Transfer On Death Deed Nebraska Form With Two Points

Description

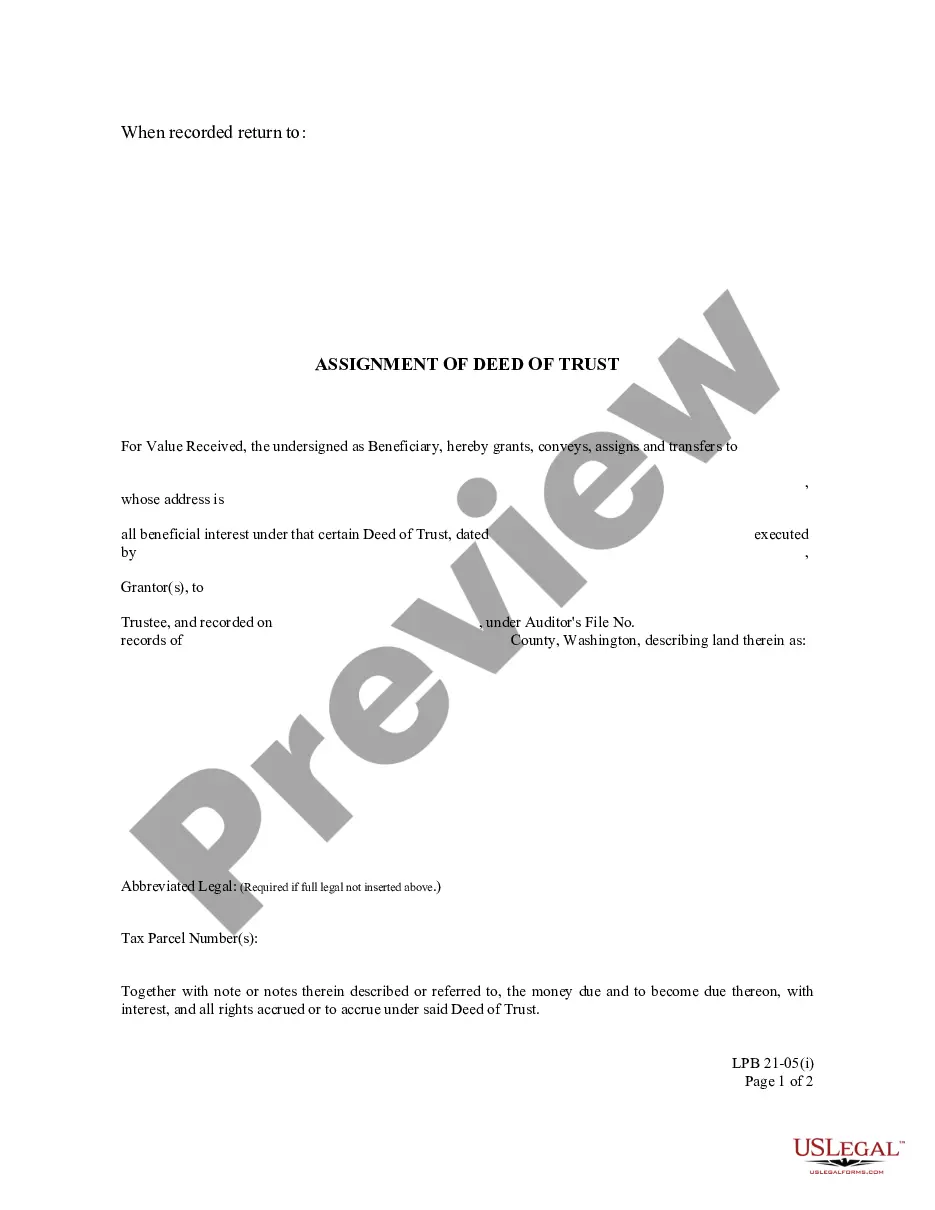

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

It’s common knowledge that you won’t become a legal authority instantly, nor can you swiftly learn how to draft the Transfer On Death Deed Nebraska Form With Two Points without possessing a specific set of expertise.

Formulating legal documents is a lengthy process that necessitates specialized training and abilities.

So why not entrust the development of the Transfer On Death Deed Nebraska Form With Two Points to the professionals.

You can access your forms again from the My documents tab at any time. If you are an existing customer, you can simply Log In and locate and download the template from the same tab.

Regardless of the purpose of your documentation—be it financial, legal, or personal—our platform has you covered. Explore US Legal Forms today!

- Discover the document you require using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain if the Transfer On Death Deed Nebraska Form With Two Points meets your needs.

- Restart your search if you need another template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is complete, you will receive the Transfer On Death Deed Nebraska Form With Two Points, complete it, print it, and send or mail it to the necessary parties or organizations.

Form popularity

FAQ

Even a company with just one employee must have workers' comp. Independent contractors, as well as domestic employees ? i.e., babysitters, gardeners, house cleaners, etc. ? who work less than 16 hours a week, do not qualify for workers' compensation in Massachusetts, though.

Independent Contractor law, which requires that workers perform a service "outside the usual course of the business of the employer" to be classified as independent contractors." Therefore, workers who deliver papers may remain independent contractors.

Members of a Limited Liability Company (LLC), partners of a Limited Liability Partnership (LLP), and partnerships or sole proprietors of an unincorporated business are not required to carry workers' compensation insurance for themselves.

All employers operating in Massachusetts are required to carry workers' compensation insurance for their employees and themselves if they are an employee of their company. The requirement applies no matter the number of hours worked or the number of employees.

All employees in Massachusetts must be covered under a workers' compensation policy.

As a 1099 worker, you have the autonomy to make your own schedule, advertise your services and more. However, independent contractors must pay taxes out of pocket and are not entitled to overtime, guaranteed minimum wage, workers' compensation or unemployment benefits.

A business does not have the same obligations for an independent contractor that is has for employees. For example, a business does not have to provide unemployment compensation insurance, workers' compensation insurance, or benefitssuch as paid vacation days to an independent contractor.

Even a company with just one employee must have workers' comp. Independent contractors, as well as domestic employees ? i.e., babysitters, gardeners, house cleaners, etc. ? who work less than 16 hours a week, do not qualify for workers' compensation in Massachusetts, though.