A Professional Corporation Form Of Organization

Description

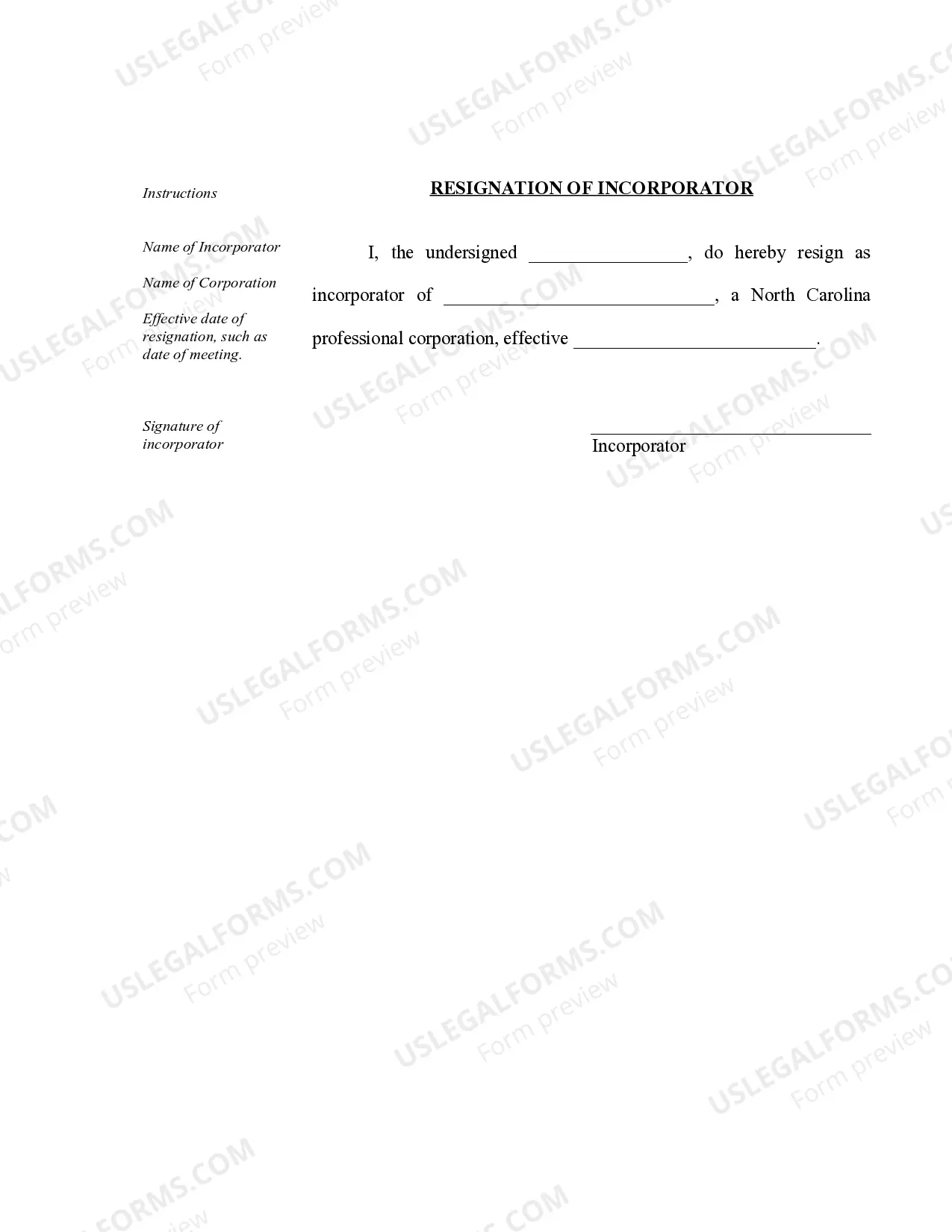

How to fill out A Professional Corporation Form Of Organization?

Individuals often link legal documentation with something intricate that only an expert can handle.

In some respects, this is accurate, as formulating A Professional Corporation Structure necessitates comprehensive understanding of subject parameters, including state and local regulations.

However, with US Legal Forms, the process has become easier: ready-to-use legal templates for various life and business scenarios specific to state laws are gathered in a unified online library and are now accessible to everyone.

Establish an account or Log In to proceed to the payment page. Pay for your subscription using PayPal or a credit card. Select the file format and click Download. You can print your document or import it to an online editor for convenient completion. All templates in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Join today!

- US Legal Forms provides over 85k current documents categorized by state and area of use, making the search for A Professional Corporation Structure or any other specific template quick and straightforward.

- Previously registered users with an active subscription need to Log In to their account and click Download to obtain the form.

- New users to the platform must create an account and subscribe before they can download any legal documents.

- Here is a detailed guide on how to obtain the A Professional Corporation Structure.

- Examine the page content thoroughly to ensure it fulfills your requirements.

- Review the form description or check it via the Preview option.

- Find another template using the Search field in the header if the first one does not meet your needs.

- Click Buy Now once you locate the appropriate A Professional Corporation Structure.

- Choose a subscription plan that suits your preferences and budget.

Form popularity

FAQ

Determining if you are an S Corporation or a C Corporation involves reviewing how your professional corporation has been structured for tax purposes. You can consult the IRS forms or documentation that reflect your corporation's election status. Additionally, your tax filings will indicate which designation applies based on your chosen election. If you're unsure, platforms like US Legal Forms can provide guidance and simplify the process for you.

In a professional corporation setting, licensed individuals work collaboratively within a legally established business framework. This environment is often designed to meet the specific needs of professionals, integrating legal, ethical, and operational standards. It provides a formal platform for delivering services while ensuring regulatory compliance. By establishing a professional corporation form of organization, you create a structured and secure environment for both clients and professionals.

A Professional Corporation (PC) and an S Corporation are not identical, although they can share certain tax characteristics. A PC is specifically aimed at licensed professionals, while an S Corporation is a tax classification that can apply to various business types, including PCs. Therefore, while a PC can elect S Corporation status, it must comply with specific professional regulations that an S Corp might not encounter. Choosing the right structure will depend on your professional and operational needs.

No, a professional corporation is not the same as a Limited Liability Company (LLC), though both structures provide liability protection. A professional corporation is specifically designed for licensed professionals and includes unique operational requirements. An LLC, however, offers more flexibility in management and operational structure, making it a different entity altogether. Carefully evaluating the benefits of each form can help you decide the best fit for your professional practice.

A professional corporation can be set up as either an S Corporation or a C Corporation, depending on the tax configuration chosen by its owners. The S Corporation status enables pass-through taxation, allowing profits and losses to flow directly to the owners’ personal tax returns. On the other hand, a C Corporation is taxed separately from its owners, which could lead to double taxation in certain cases. Understanding these differences is crucial when establishing your professional corporation.

In accounting, a professional corporation is recognized as a distinct business entity, often for professions such as accounting, consulting, or engineering. This formation allows professionals to hold a corporate title while receiving specific tax benefits and liability protections. Thus, it serves to separate personal assets from business liabilities, offering a layer of financial security in a competitive field. A professional corporation form of organization helps streamline accounting practices within licensed professions.

To qualify as a professional corporation, the organization must consist entirely of licensed professionals who provide designated services. Each member must have the appropriate licenses for their profession. This legal classification also requires adherence to state-specific regulations and standards, ensuring that professionals meet ethical and operational obligations in their field. Overall, this setup is ideal for those in specialized occupations.

A professional corporation is a type of business structure specifically for licensed professions, like doctors and lawyers. This designation establishes a legal entity in which professionals can operate. By forming a professional corporation, you gain protection against personal liability for business debts, separating personal and professional assets. This structure is beneficial for practicing professionals looking to formalize their operations.

Common examples of corporate organizations include companies like Apple, Google, and Walmart, which operate as C corporations. These businesses offer a range of products and services and are owned by shareholders who benefit from limited liability. A professional corporation form of organization may be exemplified by law firms or medical practices that operate under corporate structures.

An LLC is not automatically classified as a corporation; it is a distinct structure. You may elect to have your LLC taxed as a corporation, either as an S corporation or C corporation, by filing the appropriate forms with the IRS. Understanding the differences between these classifications can help you determine if a professional corporation form of organization suits your needs.