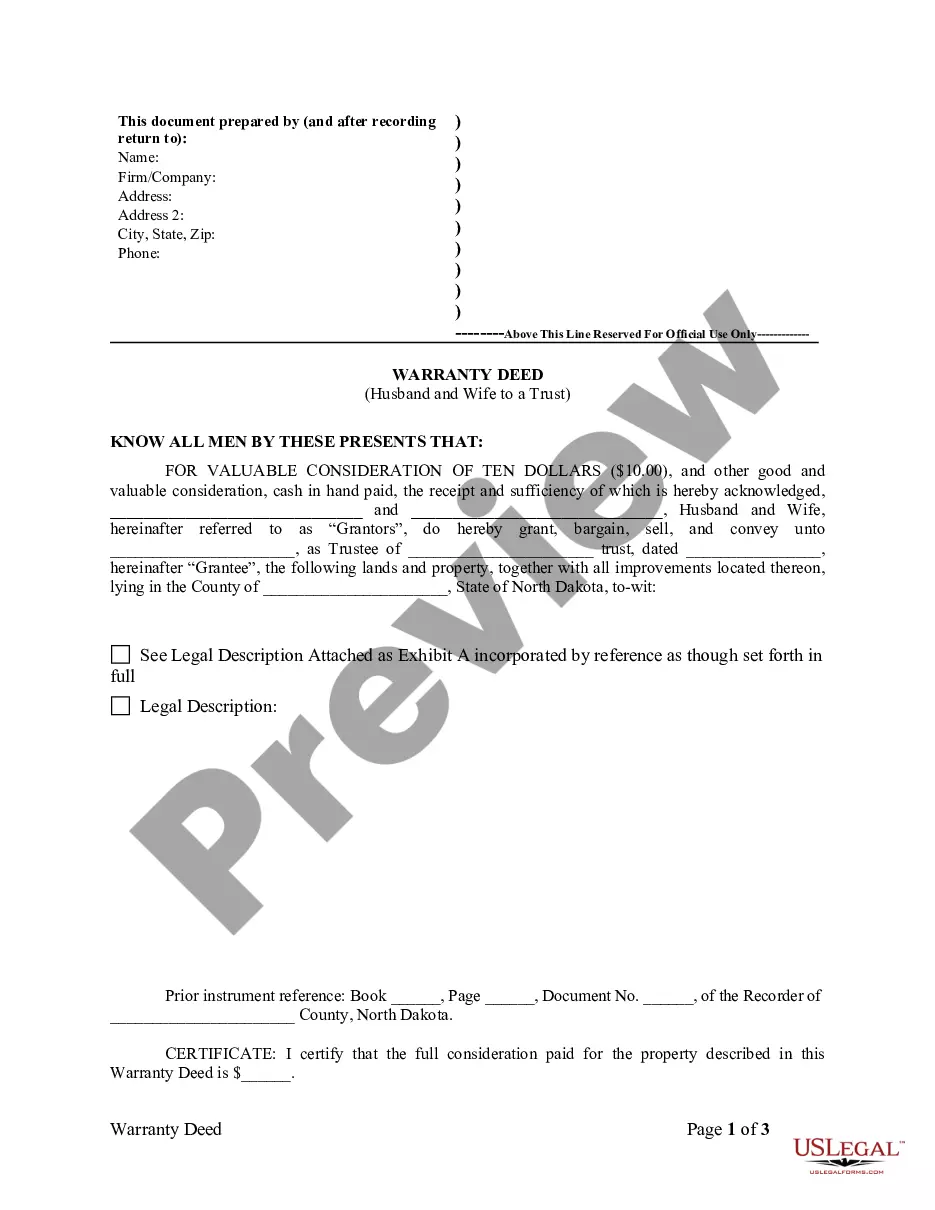

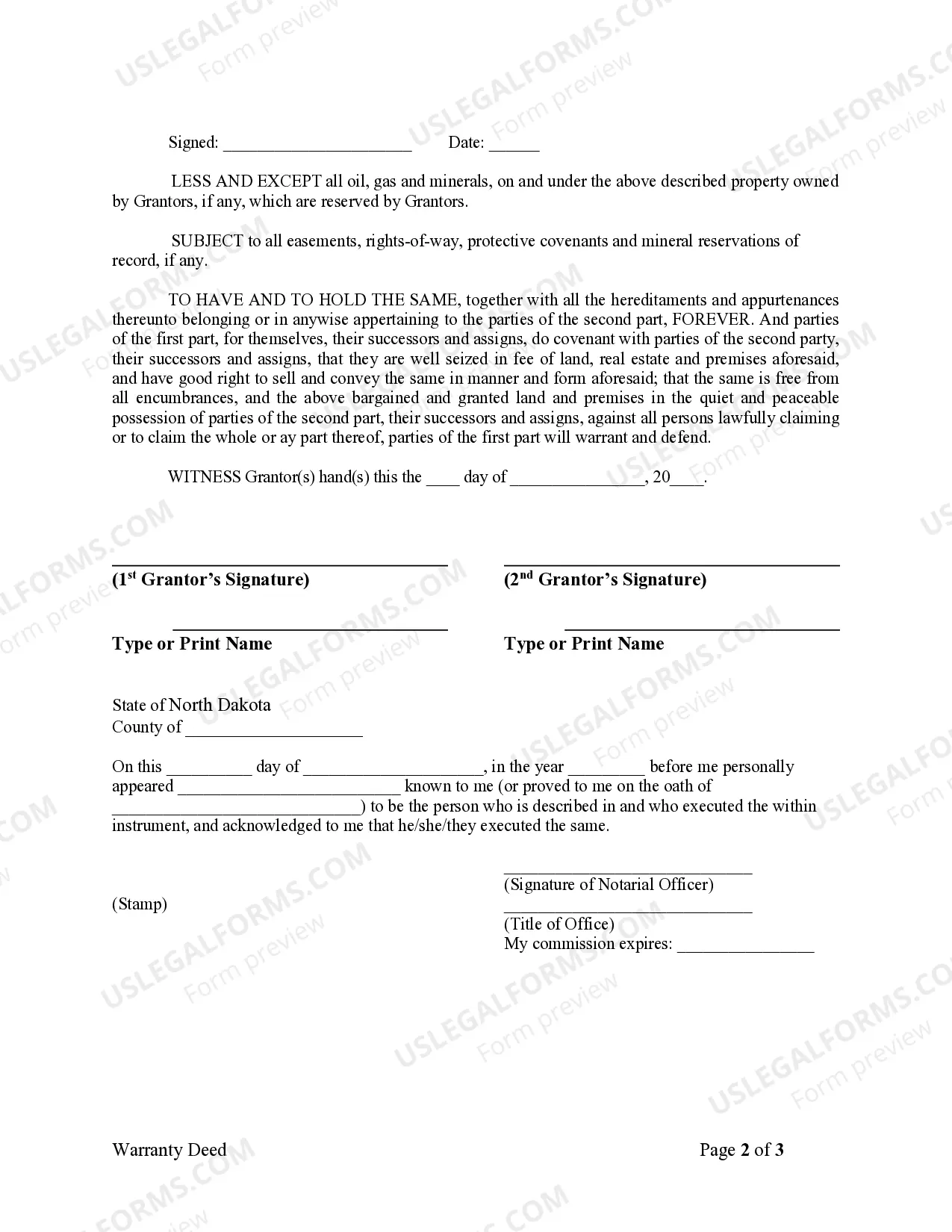

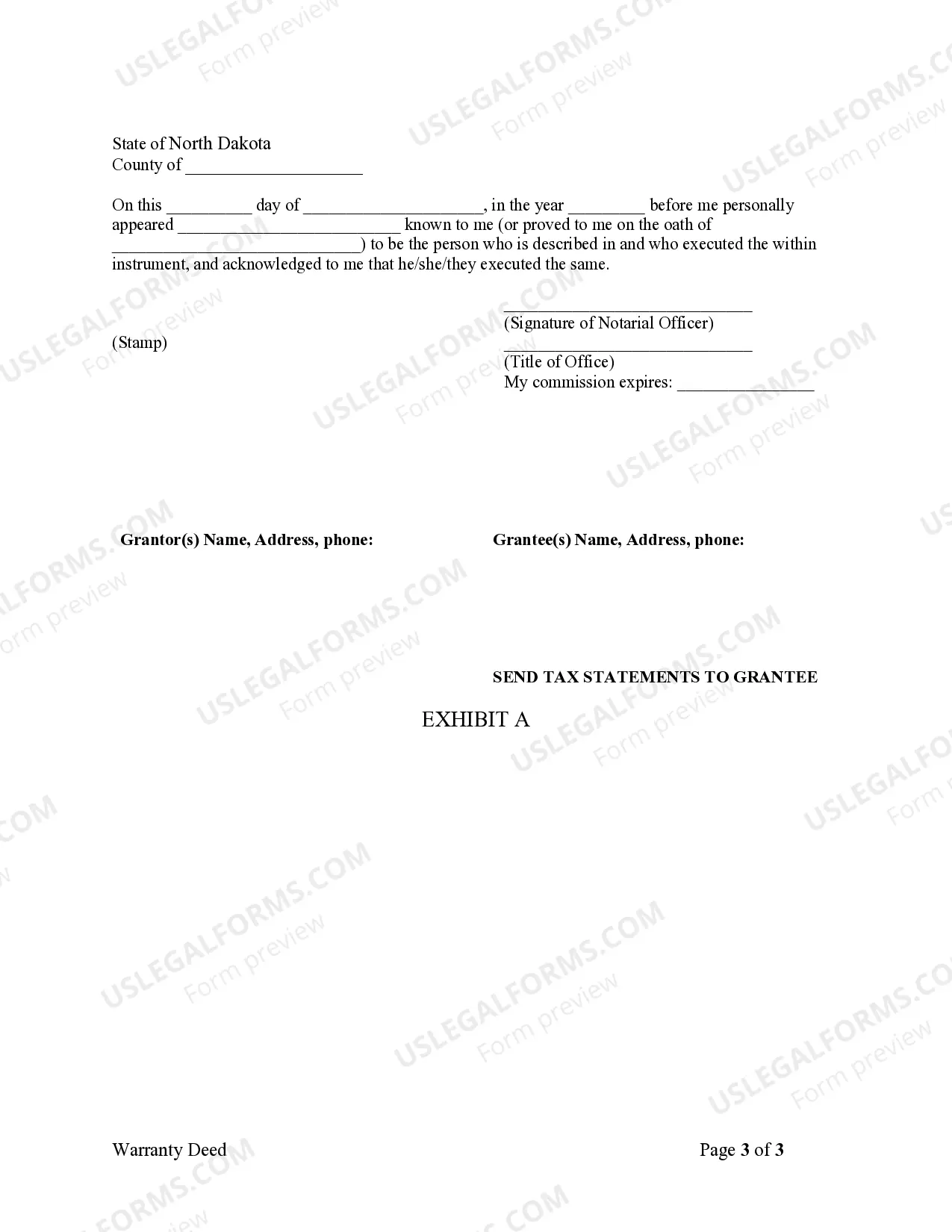

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

North Dakota Trust Withholding Form 2021

Description

Form popularity

FAQ

North Dakota does provide a state tax withholding form for trusts and other entities. This form is crucial for reporting income accurately and is necessary when dealing with the North Dakota trust withholding form 2021. Utilizing the right forms can streamline your tax process and promote timely filing.

Yes, North Dakota does have a state income tax form that residents and trusts must use when filing taxes. This form is essential, especially for those using the North Dakota trust withholding form 2021. Ensuring you have the correct form can simplify your tax filing process and help you stay compliant.

State withholding is not the same as federal withholding; they serve different purposes. While federal withholding applies to income at the national level, North Dakota tax laws may differ in rates and regulations. When using the North Dakota trust withholding form 2021, ensure you are aware of both to manage your tax obligations effectively.

North Dakota does accept federal extensions for trusts, allowing more time to file similar to individual taxpayers. This means, with the appropriate form, you can benefit from the additional time allotted under the North Dakota trust withholding form 2021. Always check for specific state guidelines to ensure compliance.

Yes, withholding can be distributed on a trust under certain circumstances. In the context of the North Dakota trust withholding form 2021, this applies to distributions made to beneficiaries. It's important to ensure that the required withholding is correctly calculated and reported to avoid any tax issues.

Calculating local tax withholding requires knowing the specific local rates that apply to your area. You can usually find this information on your city's or county's official websites. For accurate results, ensure you complete the North Dakota trust withholding form 2021 with the local tax parameters as they may differ from state regulations.

The percentage of state tax that should be withheld depends on your income and filing status. North Dakota has specific tax brackets that dictate this percentage. By referring to the guidelines on the North Dakota trust withholding form 2021, you can determine the correct withholding rate for your situation.

Calculating state tax involves taking your taxable income and applying the appropriate state tax rate. For North Dakota, you can find the rates on the state's revenue website. If you are unsure how to proceed, the North Dakota trust withholding form 2021 includes instructions to assist you in this calculation.

To figure out state tax withholding, start by using the North Dakota Department of Revenue resources, which provide guidelines based on your income and filing status. You can utilize tables or calculators provided online to determine your withholding amount. Additionally, remember that filling out the North Dakota trust withholding form 2021 accurately will help ensure you withhold the correct amount.

Your North Dakota withholding account number is a unique identifier for your business's state tax withholdings. You can typically find this number on your state tax return or any official documents related to your business. If you’re unable to locate it, consider checking with the North Dakota tax department. Using the North Dakota trust withholding form 2021 correctly will also help you manage your account.