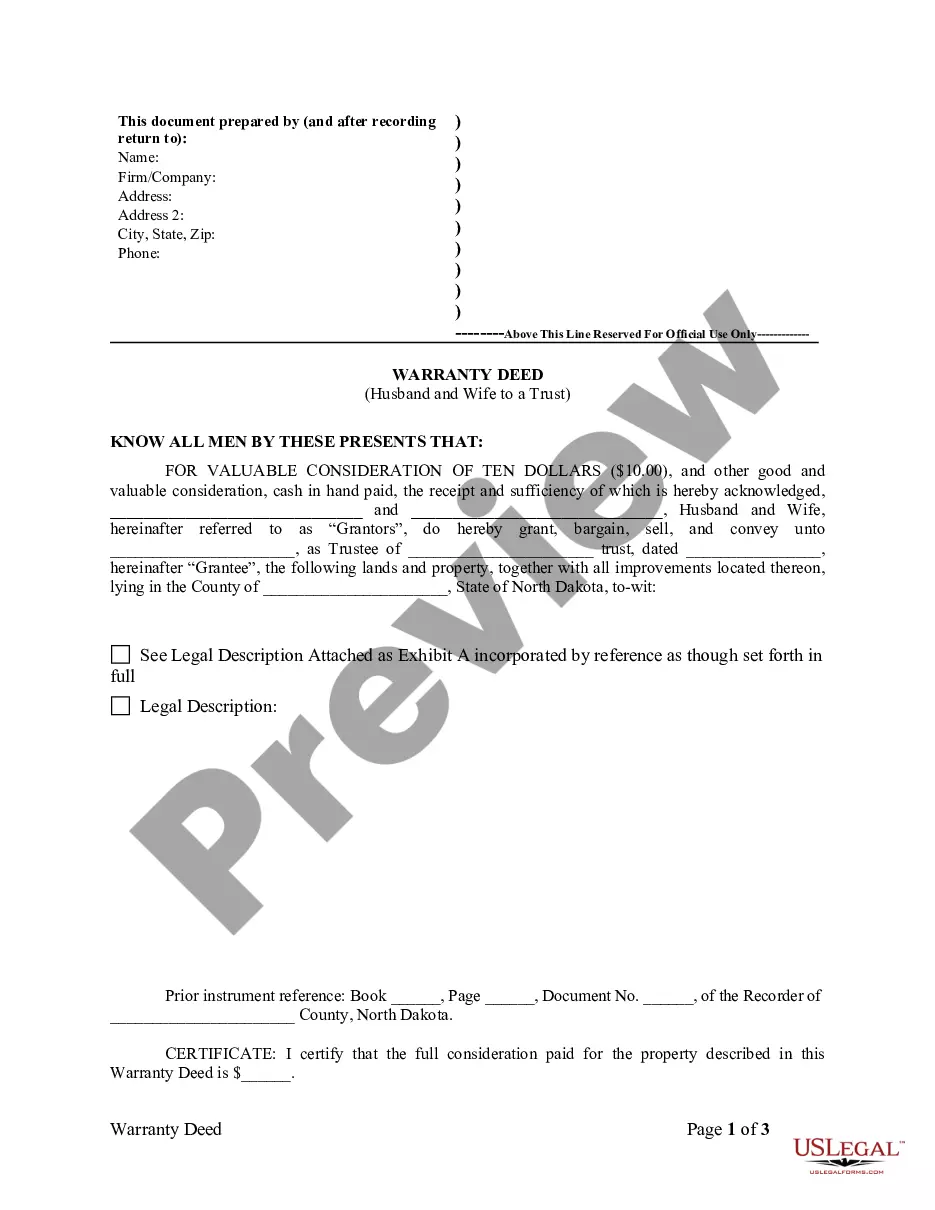

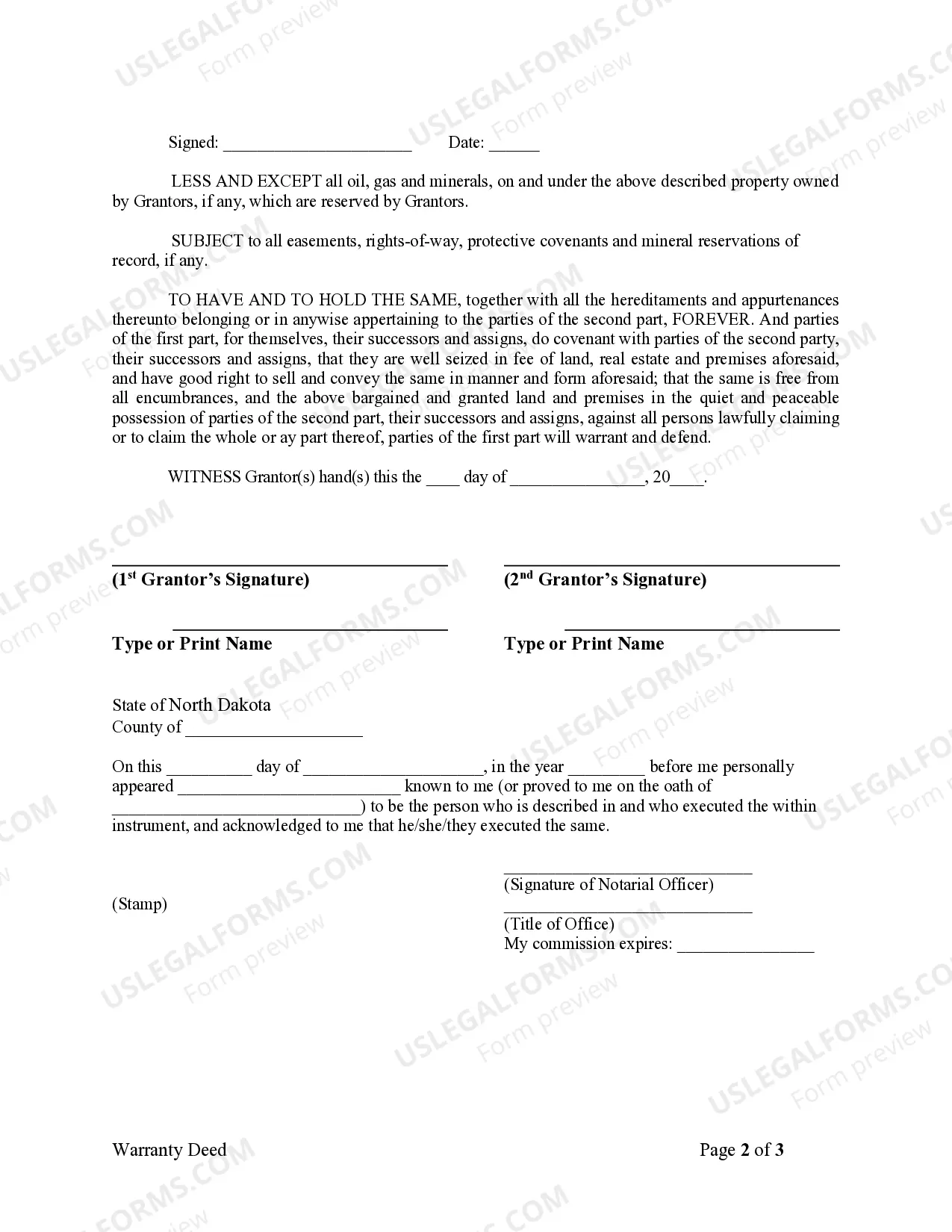

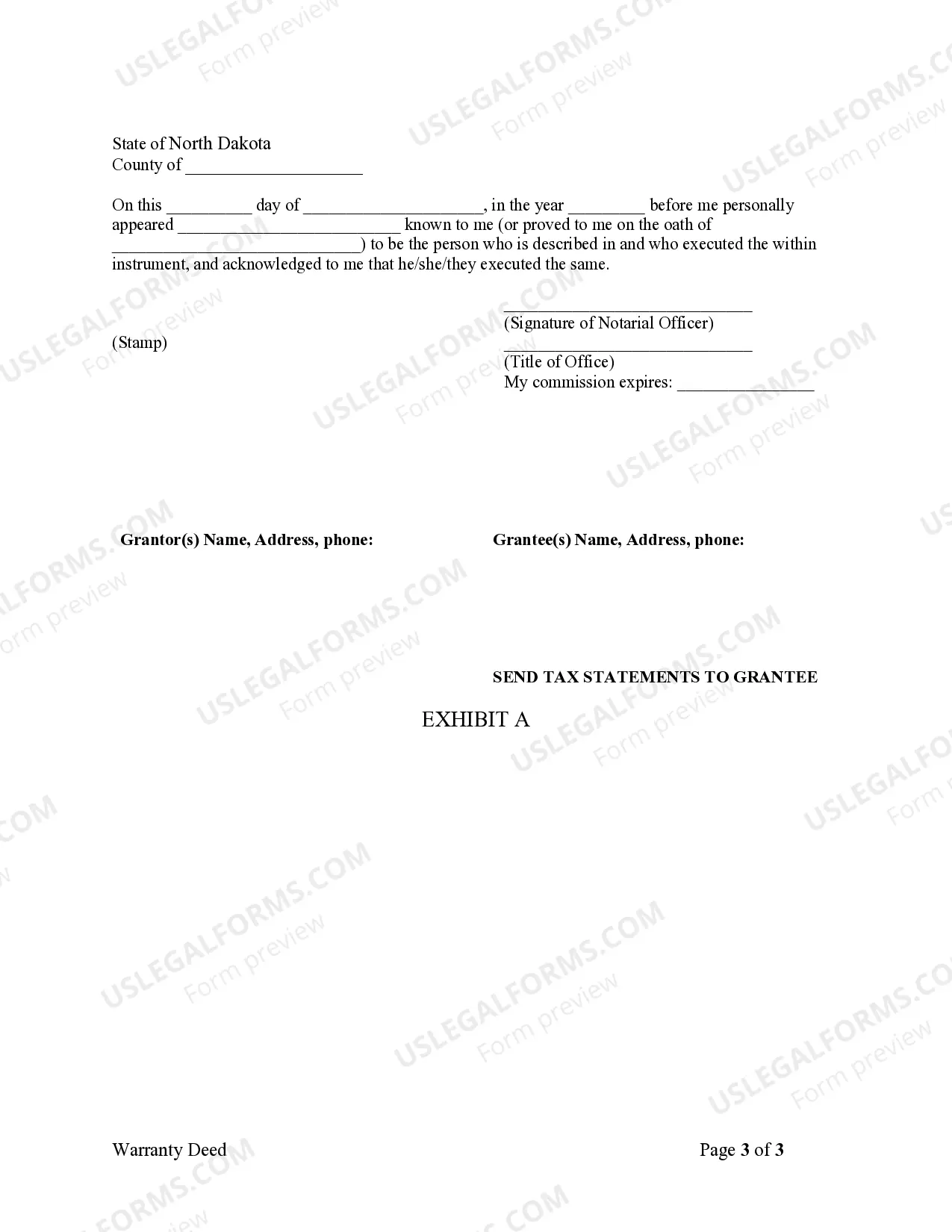

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

North Dakota Trust Withholding Tables 2021

Description

Form popularity

FAQ

You can find your tax table through several resources, including state tax department websites and financial platforms. The North Dakota trust withholding tables 2021 are specifically designed for North Dakota residents and can be accessed online. Additionally, US Legal Forms offers comprehensive resources to assist you in finding the correct tax table for your needs. Using reliable resources can help you navigate your tax situation confidently.

The withholding percentage you choose depends on your financial situation, such as income, deductions, and filing status. You may evaluate your expected tax liability using the North Dakota trust withholding tables 2021 to determine an appropriate withholding rate. A careful choice can lead to better financial management and an optimized tax return. Consulting a tax professional can also bring clarity to this decision.

Tax withholding tables are documents that outline how much tax should be withheld from salaries based on various income levels and filing statuses. They play a critical role in helping both employers and employees manage tax obligations throughout the year. For North Dakota residents, the North Dakota trust withholding tables 2021 provide specific figures tailored to the state's tax system. Using these tables can lead to more accurate withholding and fewer year-end surprises.

Choosing between 0 or 1 on your tax withholding form influences how much tax is deducted from your paycheck. A 0 status may lead to higher deductions, while 1 generally allows for lower withholding, impacting your potential refund or tax owed. Using the North Dakota trust withholding tables 2021 can help you make an informed decision about your tax situation. Analyzing your options ensures you meet your financial expectations.

States with a 0% capital gains tax offer opportunities for investors to maximize their returns without additional tax burdens. Some of the notable states that do not tax capital gains include Wyoming and Alaska. If you're considering moving or investing, it’s crucial to look at the North Dakota trust withholding tables 2021 to understand the implications of capital gains in comparison. A thorough evaluation can guide your financial decisions.

The nexus threshold in North Dakota pertains to the minimum level of business activity that creates a tax obligation in the state. When a business reaches this threshold, it must register and begin collecting taxes. To ensure compliance, it's vital to refer to the North Dakota trust withholding tables 2021 and understand your responsibilities. This knowledge can help you avoid fines and maintain good standing with tax authorities.

Withholding using tax tables refers to the practice of deducting taxes from payments based on a standardized set of tables regarding income and filing status. This method ensures tax payments are spread throughout the year, rather than in one lump sum. The North Dakota trust withholding tables 2021 provide the necessary guidelines for this process. Understanding withholding can maintain your budget and prevent surprises at tax time.

Capital gains tax in North Dakota generally falls within the state's income tax brackets. The rate can vary significantly depending on your income level, impacting how much of your gain is taxable. You can refer to the North Dakota trust withholding tables 2021 to assess your potential tax liabilities effectively. Knowing your tax responsibilities can help you plan your investments.

In North Dakota, the capital gains exclusion allows residents to exclude a portion of their capital gains from taxation. For individuals, this exclusion helps reduce the taxable amount when selling a qualified asset. The North Dakota trust withholding tables 2021 can guide you on calculations related to withholding. Understanding the exclusion can lead to savings and better financial decisions.

State withholding differs from federal withholding, as each has its own calculation methods and rates based on the respective tax codes. The North Dakota trust withholding tables 2021 guide the state withholding calculations specific to North Dakota. Understanding these differences helps you manage your finances better and ensures that you meet your tax obligations. For more detailed assistance, consider exploring the resources available on the uslegalforms platform.