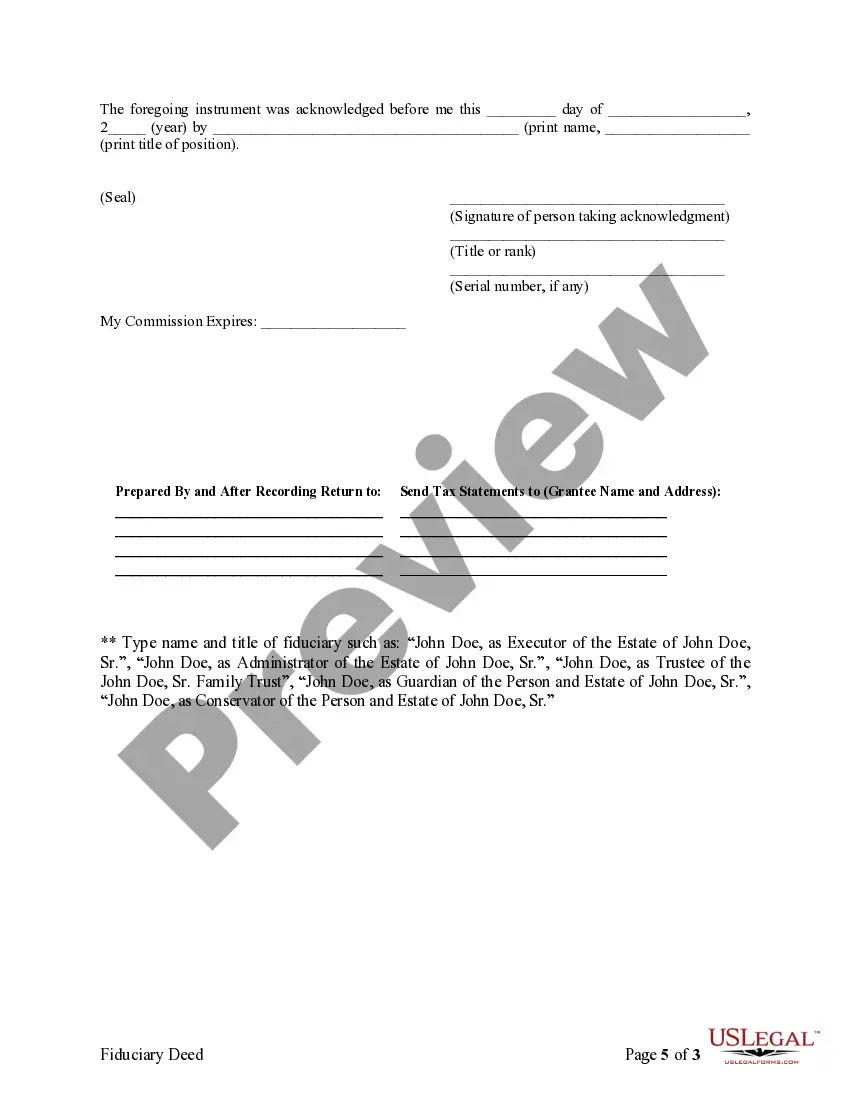

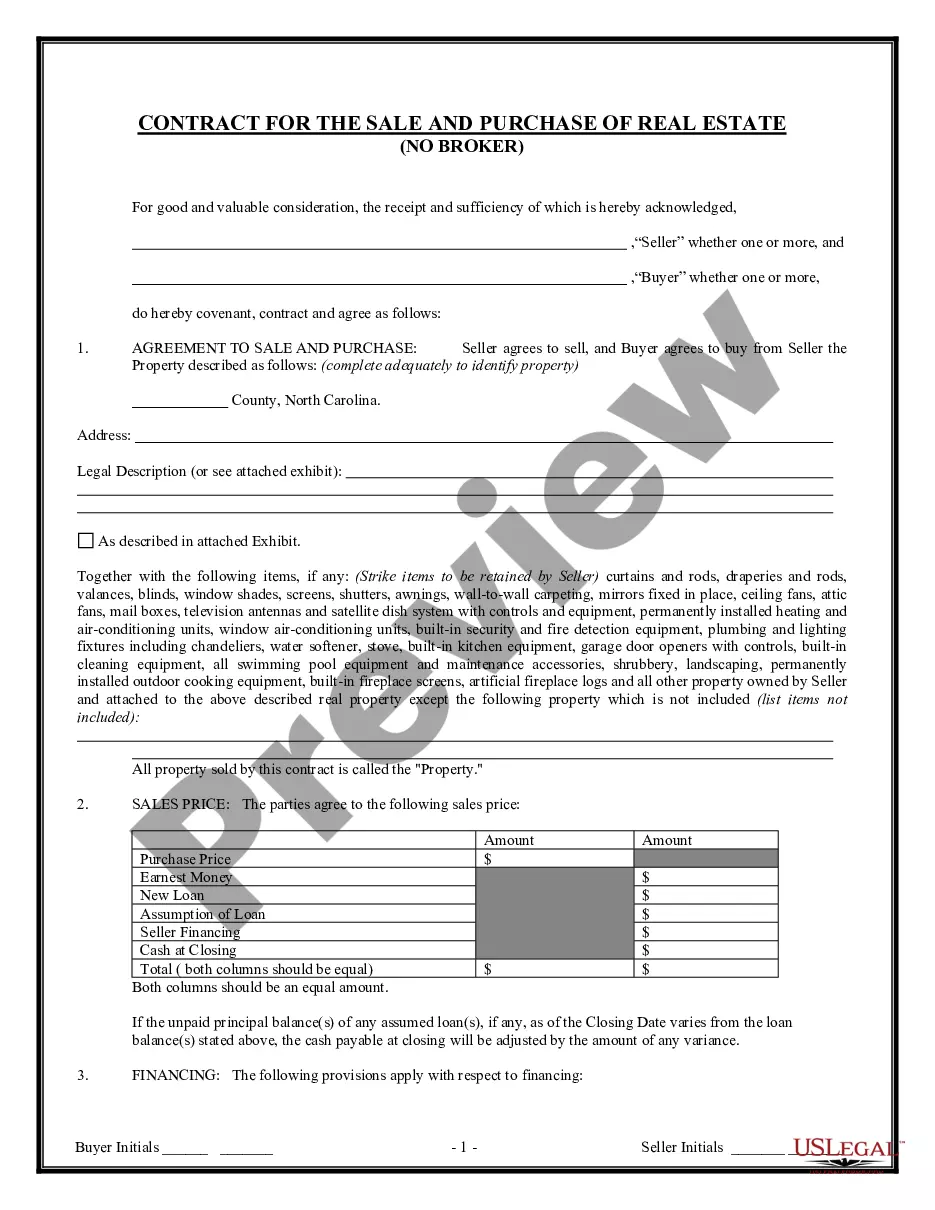

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Executor Deed Nebraska With Mortgage

Description

How to fill out Executor Deed Nebraska With Mortgage?

What is the most reliable service to obtain the Executor Deed Nebraska With Mortgage and other up-to-date versions of legal documentation? US Legal Forms is the answer!

It's the largest repository of legal forms for any circumstance. Each template is carefully drafted and validated for conformity with federal and local regulations. They are organized by area and state of usage, so finding the one you need is an easy task.

US Legal Forms is an excellent option for anyone needing to manage legal documentation. Premium users can benefit even more by electronically completing and approving previously saved documents anytime using the built-in PDF editing tool. Give it a try now!

- Experienced users of the site just need to Log In to the platform, verify if their subscription is active, and click the Download button adjacent to the Executor Deed Nebraska With Mortgage to obtain it.

- Once saved, the template stays accessible for more use in the My documents section of your account.

- If you haven't created an account within our library yet, here are the steps you should follow to set one up.

- Form compliance review. Before acquiring any template, you need to ensure that it aligns with your intended use and complies with your state or county's statutes. Review the form description and use the Preview function if it's available.

Form popularity

FAQ

In Nebraska, you do not necessarily need a lawyer to file a transfer on death deed, but having legal guidance is beneficial, especially if the deed involves an executor deed in Nebraska with mortgage considerations. This type of deed allows for property transfer upon death without probate, simplifying the process. For support with this and related forms, USLegalForms provides valuable tools and templates.

Yes, you can transfer a deed without an attorney in Nebraska, provided you understand the requirements and procedures involved. However, if the transfer relates to an executor deed in Nebraska with mortgage obligations, seeking legal advice can help ensure that all documents are completed accurately. USLegalForms offers resources that can aid you in preparing the necessary paperwork.

To fill out a quit claim deed in Nebraska, gather the necessary information, including the names of the grantor and grantee, a legal description of the property, and any mortgage details. Clearly state your intentions in the document, especially if it relates to executor deeds in Nebraska with mortgage obligations. You can find useful templates on USLegalForms to guide you through the process.

Transferring a house deed in Nebraska involves preparing a new deed, such as a quit claim deed or warranty deed, and then recording it with the county register of deeds. Make sure that the mortgage details are clear in the new document, especially if you're dealing with an executor deed in Nebraska with mortgage. Using USLegalForms, you can find templates and guidelines to simplify this process.

The most powerful deed is often viewed as the general warranty deed due to its all-encompassing warranty of title. In the case of executor deeds in Nebraska with mortgage, this type of deed may still offer a certain level of assurance, but it is critical to understand its limitations. Engaging with platforms like USLegalForms can provide clarity on how best to secure your property rights.

Statute 76-239 in Nebraska governs the transfer of property and the specifics related to executor deeds. This statute outlines the responsibilities of an executor concerning property conveyance, especially when a mortgage is involved. For anyone dealing with executor deeds in Nebraska, it is crucial to be aware of this statute to ensure compliance and proper handling of the estate.

The highest quality deed is often a general warranty deed, as it includes maximum protection from future claims and assures a buyer of a clear title. When dealing with executor deeds in Nebraska with mortgage, quality and clarity are vital to avoid potential disputes. Utilizing a reputable legal resource can assist you in understanding deed quality.

The highest level of deed is typically a full warranty deed, which provides extensive assurances about the property title. As you navigate executor deeds in Nebraska with a mortgage, understanding the type of deed you are working with is essential to ensure legal protection. It’s advisable to consult legal resources or platforms like USLegalForms to clarify deed levels.

The strongest form of deed is often considered the general warranty deed. It offers comprehensive protections to the buyer by guaranteeing that the seller holds clear title to the property. In Nebraska, executor deeds with mortgage can be effective, but understanding their limitations compared to general warranty deeds helps ensure better protection.

In Nebraska, an executor generally has 12 months to settle an estate, but this period can be extended for various reasons. Timely settlement is important for distributing assets to beneficiaries and ensuring compliance with state laws. If you are managing an estate involving an executor deed in Nebraska with a mortgage, keep in mind that some processes may take longer. It's advisable to work with legal professionals to navigate through complex issues.