Transfer Death Deed Document For Sale Of Property

Description

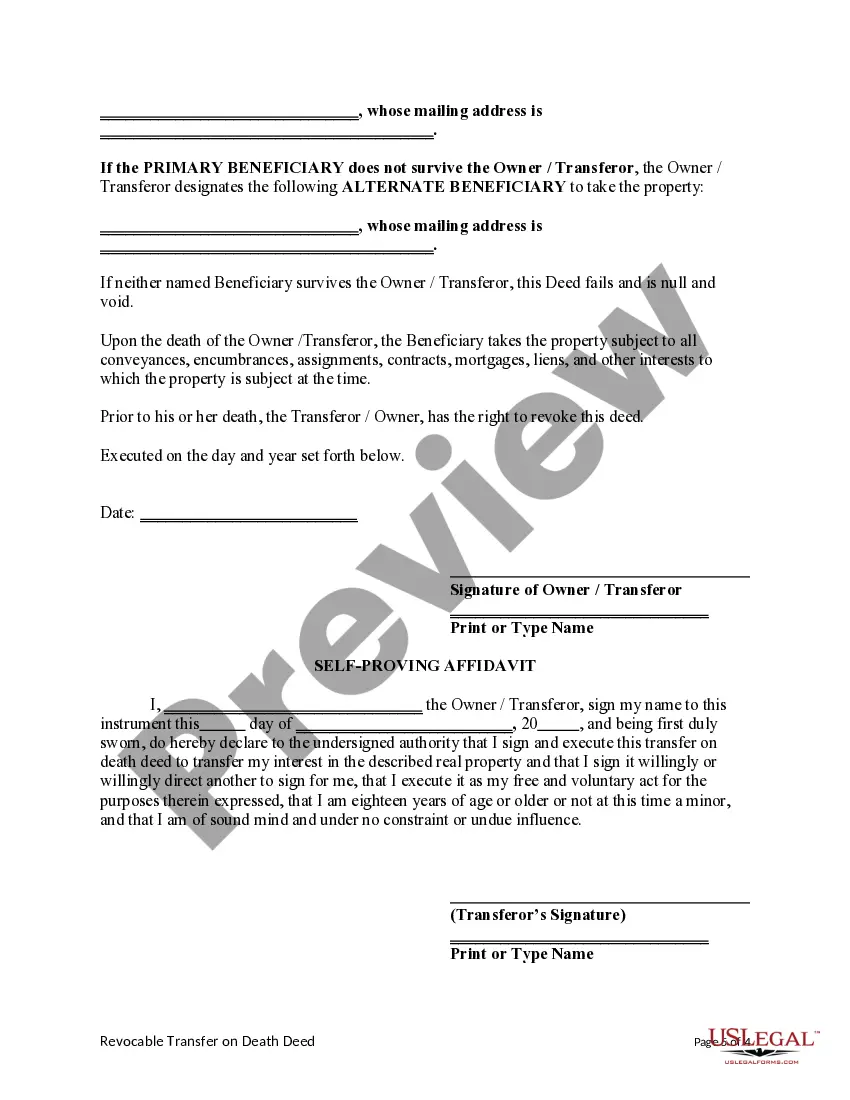

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

- Start by logging into your US Legal Forms account if you're an existing user, ensuring your subscription is active before downloading the needed form.

- If you're new, begin by previewing the form to verify it aligns with local jurisdiction requirements and your specific needs.

- If adjustments are necessary, utilize the search feature to discover alternative templates that may suit your case better.

- Once you identify the correct document, click 'Buy Now' and select your preferred subscription plan — registration is necessary for access.

- Finalize your transaction by entering payment details, either via credit card or PayPal, to complete your subscription.

- After purchasing, download the form to your device for later completion and access it anytime from the My Forms section of your profile.

By using US Legal Forms, you'll benefit from an extensive library boasting over 85,000 forms, ensuring you have everything needed for accurate legal documentation.

Don't navigate legal complexities alone. Start your journey with US Legal Forms today for hassle-free document transfer!

Form popularity

FAQ

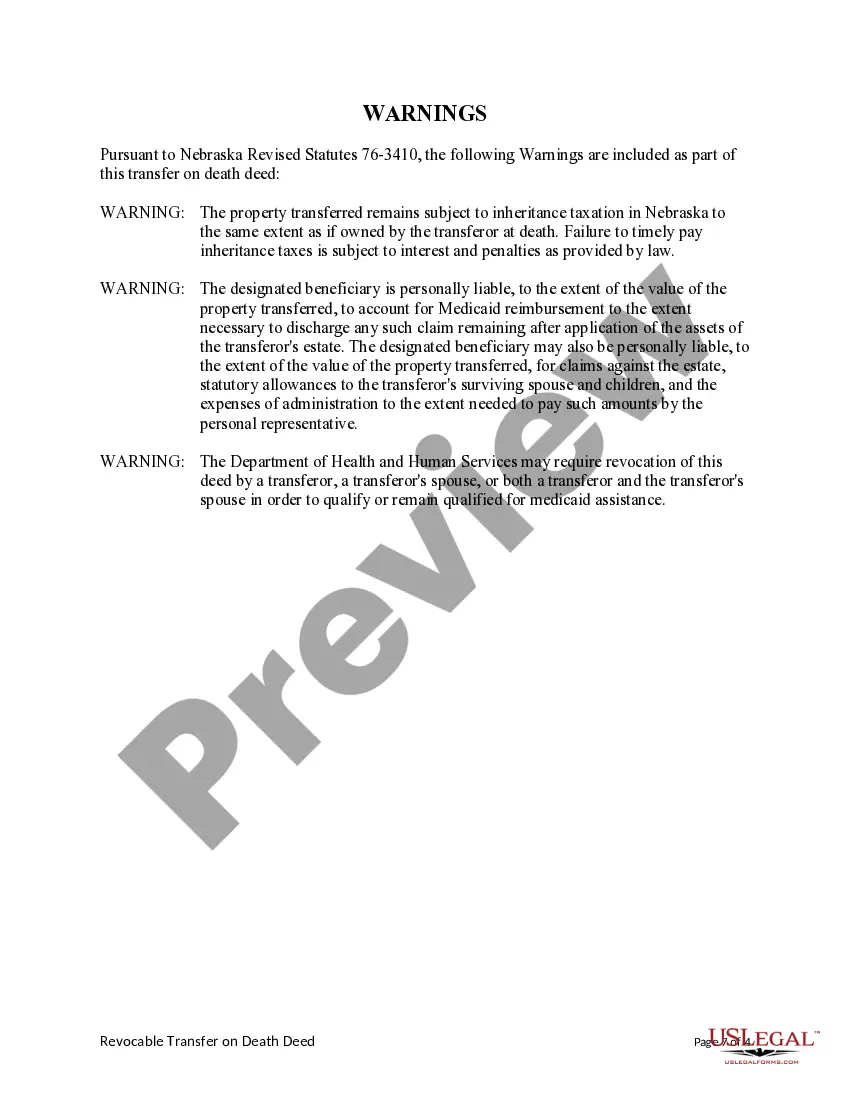

One significant downside of a transfer on death deed (TOD) is the potential for challenges from heirs who may feel unfairly treated. If the property owner has not communicated their wishes, it could lead to disputes during probate. Furthermore, TODs do not shield the property from estate taxes or claims by creditors, which may impact the beneficiaries. When contemplating a transfer death deed document for sale of property, consider these implications carefully.

To create a transfer on death deed in Illinois, specific requirements must be met. You need to prepare a deed that clearly states the intention to transfer the property upon your death. Additionally, you must sign the deed in front of a notary public and then record it with the appropriate county office. Ensuring these steps are followed can help you effectively manage your transfer death deed document for sale of property.

While a transfer on death deed may be convenient, it does have some disadvantages in Illinois. One concern is that it may not provide protection from creditors after the property owner's death. Also, disputes could arise among heirs if not all parties are aware of the deed, leading to potential conflicts. It's important to weigh these factors when considering a transfer death deed document for sale of property.

You can obtain a transfer of death deed document for sale of property through various sources. Typically, you can find these documents at local government offices, such as the county recorder or assessor’s office. Additionally, legal service providers like UsLegalForms offer templates and guidance to make the process easier. This ensures that you have the correct documentation for your property transfer.

One effective way to leave property upon death is by using a transfer on death deed, as it allows for a direct transfer to your designated heirs. This method bypasses the complex probate process, ensuring your wishes are executed more swiftly. It is essential to draft the deed accurately to avoid any legal complications later on. So, a well-prepared transfer death deed document for sale of property can significantly ease this transition.

One disadvantage of a transfer on death (TOD) deed is that it does not provide any protections for the beneficiaries. For instance, if the beneficiary has debts, creditors might be able to claim the property. Additionally, a TOD deed does not allow for the control of the property after death, which can lead to disputes among heirs. If you want to ensure a smooth transition of your property, consider using a transfer death deed document for sale of property.

While a Transfer on Death deed has many advantages, it may not be suitable for everyone. Some drawbacks include the inability to modify the deed once established or potential issues if the beneficiary predeceases you. It can also complicate your estate planning if you own multiple properties. When weighing your options, consider a Transfer death deed document for sale of property, and consult with legal professionals to handle your specific needs.

Writing a transfer deed involves several steps to ensure legal compliance. First, include the full legal description of the property, your name as the grantor, and the grantee's name. Next, have the document signed in front of a notary public to validate it. You can utilize the resources available at uslegalforms to create a comprehensive Transfer death deed document for sale of property that meets all legal requirements.

A Transfer on Death deed does not necessarily avoid inheritance tax. Instead, it facilitates the transfer of property outside of probate, which can save time and legal fees. However, it's essential to consult a tax professional, as inheritance tax laws can vary significantly by state. Utilizing a Transfer death deed document for sale of property may still be beneficial in simplifying asset transfer.

Choosing between a Transfer on Death (TOD) deed and naming a beneficiary depends on your individual circumstances. A TOD deed allows the property to transfer directly to the named beneficiary upon your death, avoiding probate. On the other hand, naming a beneficiary might introduce complexities regarding other assets. Therefore, using a Transfer death deed document for sale of property can offer a straightforward solution for transferring property efficiently.