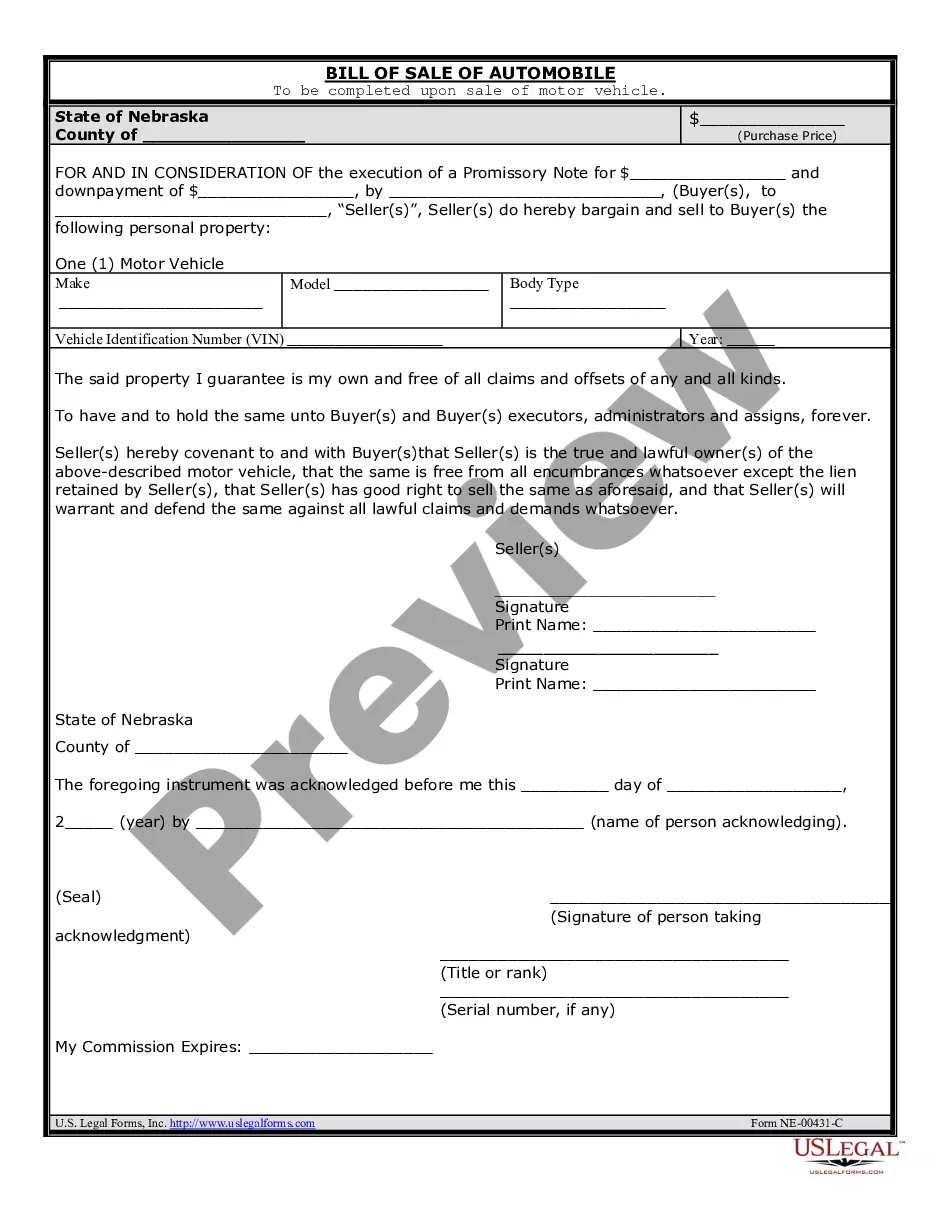

Bill Of Sale For Nebraska

Description

How to fill out Nebraska Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

The Bill Of Sale For Nebraska displayed on this page is a reusable official template crafted by expert lawyers in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and attorneys with more than 85,000 authenticated, state-specific forms for any business and personal needs. It’s the fastest, simplest, and most dependable way to acquire the documents you require, as the service assures the utmost level of data security and anti-malware safeguards.

Select the format you desire for your Bill Of Sale For Nebraska (PDF, Word, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Look through the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, use the search feature to locate the appropriate one. Click Buy Now when you have discovered the template you need.

- Register and Log In.

- Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Does a bill of sale have to be notarized in Nebraska? Yes. Both the buyer and the seller need to sign the bill of sale in the presence of a notary.

Legally Binding: It is a legally binding document that finalizes the sale and transfer of ownership.

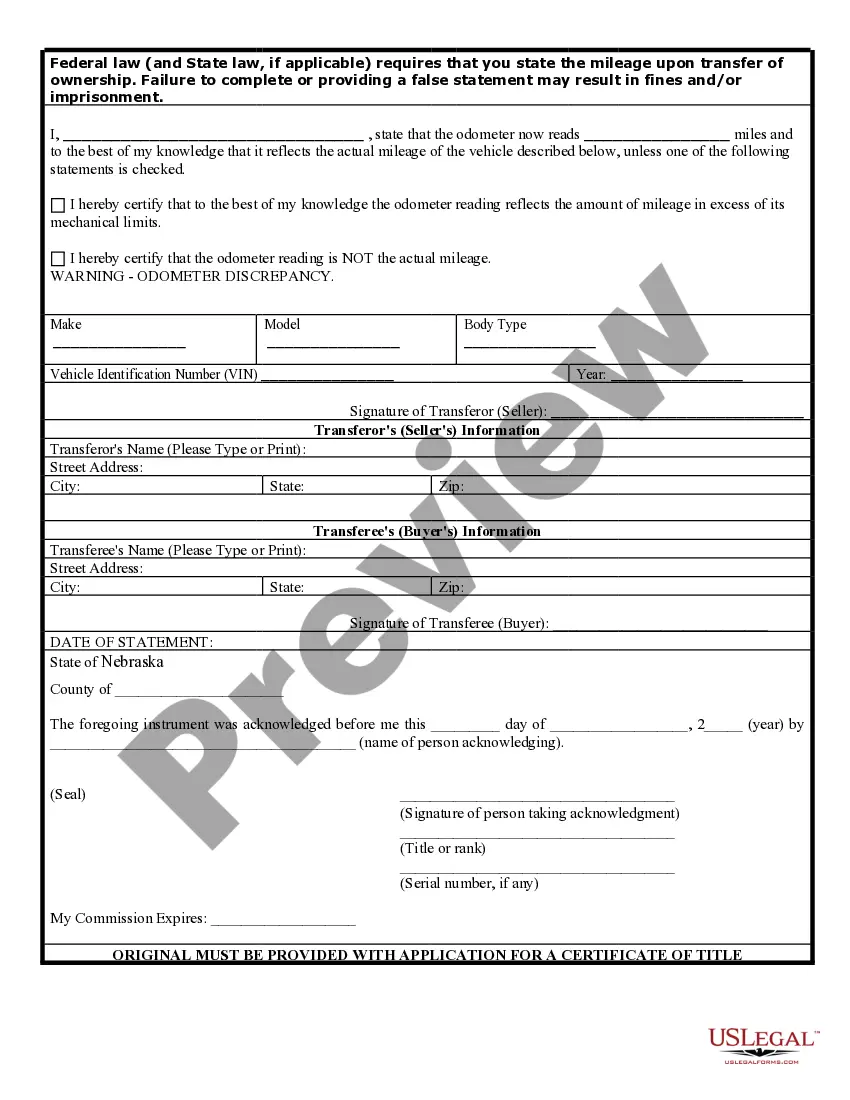

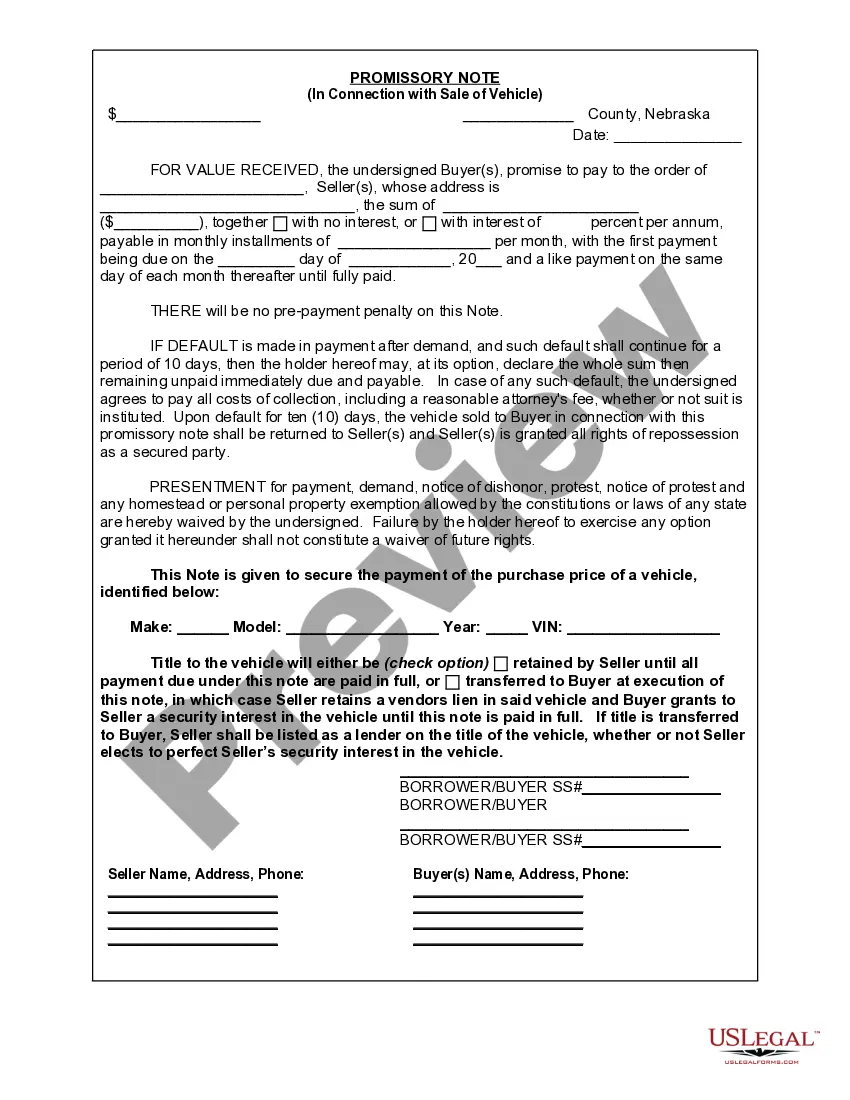

The Bill of Sale must be completed by the seller and include all vehicle information (year, make, VIN, sale price, seller's name, address and signature, buyer's name, address and signature).

Yes, a bill of sale is required for private car sales in Nebraska. Form 6 needs to be completed and signed by both the buyer and the seller in the presence of a notary.

The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 ? Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales.