Employment Employee Nc Withholding Calculator

Description

How to fill out North Carolina Employment Employee Personnel File Package?

Getting a go-to place to take the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Choosing the right legal documents requirements precision and attention to detail, which is why it is crucial to take samples of Employment Employee Nc Withholding Calculator only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and check all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Take the listed steps to complete your Employment Employee Nc Withholding Calculator:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s information to see if it matches the requirements of your state and county.

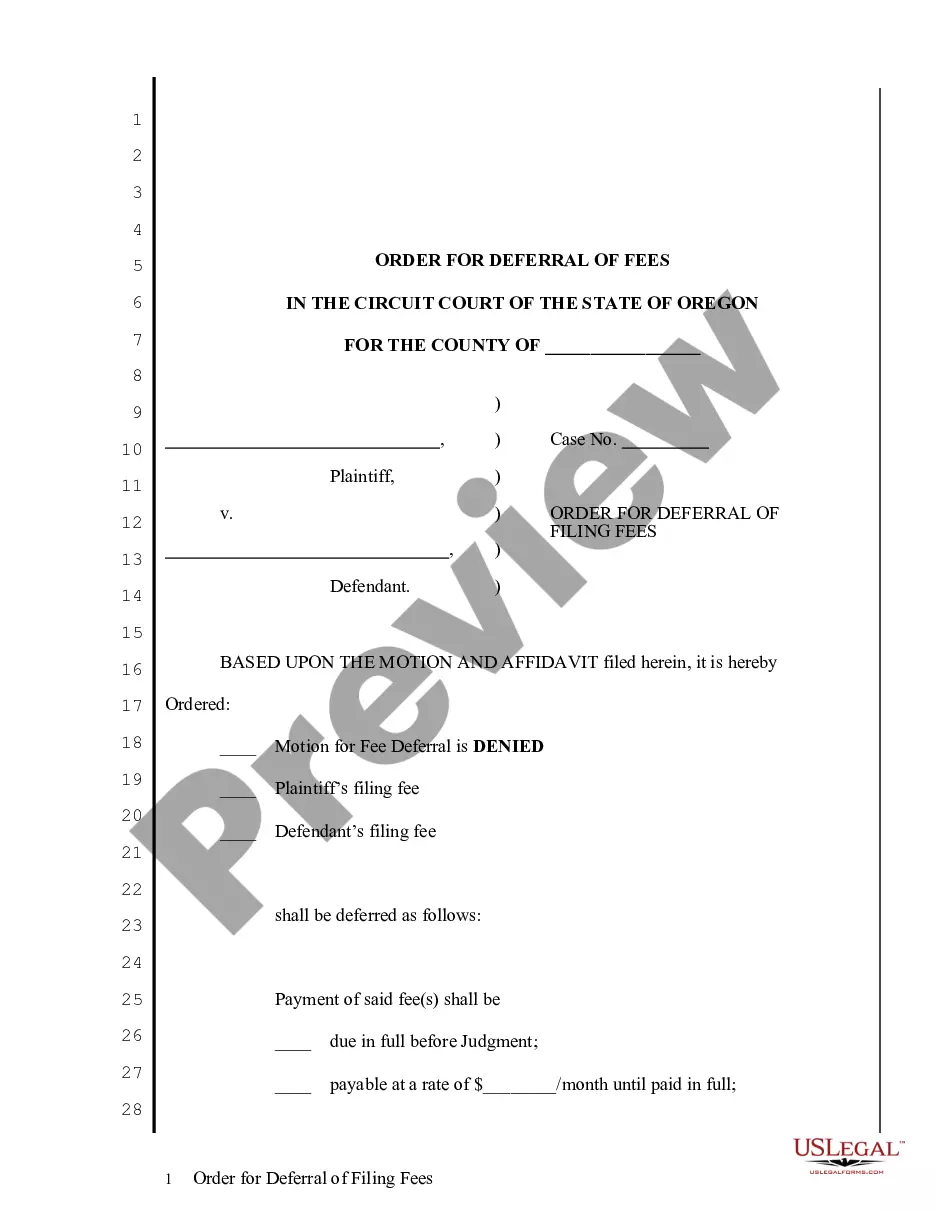

- Open the form preview, if there is one, to make sure the template is definitely the one you are interested in.

- Go back to the search and find the correct template if the Employment Employee Nc Withholding Calculator does not suit your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Employment Employee Nc Withholding Calculator.

- Once you have the form on your gadget, you can modify it with the editor or print it and finish it manually.

Remove the headache that comes with your legal documentation. Check out the extensive US Legal Forms catalog where you can find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

To calculate how much federal income tax to withhold from your employees' paychecks each pay period, you can use the wage bracket method: Divide the amount specified in Step 4(a) of your employee's Form W-4 by your annual number of pay periods. To this amount, add the employee's total taxable wages for the pay period.

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

It depends on how much a person makes. We want to shoot for withholding at the 18.5% effective rate so a person won't owe much money or have a large refund, but each person's employer has to rely on the Form W-4 (Employee's Withholding Allowance Certificate) he completed when he was hired.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.