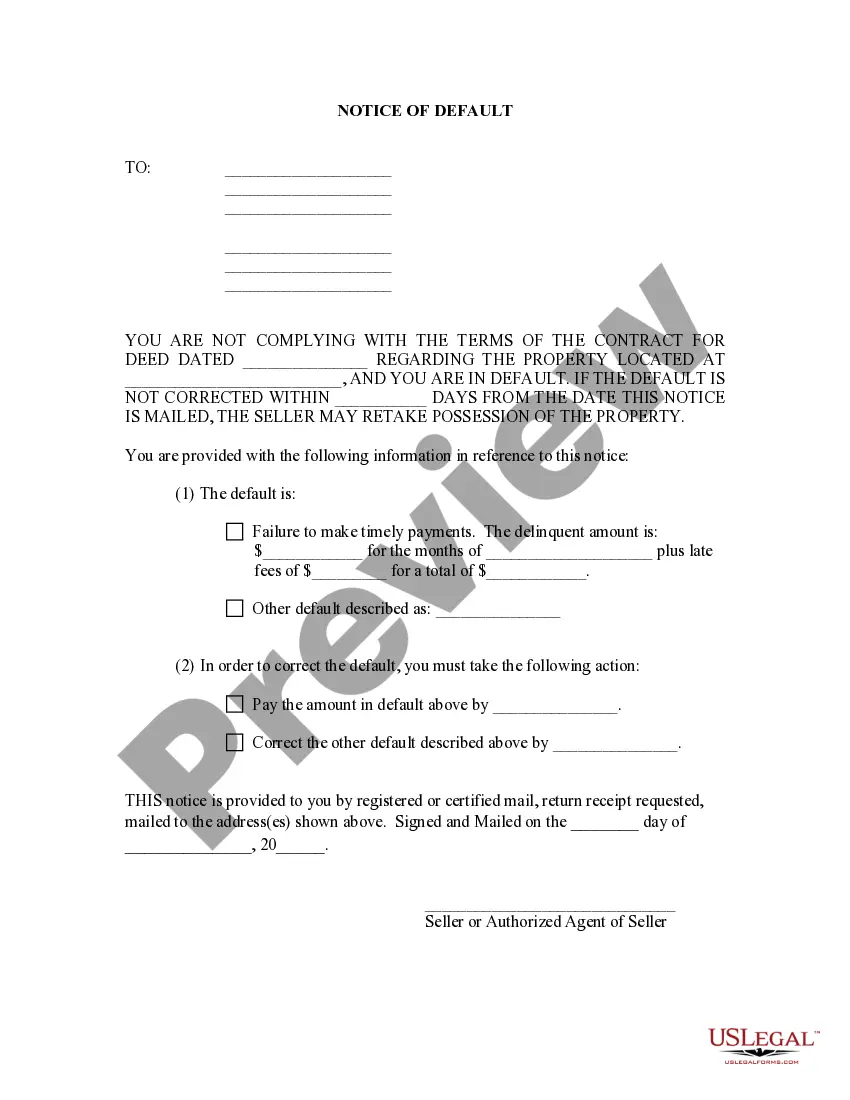

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

New Hampshire Deed Forecast

Description

How to fill out New Hampshire Deed Forecast?

Well-constructed official paperwork is one of the crucial safeguards for steering clear of complications and legal disputes, but acquiring it without the help of an attorney may require time.

Whether you need to swiftly locate a current New Hampshire Deed Projection or any other documents for employment, family, or commercial circumstances, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Additionally, you can retrieve the New Hampshire Deed Projection at any time, as all documents ever acquired on the platform are accessible within the My documents tab of your profile. Save time and money on preparing official documents. Try US Legal Forms today!

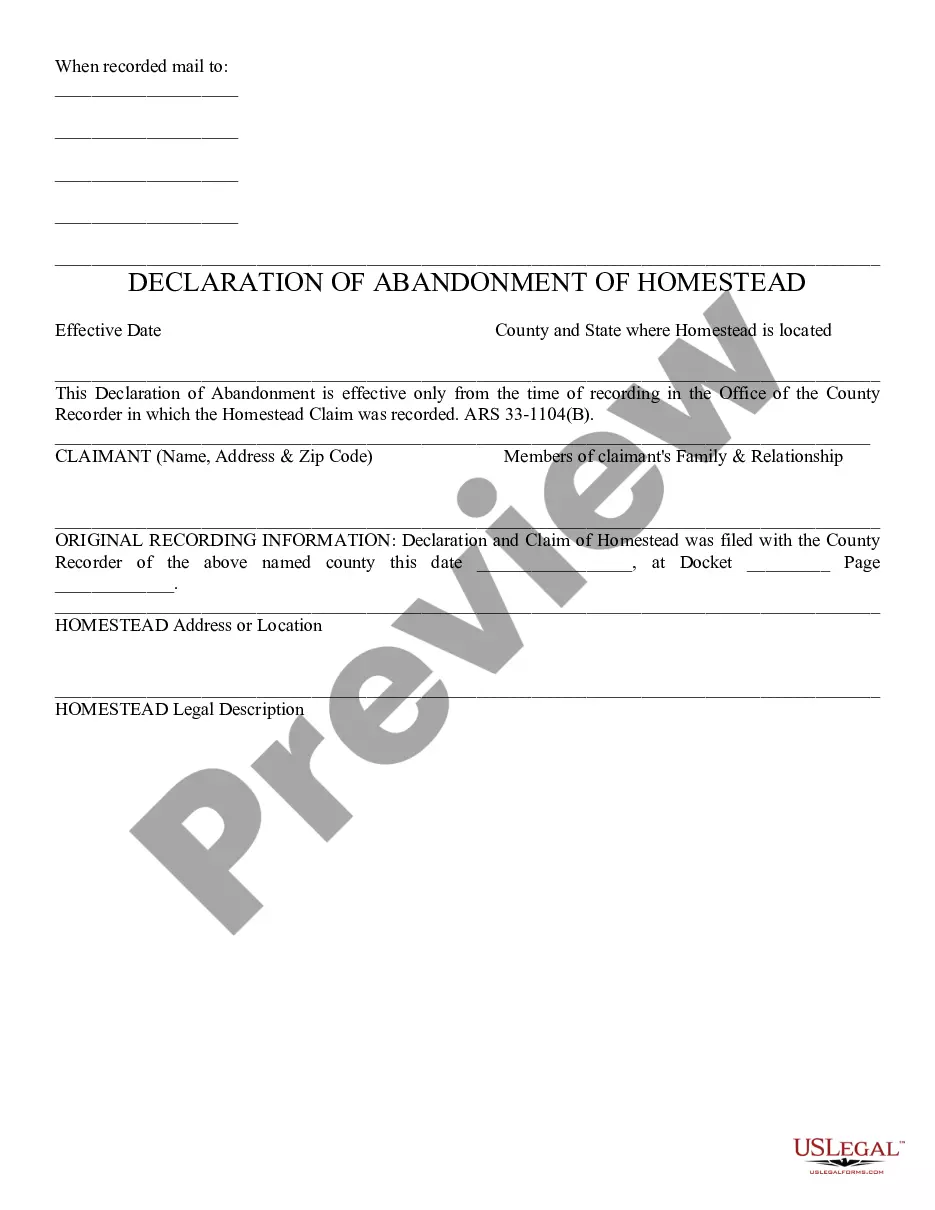

- Ensure that the document fits your situation and area by examining the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now when you identify the suitable template.

- Select the pricing plan, Log Into your account or create a new one.

- Choose your preferred payment option to buy the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your New Hampshire Deed Projection.

- Click Download, then print the template to fill it out or upload it to an online editor.

Form popularity

FAQ

In New Hampshire, certain exemptions exist for the real estate transfer tax (RETT). These typically include transfers between spouses, transfers made by a nonprofit organization, and transactions involving property that does not change hands, like a change in trustee. Understanding these exemptions enhances your New Hampshire deed forecast, helping you navigate potential costs.

Getting a copy of your house deed in New Hampshire is easy. You can approach the county registry of deeds in person or utilize their online services if available. Just provide them with details like your property's address or the name of the previous owner to help locate the deed. Using platforms like US Legal Forms can simplify this process and provide you with insights into your New Hampshire deed forecast.

To obtain a copy of your property deed in New Hampshire, you can visit your local county registry of deeds, where such documents are filed. Many registries also offer online search tools, allowing you to view and request copies conveniently from home. Fees may apply for printed copies, so be prepared for that. For a more guided experience and detailed resources, consider using US Legal Forms to assist with your New Hampshire deed forecast.

Yes, deeds are public records in New Hampshire, which means anyone can access them. These records are typically maintained at the county registry of deeds. This transparency allows homeowners and potential buyers to verify property ownership and understand property history. To explore your New Hampshire deed forecast or access specific records, check resources like US Legal Forms for streamlined search processes.

Currently, New Hampshire is discussing the future of its interest and dividend tax but has not fully phased it out. Monitoring these changes can help you better plan financially. By staying updated, you can make informed decisions that affect your New Hampshire deed forecast.

To update a deed in New Hampshire, you must create a new deed that reflects the changes. This new deed must be signed, notarized, and then recorded at the local registry of deeds. Ensuring your deed remains current is vital for an accurate New Hampshire deed forecast.

The NH tax form DP-10 is a declaration that determines taxes on interest and dividends. Taxpayers must complete this form if their income exceeds specific thresholds. Staying compliant ensures that your financial planning, including the New Hampshire deed forecast, remains smooth.

Recording a deed in New Hampshire involves submitting the completed deed to your local registry of deeds. You will typically need the original deed, payment for recording fees, and possibly a cover sheet. Timely recording helps maintain a clear and trustworthy New Hampshire deed forecast.

To file a quit claim deed in New Hampshire, you must prepare the deed with accurate information about the property and the parties involved. Once completed, the deed needs to be signed and notarized. Finally, you can file it with the local registry of deeds, which is essential for maintaining an accurate New Hampshire deed forecast.

Filing a New Hampshire state tax return depends on your income sources. Generally, if you receive taxable interest or dividends, you must file. It's essential to stay informed, as this aspect ties into the New Hampshire deed forecast.