Quit Claim Deeds For Nebraska

Description

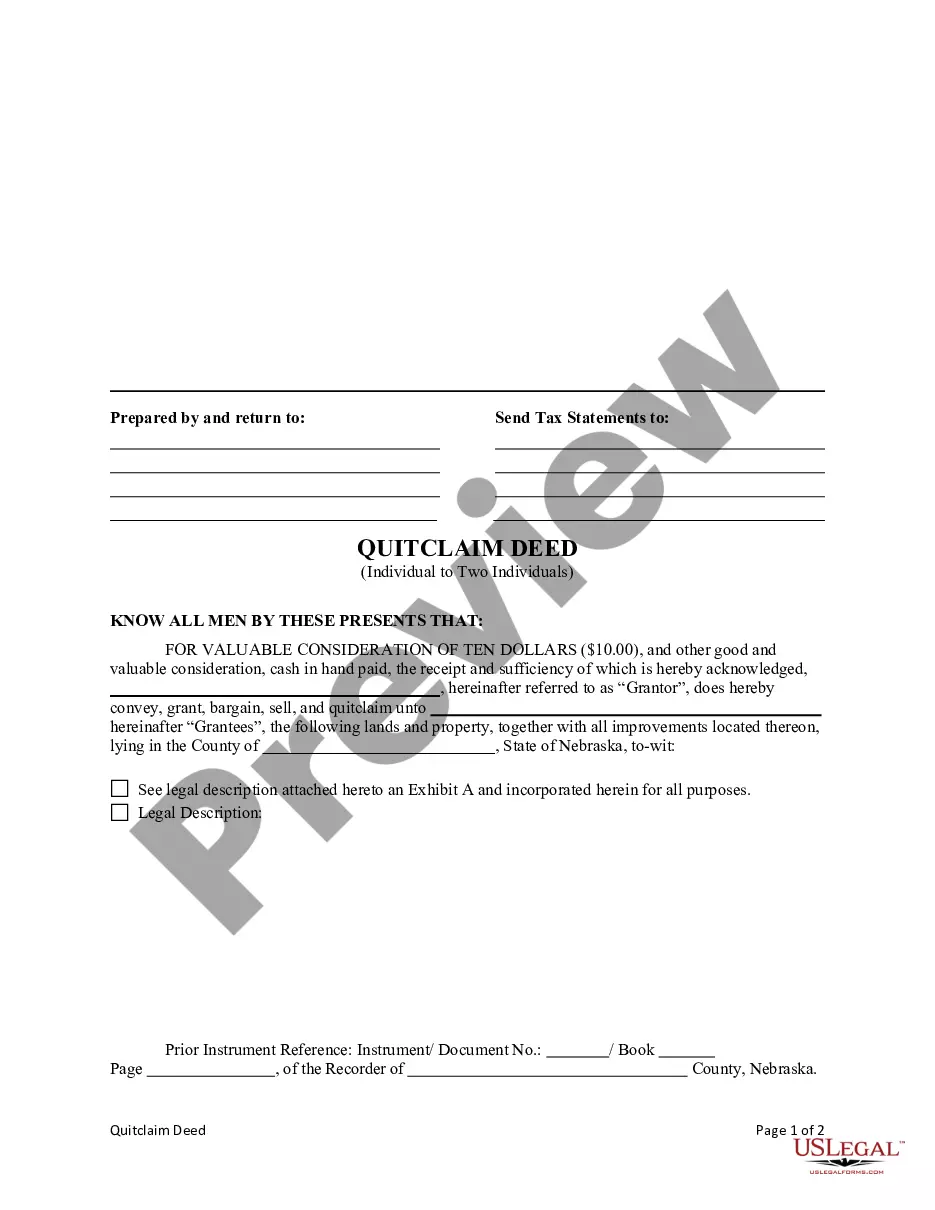

How to fill out Nebraska - Quitclaim Deed From Individual To Two Individuals?

When you need to complete Quit Claim Deeds For Nebraska in accordance with your local state’s statutes and regulations, there may be numerous options to select from.

There’s no need to verify every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Acquiring expertly crafted official documentation is simple with US Legal Forms. Additionally, Premium users can benefit from robust integrated solutions for online PDF editing and signing. Try it out today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to adhere to each state’s regulations.

- Consequently, when downloading Quit Claim Deeds For Nebraska from our site, you can be assured that you possess a valid and updated document.

- Acquiring the necessary sample from our platform is remarkably straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can navigate to the My documents section in your profile and access the Quit Claim Deeds For Nebraska at any time.

- If this is your first encounter with our library, please follow the instructions below.

- Browse the suggested page and verify it for compliance with your specifications.

Form popularity

FAQ

Nebraska 521 generally pertains to the state's property and housing regulations. It is crucial to be aware of these regulations when conducting transactions like quit claim deeds for Nebraska. Understanding Nebraska 521 helps ensure that all your property dealings comply with state laws.

To add your spouse to a property deed in Nebraska, you can file a quit claim deed to formally allocate ownership rights. This process involves preparing the deed document, including both names, and then recording it with the local county clerk's office. Utilizing quit claim deeds for Nebraska streamlines this addition and keeps ownership records updated.

Warranty deeds offer the greatest protection when transferring property, as they guarantee the title is clear of liens or claims. Unlike quit claim deeds for Nebraska, which only transfer whatever interest the grantor has, warranty deeds assure the buyer they are receiving full ownership rights. This protection can be essential in real estate transactions.

The best deed to transfer property usually depends on your specific situation. In many cases, quit claim deeds for Nebraska prove effective for informal transfers, especially among family. However, if you seek maximum protection, consider warranty deeds, which provide guarantees about the title.

Nebraska Revised Statutes 28 521 refers to laws concerning real property and ownership interests. It addresses the repercussions of certain fraudulent activities regarding property transfers. Understanding these statutes is vital when executing quit claim deeds for Nebraska to prevent legal complications.

Quit claim deeds for Nebraska are most commonly used to transfer property between family members or in divorce settlements. They allow one party to relinquish any ownership rights they have in the property without making warranties about the title. This can simplify transfers between trusted individuals.

The new Nebraska inheritance tax affects how property is transferred after someone's death. This tax varies based on the relationship between the deceased and the inheritor, and it can influence how quit claim deeds for Nebraska are utilized in estate planning. Understanding this tax can help you plan more effectively and potentially reduce liabilities.

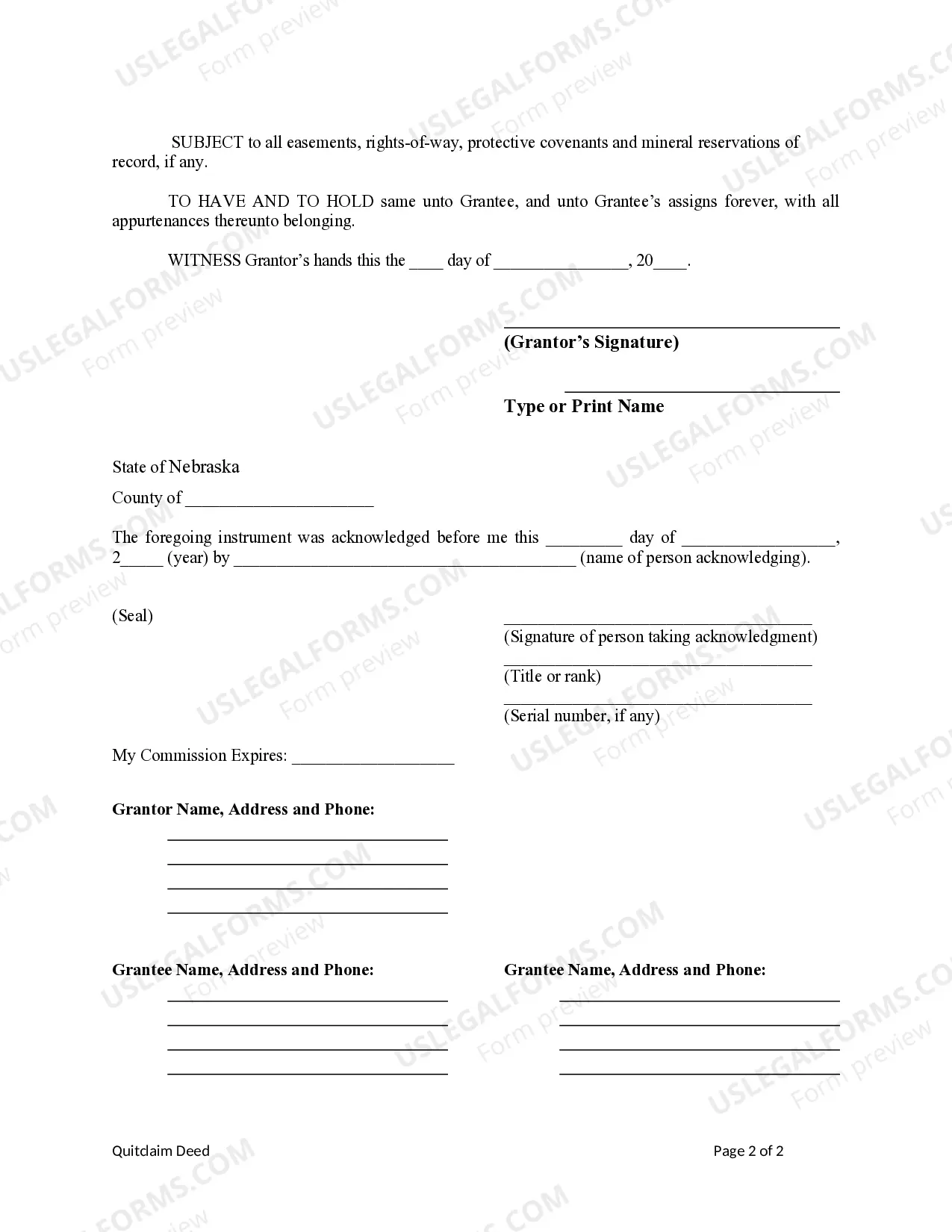

A deed in Nebraska must include essential elements such as the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. Additionally, the deed must be notarized. Ensuring that you use the correct format is crucial, and services like USLegalForms can assist in drafting quit claim deeds for Nebraska accurately.

To transfer a title after death in Nebraska, you must provide the death certificate along with the necessary transfer documents. Generally, if a transfer on death deed was executed, the title automatically transfers to the beneficiary without going through probate. Utilizing quit claim deeds for Nebraska can speed up the process, avoiding potential delays.

Filing a transfer on death deed in Nebraska requires you to complete a specific form that includes essential information about the property and the beneficiary. Once you fill it out, you must sign the deed in front of a notary. After that, file it with the county register of deeds to ensure that the transfer is recognized upon your death.