Nebraska Sales Tax For Contractors

Description

How to fill out Nebraska Contractors Forms Package?

Whether you frequently handle documents or need to submit a legal report every so often, it's vital to acquire a source of information where all the examples are connected and current.

The first step you should take with a Nebraska Sales Tax For Contractors is to verify that it is the latest version, as this determines its eligibility for submission.

If you aim to make your search for the most recent document samples easier, look for them on US Legal Forms.

Forget about the confusion associated with managing legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a repository of legal documents containing nearly every document sample you might need.

- Search for the templates you seek, immediately check their relevance, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Locate the Nebraska Sales Tax For Contractors samples in just a few clicks and save them at any moment in your profile.

- A US Legal Forms profile will provide you with easy access to all the samples you need with added convenience and less hassle.

- Simply click Log In in the website header and navigate to the My documents section with all the forms readily available, eliminating the need to spend time searching for the correct template or verifying its legitimacy.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

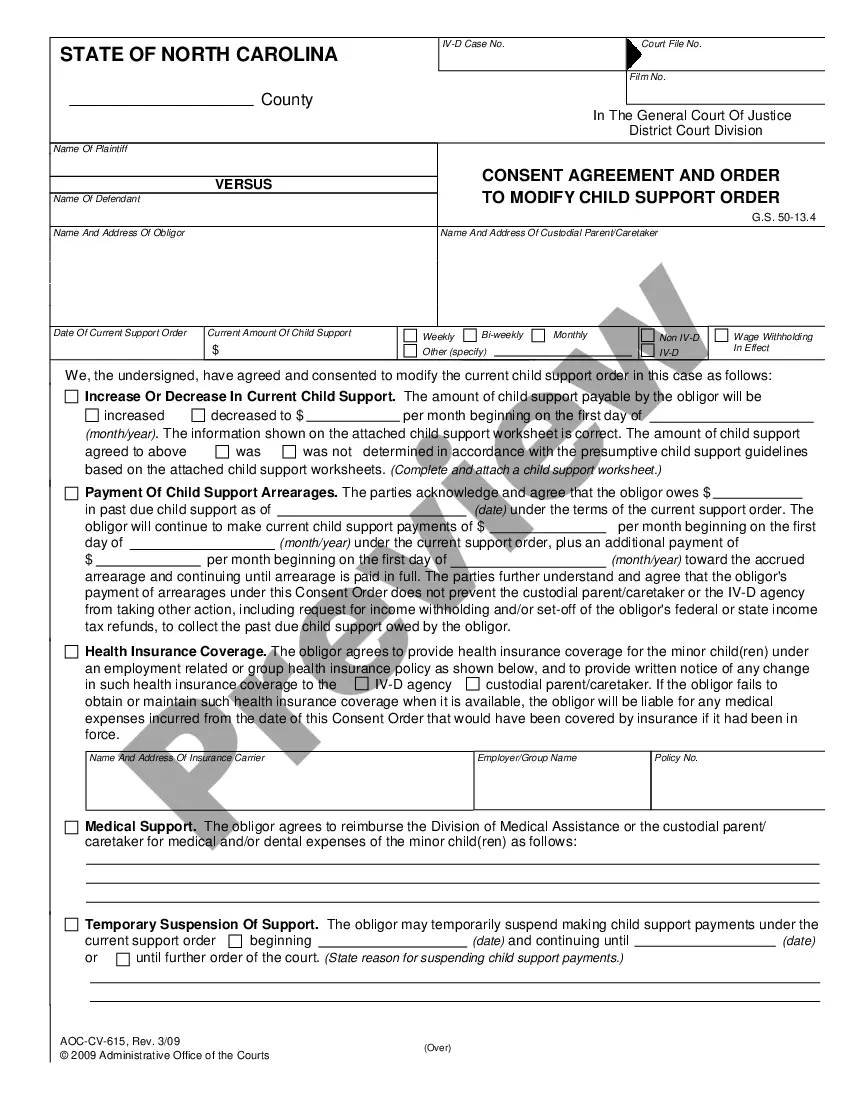

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

A contractor who elects Option 1 is a retailer of building materials and fixtures purchased and annexed to real estate.

A contractor who elects Option 2 is the consumer of building materials and fixtures purchased and annexed to real estate.

Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.