Nc Dissolve Llc With Irs

Description

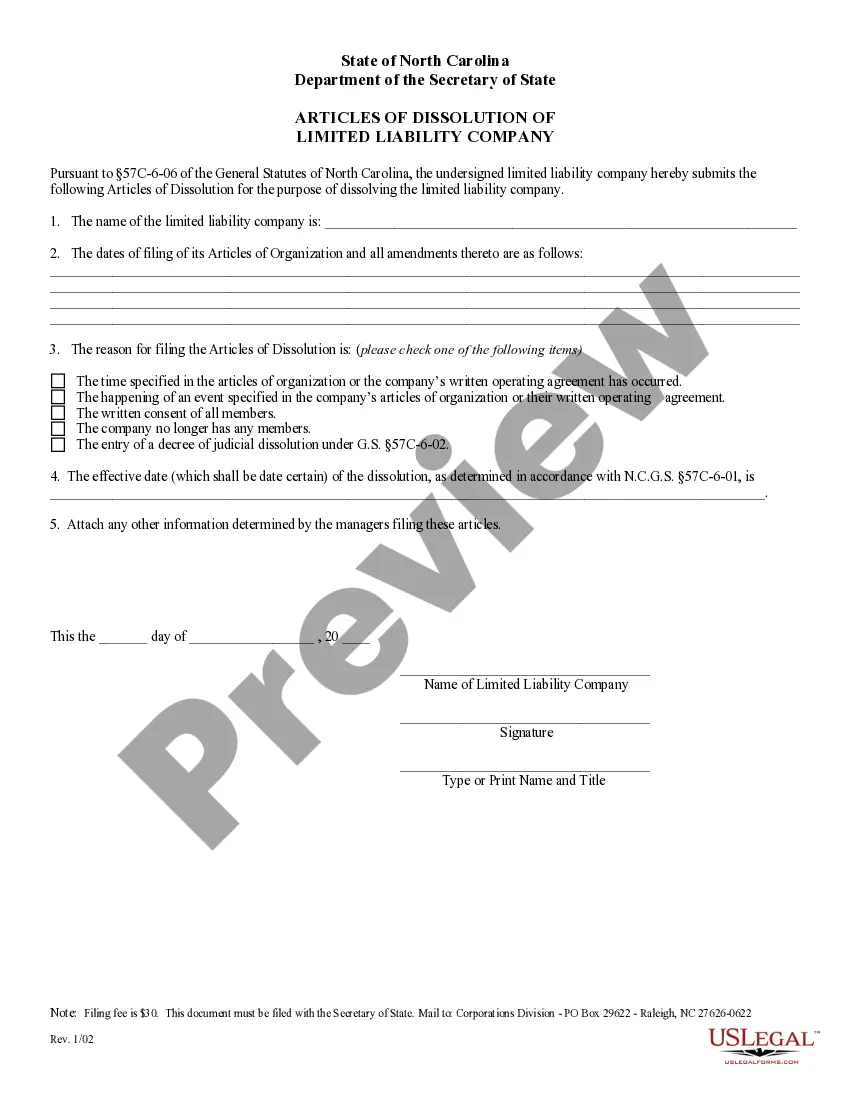

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Legal administration can be exasperating, even for the most adept experts.

When you are interested in a Nc Dissolve Llc With Irs and don’t have the opportunity to spend time searching for the appropriate and updated version, the procedures can be challenging.

Access state- or county-specific legal and business documents.

US Legal Forms addresses any needs you may have, from personal to business paperwork, all in one location.

If it is your first time with US Legal Forms, create a free account and enjoy unlimited access to all platform benefits. Here are the steps to follow after obtaining the form you need: Validate that it is the correct form by previewing it and reading through its description. Ensure that the template is recognized in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Select the format you desire, and Download, complete, sign, print, and deliver your document. Take advantage of the US Legal Forms web catalog, backed by 25 years of experience and dependability. Transform your daily document management into a seamless and user-friendly process today.

- Utilize cutting-edge tools to complete and manage your Nc Dissolve Llc With Irs.

- Access a repository of articles, tutorials, handbooks, and resources pertinent to your situation and requirements.

- Save time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Review feature to find Nc Dissolve Llc With Irs and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to see the documents you have previously downloaded and to organize your folders as you prefer.

- A comprehensive web form catalog could be a game changer for anyone who wants to manage these circumstances successfully.

- US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you whenever you need.

- With US Legal Forms, you can.

Form popularity

FAQ

A corporation (or a farmer's cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Exempt organizations and qualified subchapter S subsidiaries should not file Form 966.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

However, if an LLC elected to be taxed as a C corporation at any time, it would need to file Form 966 if it decides to dissolve or liquidate.

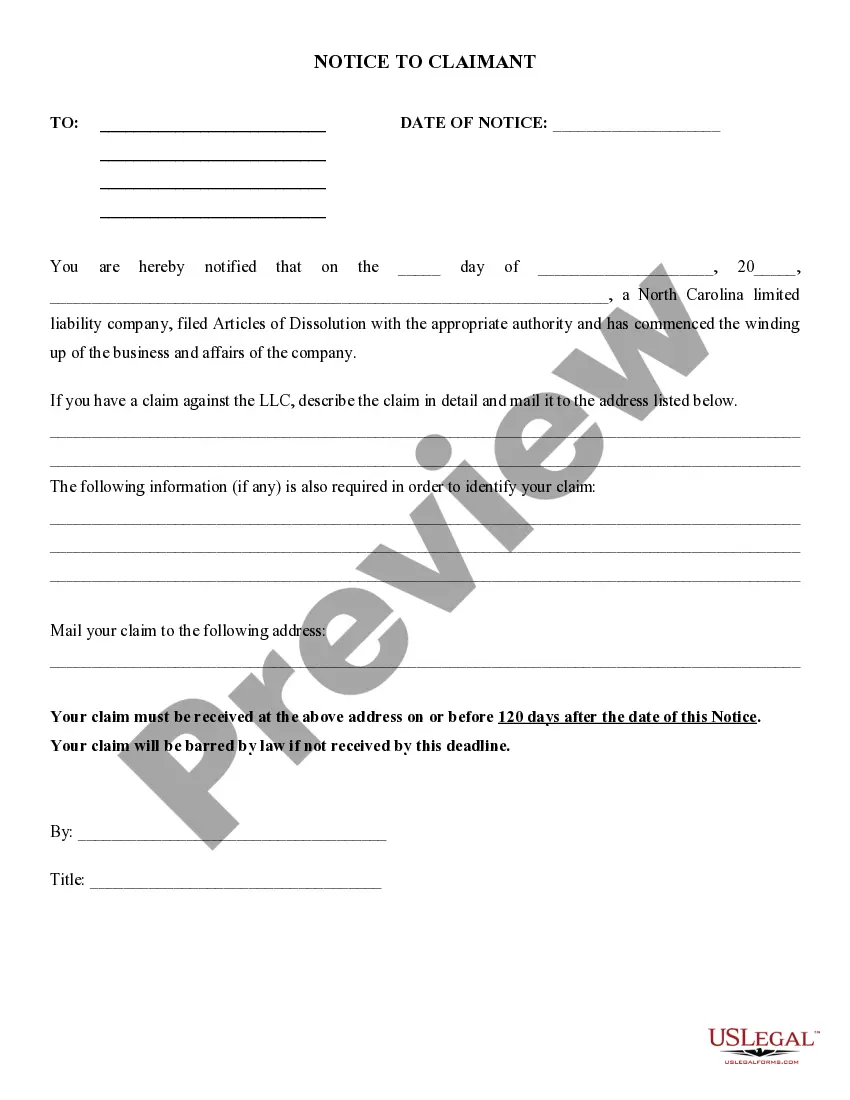

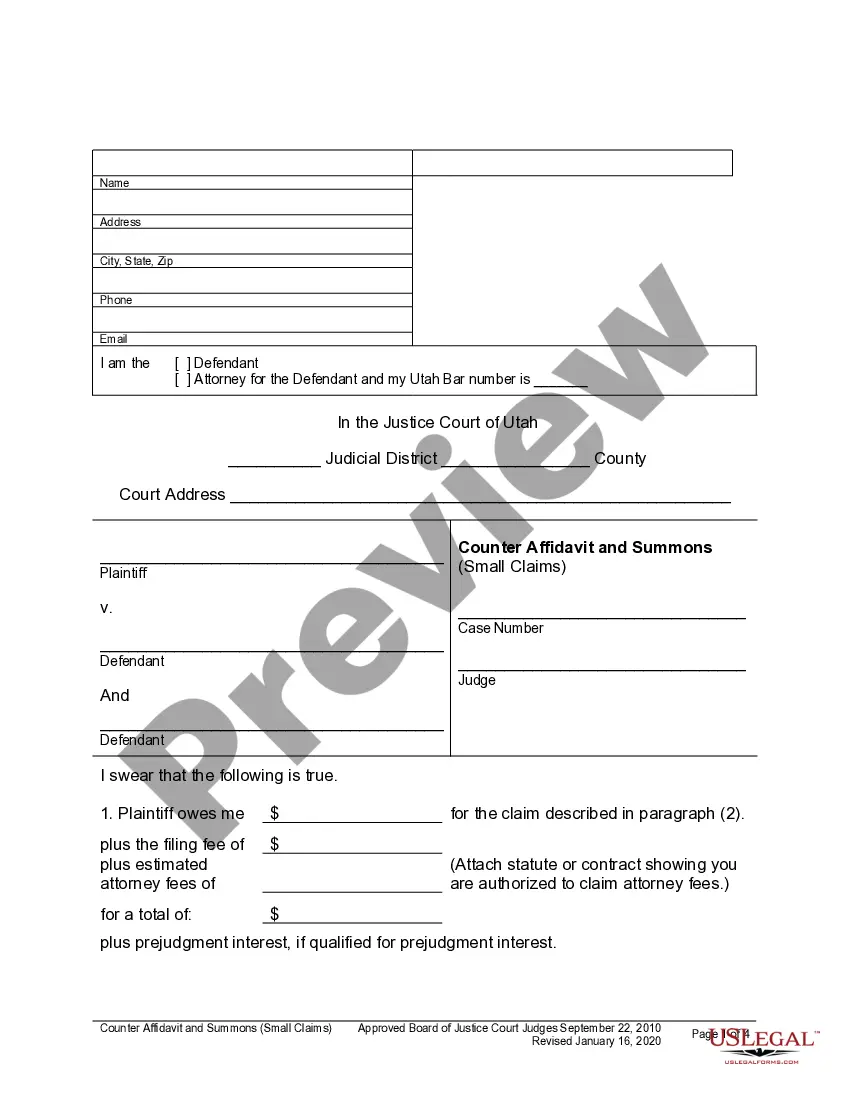

How to Dissolve an LLC Vote to Dissolve the LLC. ... File Final Tax Returns and Obtain Tax Clearance. ... File Articles or Certificate of Dissolution. ... Notify Creditors About Your LLC's Dissolution. ... Settle Debts and Distribute Remaining Assets. ... Close All Accounts and Cancel Licenses and Permits. ... Cancel Registrations in Other States.

It is required to file form 966 within 30 days of closing the corporation. This form can be prepared by the attorneys filing the dissolution documents. However, as this is a requirement of closing, it is important to file with the IRS.