Transfer On Death Deed For Mineral Rights

Description

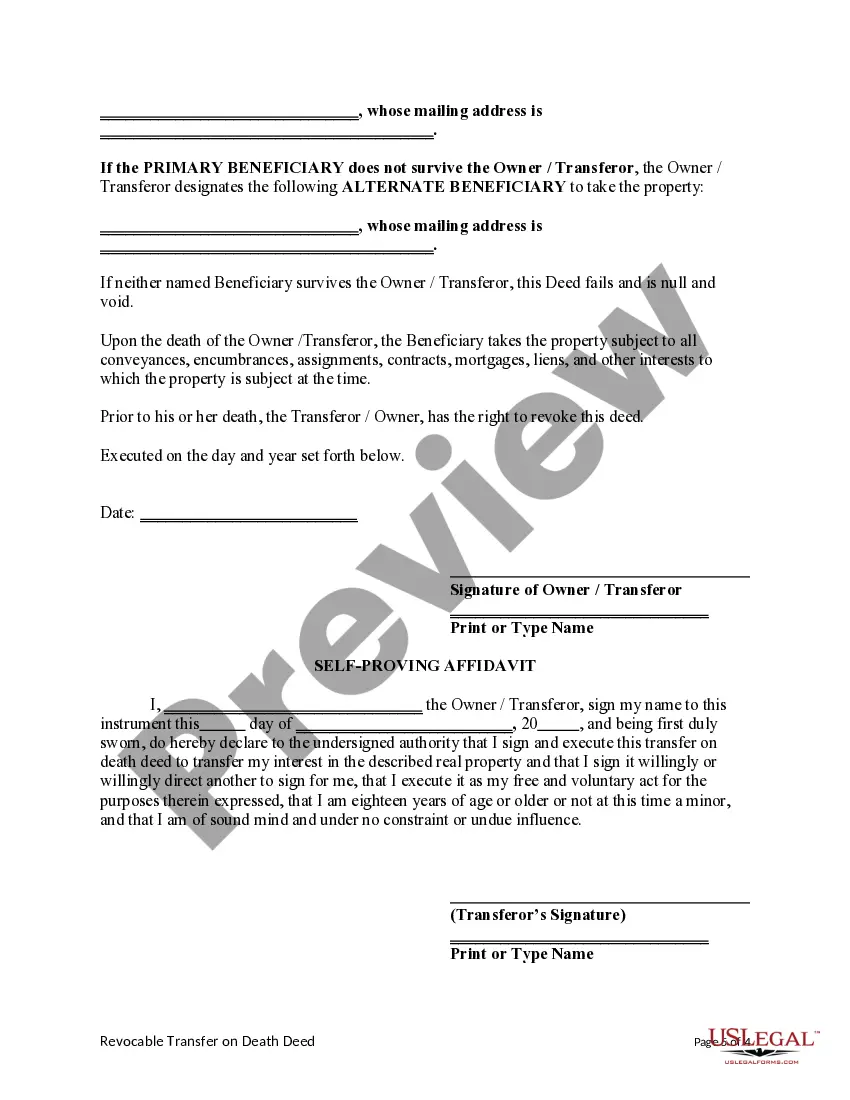

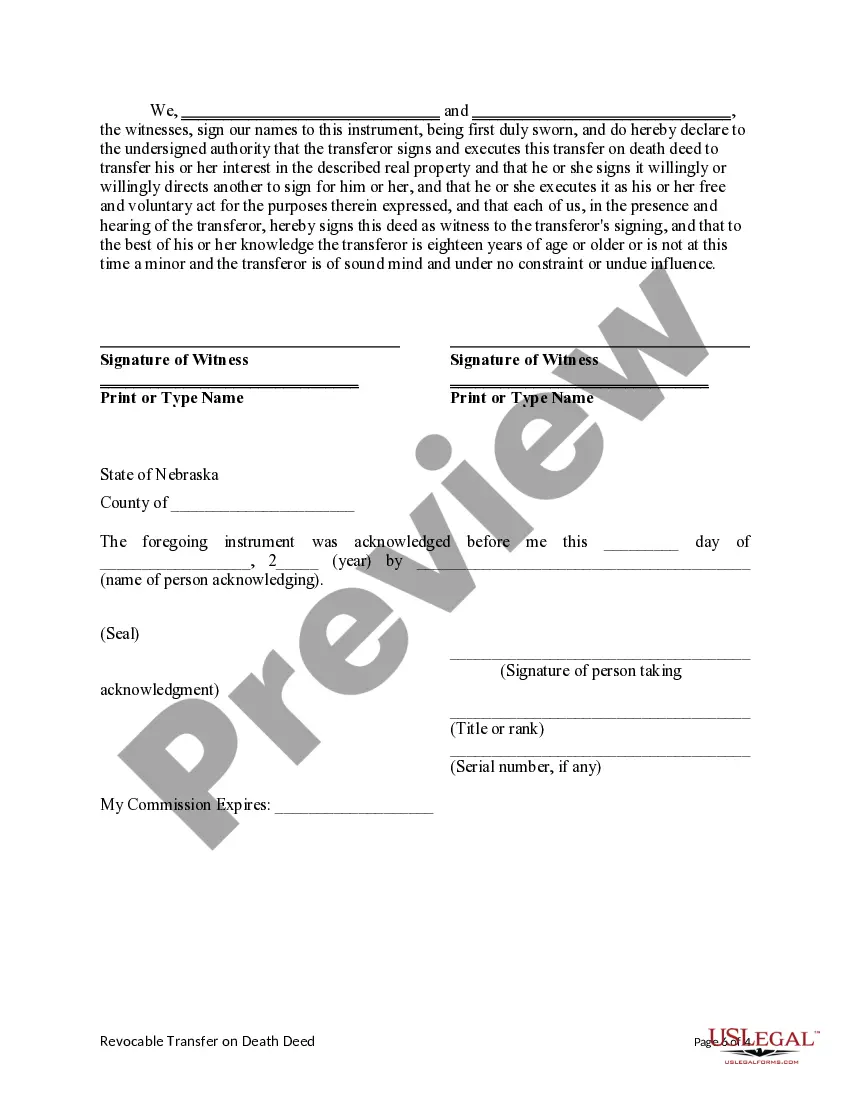

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

- If you are a returning user, simply log in to your account and access your desired form by clicking the Download button. Verify that your subscription is active; renew it if necessary.

- For new users, start by checking the Preview mode and form description to confirm that you've selected the correct Transfer on Death Deed that suits your jurisdiction.

- If you encounter any issues, utilize the Search tab to find alternative templates that meet your needs. Ensure it aligns with local regulations before proceeding.

- Proceed to purchase your document by clicking the Buy Now button and selecting a suitable subscription plan. You'll need to create an account for access to our extensive library.

- Complete your purchase by providing your payment details, either via credit card or PayPal, to finalize your subscription.

- Download your form immediately after purchase. It will be available in the My Forms section of your profile for easy future access.

By using US Legal Forms, you gain access to a comprehensive library of over 85,000 legal forms, including specialized documents for mineral rights transfers. Our platform not only offers more forms than competitors but also connects you with premium experts who can assist you in ensuring your documents are completed accurately and legally.

Don't wait to secure your mineral rights for future generations. Explore our user-friendly platform today and simplify the transfer process!

Form popularity

FAQ

To inherit mineral rights, you typically must be named in a will or designated as a beneficiary in a trust. If the property owner did not leave a will, the laws of intestate succession will determine who receives the mineral rights. Utilizing a transfer on death deed for mineral rights can simplify this process, allowing you to directly inherit the rights without going through probate. For seamless transitions and to ensure everything is correctly documented, consider using USLegalForms, which provides reliable legal forms and guidance.

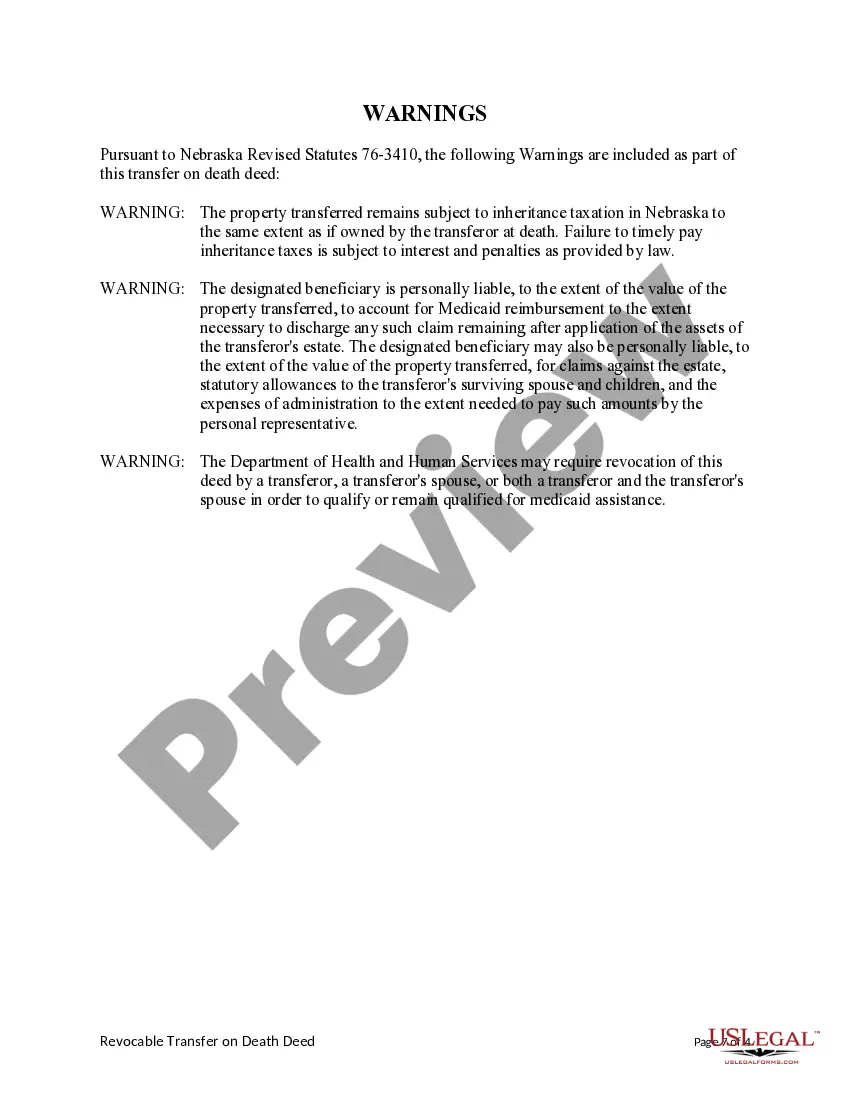

The transfer on death deed for mineral rights has some drawbacks. For instance, it does not offer protection against creditors, meaning that if the beneficiary faces financial issues, the mineral rights may still be at risk. Additionally, this deed does not provide any tax benefits, which can be important to consider when transferring valuable assets. Lastly, the transfer may affect any existing estate planning strategies, so it is crucial to review these plans before using a transfer on death deed.

Mineral rights typically do not automatically transfer to heirs upon death unless specified in a legal document. If you wish to ensure that your mineral rights go to your chosen beneficiaries, a transfer on death deed for mineral rights is an effective solution. This deed allows you to declare who receives your mineral rights upon your passing, avoiding probate and streamlining the transfer process. By using platforms like USLegalForms, you can create this deed easily, securing your intentions for your mineral rights.

If someone else owns your mineral rights, they have the legal authority to exploit the minerals located beneath your property. This means they can drill, mine, or otherwise extract resources without needing your permission. However, you may still retain ownership of the surface land, but the mineral rights belong to the other party. To ensure that your wishes are clearly communicated, consider using a transfer on death deed for mineral rights to designate how these rights should be handled in the future.

You do not necessarily need a lawyer to create a transfer on death deed for mineral rights, but having one can be beneficial. This legal document needs to meet specific state requirements to be valid, which a lawyer can help ensure. Using a service like US Legal Forms can simplify the process, providing you with the correct templates and guidance. Ultimately, it is your choice to proceed alone or seek legal assistance for your transfer on death deed for mineral rights.

Mineral rights are not automatically transferred upon the death of the owner unless specific legal measures are in place. A transfer on death deed for mineral rights enables owners to specify who will receive these rights, ensuring a streamlined transfer process. Without this deed, the rights may go through probate, leading to potential delays and complications.

To transfer mineral rights after the owner has died, you will need to follow the legal process outlined in the deceased's estate plan or will. If a transfer on death deed for mineral rights was executed, you simply need to provide the necessary documentation to establish the beneficiary's claim. Utilizing the uslegalforms platform can guide you through the required steps and paperwork.

When an individual passes away, their mineral rights typically become part of their estate and may go through probate. However, if there is a transfer on death deed for mineral rights in place, the rights will pass directly to the designated beneficiary without the need for probate. This can significantly streamline the process of transferring ownership.

While a transfer on death deed for mineral rights can be beneficial, it may also have some drawbacks. For instance, if you change your mind about the beneficiary, you must revoke the deed formally. Additionally, some states place restrictions on who can be designated as a beneficiary, which could limit your options.

Mineral rights can be transferred through various methods, including deeds and contracts. One effective option is using a transfer on death deed for mineral rights, which allows the owner to designate a beneficiary who will receive the rights upon their passing. This method simplifies the process and avoids probate, making it a convenient choice for many individuals.