Dissolved Dissolve Company Without Winding Up

Description

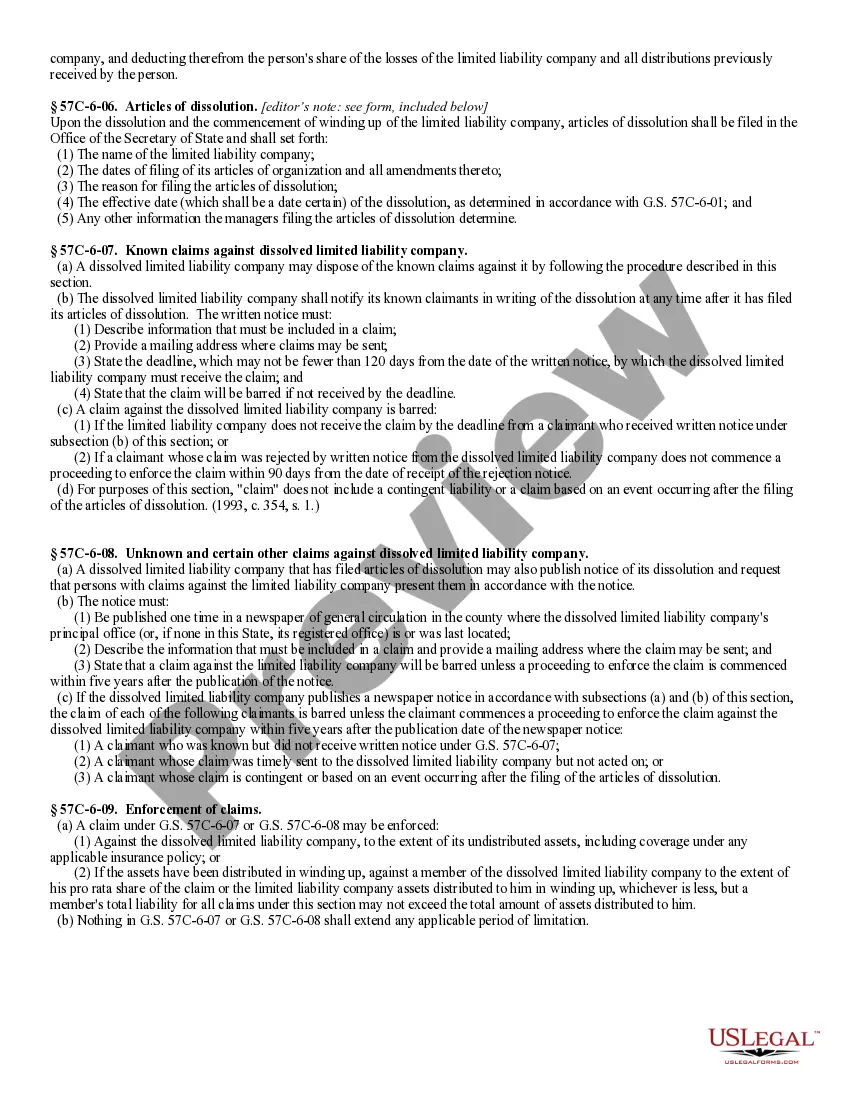

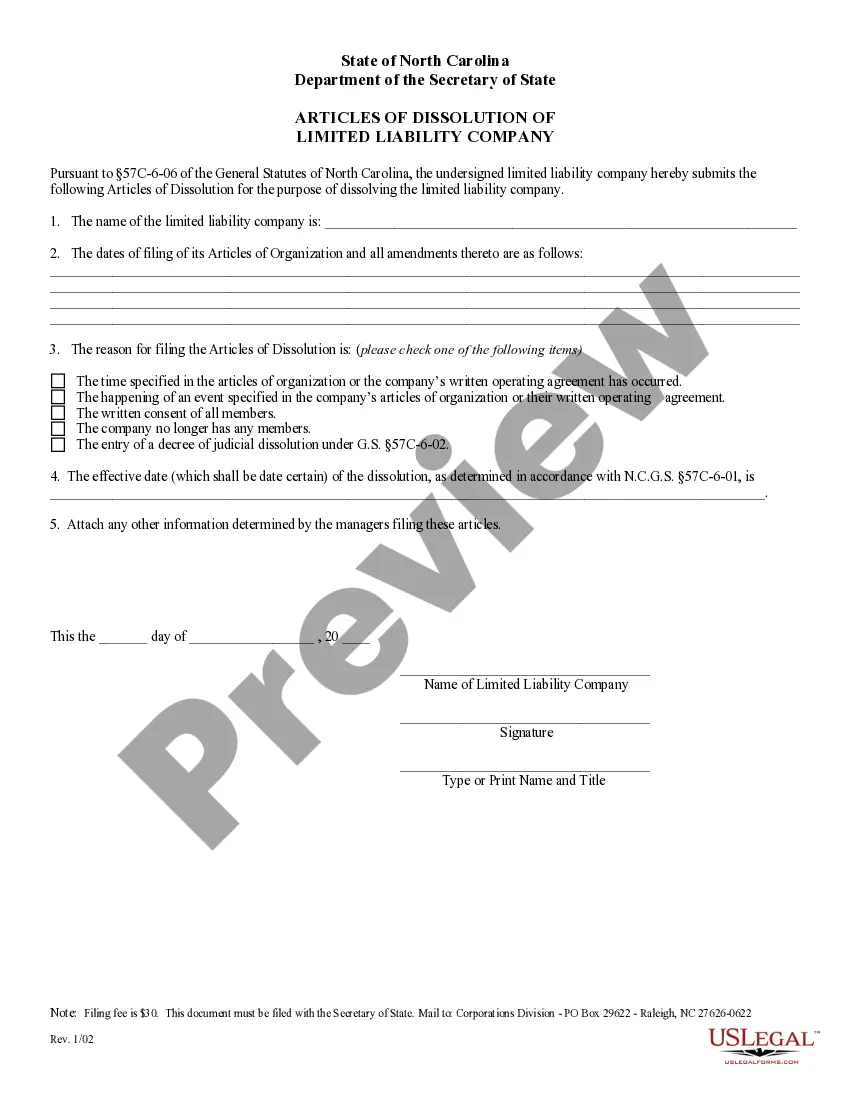

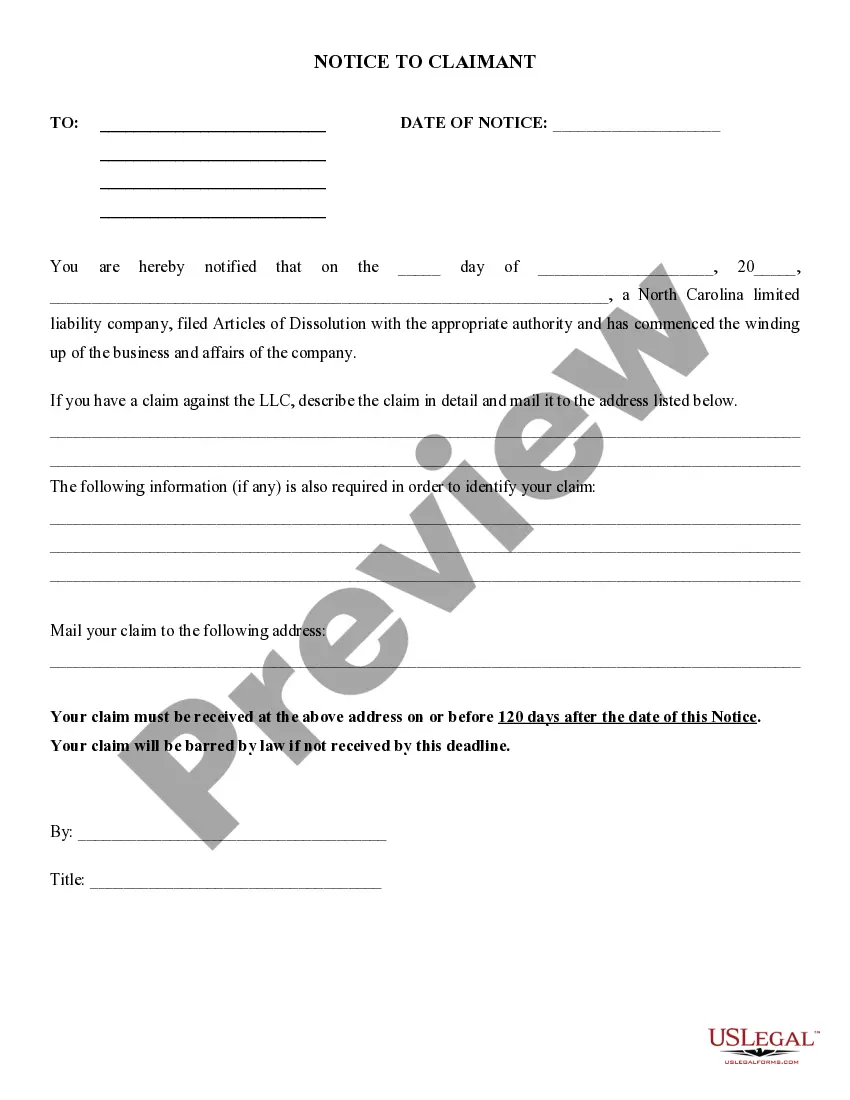

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more economical method for preparing the Dissolved Dissolve Company Without Winding Up or any other documentation without the hassle, US Legal Forms is readily available to you.

Our online catalog of over 85,000 current legal forms encompasses nearly every element of your financial, legal, and personal matters. With just a few clicks, you can rapidly access state- and county-specific forms meticulously crafted for you by our legal professionals.

Review the document preview and descriptions to confirm that you have located the document you require.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can swiftly locate and download the Dissolved Dissolve Company Without Winding Up.

- If you’re a returning user and have created an account with us before, simply Log In to your account, find the template, and download it instantly or retrieve it again at any time in the My documents section.

- Don’t possess an account? No issue. Setting it up takes minimal time and allows you to explore the library.

- But before you immediately proceed to download the Dissolved Dissolve Company Without Winding Up, please heed these suggestions.

Form popularity

FAQ

Yes, a company can be dissolved without going through the winding-up process. This usually happens when there are no assets or liabilities, allowing for a straightforward dissolution. If you find yourself in this situation, US Legal Forms can provide you with the necessary resources to help you effectively dissolve a company without winding up.

Dissolution of a company refers to the formal end of its legal existence, while winding up is the process of settling the company’s debts and distributing its assets before the dissolution. Essentially, winding up is a step that occurs before a company's dissolution can be finalized. Understanding the distinction can help you navigate how to dissolve a company without winding up, ensuring a smoother process.

Once a company is dissolved, it cannot legally operate in any business capacity. This means that the company cannot enter into contracts, conduct transactions, or engage with customers. However, if you are looking to address issues related to a dissolved company, you might want to explore ways to dissolve a company without winding up through platforms like US Legal Forms.

To notify the IRS of your corporation's dissolution, you should complete and submit Form 966, which is the Corporate Dissolution or Liquidation form. This form informs the IRS that your business has been dissolved and will no longer conduct operations. Additionally, ensure that you file your final tax return, marking it as 'final' to indicate that the corporation is no longer active. Using USLegalForms can simplify this process, providing you with the necessary forms and guidance to dissolve your company without winding up.

To legally dissolve a business, you must follow your state's specific procedures. This usually includes filing dissolution documents with the state and settling any debts or obligations. If you're considering a dissolved dissolve company without winding up, it's essential to make sure you comply with all legal requirements to avoid future liabilities. US Legal Forms offers resources that can guide you through each step of the dissolution process.

Proving that a business is no longer operating involves several steps. You may need to provide documentation such as tax returns that reflect no activity, or a formal statement indicating the closure. In cases where you want to dissolve a company without winding up, creating a clear record will help establish that the business has ceased operations. Using US Legal Forms can help streamline the documentation process.

Yes, notifying the IRS is a crucial step when you close your business. You need to report the closure and ensure that all tax obligations are settled, especially if you want to avoid complications later. This is particularly important when you aim to dissolve a company without winding up, as proper notifications help maintain your compliance. Consulting resources through US Legal Forms can assist you in understanding these requirements.

Yes, you can dissolve a company yourself, but it requires following specific legal procedures. To do this effectively, ensure you understand your state's regulations regarding a dissolved dissolve company without winding up. It's essential to file the appropriate documents with the state and settle any outstanding debts. If you're unsure about the process, consider using a platform like US Legal Forms for guidance.

To officially dissolve a business, you need to follow specific steps to ensure a smooth process. First, you must vote on the dissolution and document the decision in your company records. Next, you should file the appropriate paperwork with your state, indicating that you intend to dissolve your company without winding up. It is also important to settle any debts and distribute remaining assets among the owners before completing the dissolution process. For a seamless experience, consider using US Legal Forms, which offers templates and guidance for dissolving your company efficiently.