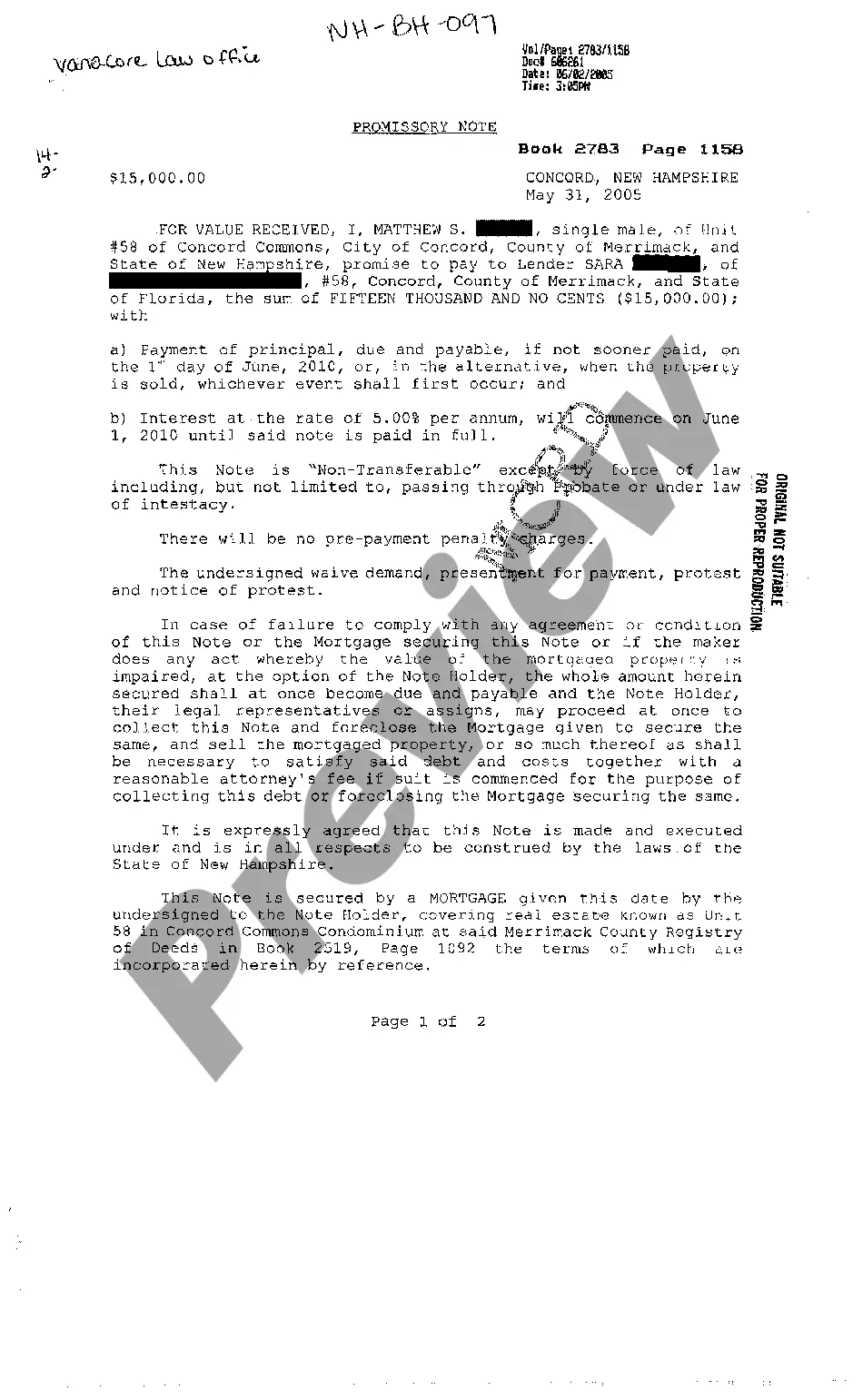

Promissory Note Secured By Mortgage Form

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

What is the most reliable service to obtain the Promissory Note Secured By Mortgage Form and other updated versions of legal papers.

US Legal Forms is the solution! It boasts the largest collection of legal templates for any situation.

If you haven’t created an account yet, here are the steps you need to follow to set one up: Template compliance review. Before acquiring any template, ensure it meets your requirements and is compliant with your state or county regulations. Read the template description and utilize the Preview feature if it’s available. Alternative document identification. If there are any discrepancies, use the search bar at the top of the page to find a different template. Click Buy Now to select the proper one. Account creation and subscription registration. Select the most suitable pricing option, Log In or create a new account, and process your subscription payment through PayPal or credit card. Obtaining the documents. Choose your preferred format (PDF or DOCX) to save the Promissory Note Secured By Mortgage Form and click Download to get it. US Legal Forms is an excellent solution for anyone needing to organize legal paperwork. Premium users enjoy additional benefits, such as the ability to complete and sign saved documents electronically at any time using the built-in PDF editing tool. Check it out today!

- Each template is expertly crafted and verified for adherence to federal and local laws and regulations.

- They are categorized by field and state of application, making it easy to find exactly what you require.

- Experienced users simply need to Log In to the platform, ensure their subscription is active, and click the Download button next to the Promissory Note Secured By Mortgage Form to acquire it.

- After saving, the template is accessible for future use under the My documents section of your account.

Form popularity

FAQ

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.