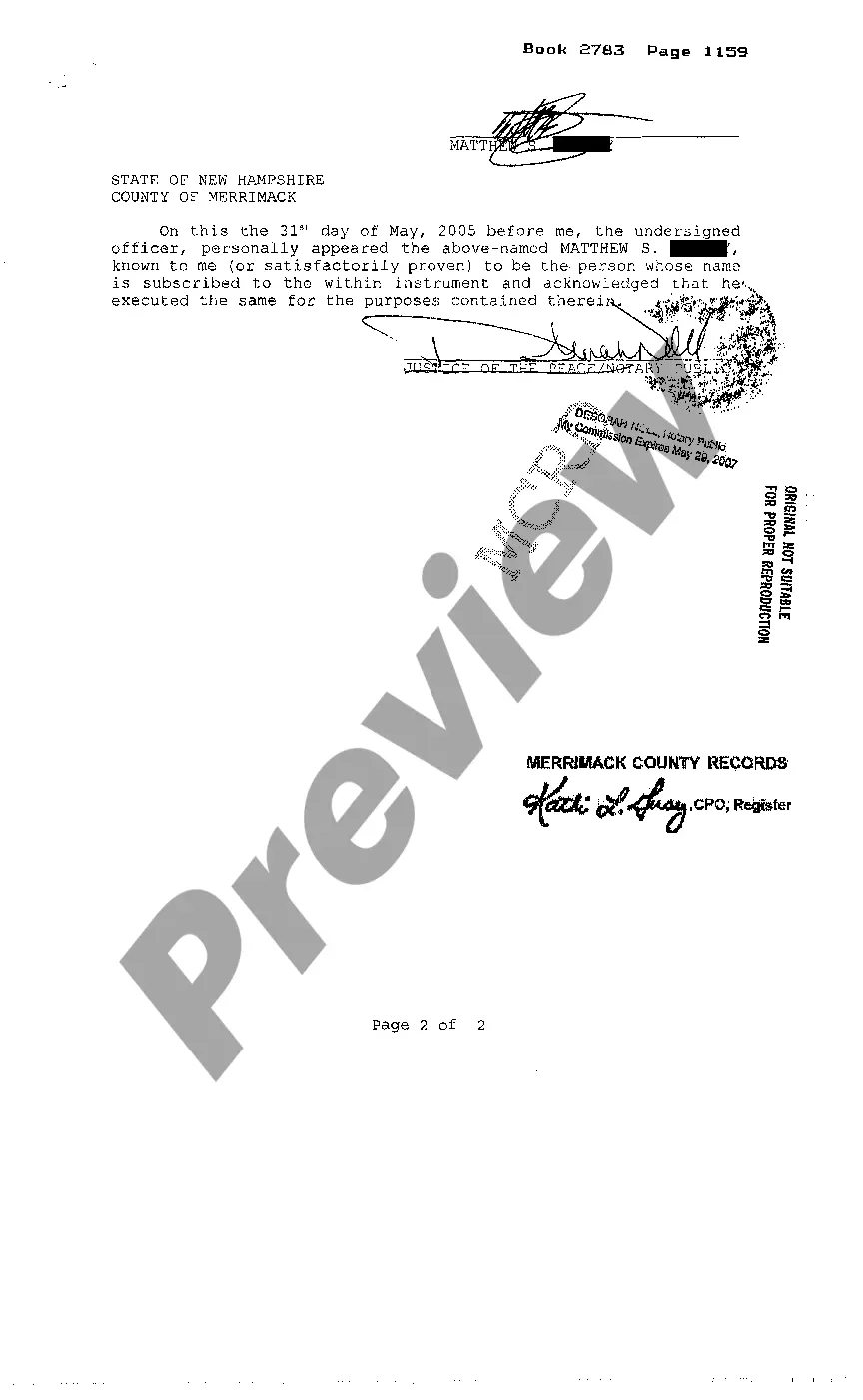

Promissory Note Secured By Mortgage With Balloon Final Payment)

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

Red tape requires detail and correctness.

If you don’t deal with completing forms like the Promissory Note Secured By Mortgage With Balloon Final Payment) regularly, it may lead to some misunderstanding.

Selecting the right example from the outset will ensure that your document submission proceeds smoothly and avoid any inconveniences from resubmitting a document or repeating the same task from the beginning.

If you are not a registered user, finding the necessary template may involve a few additional steps: Find the template via the search function. Ensure the Promissory Note Secured By Mortgage With Balloon Final Payment) you identified is valid for your region. Review the preview or check the description that outlines the details regarding the template's use. When the result matches your search, click the Buy Now button. Choose the appropriate option from the available subscription plans. Log In to your account or create a new one. Finalize the purchase using a credit card or PayPal as the payment method. Download the document in your preferred file format. Acquiring the correct and up-to-date samples for your paperwork can be done in just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your efficiency when dealing with documents.

- Acquire the suitable template for your documentation through US Legal Forms.

- US Legal Forms is the largest online directory of forms, housing over 85 thousand samples across various industries.

- You can find the most recent and relevant version of the Promissory Note Secured By Mortgage With Balloon Final Payment) by simply searching on the website.

- Identify, save, and download templates in your account or verify with the description to confirm you have the correct one accessible.

- With an account at US Legal Forms, you can effortlessly gather, store in a centralized place, and sift through the templates you save to retrieve them quickly.

- While on the site, click the Log In button to authenticate.

- Next, navigate to the My documents page, where your documents are organized.

Form popularity

FAQ

Repaying Loans with a Promissory Note Once a solid track record of repayment has been established, the borrower can refinance the promissory note with a traditional mortgage if desired and pay the seller off completely.

You can use a personal loan to pay off your mortgage, but this may not be the best strategy, particularly if the loan's interest rate is higher than your mortgage interest rate.

Cons of a balloon paymentThe loan provider may not approve refinancing of your balloon payment if you can't pay it when the time comes. Not being able to afford a balloon payment may lead to a cycle of debt because you will need to refinance it.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.