Inherited Mineral Rights North Dakota Without A Will

Description

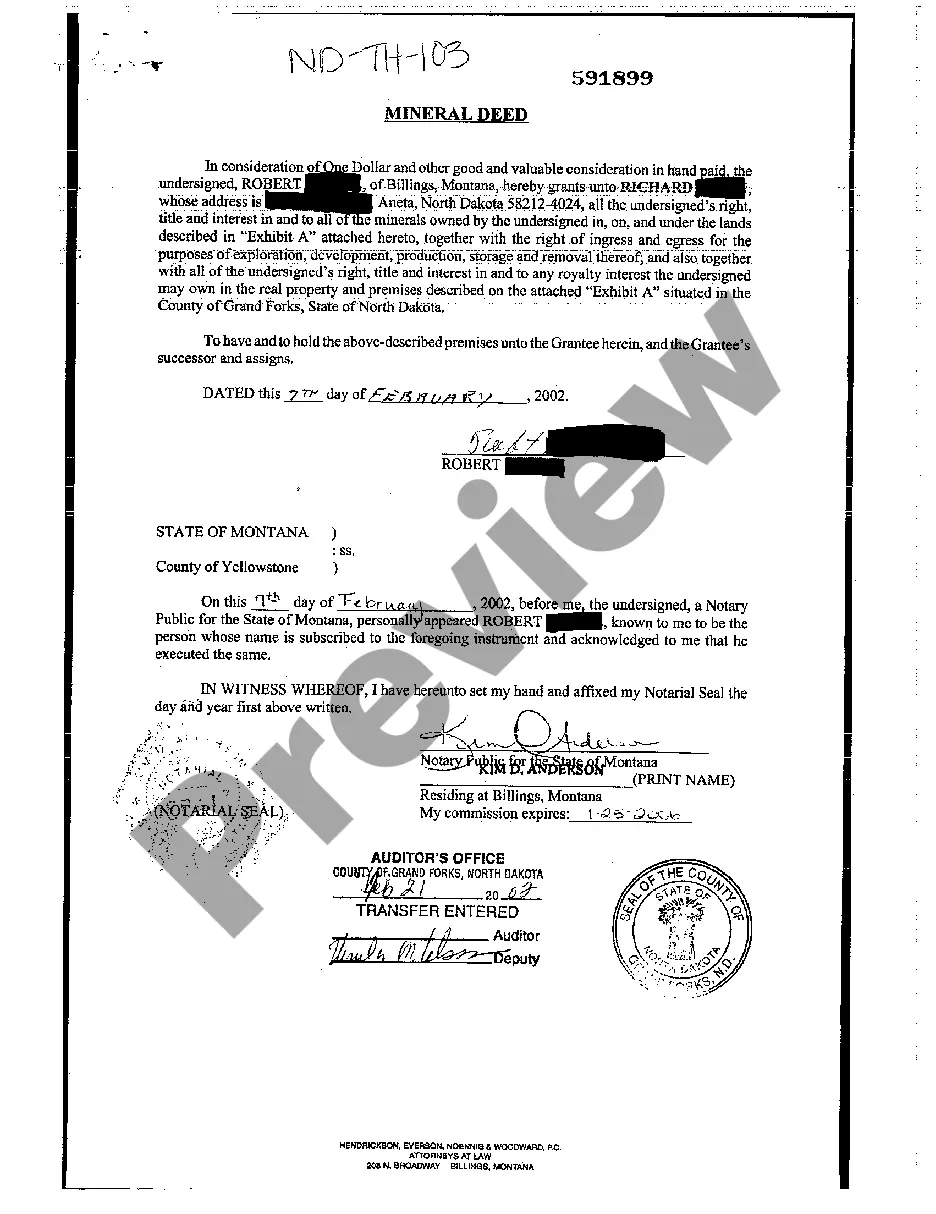

How to fill out North Dakota Mineral Deed Individual To Individual?

It’s obvious that you can’t become a legal professional immediately, nor can you figure out how to quickly prepare Inherited Mineral Rights North Dakota Without A Will without having a specialized set of skills. Putting together legal forms is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the Inherited Mineral Rights North Dakota Without A Will to the pros?

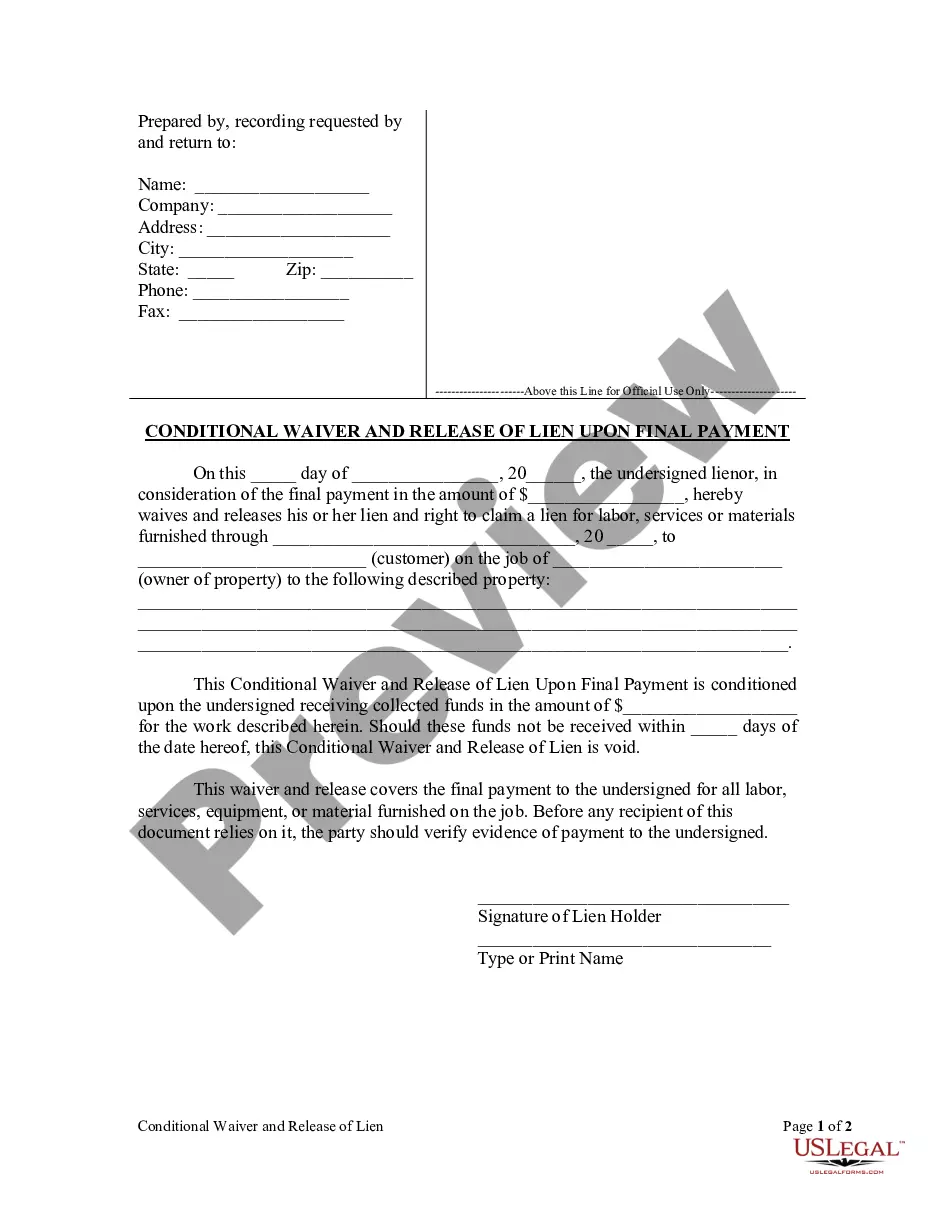

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court documents to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Inherited Mineral Rights North Dakota Without A Will is what you’re looking for.

- Begin your search again if you need a different template.

- Register for a free account and select a subscription plan to buy the template.

- Pick Buy now. Once the payment is through, you can download the Inherited Mineral Rights North Dakota Without A Will, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

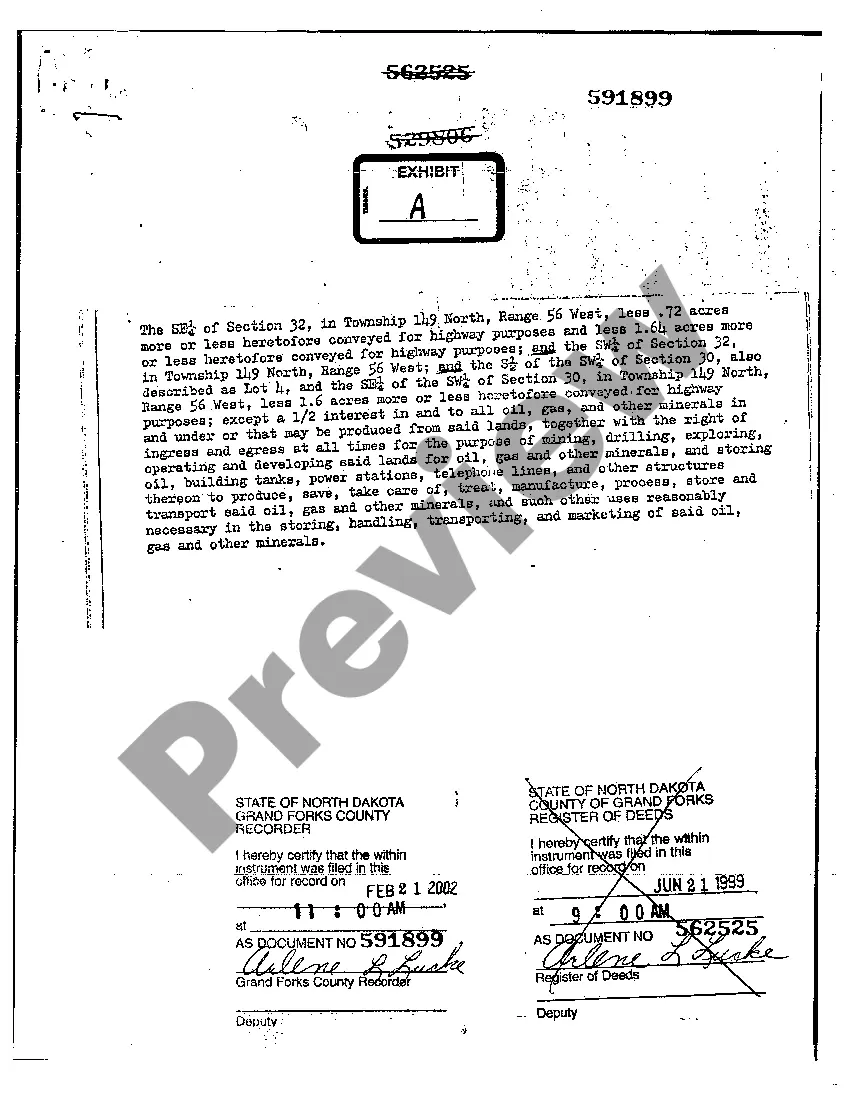

How can I find out who owns the oil rights on property in North Dakota? To determine mineral rights on a parcel of land, you need to go to the County Recorder's Office in the county of that parcel and request any recorded deed documents for the parcel.

Die intestate in North Dakota and your children will inherit part of your estate. However, how much they receive depends on whether you also leave behind a spouse, if those children are with your surviving spouse, and if you have children with someone other than your surviving spouse.

North Dakota Rules of Intestacy Exactly who inherits from your estate, and the amount or percentage that they inherit, depends on which family members survive you, as follows: Children but no spouse ? children inherit the entire estate.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.