North Carolina Release For Retirement

Description

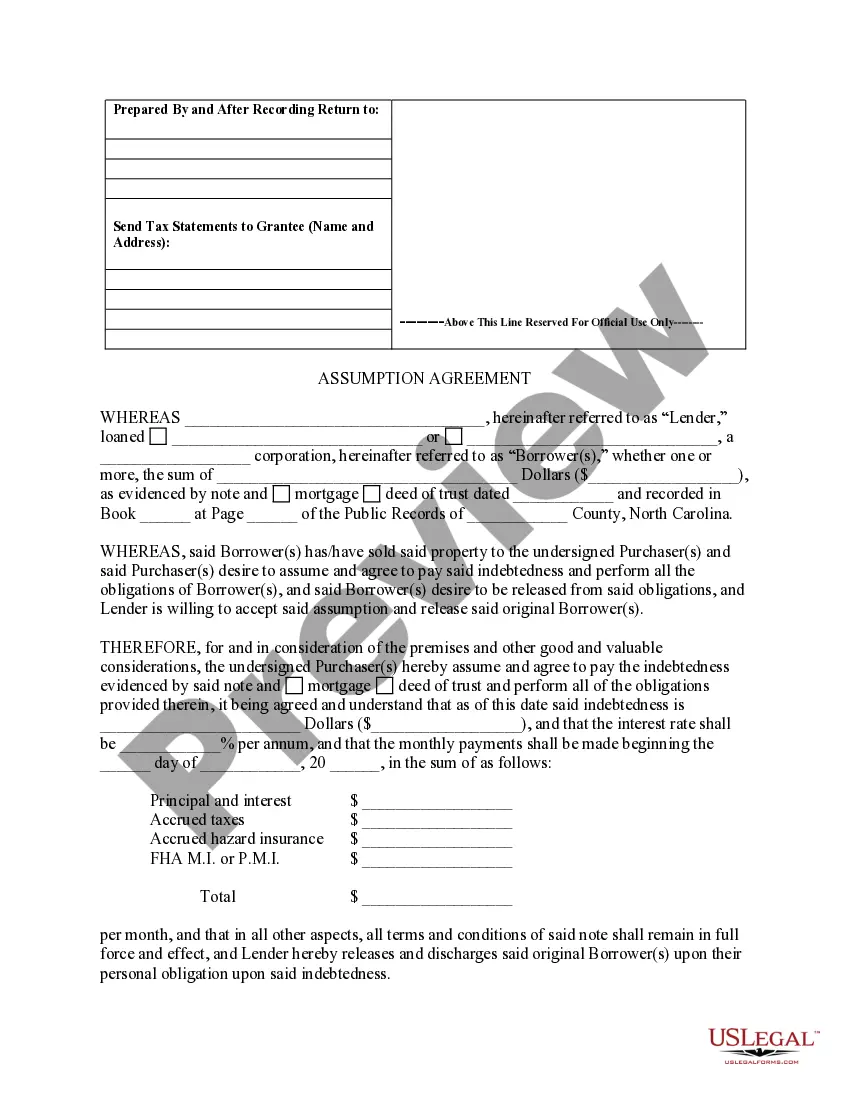

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

No matter if you handle documents regularly or occasionally need to send a legal report, it is essential to find a valuable resource where all the samples are applicable and current.

The first step you should take with a North Carolina Release For Retirement is ensuring that it is the most recent version, as it determines if it can be submitted.

If you wish to simplify your search for the latest document samples, look for them on US Legal Forms.

To obtain a document without an account, follow these instructions: Use the search feature to locate the form you desire. Review the North Carolina Release For Retirement preview and description to confirm it is genuinely what you need. After verifying the form, simply click Buy Now. Choose a subscription plan that is suitable for you. Either create a new account or Log In to your existing one. Provide your credit card information or PayPal account to complete the purchase. Select the document format for download and validate it. Put an end to confusion when handling legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that encompasses nearly every document template you can seek.

- Search for the forms you require, assess their applicability immediately and learn more about their use.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Obtain the North Carolina Release For Retirement samples in just a few clicks and save them anytime in your profile.

- A US Legal Forms profile facilitates easier access to all the samples you need with enhanced convenience and less hassle.

- You only need to click Log In in the site header and navigate to the My documents section where all your required forms are conveniently available.

- This way, you will not have to waste time searching for the right template or verifying its legitimacy.

Form popularity

FAQ

Service Retirement (Unreduced Benefits)you reach age 60 and complete 25 years of creditable service, or. you complete 30 years of creditable service, at any age.

You may be subject to a 10% tax penalty for early withdrawal, in addition to any federal and state income tax on the withdrawal. The IRS charges a 10% penalty on withdrawals from qualified retirement plans before you reach age 59 ½, with certain exceptions.

Members should fill out and submit Form 5 (Withdrawing Your Retirement Service Credit and Contributions) to the Retirement Systems Division. After your Form 5 is processed, you will receive a paper check by mail unless you request that your contributions be rolled into another type of eligible retirement account.

Attend a Retirement Planning Conference or schedule a one-on-one virtual appointment; take the time to create a Custom Benefit Estimate (in your ORBIT account), and. click Apply for Retirement Online in the left menu bar to start your application (120 days from your retirement date).

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.