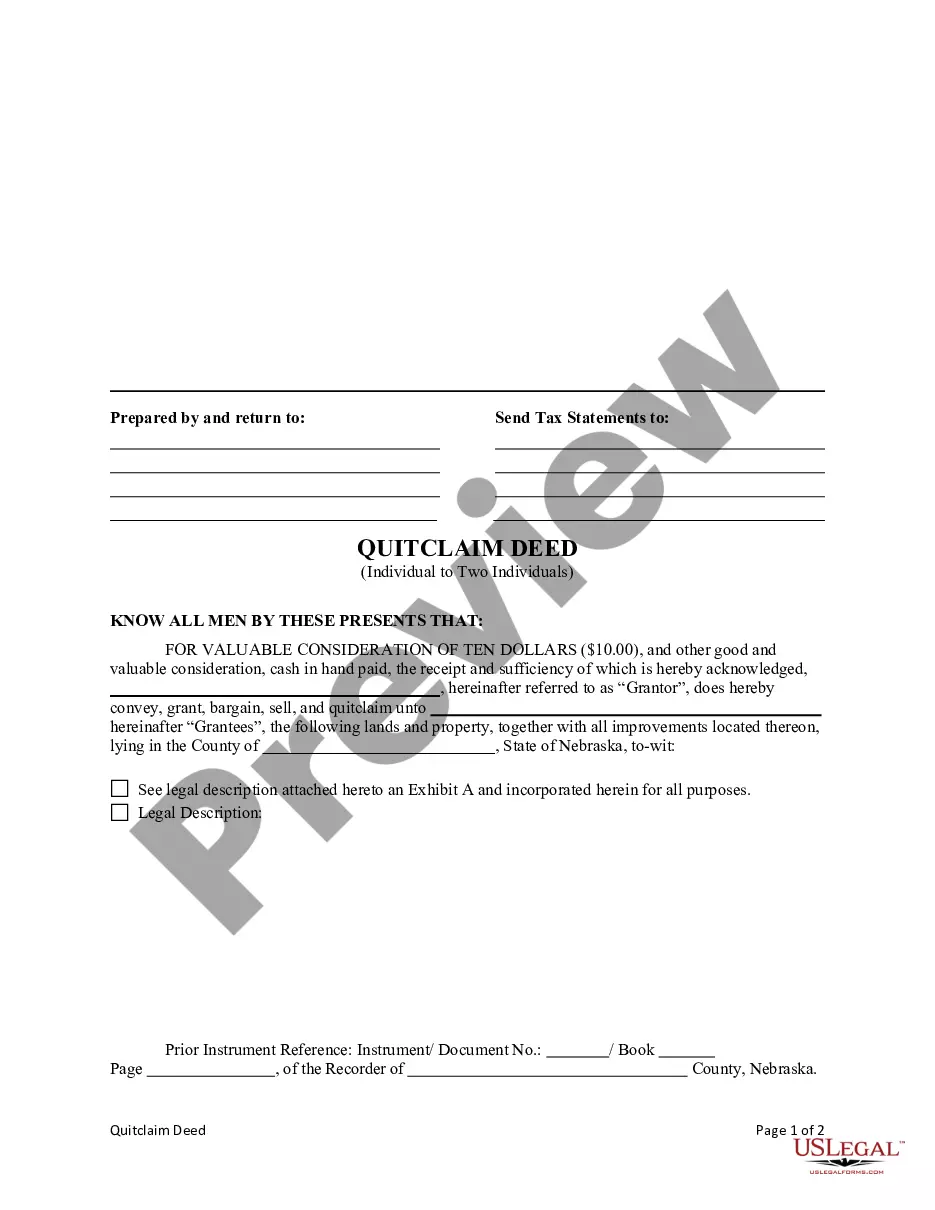

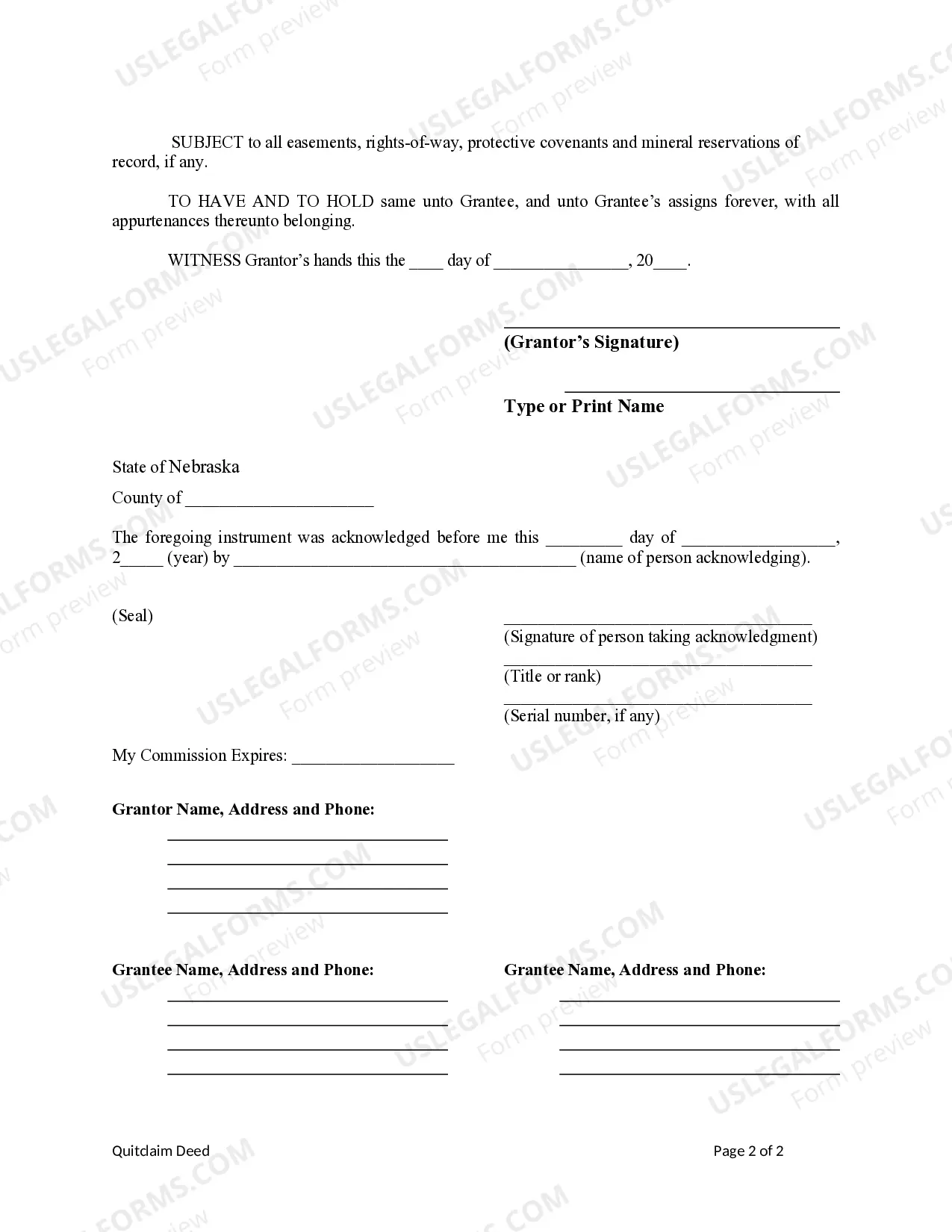

This form is a Quitclaim Deed where the grantor conveys and quitclaims to the grantees as tenants in common. This deed complies with all state statutory laws.

Nebraska Quit Claim Deed Form

Description

How to fill out Nebraska Quit Claim Deed Form?

Bureaucracy demands exactness and correctness.

If you do not handle completing forms like the Nebraska Quit Claim Deed Form regularly, it may lead to some misunderstanding.

Choosing the right sample from the outset will ensure that your document submission proceeds without issues and avoid the hassles of resubmitting a file or performing the same task from the beginning.

If you are not a subscribed user, finding the necessary sample will require a few extra steps.

- You can always discover the appropriate sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest online collection of forms that presents over 85 thousand samples across a variety of fields.

- You can obtain the most current and suitable version of the Nebraska Quit Claim Deed Form by simply searching for it on the platform.

- Find, store, and save templates in your account or verify with the description to confirm you have the accurate one on hand.

- With an account at US Legal Forms, it is straightforward to gather, keep in one location, and navigate through the templates you saved for quick access.

- When on the site, click the Log In button to authenticate.

- Then, visit the My documents page, where the record of your documents is maintained.

- Review the descriptions of the forms and save the ones you require at any time.

Form popularity

FAQ

To create a quit claim deed in Nebraska, you need to fill out a Nebraska quit claim deed form, including relevant information about the property and the parties involved. After completing the form, you should have it signed and notarized. Finally, submit the deed to the county clerk for recording. If you need assistance, USLegalForms offers a variety of templates to help you navigate this straightforward process.

You do not necessarily need a lawyer to file a transfer on death deed in Nebraska, as the process can be straightforward. However, seeking legal advice can ensure that you complete the deed accurately and according to state laws. You can use a Nebraska quit claim deed form available through USLegalForms to assist you. This resource provides templates that are user-friendly and simplify the filing process.

Yes, you can create a transfer on death deed in Nebraska, which lets you transfer property upon your passing without probate. This deed must be signed, notarized, and filed with the county clerk before your death to be valid. Using a Nebraska quit claim deed form is also an option for transferring property, but it operates differently than a transfer on death deed. USLegalForms offers templates and guidance to help you with this process.

Transferring a title after death in Nebraska involves using a transfer on death deed or a Nebraska quit claim deed form. This document allows you to pass your property directly to a beneficiary without going through probate. It's essential to ensure that the deed is correctly prepared and filed with the county clerk. For assistance, consider using the resources available on USLegalForms to simplify the process.

To file a quitclaim deed in Nebraska, you should first complete the Nebraska quit claim deed form, making sure to include all necessary details about the property and the parties involved. Once completed, sign the document in front of a notary public. Finally, submit the signed and notarized document to your local county clerk's office for official recording. Using a platform like US Legal Forms can provide you with the correct forms and guidance to navigate this process effectively.

Filing a quit claim deed in Nebraska involves completing the appropriate Nebraska quit claim deed form, ensuring all required information is accurate and complete. After completing the form, you must sign it in front of a notary public and then file it with the county clerk's office where the property is located. This process formally transfers ownership and protects your legal rights. Using US Legal Forms can help make this filing process straightforward.

To obtain the deed to your house in Nebraska, you need to locate the original document, usually kept at the county clerk's office where the property is registered. If you cannot find it, you may need to request a copy through the clerk's office. Additionally, our Nebraska quit claim deed form allows you to create a new deed if you need to transfer ownership. Using a reliable service like US Legal Forms can simplify this process.

Nebraska Revised Statutes 28 521 outlines laws regarding property crimes, including theft and unauthorized use of property. Although this may sound far removed from the Nebraska quit claim deed form, it emphasizes the importance of ensuring you have clear title and ownership before transferring property. Engaging in property transactions requires an understanding of local laws as they can affect your rights and responsibilities. Always consult legal resources to navigate these statutes properly.

The new Nebraska inheritance tax varies based on the relationship of the inheritor to the deceased and the total value of the estate. Nebraska has several tax rates depending on these factors; for example, immediate family members may face lower rates compared to distant relatives. Understanding these taxes is vital for anyone involved in property transfers, including those completing a quit claim deed. Utilizing the Nebraska quit claim deed form does not exempt individuals from these taxes, so getting familiar with the law can save you from surprises.

To fill out a quitclaim deed in Nebraska, start by obtaining the Nebraska quit claim deed form from a reliable source, such as USLegalForms. Next, provide clear information about the grantor and grantee, including names and addresses, as well as a legal description of the property. Make sure both parties sign the form in front of a notary public, then file it with the county clerk for proper record-keeping.