Financial Planning Worksheet For Career Transition

Description

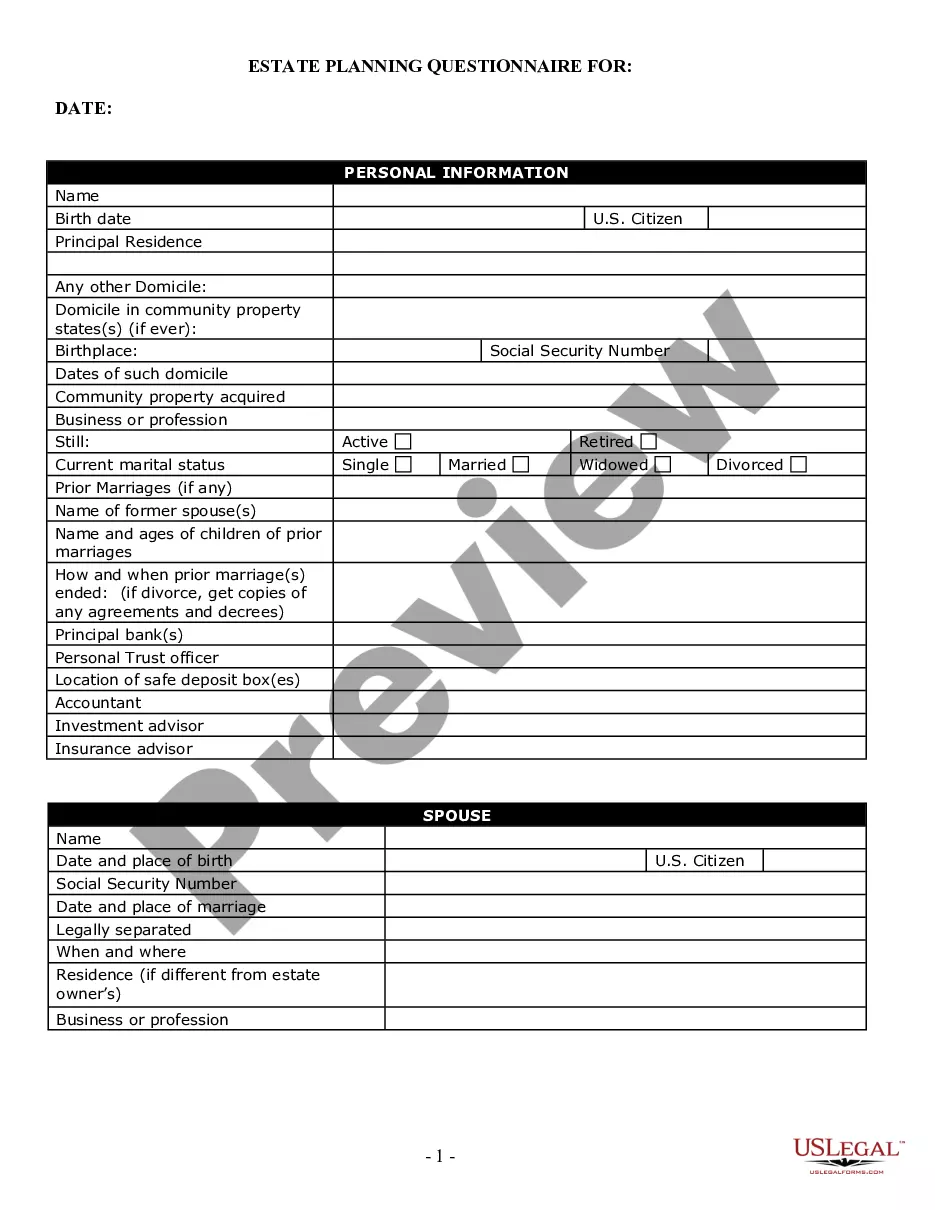

How to fill out North Carolina Estate Planning Questionnaire And Worksheets?

Accessing legal templates that meet the federal and regional regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the correctly drafted Financial Planning Worksheet For Career Transition sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are simple to browse with all papers arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when acquiring a Financial Planning Worksheet For Career Transition from our website.

Obtaining a Financial Planning Worksheet For Career Transition is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the guidelines below:

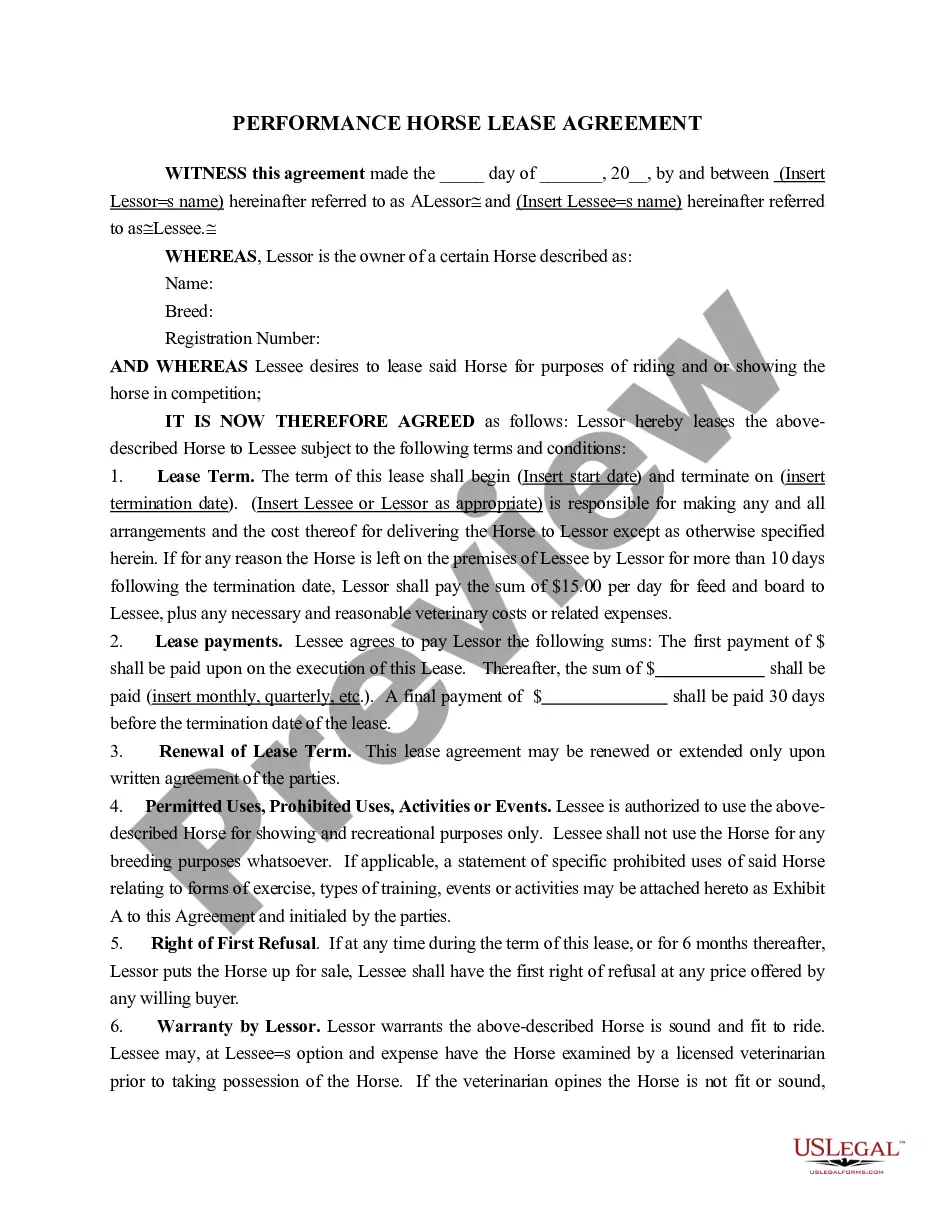

- Analyze the template using the Preview option or via the text outline to ensure it fits your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Financial Planning Worksheet For Career Transition and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Here's a walkthrough of the five steps of the financial planning process: Step 1: Understand your current financial situation. ... Step 2: Write down your financial goals. ... Step 3: Look at the different investment options. ... Step 4: Create and implement a customized plan for you. ... Step 5: Re-evaluate and revise your plan.

You will get hands-on intensive instruction on the Financial Planning Worksheet. The five components of the Financial Planning Worksheet are: Net Worth Statement, Income, Budget or Spending Plan, Financial Health Assessment with Action Plan, Debt Destroyer, and Financial Links.

Zero-based budgeting is when your income minus your expenses equals zero. Perfect name, right? So, if you make $3,000 a month, everything you give, save or spend should add up to $3,000. Every dollar that comes in has a purpose, a job, a goal.

How to create a budget spreadsheet in 7 steps Pick your platform. The best budget spreadsheet for you is probably the one you're most comfortable using. ... Break down your income. ... Break down your expenses. ... Determine timing. ... Set up the spreadsheet. ... Plug in the numbers. ... Update as necessary.

During this course, you will learn how to develop a spending plan (also known as a budget) or update the one you previously developed to gain an understanding of how transition will affect your financial situation through discussion of income, debt, expenses, and assets.