Relinquishment Deed In Marathi

Description

How to fill out Relinquishment Deed In Marathi?

There is no longer a requirement to spend countless hours searching for legal documents to fulfill your local state regulations.

US Legal Forms has compiled all of them in a single location and simplified their accessibility.

Our platform offers over 85k templates for any business and personal legal situations categorized by state and field of use. All forms are expertly created and verified for authenticity, ensuring you receive an up-to-date Relinquishment Deed In Marathi.

Choose your preferred subscription plan and either set up an account or Log In. Pay for your subscription with a card or via PayPal to proceed. Choose the file format for your Relinquishment Deed In Marathi and download it to your device. Print your form to complete it by hand or upload the template if you wish to do it in an online editor. Creating official paperwork under federal and state regulations is quick and easy with our collection. Try US Legal Forms today to keep your documentation organized!

- If you are acquainted with our service and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all purchased documents whenever necessary by selecting the My documents tab in your profile.

- If you've not used our service previously, the procedure will require a few additional steps to finish.

- Here’s how new users can find the Relinquishment Deed In Marathi in our catalog.

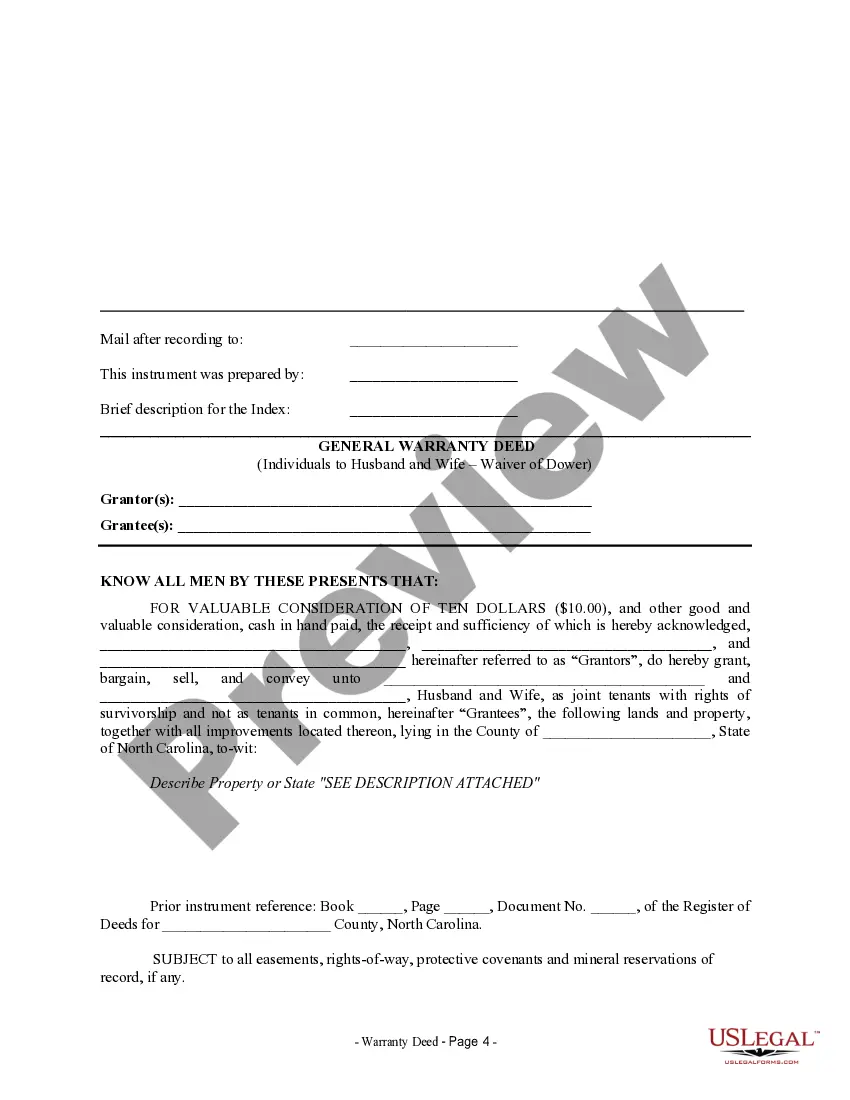

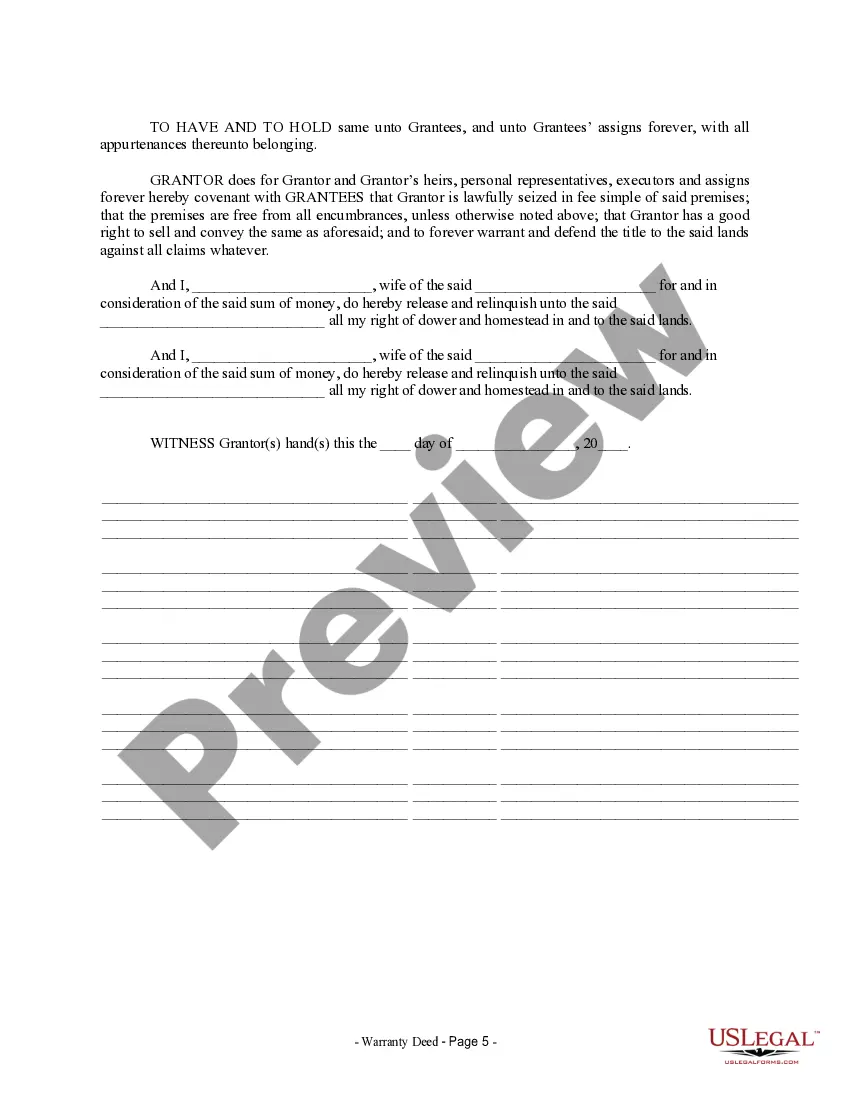

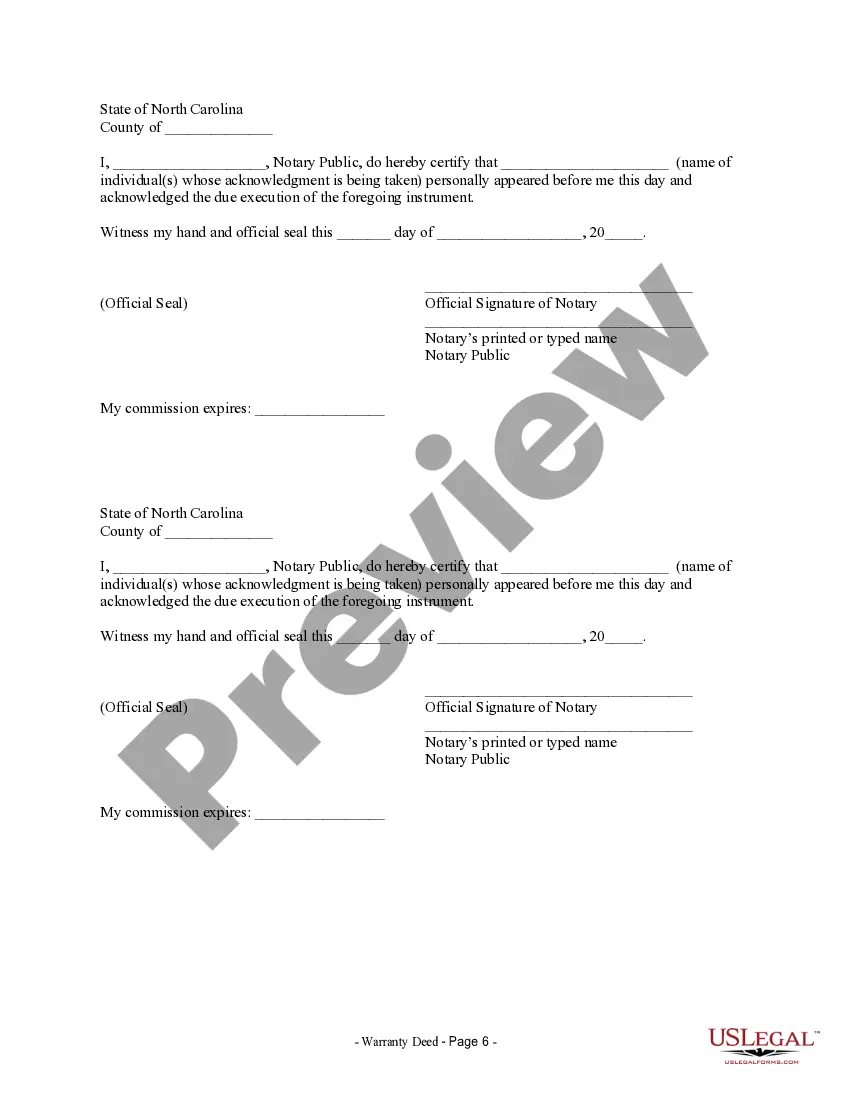

- Examine the page content thoroughly to ensure it includes the sample you need.

- To do this, make use of the form description and preview options if available.

- Utilize the Search field above to look for another sample if the prior one didn't meet your needs.

- Click Buy Now next to the template title once you identify the correct one.

Form popularity

FAQ

In Maharashtra, a relinquishment deed is specifically applicable to transfers of property rights among family members. It ensures that one party relinquishes their claim to a property, thereby allowing another family member to gain full ownership. This process can be made simpler by consulting legal resources and templates available on platforms like uslegalforms to navigate the specifics of a relinquishment deed in Marathi.

A relinquishment deed in India is a legal document that allows a person to give up their rights over a property in favor of another person. This is commonly used in family situations where one family member relinquishes their share in favor of another. Understanding the nuances of a relinquishment deed in Marathi can guide you in making informed decisions about property transfers in India.

In India, a gift deed is subject to tax regulations under the Income Tax Act. If the value of the gifted property exceeds a certain threshold, it may be considered taxable income for the recipient. However, certain exemptions apply, especially for gifts received from relatives. For detailed information about tax implications related to a gift deed, you may refer to resources available on the uslegalforms platform.

Choosing between a gift deed and a release deed depends on your specific circumstances. A gift deed transfers ownership without any consideration, while a release deed relinquishes rights to a property. If you need a relinquishment deed in marathi, consider consulting with a legal expert to make an informed choice based on your needs.

A letter to relinquish property rights is a formal document that signifies one's intent to transfer their stake in a property to another party. This letter outlines the property details and declares the relinquishment clearly. For those in Maharashtra, using a relinquishment deed in marathi is often the preferred method to ensure legality and clarity in the process.

Yes, stamp duty is applicable when transferring property between family members in Maharashtra. Depending on the relationship, the stamp duty may vary. It is important to consult relevant laws and check the applicable rates. When dealing with a relinquishment deed in marathi, understanding these regulations ensures a smooth transaction.

Yes, a relinquishment deed is taxable in India. When you transfer your property rights through this deed, it may attract capital gains tax if there is a profit during the transfer. It's important to understand the implications of a relinquishment deed in Marathi, as local regulations may also influence taxation. For detailed guidance on this matter, consider utilizing the resources available on the US Legal Forms platform, which can provide clarity on legal documentation and tax responsibilities.

A letter of relinquishment is a formal document that indicates a person's intent to give up certain rights or claims. This letter serves as an official acknowledgement, particularly in legal contexts, and may use the phrase 'Relinquishment deed in marathi' to clarify its purpose. It is important to ensure the document is accurate and legally binding, making platforms like US Legal Forms a valuable resource for creating such letters.

To write a letter of relinquishment, start by clearly stating your name and address at the top. Next, include the recipient's name and address, followed by the date. In the body, clearly express your intent to relinquish rights, using the term 'Relinquishment deed in marathi' to emphasize the legal context. Finally, sign the letter and keep a copy for your records.