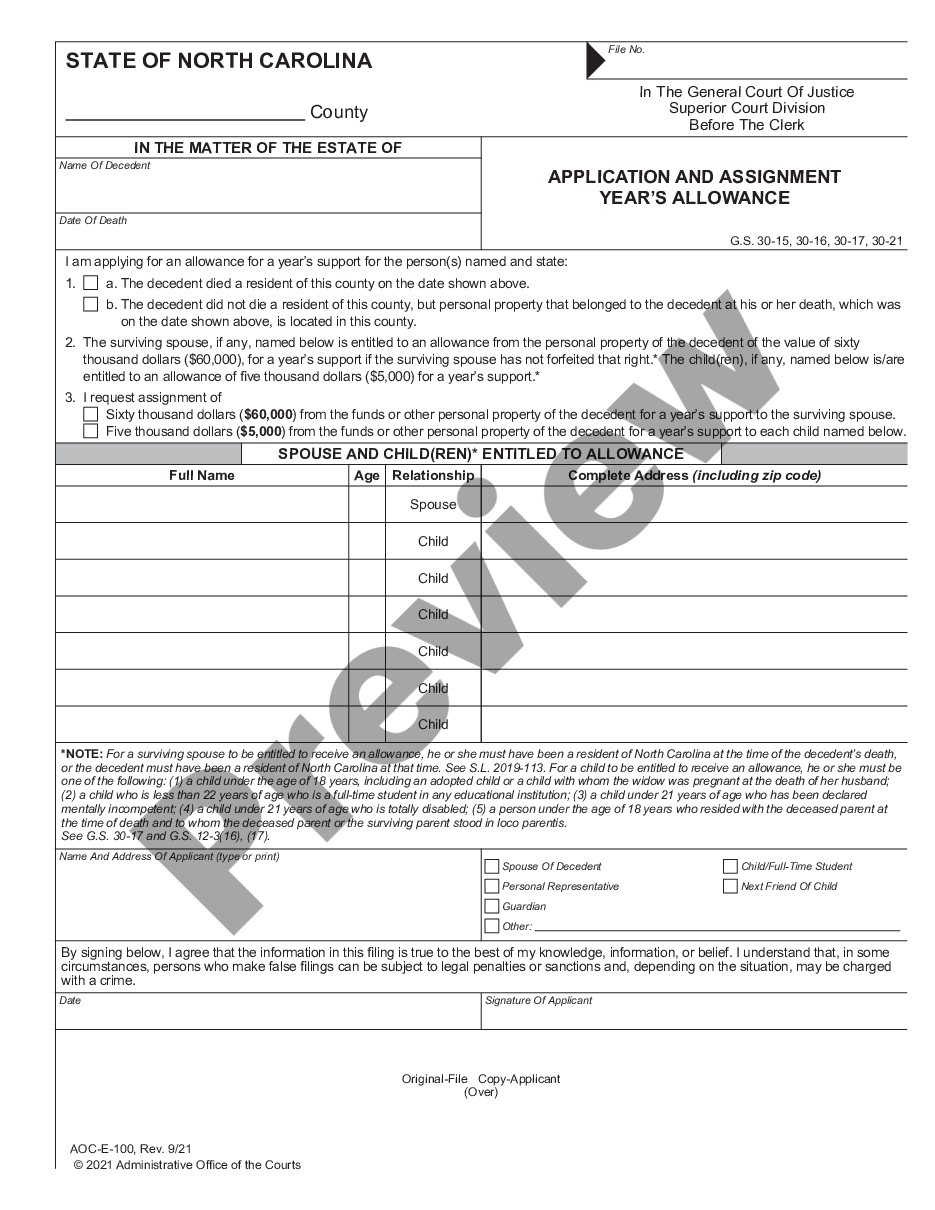

Spousal Allowance Nc Form For Estate

Description

How to fill out North Carolina Application And Assignment Year's Allowance?

The Spousal Allowance Nc Form For Estate you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and local laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Spousal Allowance Nc Form For Estate will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it satisfies your needs. If it does not, use the search bar to find the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Spousal Allowance Nc Form For Estate (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork again. Utilize the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

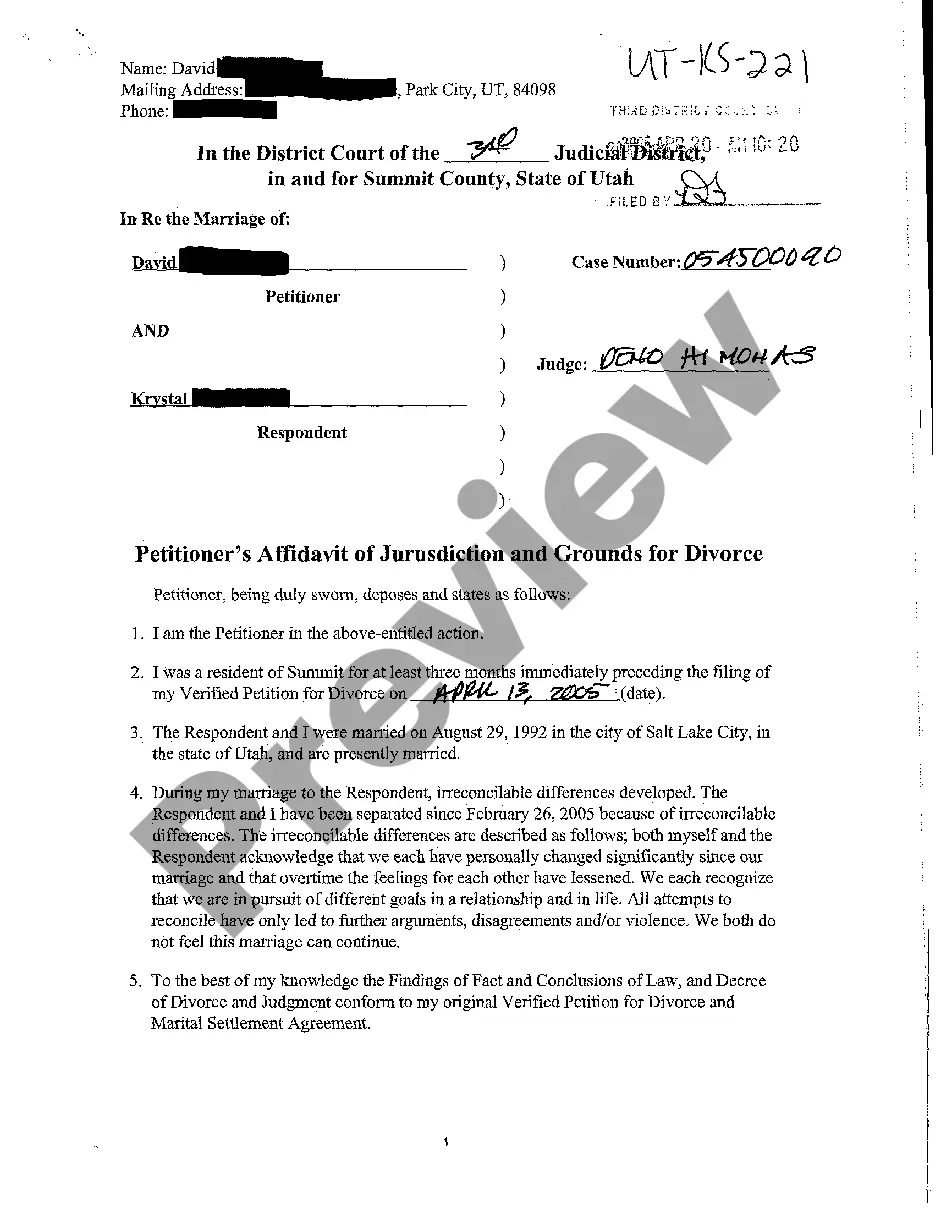

Hear this out loud PauseThe theory behind this law is that spouses of either gender come to depend on one another throughout a marriage, and in the tragic event that one of them loses their partner, the surviving member should be entitled to a monetary allowance from their partner's estate regardless of what debts the deceased owed.

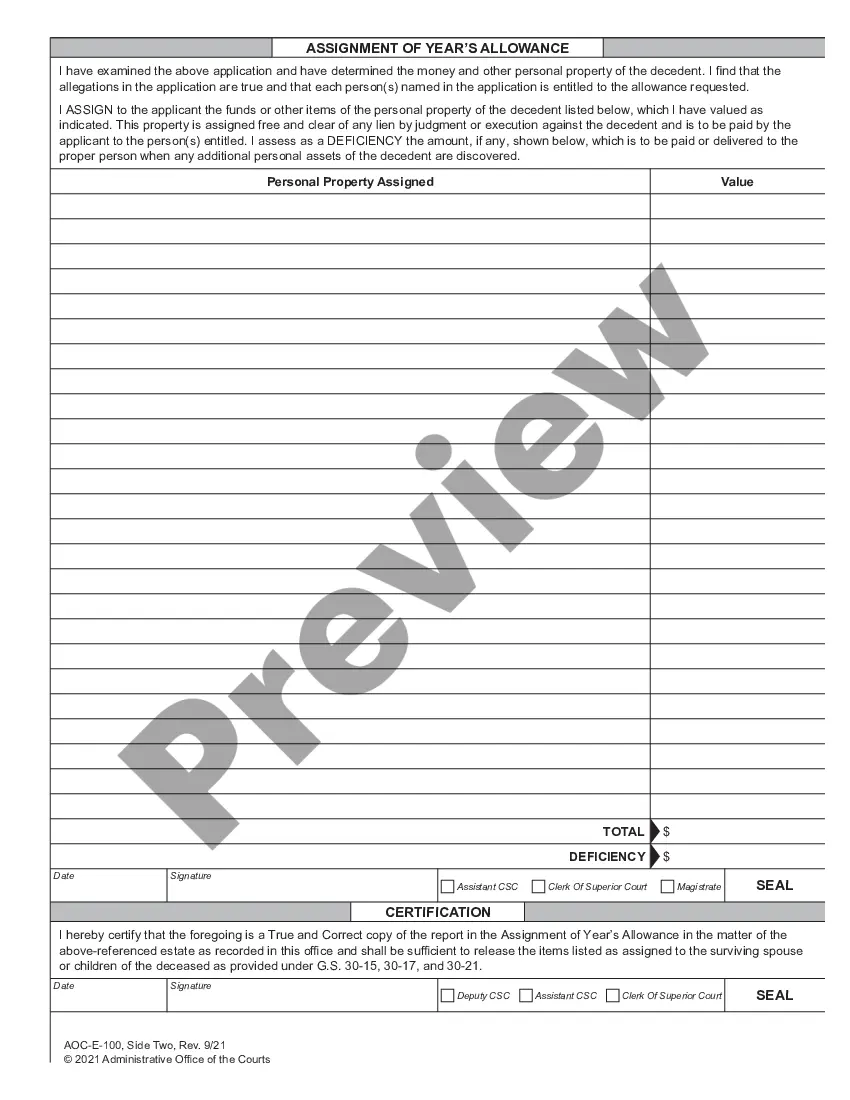

Hear this out loud PauseNCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

Hear this out loud PauseThe Year's Allowance allows for the assignment of up to $30,000.00 in personal property (vehicles, money, etc.) from the deceased spouse to their surviving spouse, without having to go through probate.

Hear this out loud PauseCalifornia and federal tax laws about spousal support are the same. If you pay support, you can deduct the payments on your federal or state income tax forms. If you receive support, you must report the payments as income on your federal and state tax forms.

A Spousal Allowance (SA) is the remaining amount of income that an institutionalized spouse has after deducting the maintenance allowance (part of the patient pay calculation) that will be given to the Community Spouse. This amount is called the Community Spousal Monthly Income Allowance (M1480.