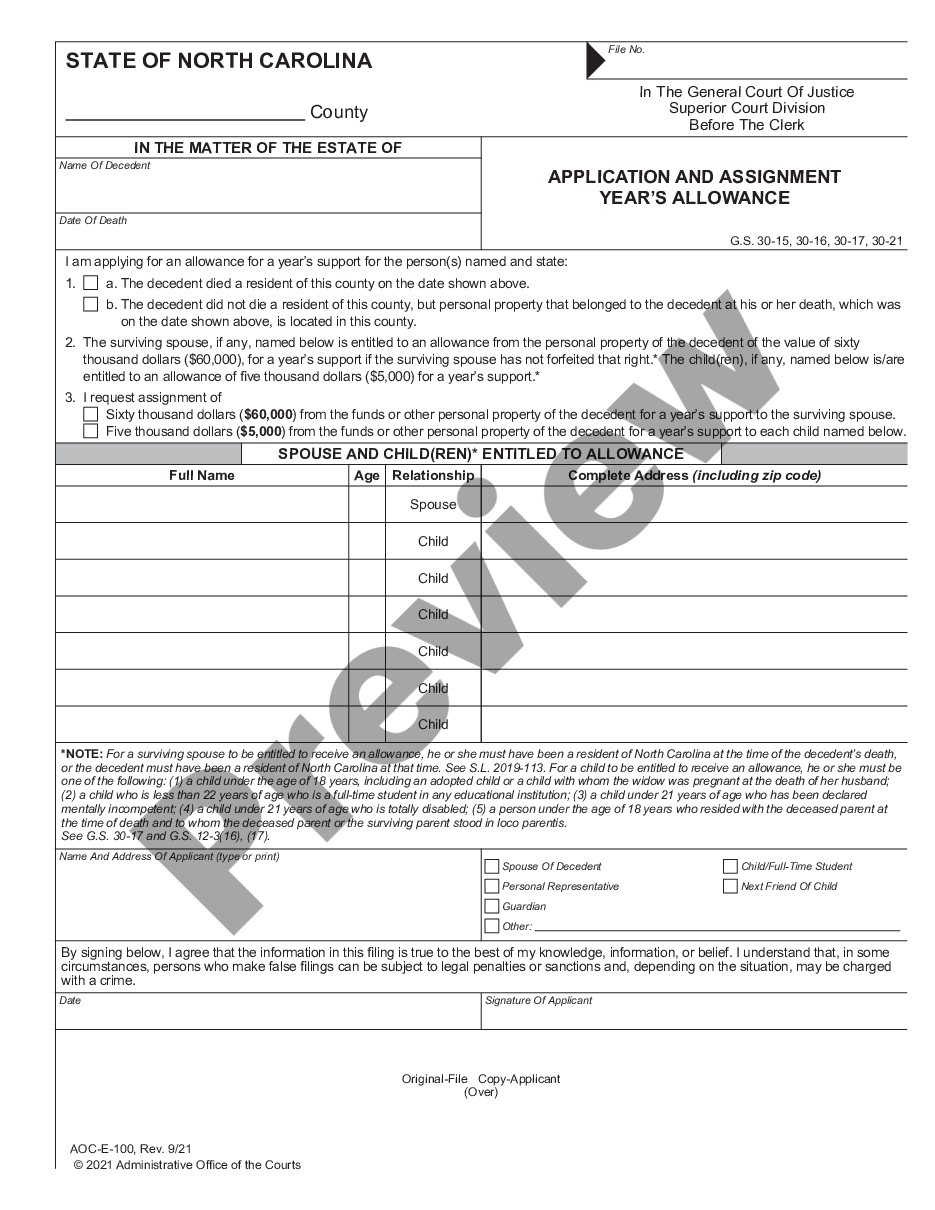

Application And Assignment Year's Allowance Form

Description

How to fill out North Carolina Application And Assignment Year's Allowance?

Red tape demands exactness and meticulousness.

If you do not handle the completion of forms like the Application and Assignment Year's Allowance Form on a daily basis, it may result in some confusion.

Selecting the appropriate template from the outset will guarantee that your document submission will proceed smoothly and avert any complications of having to resubmit a document or redo the same task from scratch.

Locating the correct and updated templates for your documentation is a matter of mere minutes with an account at US Legal Forms. Sidestep bureaucratic uncertainties and enhance your efficiency with paperwork.

- Find the correct template using the search tool.

- Make sure the Application and Assignment Year's Allowance Form you found is pertinent to your state or locality.

- Examine the preview or review the description that contains information about the application.

- When the outcome aligns with your search, click the Buy Now button.

- Choose the appropriate option among the offered pricing plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal account.

- Save the form in your preferred file format.

Form popularity

FAQ

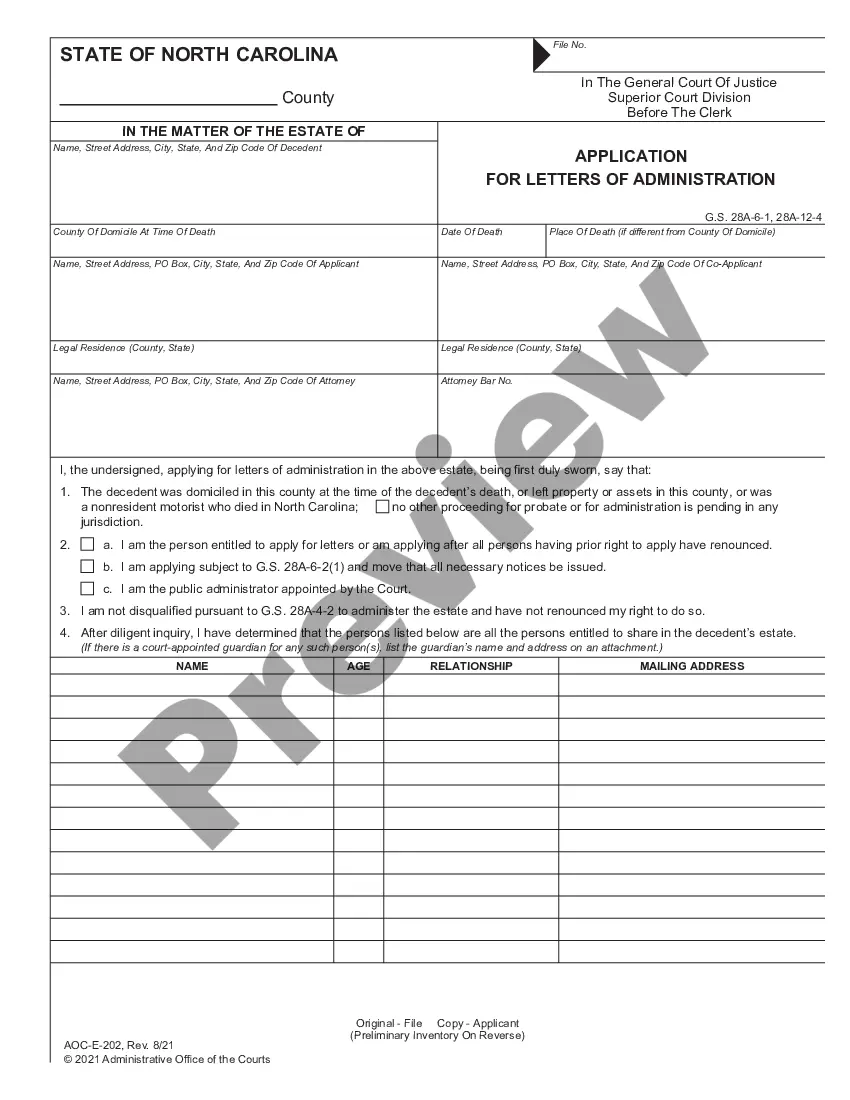

Spouses in North Carolina Inheritance LawIf you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

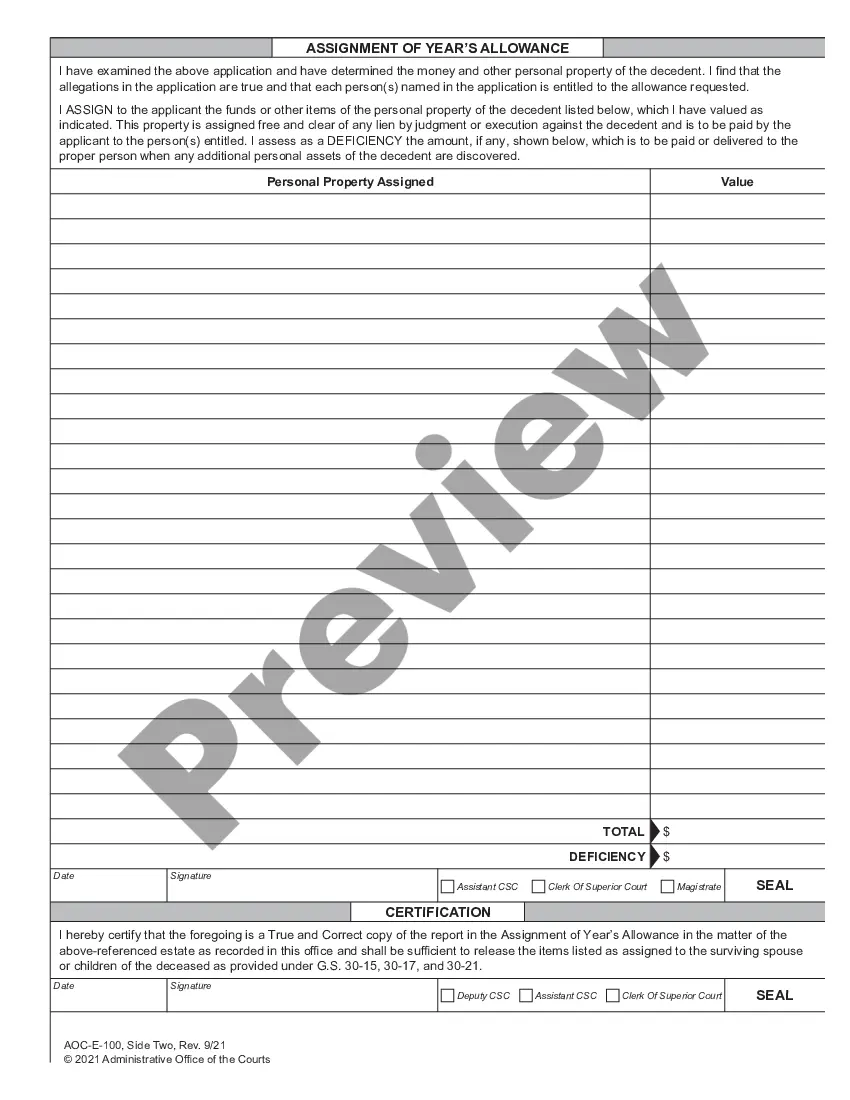

The spousal allowance is paid from the deceased spouse's personal property. If the deceased's personal property is located in a different county besides the one in which the deceased lived at the time of their death, an extra step may be necessary, but the spousal allowance is still available.

An Application for a Year's Allowance for the surviving spouse and/or dependent child(ren) may be filed with the clerk at any time within one (1) year of the decedent's death. The allowance will be from cash or personal property or a combination of both, but does not include real estate.

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.