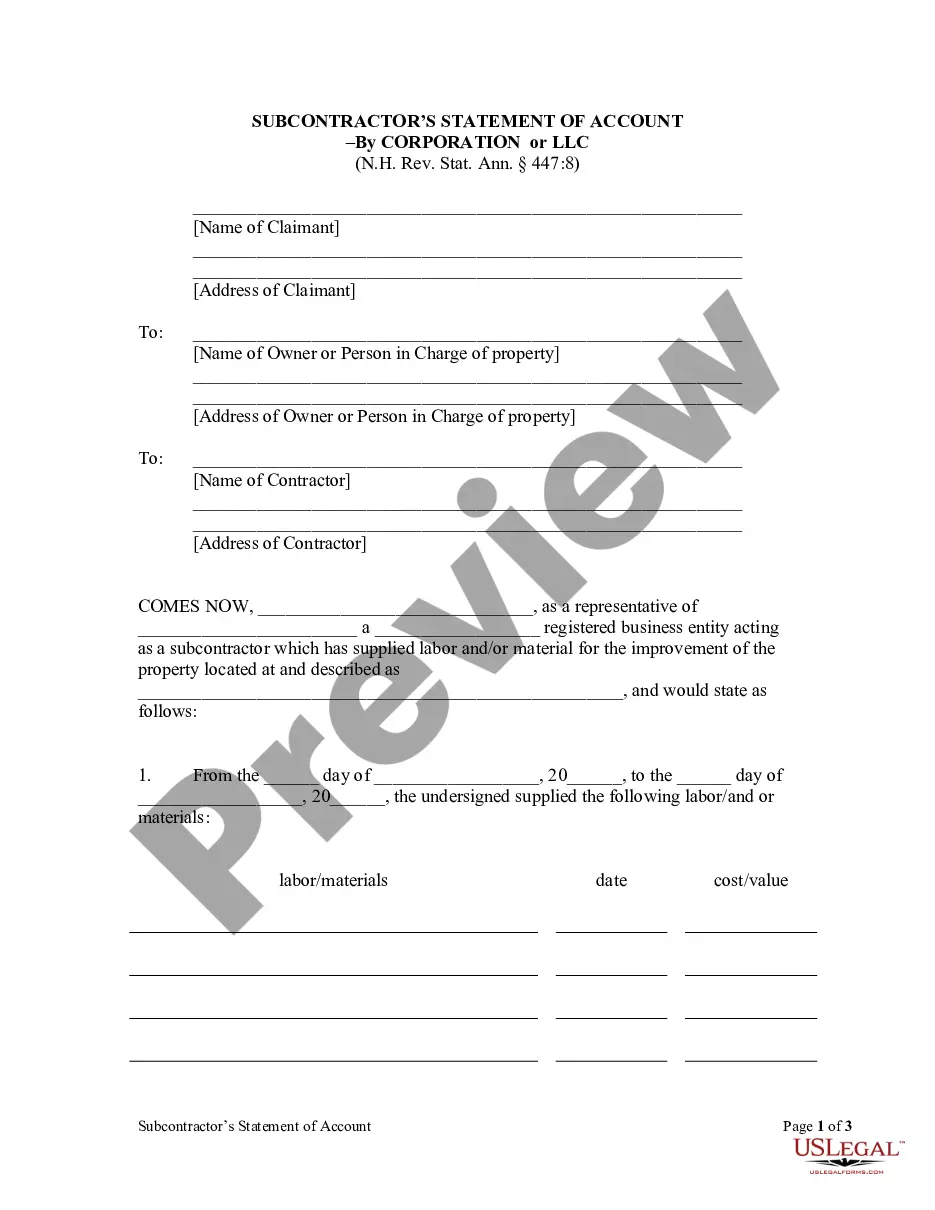

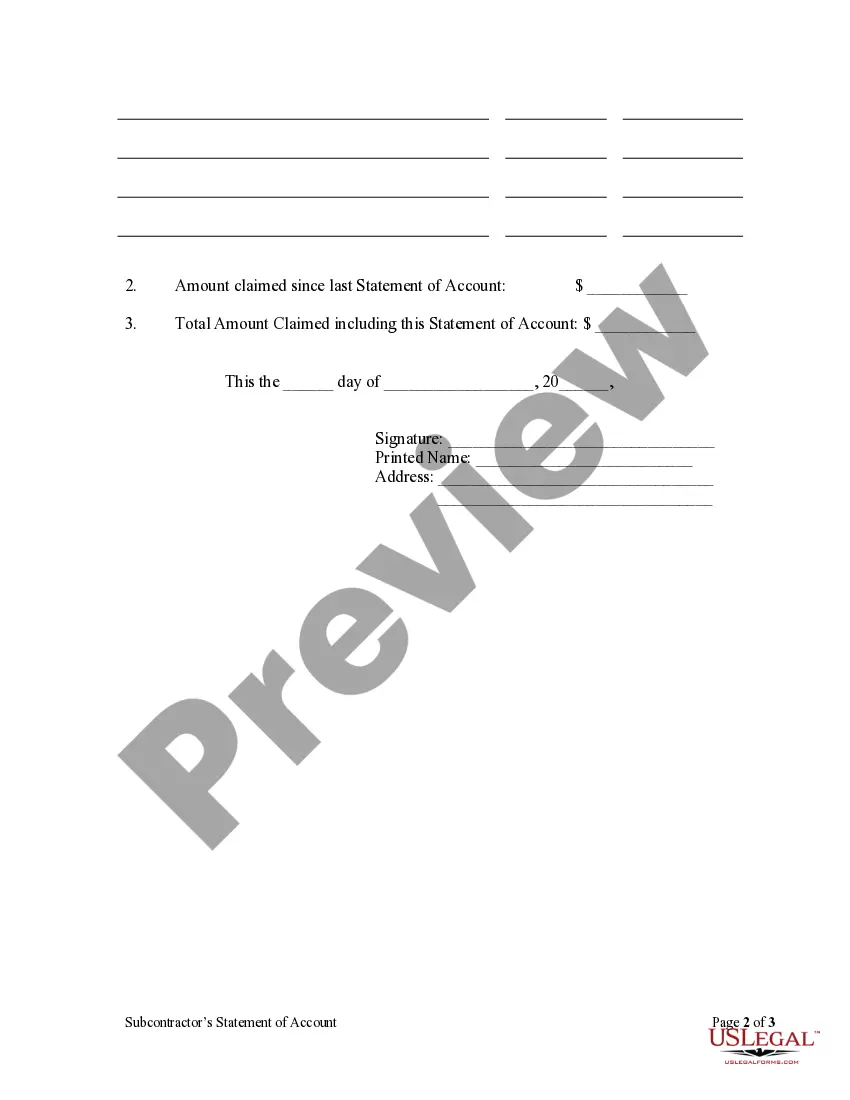

Subcontractor's Notice of Account - Corporation: A Subcontractor's Statement of Account lists the amount of time, materials and labor the corporation has exerted on a particular job site. For these services rendered, the corporation states the amount due on the account.

New Hampshire Account Withholding Certificate

Description

How to fill out New Hampshire Account Withholding Certificate?

When you must finalize the New Hampshire Account Withholding Certificate that adheres to your local state's statutes and regulations, there may be numerous options to select from.

There's no necessity to review every document to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a dependable service that can assist you in acquiring a reusable and current template on any subject.

Browse the suggested page and verify it for alignment with your needs. Utilize the Preview mode and read the form description if available. Find another template using the Search bar in the header if necessary. Click Buy Now when you locate the appropriate New Hampshire Account Withholding Certificate. Choose the most fitting pricing plan, Log In to your account, or create one. Pay for a subscription (options for PayPal and credit card payments are available). Download the template in the desired file format (PDF or DOCX). Print the document or complete it electronically using an online editor. Acquiring expertly drafted official documents becomes uncomplicated with US Legal Forms. Additionally, Premium users can also benefit from the robust integrated tools for online document editing and signing. Experience it today!

- US Legal Forms is the most comprehensive online catalog with a compilation of over 85k ready-to-use documents for business and individual legal situations.

- All templates are verified to comply with each state's laws.

- Consequently, when downloading the New Hampshire Account Withholding Certificate from our platform, you can be assured that you have a valid and current document.

- Obtaining the necessary template from our platform is very simple.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and retrieve the New Hampshire Account Withholding Certificate at any time.

- If this is your first interaction with our website, please follow the instructions below.

Form popularity

FAQ

Individuals who earn income in New Hampshire may need to file a New Hampshire account withholding certificate. This form is essential for those whose employers withhold state taxes from their paychecks. By filing the certificate, you ensure accurate withholding, preventing underpayment or overpayment of state taxes. Utilizing platforms like USLegalForms can simplify this process and help you find the right forms easily.

Filling out an employee withholding certificate involves providing necessary details like your name, address, and Social Security number. Additionally, you should specify your filing status and the number of allowances you're claiming. This step is crucial for determining the right amount of withholding, and using the New Hampshire account withholding certificate will guide you through it.

To fill out a withholding certificate effectively, begin by entering your personal information, such as your name, address, and Social Security number. Next, indicate your filing status and any claims for allowances. Following this guide ensures that your employer knows the correct withholding amount, making the New Hampshire account withholding certificate a practical tool.

Filling out a withholding exemption form requires you to indicate your eligibility for exemption from withholding, typically based on specific criteria. For instance, you may qualify if you had no tax liability last year and expect none this year. Be sure to complete the New Hampshire account withholding certificate accurately to avoid any tax surprises.

To fill out the employee withholding certificate in step 3, you need to identify any additional income you expect for the year. This includes income from jobs outside your main employment or self-employment earnings. Accurate reporting ensures the correct amount of tax is withheld. Utilizing a New Hampshire account withholding certificate simplifies the process.

A withholding statement serves to summarize the amount of taxes withheld from your paycheck. This document provides clarity on your tax obligations and can help you plan for your financial future. By reviewing your withholding statement, you can ensure that your New Hampshire account withholding certificate accurately reflects your financial needs. It's an essential tool for managing your taxes efficiently.

Yes, New Hampshire has a state withholding form, known as the New Hampshire account withholding certificate. This form allows employees to declare their withholding preferences and helps employers with correct tax deductions. Utilizing this certificate promotes efficient tax compliance and minimizes potential discrepancies during tax filing.

You need to file the NH DP 10 if you have withholding tax obligations under the New Hampshire tax regulations. This applies primarily to employers who withhold taxes from employee wages. To ensure accurate reporting and compliance, reference your New Hampshire account withholding certificate when completing the DH DP 10.

Yes, filing New Hampshire taxes online is possible. Many platforms and software options facilitate online tax filing, making it a convenient choice. While you prepare necessary documents such as your New Hampshire account withholding certificate, online filing can often expedite the overall tax process.

In New Hampshire, you generally do not need to file a state income tax return since there is no income tax on wages. However, if you have income from sources like interest and dividends exceeding a certain threshold, you will need to file. It's crucial to consider your financial situation and consult a tax advisor for clarity. Utilizing the New Hampshire account withholding certificate can assist in strategizing your tax responsibilities.