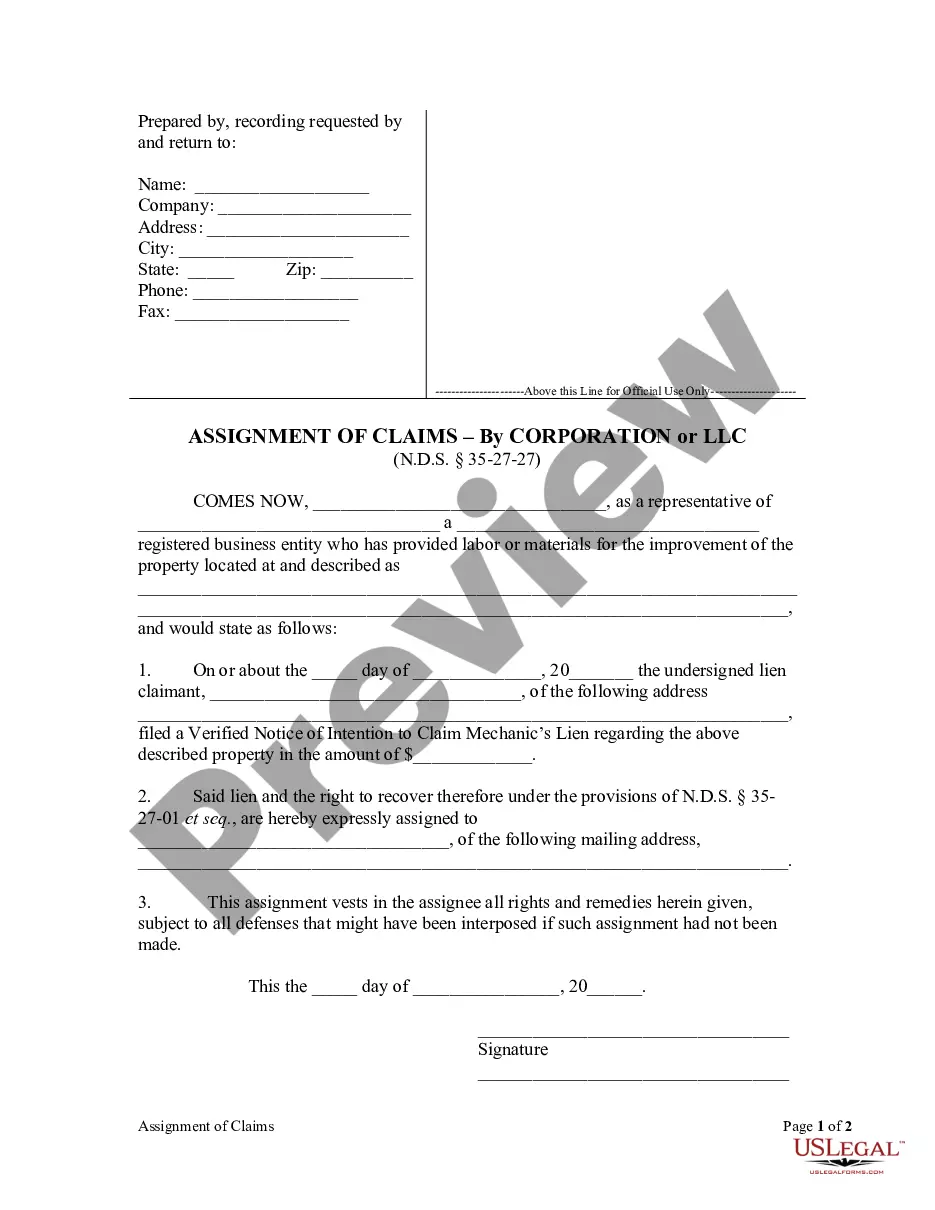

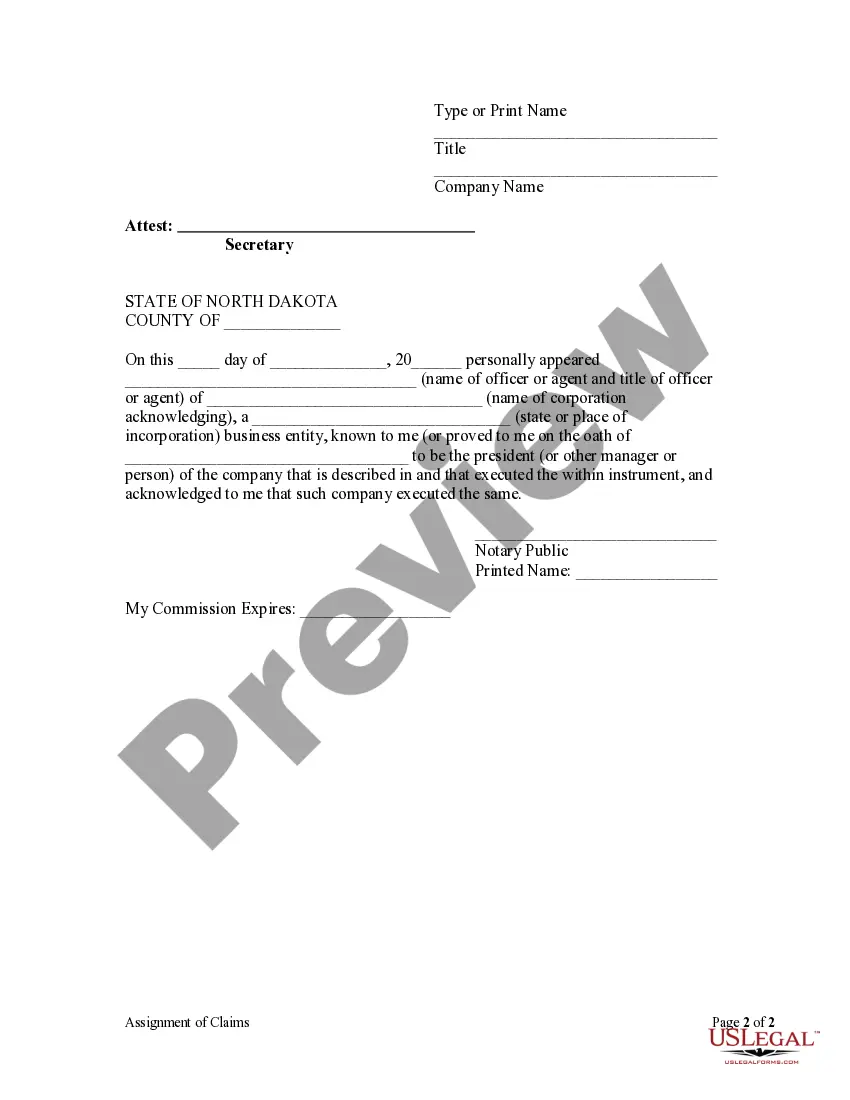

This Assignment of Claims form is for use by a corporation that has provided labor or materials for the improvement of real property to assign the corporation's lien for the same who will have all the rights and remedies of the lien claimant, subject to all defenses that might have been interposed if such assignment had not been made.

North Dakota Assignment Withholding

Description

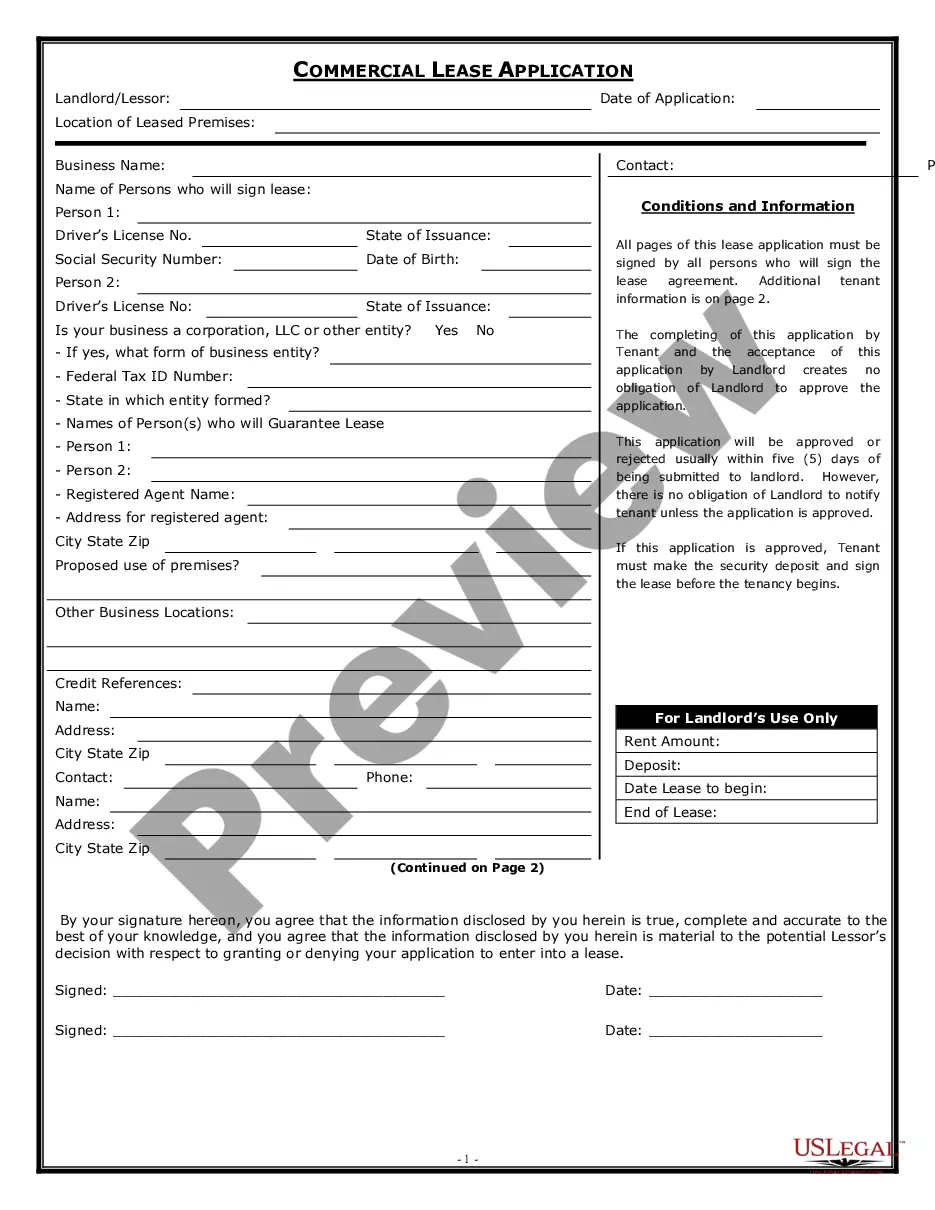

How to fill out North Dakota Assignment Withholding?

There's no longer a requirement to devote time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and simplified their retrieval.

Our website offers over 85k templates for various business and personal legal situations organized by state and application area. All forms are expertly crafted and confirmed for accuracy, ensuring you can confidently obtain an updated North Dakota Assignment Withholding.

Select the desired pricing plan, register for an account, or Log In. Proceed to pay for your subscription with a card or PayPal. Choose the file format for your North Dakota Assignment Withholding and download it to your device. Print your document to complete it by hand or upload the example if you wish to edit it online. Preparing legal documents under federal and state laws and regulations is fast and straightforward with our library. Try US Legal Forms right now to maintain your documentation in order!

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents whenever needed by accessing the My documents tab in your profile.

- If you haven't used our service before, the procedure will involve additional steps to complete.

- Here’s how new users can find the North Dakota Assignment Withholding in our collection.

- Carefully read the page content to confirm it has the example you need.

- Utilize the form description and preview options if available.

- Use the Search bar above to look for another sample if the current one does not suit your needs.

- Click Buy Now next to the template name once you locate the suitable one.

Form popularity

FAQ

A 0 tax return can be advantageous if it means you had no taxable income for the year. This situation allows you to avoid tax obligations and may qualify you for certain state assistance programs. However, if you had income, a zero return may lead to complications with tax authorities. Thus, accurately reflecting your financial situation is crucial, and you can rely on uslegalforms for help navigating the tax return process.

Putting zeros on your tax return typically indicates that you are not reporting any income for that year. This approach can be beneficial if you had no earnings, yet it is important to ensure that this reflects your true financial situation. In cases where income was earned but not reported, using zeros may raise questions from tax authorities. If you feel uncertain about how to handle your tax situation, uslegalforms can provide the guidance necessary.

Selecting the right withholding percentage is essential for managing your finances. Factors affecting your decision include your annual income, taxable deductions, and any additional income you may earn. Ensure you evaluate your tax liability to determine the most appropriate percentage. Tools from uslegalforms can be helpful in calculating the right withholding percentage tailored for your situation.

Choosing whether to claim 0 or 1 on your withholding depends on your financial objectives. Claiming 0 may result in a higher amount withheld for taxes, potentially leading to a refund at tax time. Conversely, claiming 1 may provide immediate access to more of your earnings. Assess your circumstances and consider consulting resources like uslegalforms for a better understanding of your options.

To fill out your withholding form, start by providing your personal information such as name, address, and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim based on your tax situation. Afterward, review your completed form for accuracy before submitting it to your employer. If you need additional help, uslegalforms offers templates that can assist in completing tax-related paperwork.

You can figure out how much state tax should be withheld by completing a withholding form, which typically includes your income level, tax status, and number of dependents. Additionally, you may consult the North Dakota state tax tables to see the recommended withholding amounts. Remember, proper estimation is crucial to avoid overpaying or underpaying taxes. For personalized guidance, consider using resources from uslegalforms, which can simplify this process.

Generally, non-residents who receive certain types of income, such as dividends or interest, may find themselves subject to a 30% withholding rate. This regulation primarily affects foreign investors and entities earning income in the U.S. Understanding your residency status and income types can help you navigate these withholding requirements effectively.

Certain individuals may qualify for an exemption from North Dakota assignment withholding based on specific criteria, such as low income or eligibility for particular tax credits. If you meet these qualifications, it's essential to file the correct forms to claim your exemption. Utilizing available resources from platforms like US Legal Forms can streamline this process.

You may be subject to backup withholding if you fail to provide a correct taxpayer identification number or if you do not meet certain reporting requirements. This applies if the IRS informs you that you are at risk for backup withholding due to various tax compliance issues. Understanding your tax obligations can prevent unexpected withholding and ensure that you receive your expected income.

Yes, North Dakota does impose taxes on non-residents who earn income within the state, which can include wages and other forms of compensation. If you work in North Dakota, even temporarily, you may be subject to North Dakota assignment withholding on your earnings. Being aware of this regulation helps you manage potential tax liabilities.