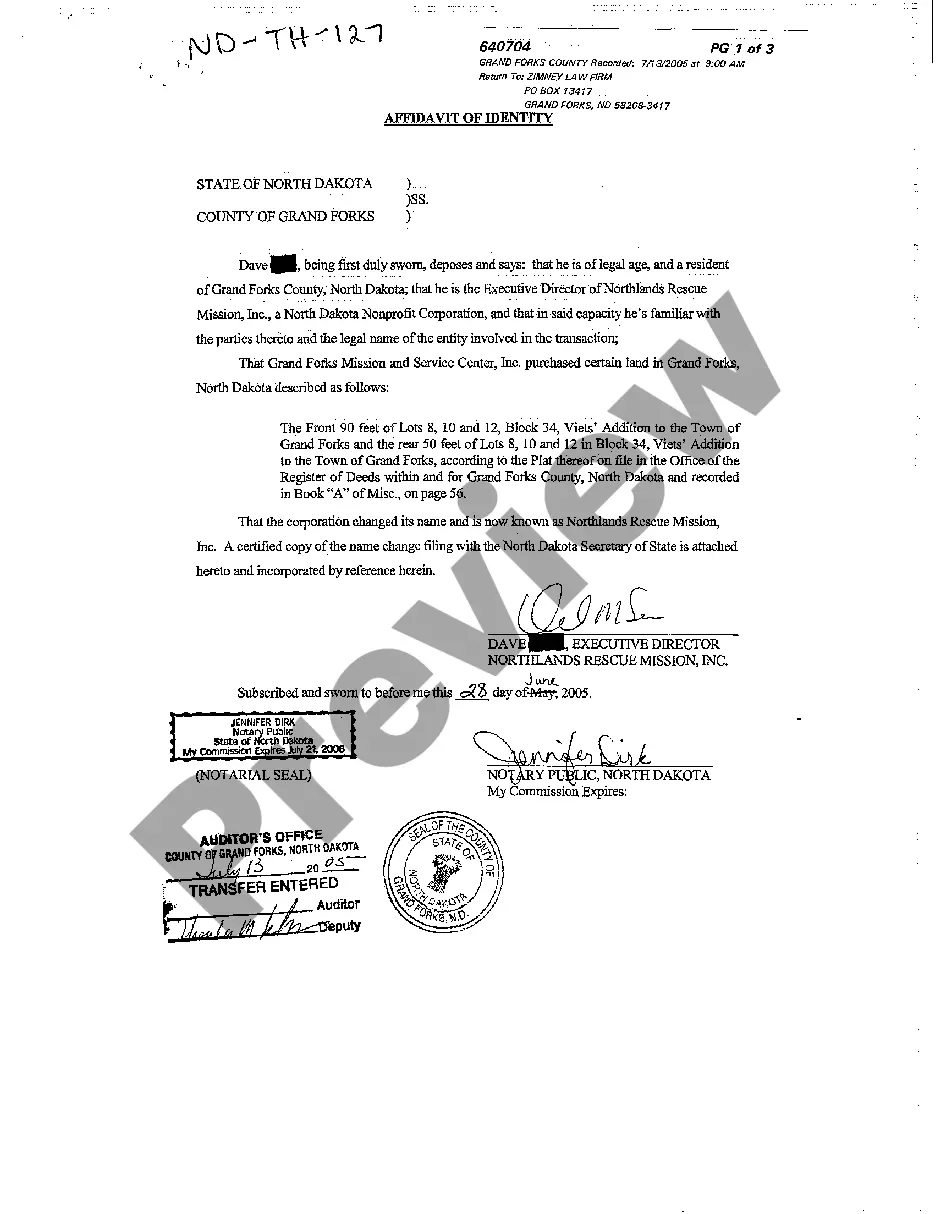

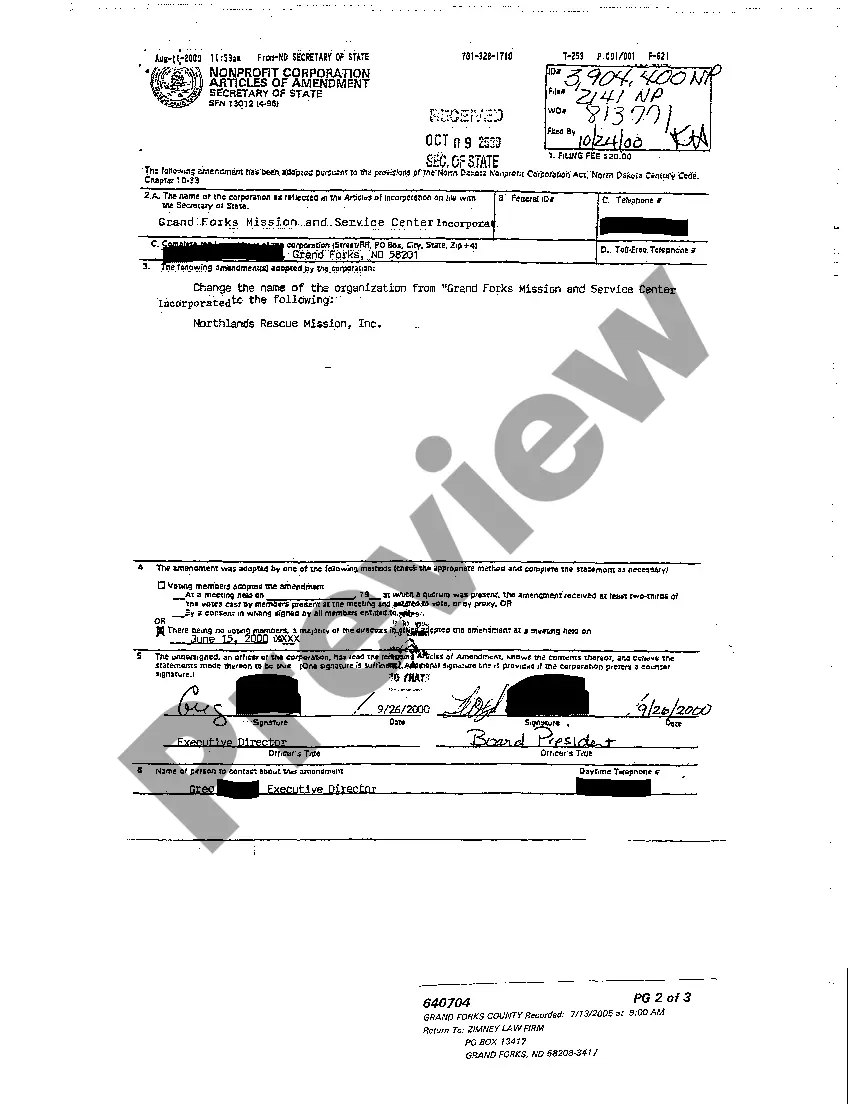

Affidavit Of Identity North Dakota Real Estate Withholding Tax

Description

How to fill out North Dakota Affidavit Of Identity Regarding Corporation Grantee's Name Change?

There's no longer a need to squander hours searching for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and made their accessibility easier.

Our platform provides over 85,000 templates for any business and individual legal situations organized by state and area of use.

Utilize the Search bar above to look for another template if the current one does not suit you. Click Buy Now next to the template title once you find the appropriate one. Choose the preferred pricing plan and register for an account or Log In. Make payment for your subscription with a card or through PayPal to proceed. Select the file format for your Affidavit Of Identity North Dakota Real Estate Withholding Tax and download it to your device. Print out your form to fill it in by hand or upload the sample if you prefer to do it in an online editor. Preparing legal documents under federal and state laws and regulations is quick and easy with our library. Try US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and verified for accuracy, ensuring you can confidently obtain a current Affidavit Of Identity North Dakota Real Estate Withholding Tax.

- If you are acquainted with our service and already have an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by opening the My documents tab in your profile.

- If you've never utilized our service before, the process will require a few more steps to complete.

- Here’s how new users can find the Affidavit Of Identity North Dakota Real Estate Withholding Tax in our library.

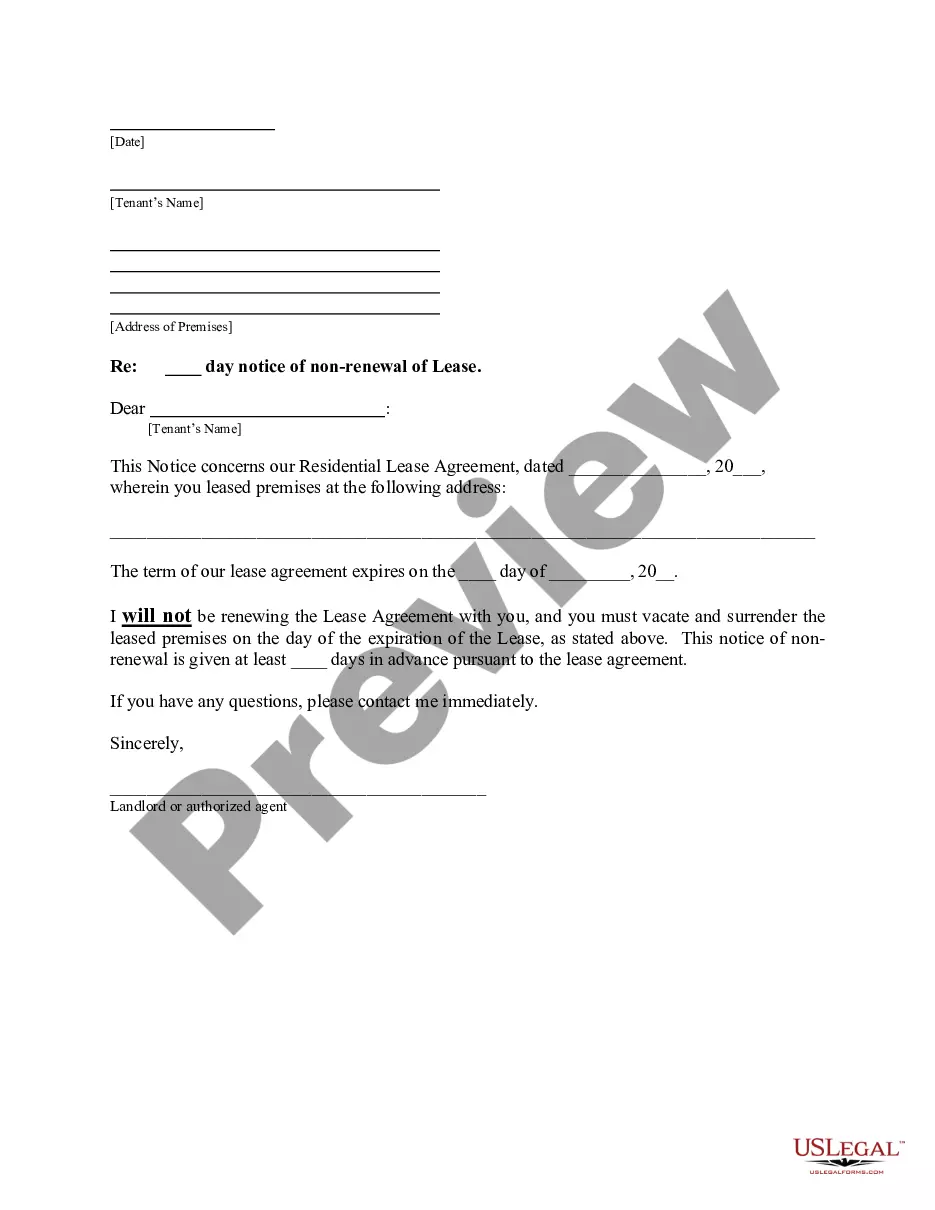

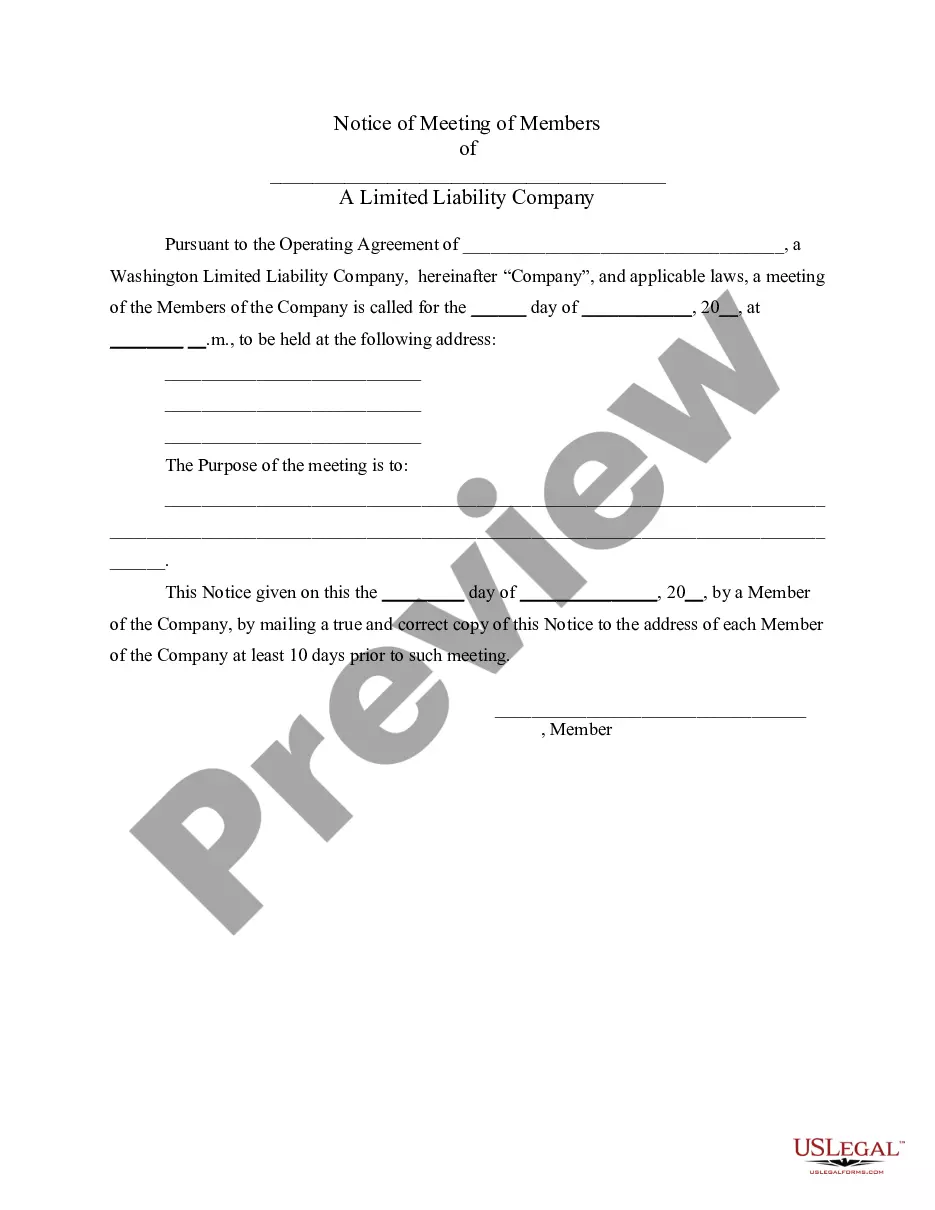

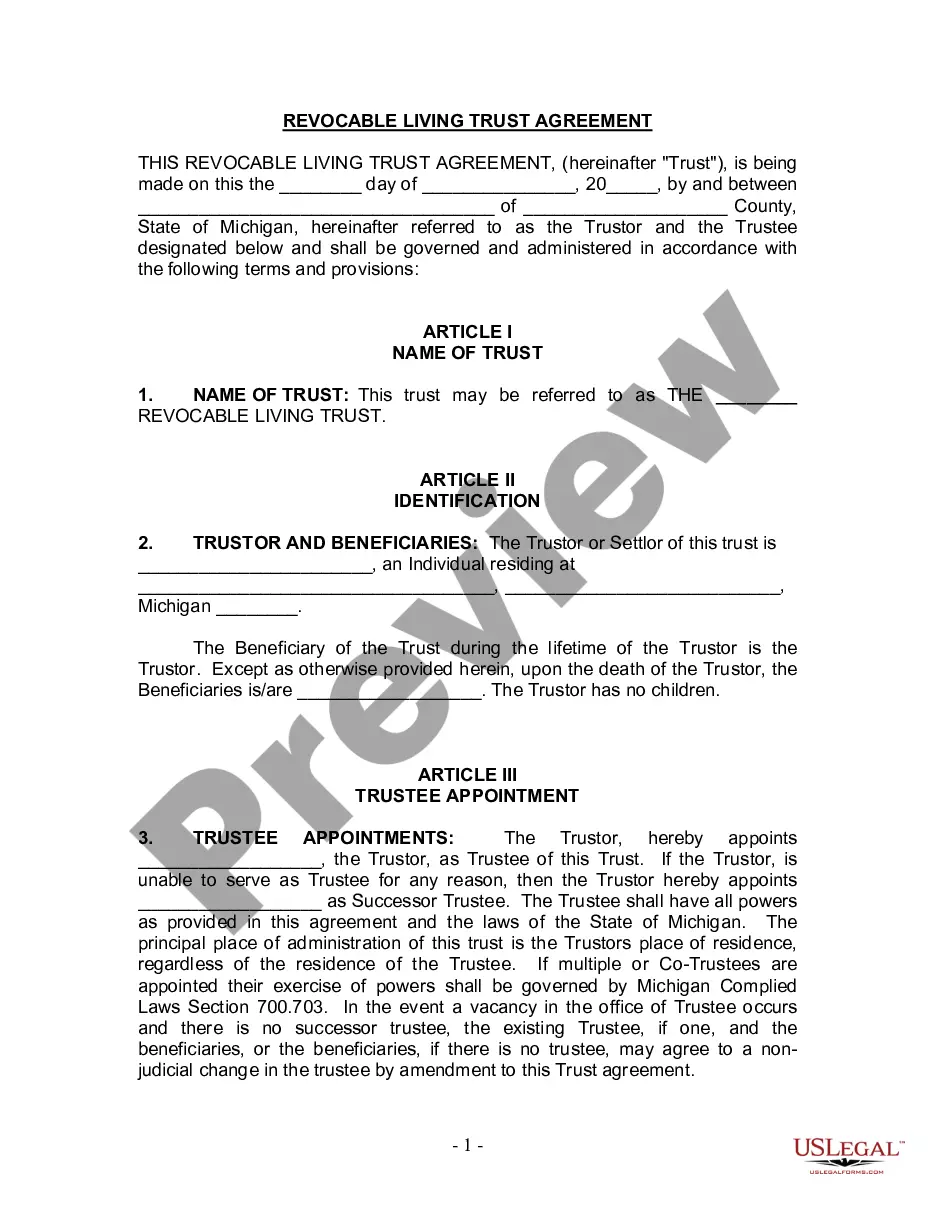

- Read the page content carefully to confirm it has the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

Apply for a North Dakota Tax ID (EIN) Number. To obtain your Tax ID (EIN) in North Dakota start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.

North Dakota does not have an inheritance tax. The inheritance tax was repealed in 1927 and replaced with an estate tax.

127, Bismarck, ND 58505-0599. 2022 Mail Form 307 with paper information returns to: Office of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.18-Dec-2019