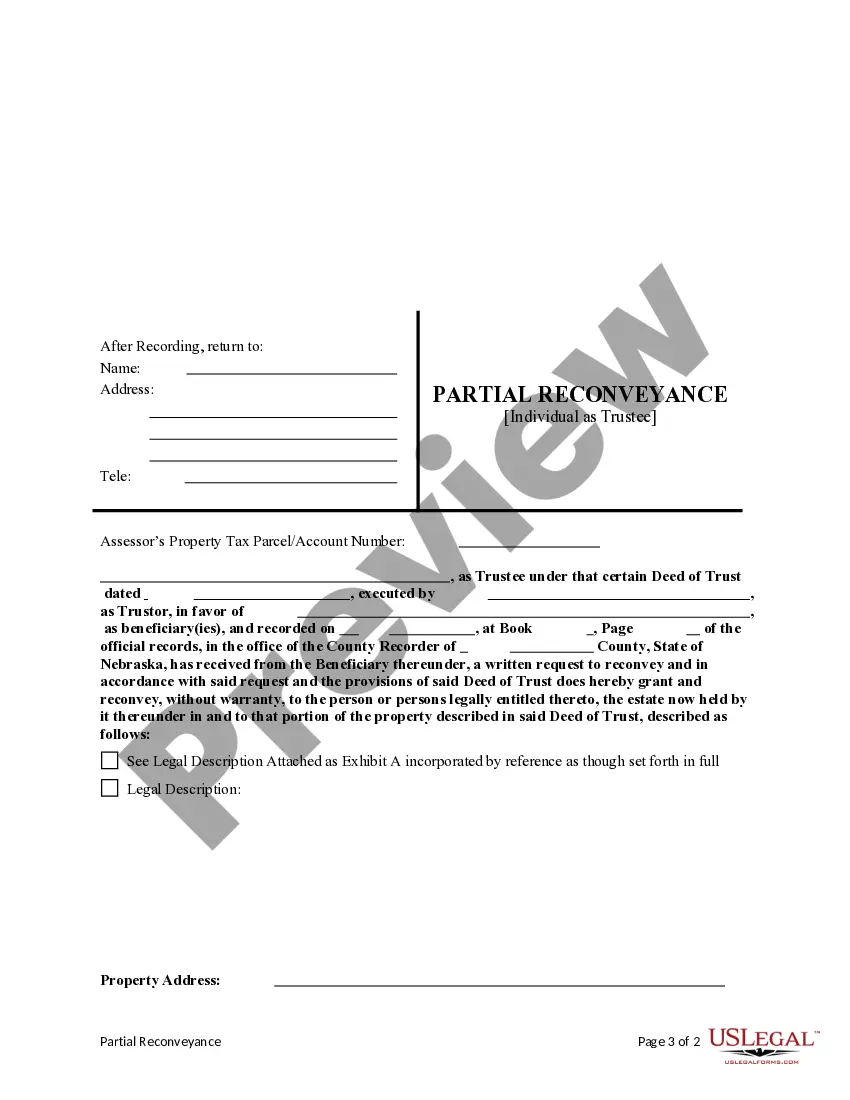

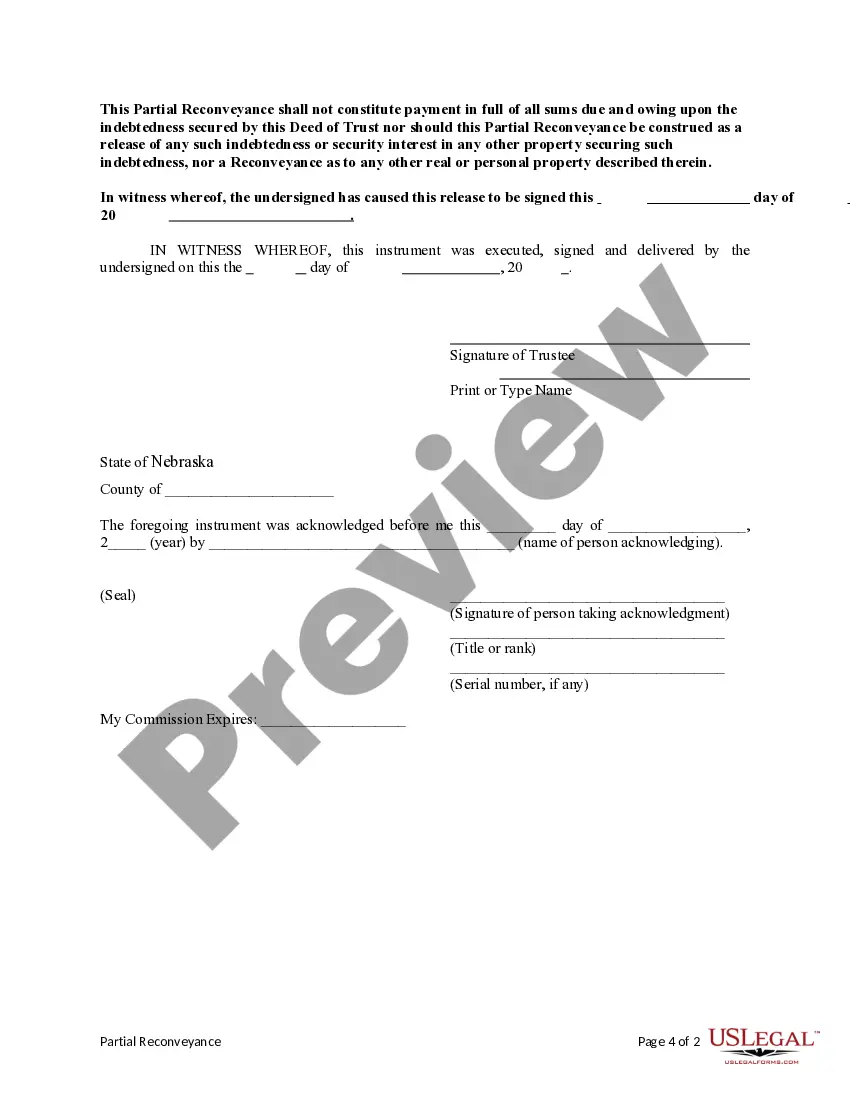

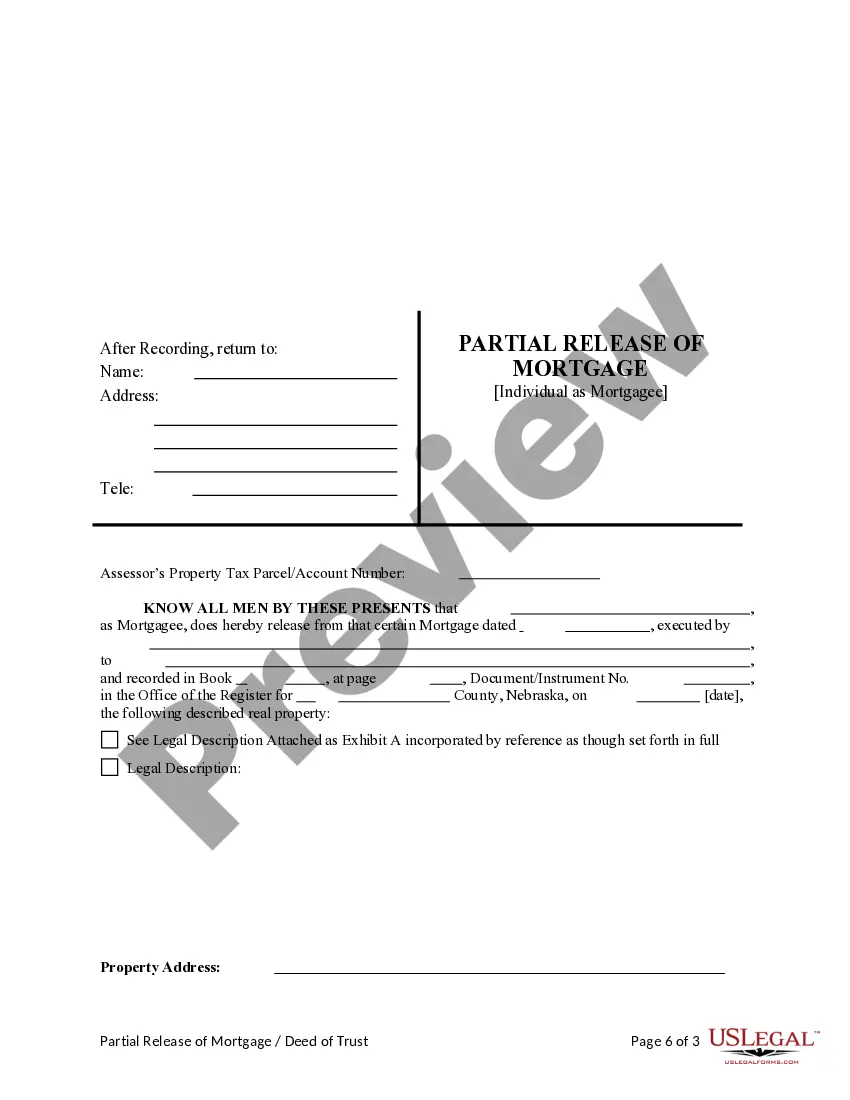

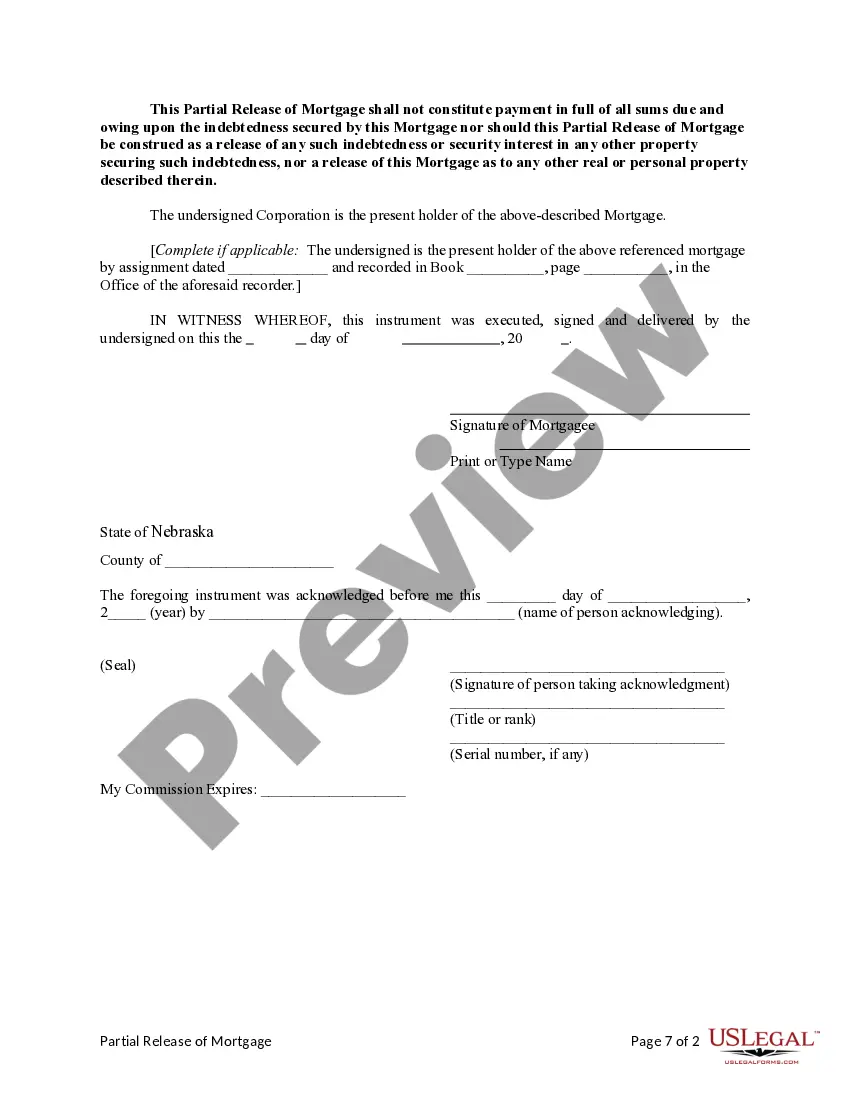

This form is for a holder of a deed of trust or mortgage to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Nebraska Deed Of Trust Foreclosure

Description

How to fill out Nebraska Partial Release Of Property From Deed Of Trust Or Mortgage For Individual?

Properly prepared official documentation is among the critical assurances for preventing problems and legal disputes, but acquiring it without an attorney's assistance may require time.

Whether you need to swiftly obtain a current Nebraska Deed Of Trust Foreclosure or any other forms for work, family, or business circumstances, US Legal Forms is always ready to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can access the Nebraska Deed Of Trust Foreclosure at any time since all documentation obtained on the platform is stored within the My documents section of your account. Save time and resources on preparing official paperwork. Experience US Legal Forms today!

- Verify that the form is appropriate for your needs and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Press Buy Now when you locate the right template.

- Select a pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Nebraska Deed Of Trust Foreclosure.

- Click Download, then print the template for completion or incorporate it into an online editor.

Form popularity

FAQ

In Nebraska, there is a redemption period for homeowners affected by a deed of trust foreclosure. Typically, the redemption period lasts for one year from the date of the foreclosure sale. This means you have the opportunity to reclaim your property by paying off the amount owed, plus any associated fees. Understanding this process is essential, and using resources like US Legal Forms can help you navigate the intricacies of Nebraska deed of trust foreclosure.

The Nebraska Deed of Trust Act outlines the rules and procedures for securing loans with real property. This act allows lenders to use a deed of trust instead of a mortgage, which facilitates a more straightforward foreclosure process. Understanding this act is crucial for borrowers to navigate the Nebraska deed of trust foreclosure effectively. You can find detailed information and resources about the act on platforms like USLegalForms.

In Nebraska, foreclosure typically follows a judicial process. Lenders must file a lawsuit to pursue foreclosure through the courts. Once the court approves the foreclosure, the property may be sold at a public auction. It is essential for homeowners to understand the Nebraska deed of trust foreclosure process to protect their rights and options.

Yes, Nebraska allows for non-judicial foreclosures under certain conditions, particularly for deeds of trust. This process can be quicker and simpler than judicial foreclosures, which often involve court proceedings. Understanding non-judicial foreclosure is essential, especially if you're facing Nebraska deed of trust foreclosure. Awareness of the process can help you take appropriate steps to protect your property and rights.

Nebraska is classified as a deed of trust state. This distinction is critical, especially when dealing with foreclosures. If you are facing potential foreclosure, understanding that Nebraska relies on deeds of trust can clarify the legal process you will encounter. It also underscores the importance of consulting legal experts about Nebraska deed of trust foreclosure to safeguard your interests.

Several states, primarily in the western United States, utilize a deed of trust instead of a traditional mortgage. States such as California, Washington, and Arizona commonly employ the deed of trust model. In Nebraska, this practice is prevalent and impacts the foreclosure process significantly. Knowing whether your state uses a deed of trust can help you better understand your options in case of Nebraska deed of trust foreclosure.

The foreclosure process in Nebraska can vary significantly, typically lasting several months to over a year. The timeline depends on factors like the type of foreclosure and whether it is contested. An understanding of Nebraska deed of trust foreclosure laws can provide clarity on what to expect. Consulting with professionals can also help navigate this complex area, protecting your rights throughout the process.

Nebraska operates primarily as a deed of trust state. This means that most home loans in Nebraska are secured by a deed of trust rather than a traditional mortgage deed. Should foreclosure occur, understanding this distinction is crucial, particularly regarding the procedures involved in a Nebraska deed of trust foreclosure. Awareness of the type of security instrument can aid borrowers in making informed decisions.

Yes, Nebraska operates as a deed of trust state. This means that, in most mortgage transactions, a deed of trust is used instead of a traditional mortgage. This legal framework can streamline the foreclosure process, allowing for quicker resolutions in Nebraska deed of trust foreclosure situations, which can benefit both lenders and borrowers when properly managed.

In Nebraska, the time required for adverse possession is generally 10 years. During this period, an individual must demonstrate uninterrupted and open use of the property. This concept can sometimes interact with Nebraska deed of trust foreclosure, especially when properties enter distressing situations or when ownership disputes arise, making it crucial to understand your rights.