Relinquishment Deed For Property

Description

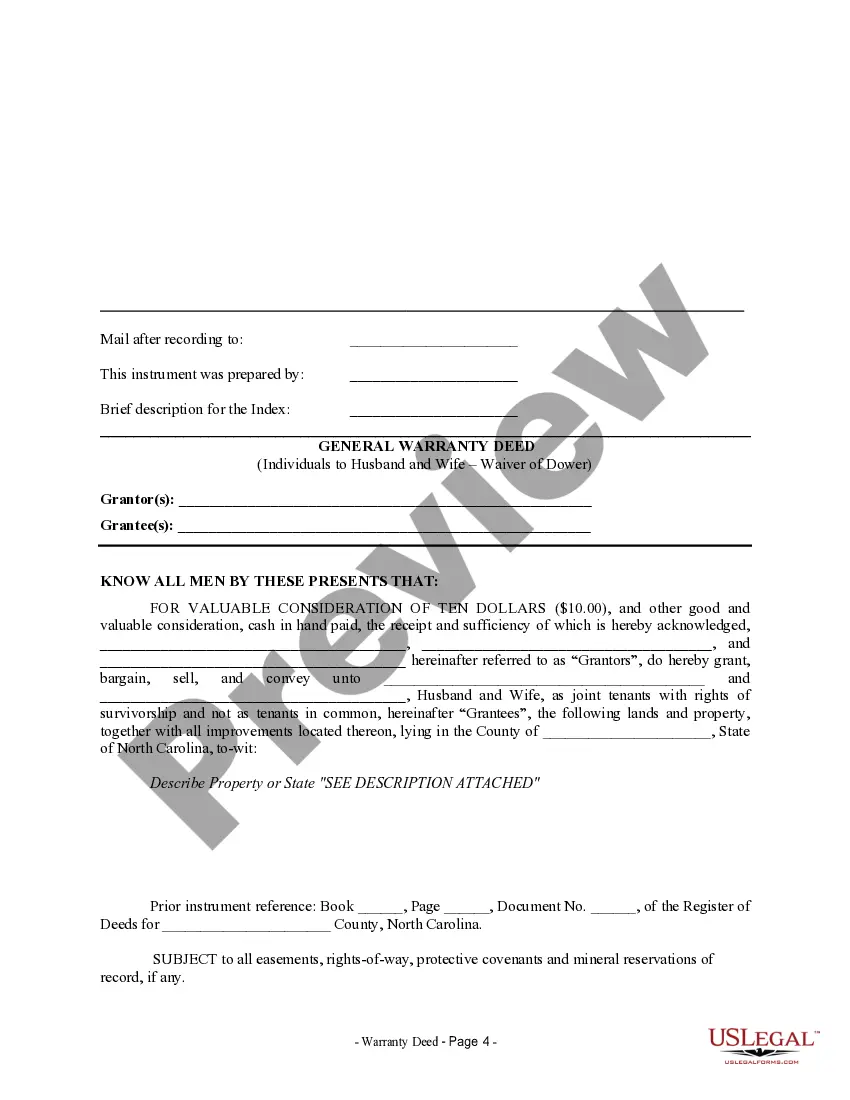

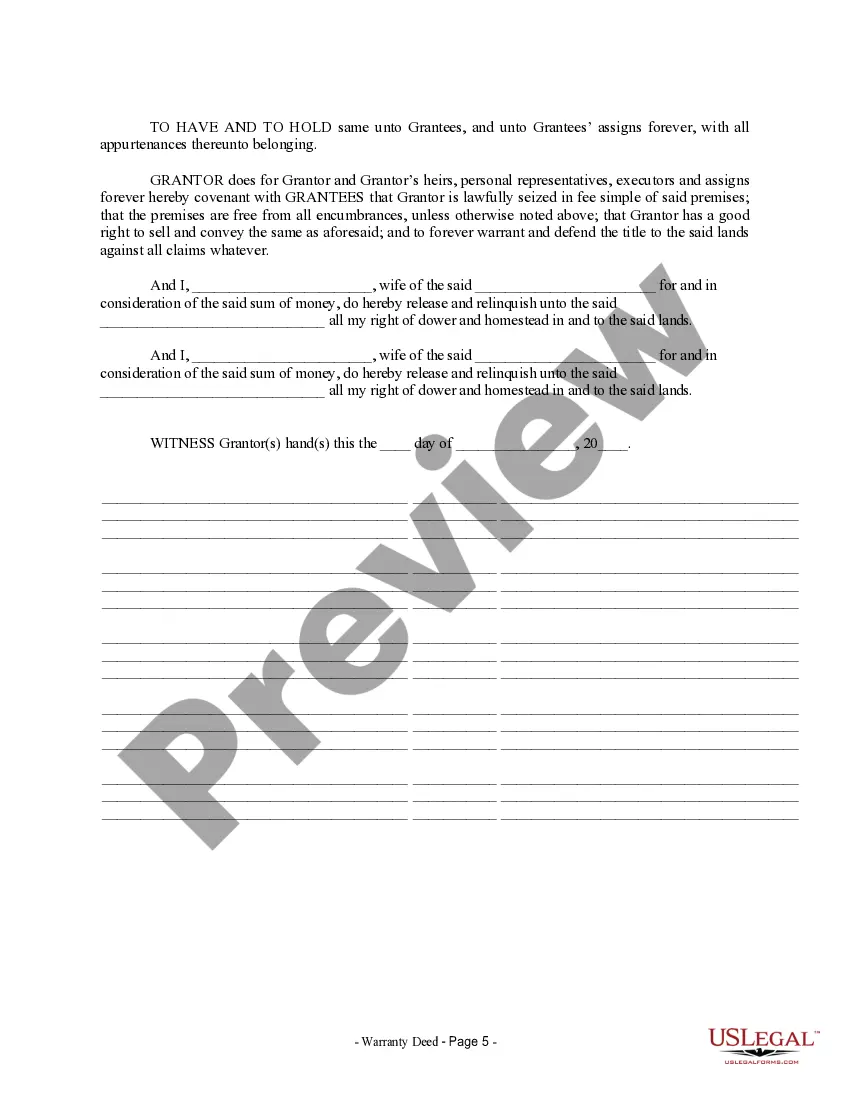

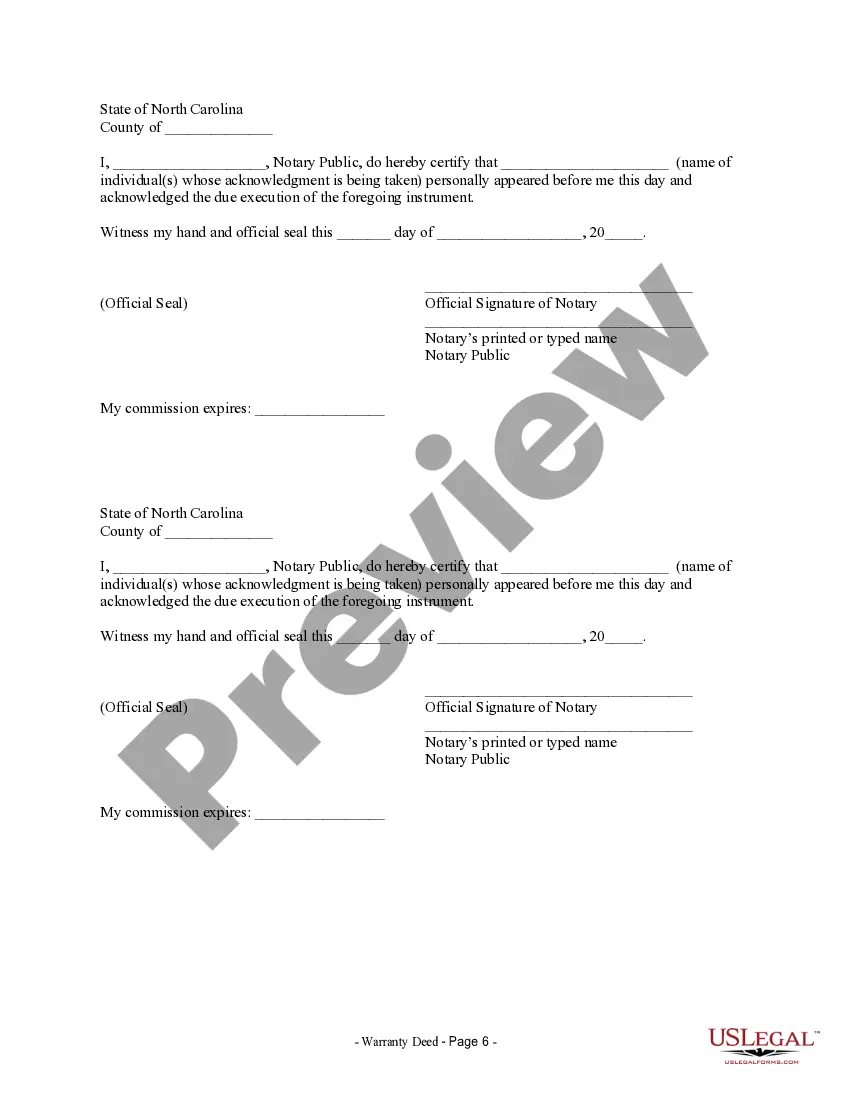

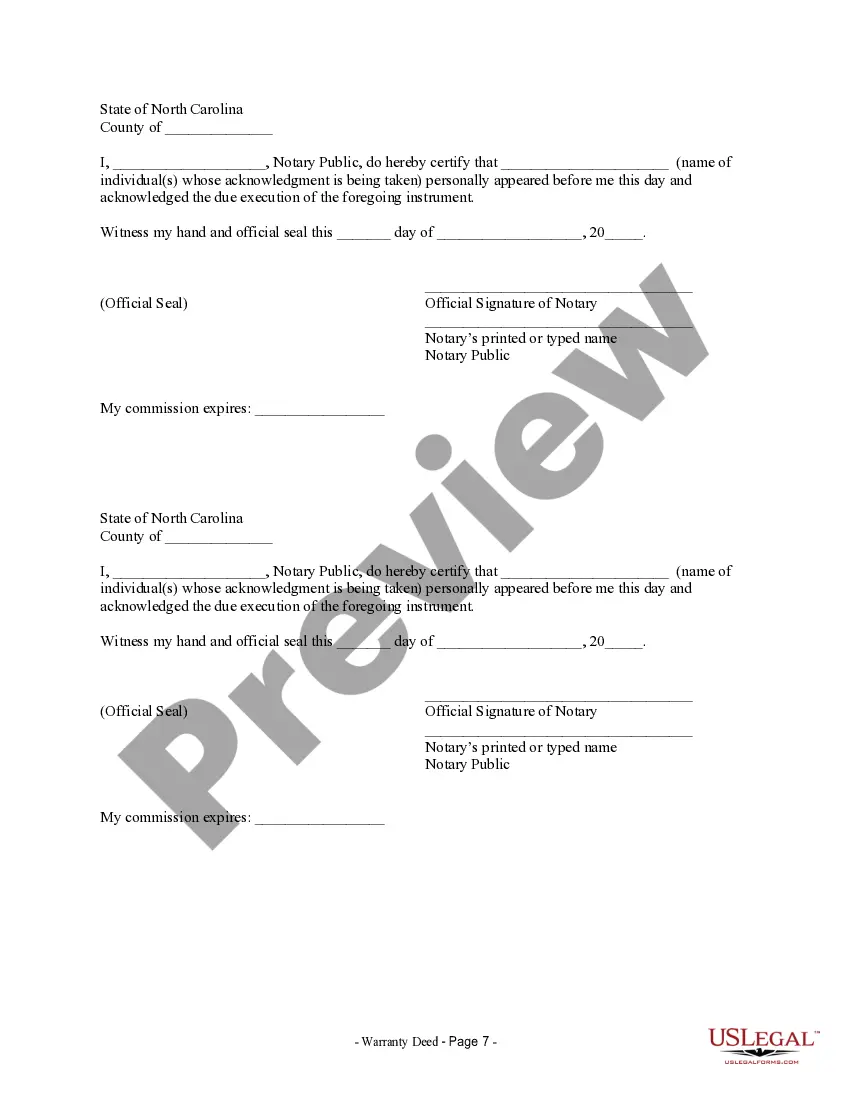

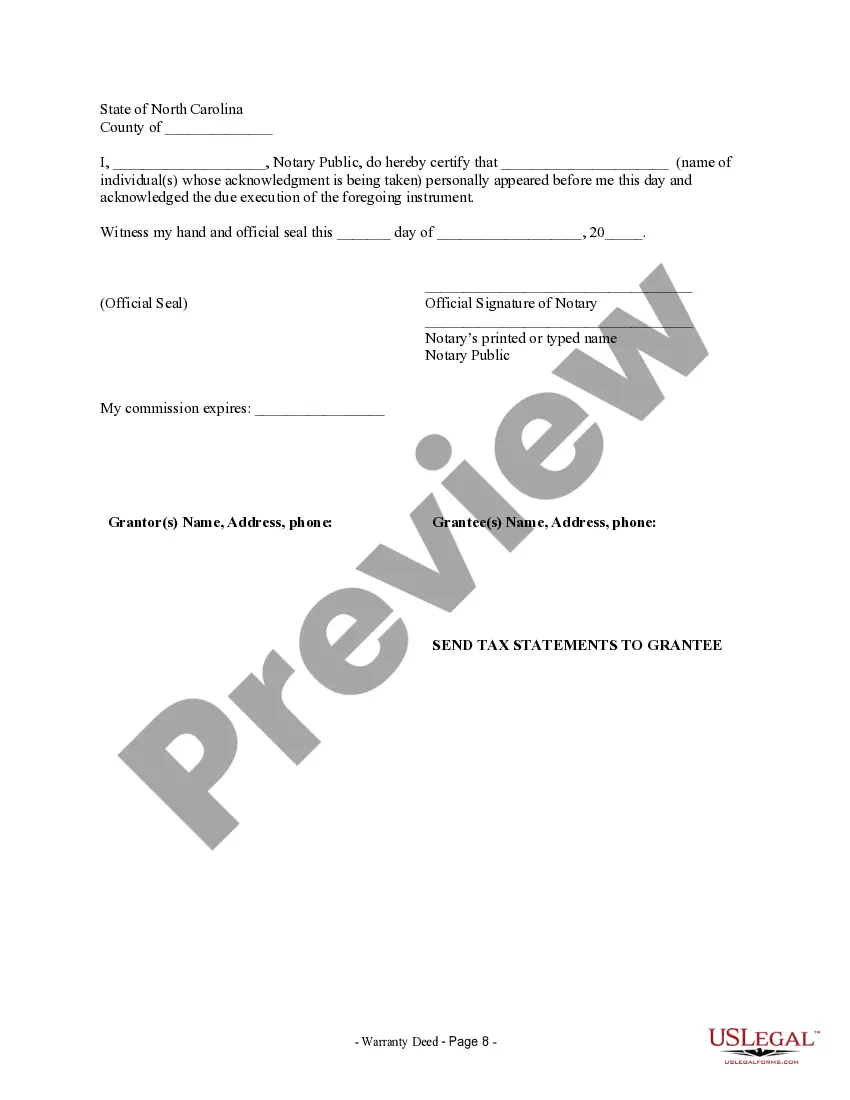

How to fill out North Carolina General Warranty Deed For With Relinquishment Of Dower?

There is no longer a necessity to devote time searching for legal documents to satisfy your local state mandates.

US Legal Forms has gathered all of them in a single location and facilitated their availability.

Our platform offers over 85,000 templates for any business and personal legal situations compiled by state and category of use.

Utilize the search bar above to find another template if the current one wasn't suitable. Click Buy Now next to the template name once you discover the correct one. Select the most appropriate subscription plan and create an account or Log In. Make a payment for your subscription using a credit card or through PayPal to continue. Choose the file format for your Relinquishment Deed For Property and download it to your device. Print your form to fill it out by hand or upload the sample if you would rather work with an online editor. Creating legal paperwork under federal and state laws and regulations is quick and straightforward with our platform. Experience US Legal Forms today to maintain your documentation in order!

- All forms are professionally composed and confirmed for authenticity, so you can trust in acquiring an up-to-date Relinquishment Deed For Property.

- If you are acquainted with our platform and already possess an account, you need to verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever necessary by opening the My documents tab in your profile.

- If you've never interacted with our platform before, the procedure will require a few additional steps to finalize.

- Here’s how new users can procure the Relinquishment Deed For Property from our catalog.

- Review the page content thoroughly to confirm it includes the sample you require.

- To assist you, utilize the form description and preview options if available.

Form popularity

FAQ

A relinquishment deed in India serves as a legal document that enables a property owner to transfer their share in the property to another party, often a family member. This deed is commonly utilized in cases of inheritance or family settlements, ensuring clear ownership rights. By utilizing a relinquishment deed for property, you can effectively simplify the transfer process and avoid future disputes. Knowing the legal implications is essential, and US Legal Forms can assist you in understanding the necessary steps.

When it comes to the relinquishment deed for property in India, it is important to understand its tax implications. Generally, if the relinquishment deed involves the transfer of property, it can be subject to capital gains tax. However, exemptions may apply depending on specific conditions, such as how long the property has been held. Always consult with a tax professional to navigate the complexities surrounding taxes on relinquishment deeds.

Yes, a relinquishment deed for property can be registered at any sub-registrar's office in India, provided the property is located within that jurisdiction. It's important to ensure that all required documents are in order before registration. Always check local regulations for specific requirements and procedures, and consider using services like uslegalforms to simplify the process.

Sending a relinquishment deed for property from abroad involves several steps. You must first execute the deed in your home country, typically requiring notarization. After that, you can send it via international courier to a trusted representative in India for execution and registration. Platforms like uslegalforms can guide you on the entire process, ensuring compliance with local laws.

The stamp duty on a relinquishment deed for property in India varies across states. Typically, it ranges from 0.1% to 5% of the total market value of the property being relinquished. It's essential to check the specific regulations in your state, as local laws apply. Using reputable platforms like uslegalforms can help you confirm the exact duties applicable to your situation.