Recorded Lien Individual For The Future

Description

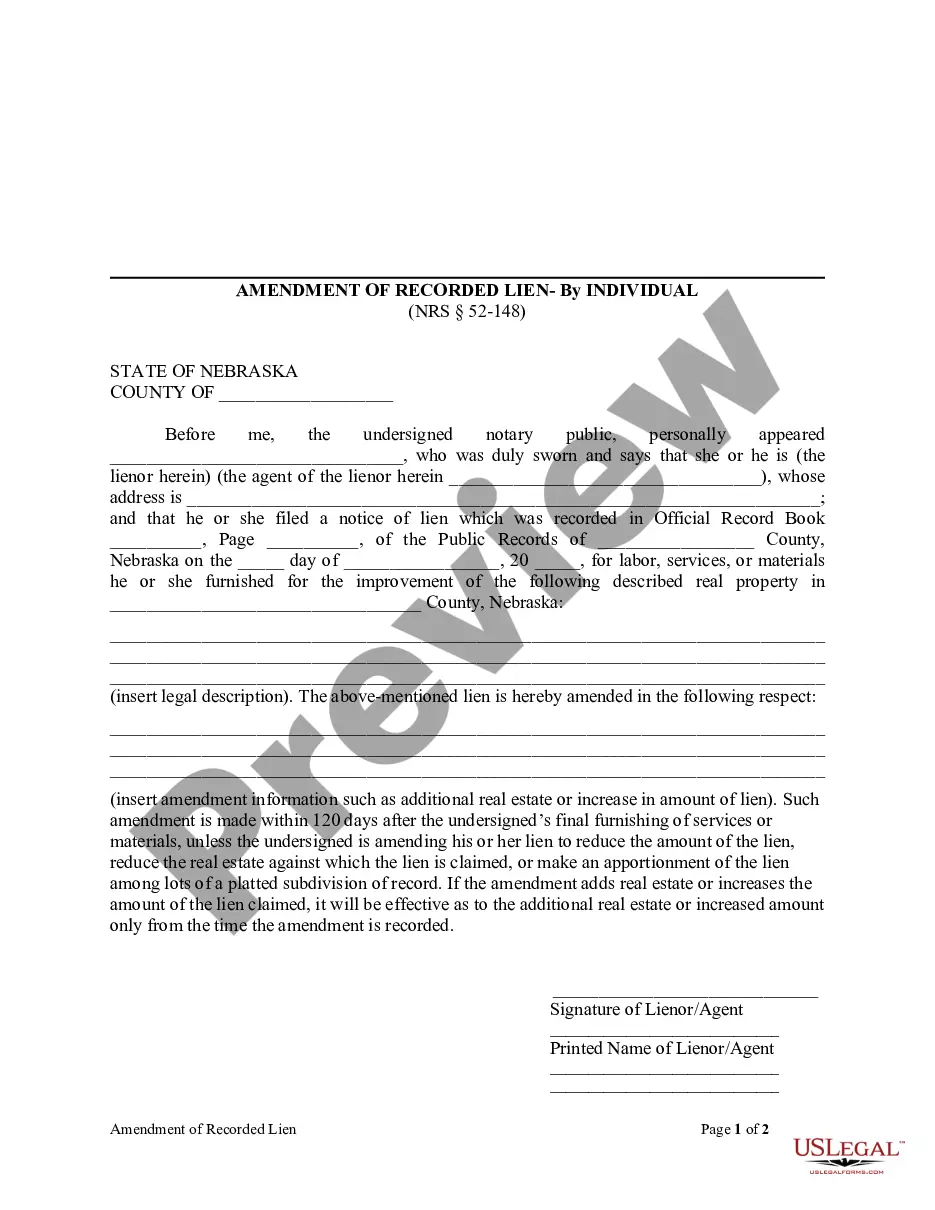

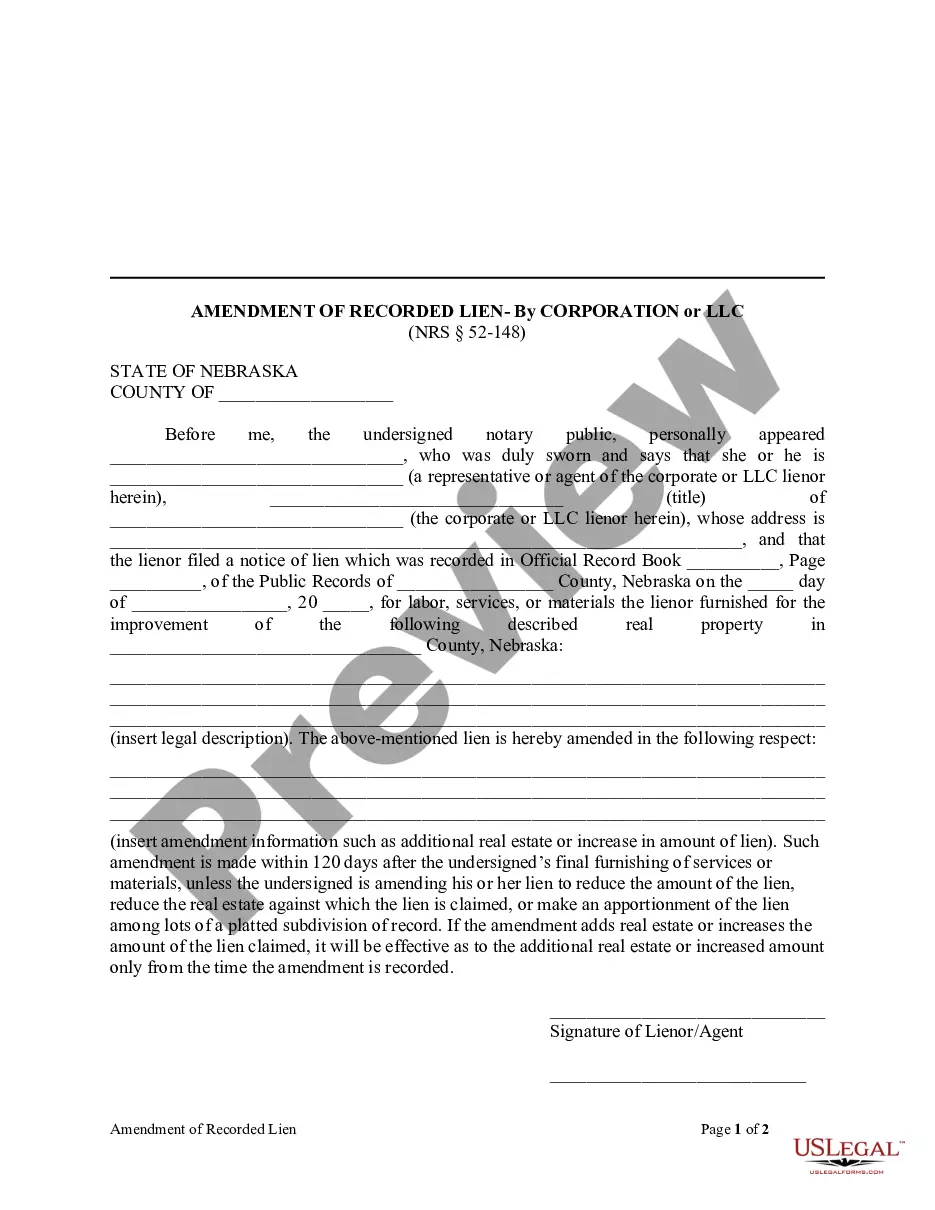

How to fill out Nebraska Amendment Of Recorded Lien - Individual?

- Log in to your US Legal Forms account if you’re a returning user. Ensure your subscription is current to avoid interruptions.

- If you’re new, start by reviewing the form preview and descriptions to select the right template that meets your requirements and complies with your local regulations.

- Use the search feature to find additional forms, if necessary, to make sure you have the correct documentation.

- Select the document you need by clicking the 'Buy Now' button and choose the subscription plan that suits you best. You’ll need to create an account to access our extensive library.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Finally, download the form template to your device. You can always access it later in the 'My Forms' section of your profile.

By following these straightforward steps, you can easily obtain the legal documents you need, ensuring they are accurate and compliant.

Empower yourself with US Legal Forms to efficiently manage your legal documentation. Start your journey today and harness the expertise available to you!

Form popularity

FAQ

In Florida, a lien is valid for one year from the filing date unless it is enforced in court. This time frame is essential for a recorded lien individual for the future to remain proactive about their financial interests. Understanding how to manage and extend this period can significantly impact your position. Consider using USLegalForms to streamline this process and protect your investment.

A lien in Florida is generally valid for a period of one year from the date it was filed. If necessary, it can be extended by following proper legal procedures, which allows a recorded lien individual for the future to maintain their claim. It's vital to keep track of the expiration dates and take action to renew when applicable. Tools offered by platforms like USLegalForms can assist you in monitoring these deadlines.

Florida has specific rules regarding liens that individuals must follow to ensure enforceability. These rules include notifying the property owner before filing and adhering to statutory timelines. Familiarity with these lien rules will better position you as a recorded lien individual for the future. For guidance, USLegalForms offers templates and resources tailored for your needs.

In Florida, the timeline for a lien starts from the date of filing. Typically, you must give a notice of intent to lien within a specific period, followed by the actual filing of the lien. This timeline is crucial to protect your interests as a recorded lien individual for the future. Make sure you understand these deadlines to avoid complications.

A lien in Florida may be considered invalid for various reasons, such as lack of proper documentation or failure to meet filing requirements. If there are mistakes in the recorded information, it can also lead to an invalid lien. Therefore, it’s important to ensure all documents related to a recorded lien individual for the future are accurate and filed correctly. Utilizing platforms like USLegalForms can help you navigate this process effectively.

To prove a property has no lien, you need to conduct a thorough title search, which involves reviewing public records at the county clerk's office. Additionally, obtaining a title report from a title company can help you verify that there are no outstanding liens. This proactive approach ensures you are aware of any recorded lien individual for the future and protects your property rights.

Typically, an equitable lien might not be recorded, as it arises from a court decision or agreement rather than a formal document. Unlike statutory or mortgage liens, which are officially filed, equitable liens may exist solely based on the circumstances of a transaction. Understanding these nuances can prepare you for potential issues with any recorded lien individual for the future.

Finding unrecorded liens can be challenging, as these liens are not documented in public records. One way to discover them is by reviewing court records and checking with creditors who may have claims. Regularly monitoring for any recorded lien individual for the future can help you stay informed and avoid surprises related to unrecorded debts.

If a lien is not recorded, it may not be enforceable against third parties. This means the lienholder may struggle to collect on the debt secured by the lien. Therefore, tracking any recorded lien individual for the future is crucial as having your lien recorded ensures it holds legal weight in property matters.

Yes, it is possible for someone to put a lien on your house without your immediate knowledge. This can happen if a creditor files a lien for unpaid debts, and they may not inform you directly. To protect yourself, it is wise to regularly check for any recorded lien individual for the future, as it helps maintain transparency regarding your property.