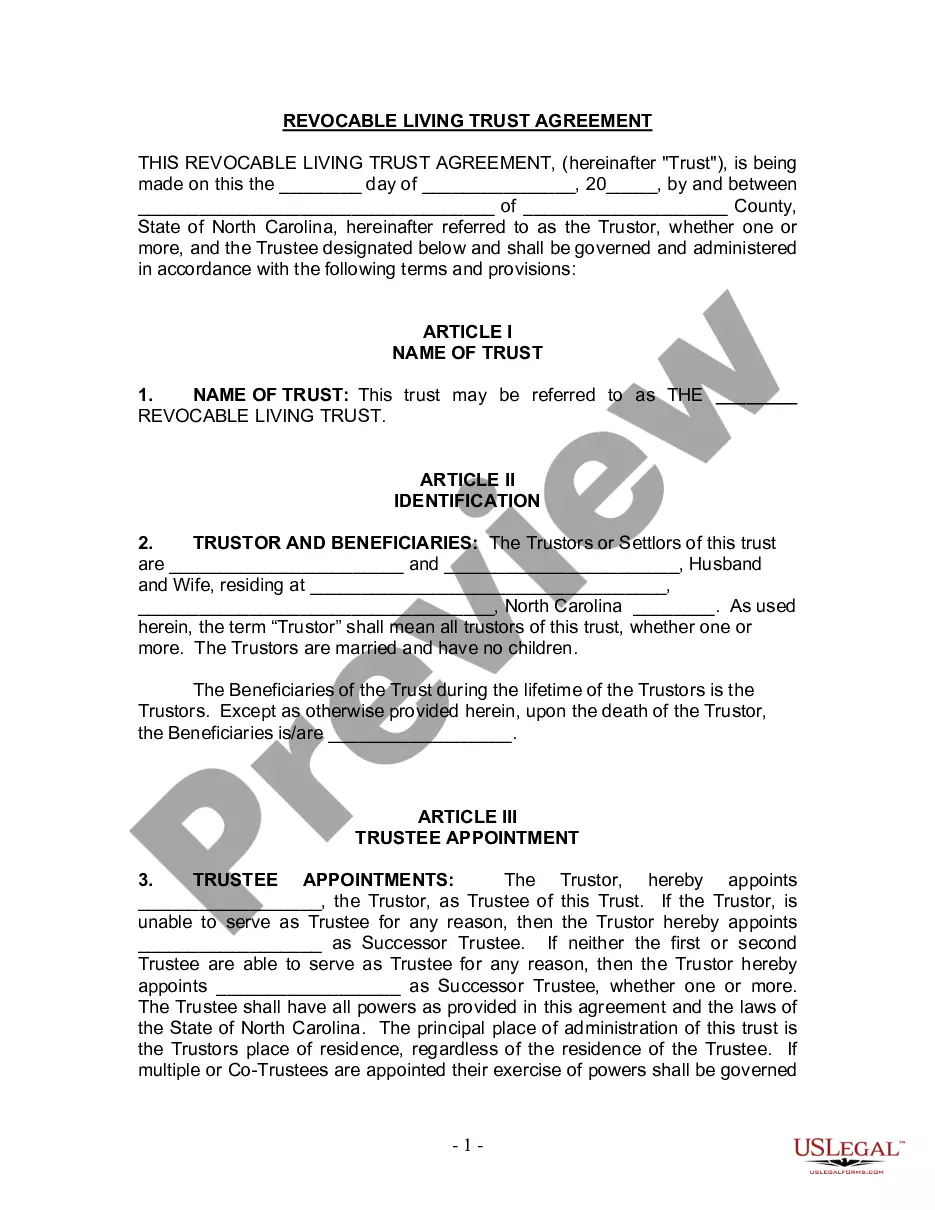

North Carolina Trust Revocable With Trust

Description

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

Whether for commercial intentions or personal concerns, everyone encounters legal circumstances at some stage in their life.

Completing legal documentation requires meticulous focus, starting with selecting the correct form sample.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the suitable sample across the internet. Use the library’s straightforward navigation to find the appropriate template for any occasion.

- Locate the sample you require by utilizing the search bar or catalog navigation.

- Review the form’s description to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search feature to find the North Carolina Trust Revocable With Trust sample you need.

- Obtain the file if it fulfills your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- Should you not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the North Carolina Trust Revocable With Trust.

- After it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The Colorado LLC filing is currently $50. The Colorado state legislature passed a bill in 2022 reducing the cost of starting an LLC in Colorado from $50 to $1, but that ended in May 2023.

Colorado LLC Approval Times Online filings: Online filings for Colorado LLCs are approved immediately. Since you can download your documents as soon as they're approved by the Secretary of State, there is no extra transit time.

The website has a guide that walks you through that process as well. Step 1: Name your Colorado LLC. Your first step is to decide on a name for your Colorado LLC. ... Step 2: Appoint a registered agent in Colorado. ... Step 3: File Colorado Articles of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Here's what you can gain by forming a Colorado Limited Liability Company. Limited Personal Liability. ... Tax Advantages. ... Privacy Protection. ... Management Flexibility. ... Ownership Flexibility. ... Flexible Profit Distributions. ... Easy to Set Up and Maintain. ... Inexpensive.

Costs to forming a Colorado LLC There is a $50 (one-time) fee to form an LLC. There are also ongoing fees (like a $10 Annual Report fee), which we discuss below.

Colorado LLC Formation Filing Fee: $50 Filing in Colorado is way less burdensome than in most other states?the fee is just $50. Colorado Articles of Organization must be filed online through the Secretary of State's website.

1. Kentucky. Kentucky is the cheapest state to form an LLC, with a filing fee of just $40. The state also offers business owners incentive programs that provide small businesses with financial assistance.