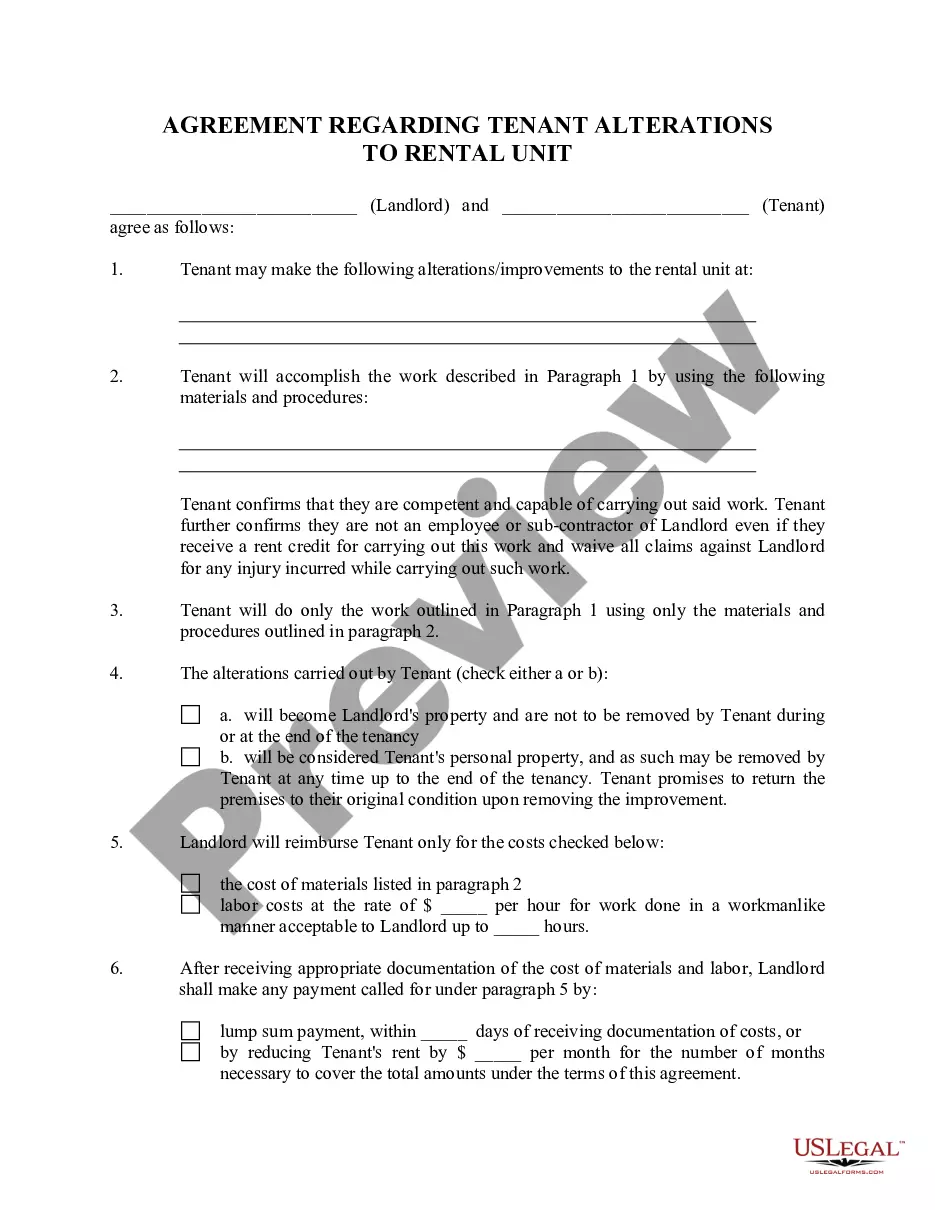

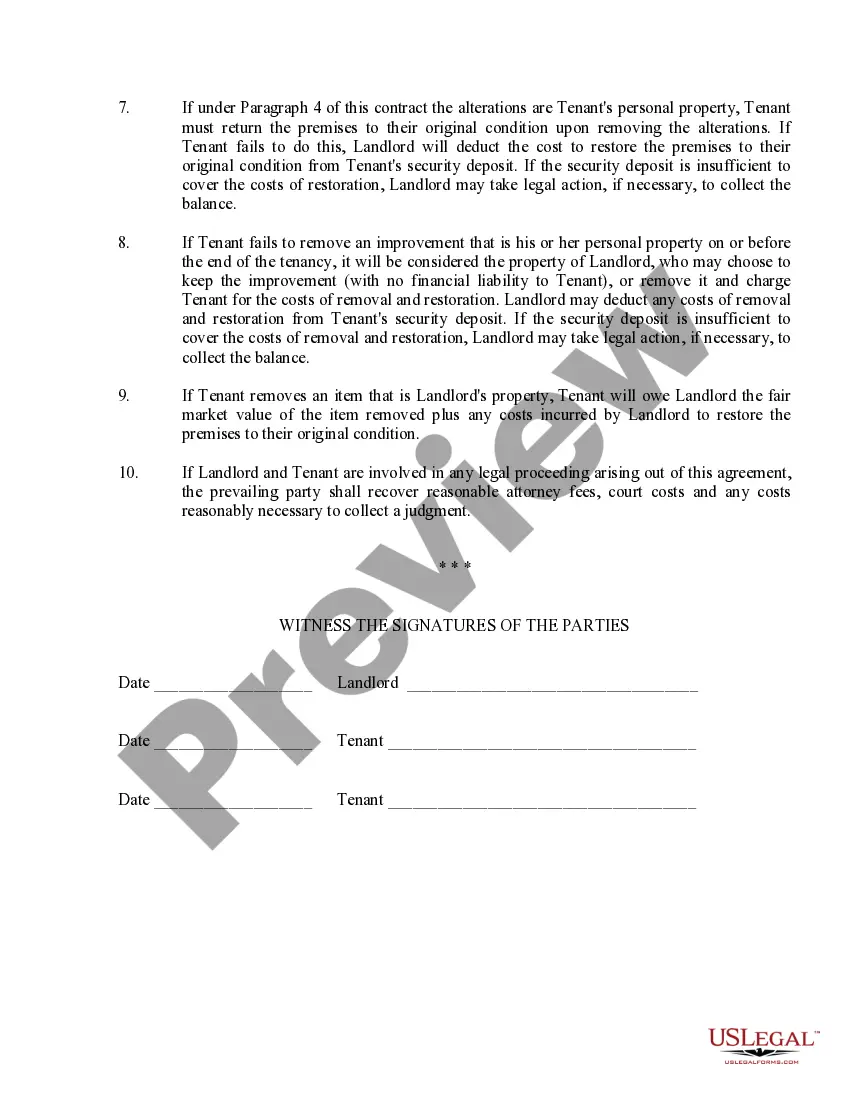

This Landlord Agreement to allow Tenant Alterations to Premises contract is an agreement between a landlord and a tenant regarding changes the tenant wishes to make to the rented premises. A written agreement is helpful in avoiding misunderstandings that might otherwise occur. Various issues are covered, including who will pay for the improvements, whose property the improvements will be considered, and whether or not and under what circumstances the tenant may remove the alterations if and when the tenant decides to move out.

North Dakota Agreement Withholding Tax Due Dates

Description

How to fill out North Dakota Landlord Agreement To Allow Tenant Alterations To Premises?

How to locate professional legal documents that adhere to your state regulations and prepare the North Dakota Agreement Withholding Tax Due Dates without enlisting an attorney's assistance.

Numerous services online provide templates for various legal situations and formalities.

However, it might require time to determine which of the available samples meet both your needs and legal criteria.

Download the North Dakota Agreement Withholding Tax Due Dates using the respective button next to the file name. If you lack an account with US Legal Forms, follow the instructions below: Examine the web page you've accessed and confirm that the form meets your requirements. Utilize the form description and preview options if they are available. Search for another template in the header referencing your state if needed. Click the Buy Now button when you identify the appropriate document. Choose the most fitting pricing plan, then sign in or create an account. Select your payment method (via credit card or through PayPal). Opt for the file format for your North Dakota Agreement Withholding Tax Due Dates and click Download. The documents you receive will remain yours: you can always revisit them in the My documents tab of your profile. Join our platform and create legal documents independently like a skilled legal professional!

- US Legal Forms is a trustworthy service that assists you in finding official paperwork created in accordance with the most recent state law revisions, while also helping you save money on legal aid.

- US Legal Forms is not just an ordinary web directory.

- It comprises over 85k validated templates for different business and personal circumstances.

- All documents are organized by region and state to streamline your search process and make it less cumbersome.

- It also includes advanced tools for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly complete their documents online.

- Obtaining the necessary paperwork requires minimal time and effort.

- If you already possess an account, Log In and verify that your subscription is active.

Form popularity

FAQ

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Upon withholding, the withholding agent shall furnish the taxpayer with a BIR Form 2307 (Certificate of Creditable Tax Withheld at Source) or Form 2316 (Certificate of Compensation Payment/ Tax Withheld), to be later attached to the Income Tax Return (ITR), as proof that the taxes have already been withheld.

It's important to fill out a Form W-4 correctly because the IRS requires people to pay taxes on their income gradually throughout the year. If you have too little tax withheld, then you could owe a surprisingly large sum to the IRS in April, plus interest and penalties for underpaying your taxes during the year.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.18-Dec-2019

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.