Relinquishment Deed Without Consideration Stamp Duty

Description

How to fill out Relinquishment Deed Without Consideration Stamp Duty?

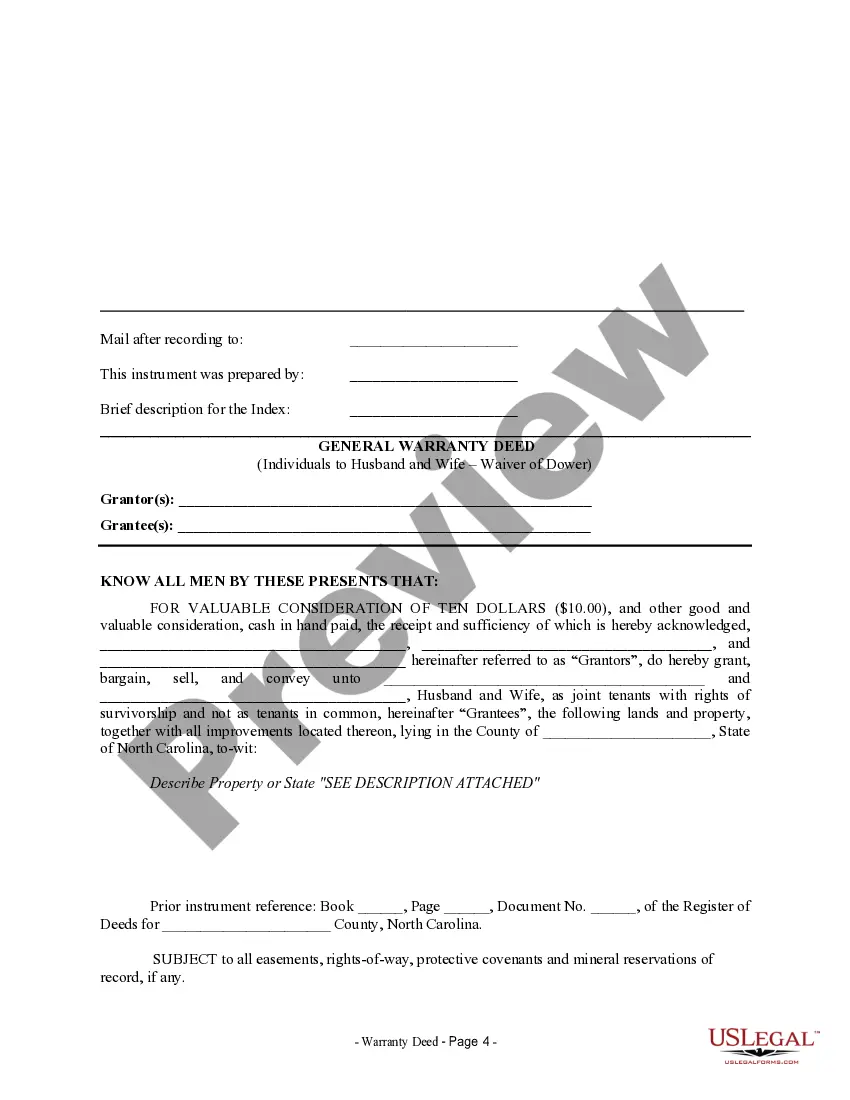

Individuals typically link legal documents with complexity that only an expert can handle.

In a sense, this is accurate, as creating a Relinquishment Deed Without Consideration Stamp Duty requires significant knowledge of subject matters, including state and county laws.

However, with the US Legal Forms, everything has become more straightforward: pre-prepared legal templates for any life and business circumstance tailored to state regulations are compiled in a single online repository and are now accessible to all.

Create an account or Log In to proceed to the payment page.

- US Legal Forms offers over 85k current documents categorized by state and purpose, so searching for Relinquishment Deed Without Consideration Stamp Duty or any other specific template only takes moments.

- Previously registered users with an active subscription must Log Into their account and click Download to obtain the form.

- New users will first need to establish an account and subscribe before they can save any documentation.

- Here are the step-by-step instructions on how to obtain the Relinquishment Deed Without Consideration Stamp Duty.

- Examine the page content closely to confirm it meets your requirements.

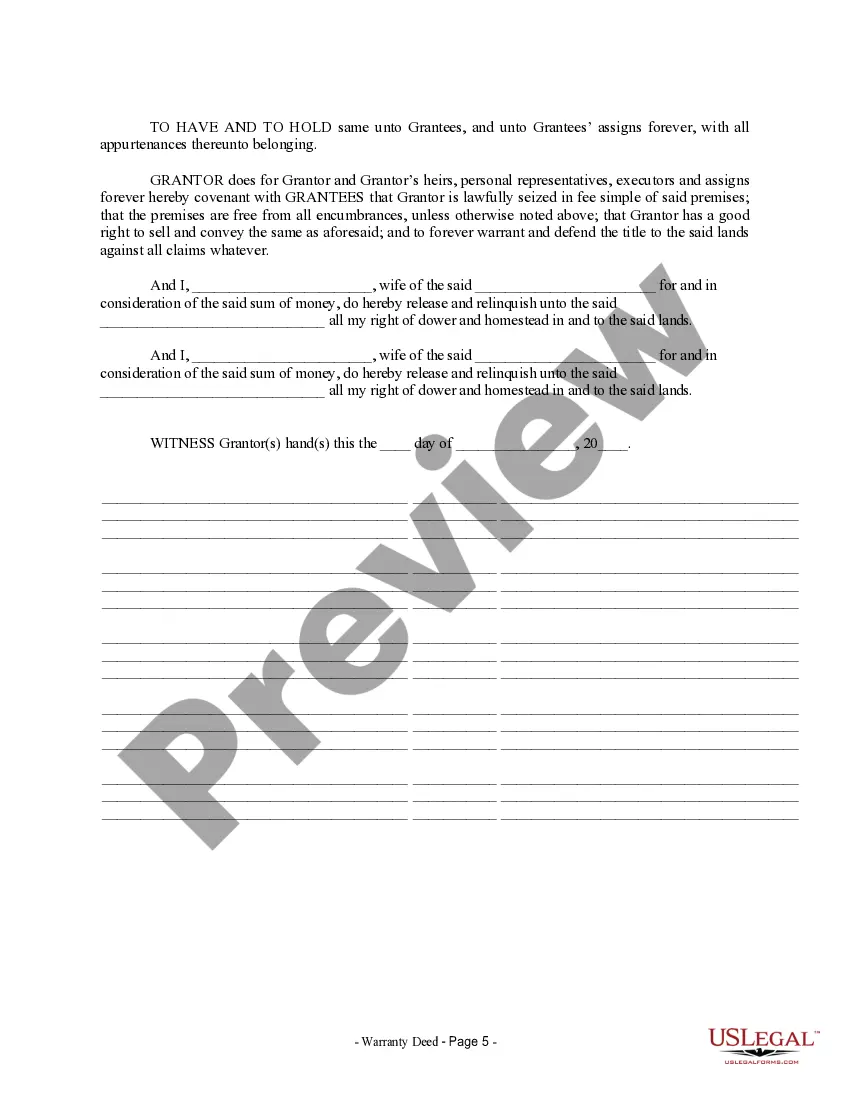

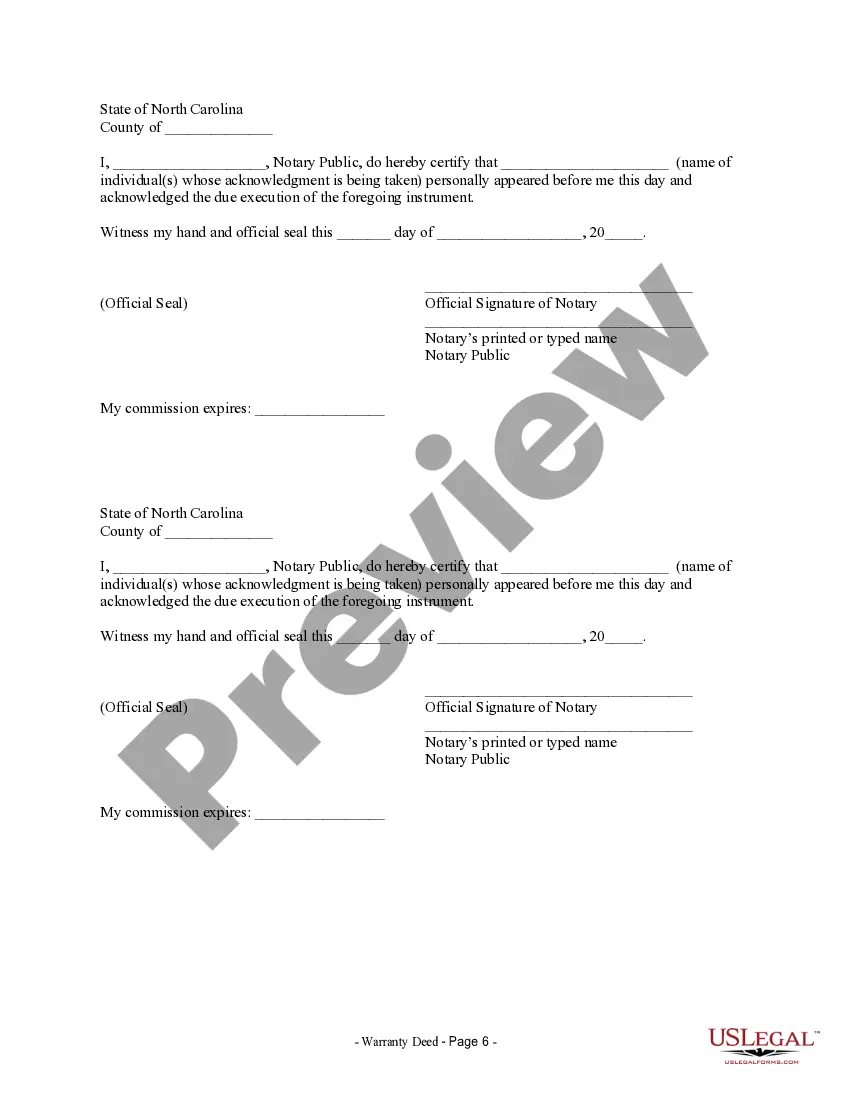

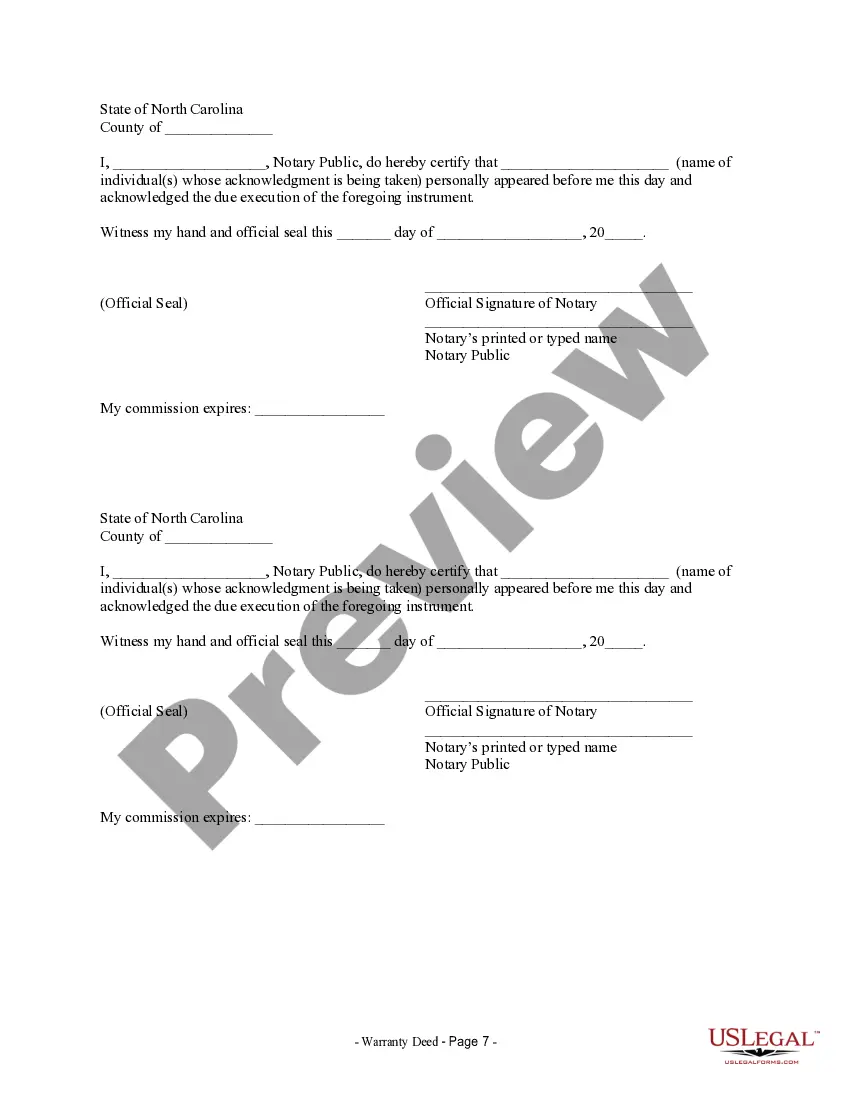

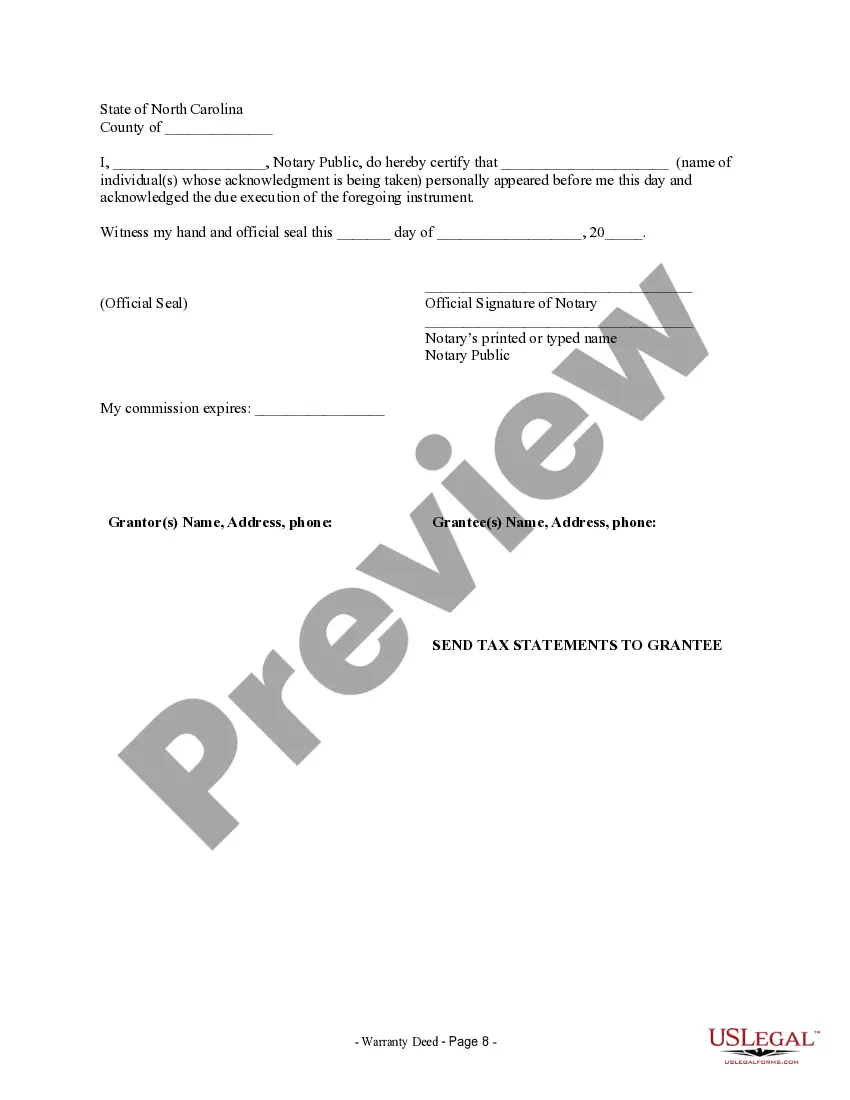

- Review the form description or view it through the Preview feature.

- If the previous sample doesn’t fit your needs, look for another one using the Search bar above.

- Once you find the correct Relinquishment Deed Without Consideration Stamp Duty, click Buy Now.

- Choose a pricing plan that accommodates your needs and budget.

Form popularity

FAQ

Yes, stamp duty is generally applicable on the transfer of property between family members in Maharashtra. However, there are specific rules governing this, especially in cases involving a relinquishment deed without consideration. It’s vital to verify local regulations or seek advice to clarify any exemptions applicable in your situation.

To register a relinquishment deed in Delhi, you need to draft the deed properly and have it executed by all parties involved. Submit it to the local sub-registrar along with required documentation and the applicable stamp duty. If you need assistance, various legal platforms can help streamline the process and ensure compliance with regulations.

Yes, stamp duty is generally payable on the transfer of property between family members in India. However, certain exemptions may apply, especially if the transfer occurs through a relinquishment deed without consideration. It is essential to assess the local regulations and consult a legal professional to navigate these rules effectively.

The stamp duty on a relinquishment deed in India can vary significantly by state. Generally, it is lower compared to other property transactions. Many states provide exemptions or reduced rates when transferring property to relatives. Understanding the specific provisions for relinquishment deed without consideration stamp duty in your state is crucial.

The stamp duty on a transfer deed in Maharashtra typically ranges from 3% to 7% of the property's market value. This may differ based on the nature of the transaction and the relationship between the parties. Specifically, if it involves a relinquishment deed without consideration, other provisions may apply. It is advisable to check current rates with local authorities.

In Maharashtra, the stamp duty on the gift of immovable property to relatives is generally 3% of the property value. This is applicable if the property is registered as a gift deed. However, if the gift is through a relinquishment deed without consideration, this duty can vary. Always consult local regulations or a legal expert for precise details.

Yes, a relinquishment deed without consideration stamp duty can be registered anywhere in India, as long as it complies with the relevant state laws and regulations. The document must be executed on appropriate stamp paper and presented for registration within the stipulated timeframe. It is crucial to visit the local sub-registrar's office where the property is located to ensure that the deed meets all local legal requirements. Utilizing platforms like uslegalforms can simplify the preparation and submission process, ensuring adherence to all legal norms.

To send a relinquishment deed without consideration stamp duty from abroad, you can use a registered postal service that offers international shipping. It is advisable to ensure that the deed is properly notarized and includes all necessary signatures before sending it. You may also want to consult with a local attorney in India to ensure compliance with local laws during the process. This helps in making the registration smoother once the document reaches its destination.