Death Deed In Texas

Description

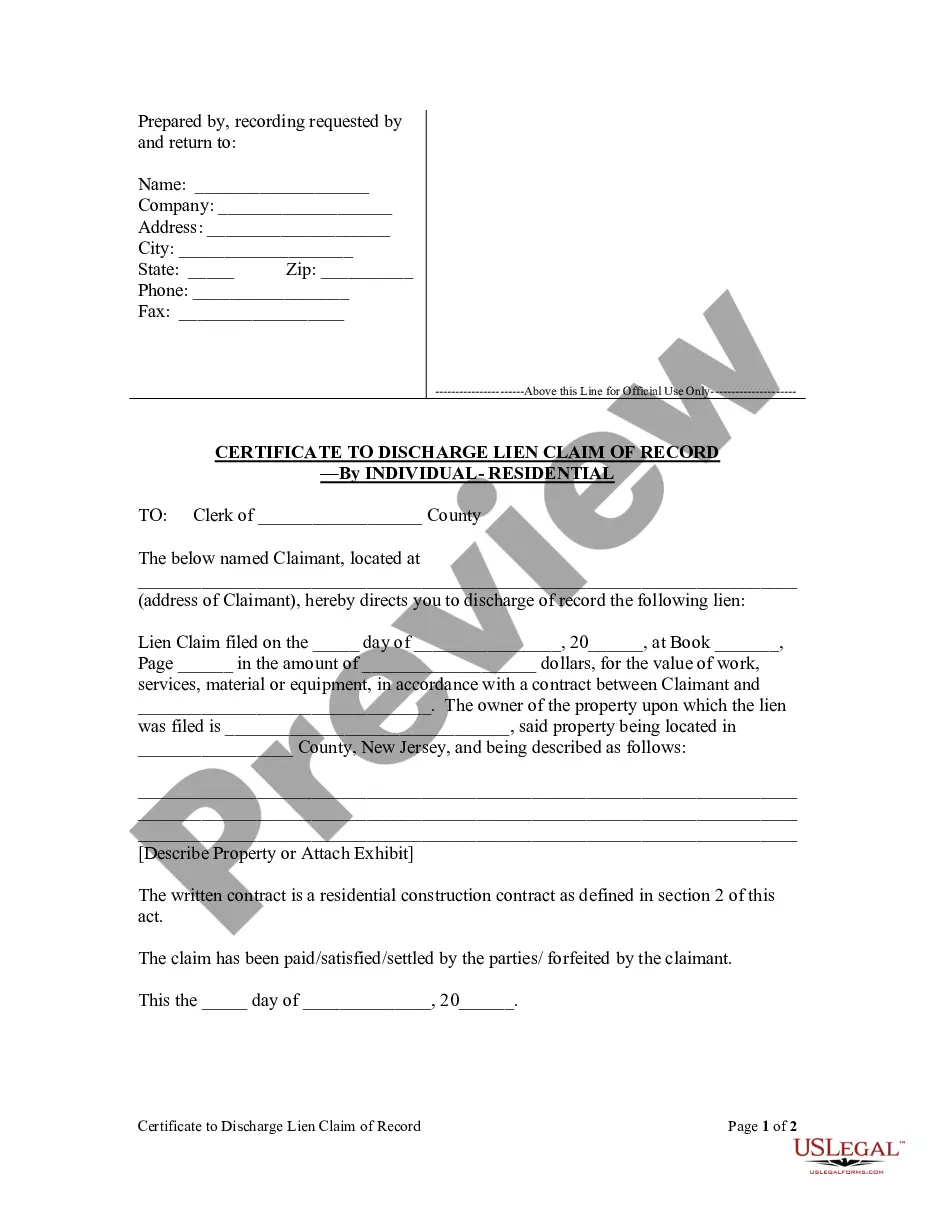

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

Regardless of whether it's for commercial reasons or personal matters, everyone encounters legal circumstances at some stage in their lives.

Completing legal documents necessitates meticulous care, starting with choosing the appropriate template example.

With an extensive catalog from US Legal Forms available, you don’t need to waste time searching for the right template online. Take advantage of the library’s straightforward navigation to discover the suitable template for any circumstance.

- Obtain the form you need by using the search bar or browsing the catalog.

- Review the details of the form to ensure it aligns with your circumstances, state, and county.

- Click on the preview of the form to examine it.

- If it’s not the correct document, return to the search feature to locate the Death Deed In Texas template you need.

- Acquire the template when it corresponds with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the desired file format and download the Death Deed In Texas.

- Once it is saved, you can complete the form using editing software or print it out to fill it out by hand.

Form popularity

FAQ

Rule 37 - Failure to Make or Cooperate in Discovery: Sanctions. (a)Motion for Order Compelling Discovery. A party, upon reasonable notice to other parties and all persons affected thereby, may apply for an order compelling discovery as follows: (1)Appropriate Court.

On motion and upon such terms as are just, the court may relieve a party or a party's legal representative from a final judgment, order, or proceeding for the following reasons: (1) Mistake, inadvertence, surprise, or excusable neglect; (2) Newly discovered evidence which by due diligence could not have been discovered ...

Divorce records are available from the Clerk of the Family Court where the divorce was granted. Marriage, birth and death records are available from the Town Clerk in the town or City Clerk in the city where the event took place.

Instead, Rhode Island courts employ an income shares model in which the adjusted gross income of both parents is used to determine the child support amount owed by the non-custodial parent. Courts must begin by using the model, but can always order the non-custodial parent to pay additional child support.

Failure by any person without adequate excuse to obey a subpoena served upon that person may be deemed a contempt of the court in which the action is pending.

A miscellaneous petition or complaint for custody is filed by submitting to the family clerk the following documents: the complaint for custody, a dr6, the family services counseling form, the summons, and the filing fee. If you cannot pay the filing fee, you should file for in forma pauperis status.

The DR-6 (a-b) ?Statement of Assets Liabilities Income Expenses? is a form that all family court parties are required to fill out and file when filing complaints about divorce. separation, miscellaneous complaints, or when an answer or modification request is filed.

How much does a divorce cost in RI? Filing the necessary paperwork at your county courthouse costs around $250. If you can't afford this, the court may waive the filing fee depending on your income level. You can see if you qualify by filling out the necessary forms at your district court.