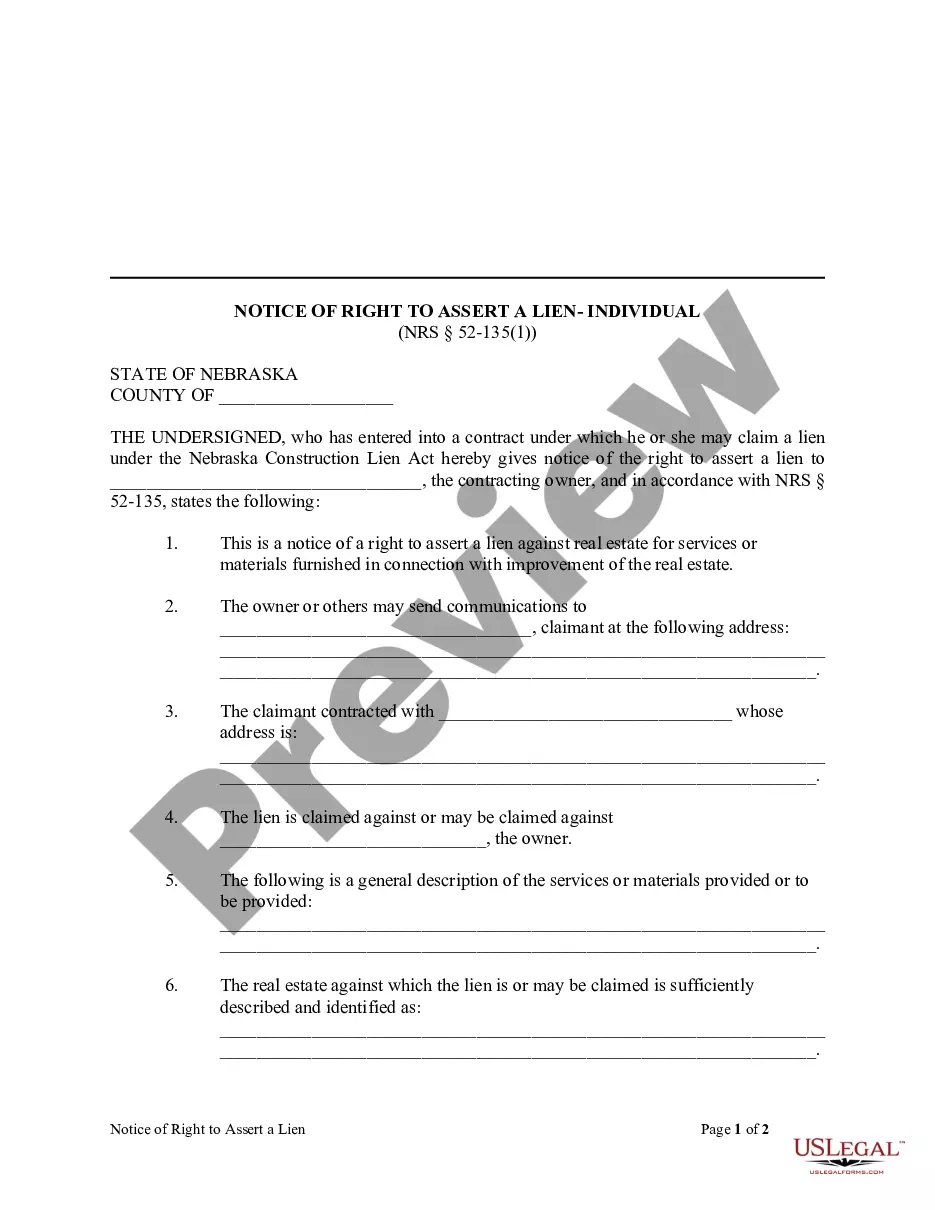

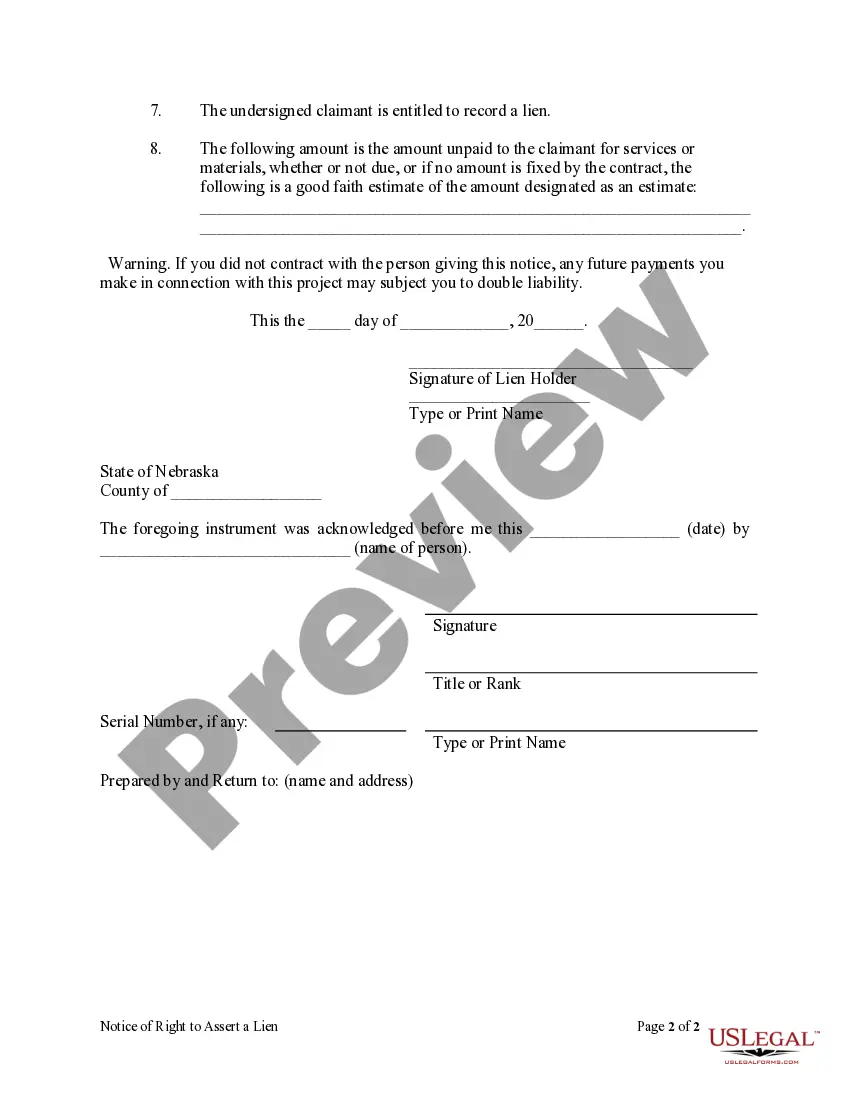

Nebraska Lien Form

Description

Form popularity

FAQ

Yes, Nebraska generally requires a bill of sale for used vehicles to document the transaction. This document serves as proof of ownership and is necessary for registering the vehicle. Make sure to accompany your bill of sale with a Nebraska lien form when you have a lien on the vehicle, ensuring all legal requirements are met.

You have a limited period to file a lien in Nebraska, which varies based on the type of debt. Typically, it's important to file before the statute of limitations expires. Consult legal resources or consider using uslegalforms to better understand the timelines and rules regarding Nebraska lien forms.

To put a lien on your property in Nebraska, fill out a Nebraska lien form that specifies the amount owed and the property details. Submit this form to the county clerk or register of deeds, along with any required fees. This process legally establishes your claim and protects your interests in the property.

Filing a lien on a vehicle in Nebraska involves completing a Nebraska lien form specifically designed for motor vehicles. You'll need to include details such as the vehicle identification number and the lienholder's information. Once completed, submit the form to the county treasurer’s office to ensure your lien is recorded properly.

The most common lien on property is often a mortgage lien, which secures a lender's interest in a property. However, mechanic’s liens and tax liens are also prevalent in Nebraska. Understanding how these liens work can help you manage your property effectively. For filing or researching options, a Nebraska lien form can be instrumental.

A notice of intent to lien in Nebraska serves as an official warning to a property owner that a lien may be filed due to unpaid debts. This notice must typically be sent prior to filing the actual lien. Using a Nebraska lien form for this notice helps maintain a clear record and communicates your intentions effectively.

To file a lien in Nebraska, you will need to gather the necessary information about the debt and the property. Complete a Nebraska lien form, providing all relevant details, then submit it to the county office responsible for recording liens. It is essential to check specific requirements as different liens may have unique procedures.

Filing a lien on a property in Nebraska requires completing a Nebraska lien form. This form must detail the property and the reason for the lien. After filling it out, you must submit the form with any necessary fees to the appropriate county clerk or register of deeds. Proper filing ensures your claim is legally recognized.

In Nebraska, you typically have a specific timeframe to file a lien after the debt is incurred. Generally, you must file the lien within the statute of limitations for the type of debt involved, which can vary. For a clearer understanding, consult a legal expert or visit uslegalforms to access reliable resources regarding Nebraska lien forms.

To put a lien on a title in Nebraska, you need to complete a Nebraska lien form. This form must include specific details about the vehicle and the lienholder. After filling out the form, submit it to the county treasurer's office along with any required fees. Following this, the lien will be officially recorded against the title.