Living Trust Without An Attorney

Description

Form popularity

FAQ

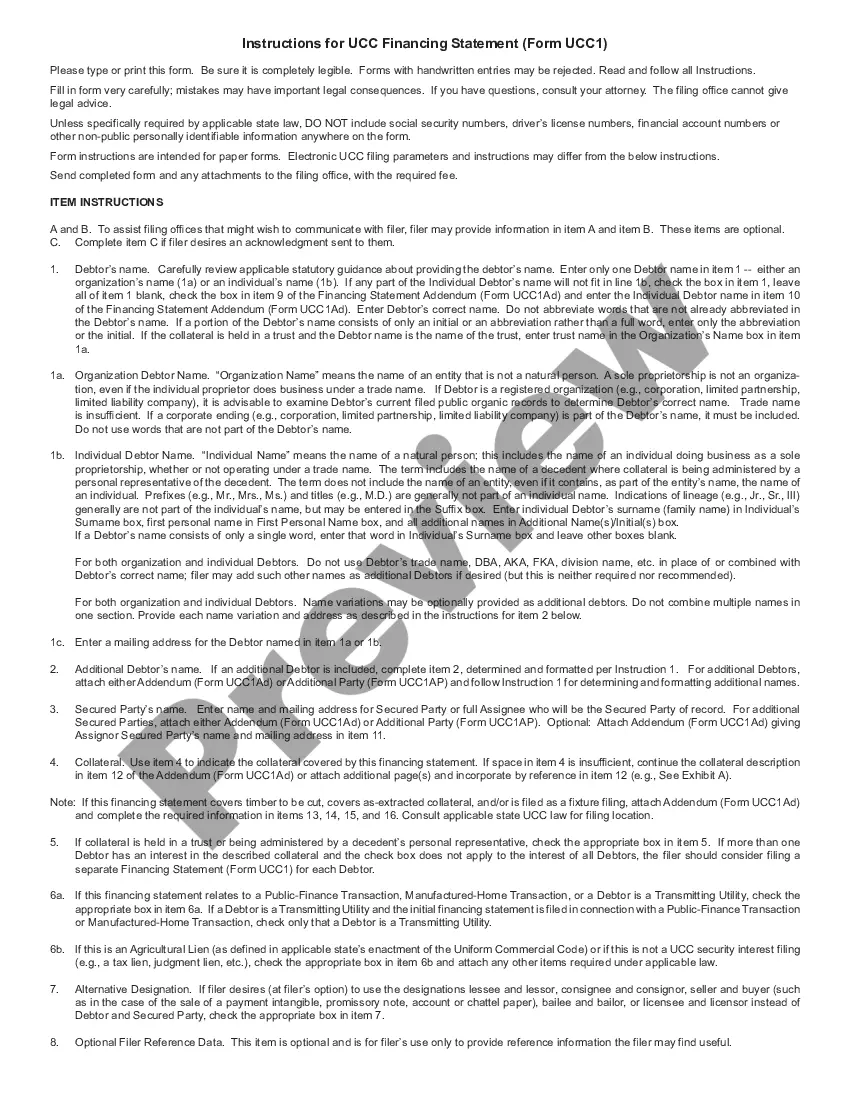

The person who creates a trust is known as the grantor or trustor. This individual provides the assets to be placed in the trust and establishes its terms and conditions. If you're considering a living trust without an attorney, understanding the role of the grantor is essential as it empowers you to make informed decisions about your estate planning.

The best person to set up a trust is someone who is informed about their financial situation and specific family needs. This organization can often be achieved by yourself if you opt for a living trust without an attorney. Utilizing tools and resources available through platforms like US Legal Forms can simplify the process and guide you through creating a trust tailored to your requirements.

The best trustee for a trust is someone who is trustworthy, responsible, and understands the responsibilities of managing a trust. This could be a family member, a friend, or even a professional trust company. When setting up a living trust without an attorney, consider your options carefully to ensure that your chosen trustee aligns with your goals and the needs of your beneficiaries.

In a trust, the person who holds the most power is the trustee. This individual manages the trust’s assets and ensures that funds are distributed according to the terms laid out in the trust document. If you decide to create a living trust without an attorney, choosing the right trustee is crucial. A trusted family member or a close friend can often serve this role effectively.

The main downside of a living trust is the initial setup and possible maintenance fees, which can add complexity to your estate planning. If not properly funded, a living trust might fail to protect your assets from probate, which defeats its purpose. Moreover, if you decide to create a living trust without an attorney, you need to be diligent about keeping it updated. Utilizing platforms like uslegalforms can help ensure that you avoid these pitfalls effectively.

Some reasons to not have a trust include the additional legal work and complexity it introduces to your estate planning. If your assets are minimal, or your estate structure is simple, you might find a will to be sufficient. Also, a living trust without an attorney may not always be necessary if you have no major assets that would complicate probate. Remember, it’s essential to assess your personal situation carefully.

While living trusts offer many benefits, they also come with some drawbacks. Setting up a living trust without an attorney may lead to potential errors if not done carefully. Additionally, assets placed in a trust typically need to be retitled, which requires additional steps and can create confusion.

One of the biggest mistakes parents make is failing to name guardians for their children in the trust. Additionally, vague language or unfinished documents can lead to confusion later on. By ensuring clear terms and setting your trust up properly, especially a living trust without an attorney, you can avoid these pitfalls.

Yes, you can create your own living trust in California. With the right resources, many people successfully set up their living trust without an attorney. Online platforms, like US Legal Forms, provide templates and guides that simplify the process, allowing you to protect your assets effectively.