Dissolve Limited Liability Company For Rental Property

Description

Form popularity

FAQ

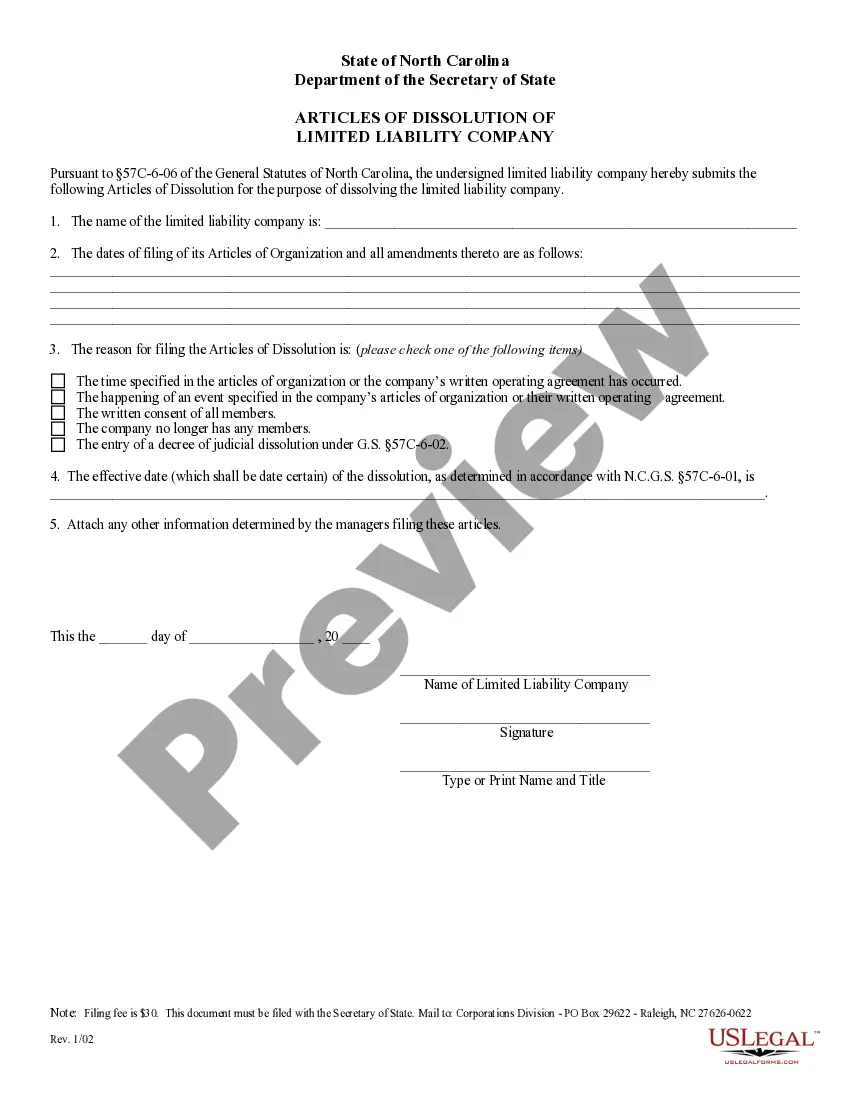

Before you dissolve a limited liability company for rental property, ensure you have settled all debts and obligations associated with the business. Review your rental agreements and notify tenants about the dissolution plan to maintain transparency. Additionally, consult with a legal professional to understand the implications of the dissolution process. Using a platform like US Legal Forms can simplify this process, helping you with the necessary documents and guidelines to smoothly dissolve your LLC.

To take a property out of an LLC, you generally need to follow a few key steps. First, review your LLC's operating agreement and check state regulations to ensure compliance. After that, you can formally transfer the property to your name or another entity through a deed. Keep in mind that when you dissolve a limited liability company for rental property, it may involve tax implications and potential liability issues, so consider consulting a legal expert or utilizing platforms like uslegalforms for smooth navigation.

Dissolving an LLC is the formal process of closing it down, while terminating can refer to ending contracts or specific operations within the company. When you dissolve a limited liability company for rental property, you are taking definitive steps to end the business legally. Understanding these terms can help you navigate the complex process involved in officially closing your company.

When a business is terminated, it signifies that the business operations have ceased under law. This can happen voluntarily or involuntarily and may involve dissolving the business entirely. For someone looking to dissolve a limited liability company for rental property, termination is an important aspect to consider in the overall process.

Yes, notifying the IRS is crucial when you close your LLC. You must file a final tax return and inform them of your intention to dissolve the limited liability company for rental property. This ensures that you fulfill all your federal tax obligations and avoid future complications.

Dissolution and termination can sound similar, but they have subtle differences. Dissolution refers to the process of formally closing the company, while termination often describes the end of a specific phase of the business's operations. To dissolve a limited liability company for rental property, you must follow the legal steps necessary to officially end the company's existence.

After you dissolve your LLC, you must settle any remaining business affairs, including debts and assets distribution. The dissolution may also affect your liability protection, making you personally liable for any obligations. Make sure to keep records of the dissolution process, as it impacts your legal standing moving forward.

To take your property out of an LLC, you need to follow a clear process. First, ensure all LLC debts are settled and the property is legally transferred to your personal name. This might require a formal agreement and a deed transfer, which can be easily facilitated by using the resources available at US Legal Forms.

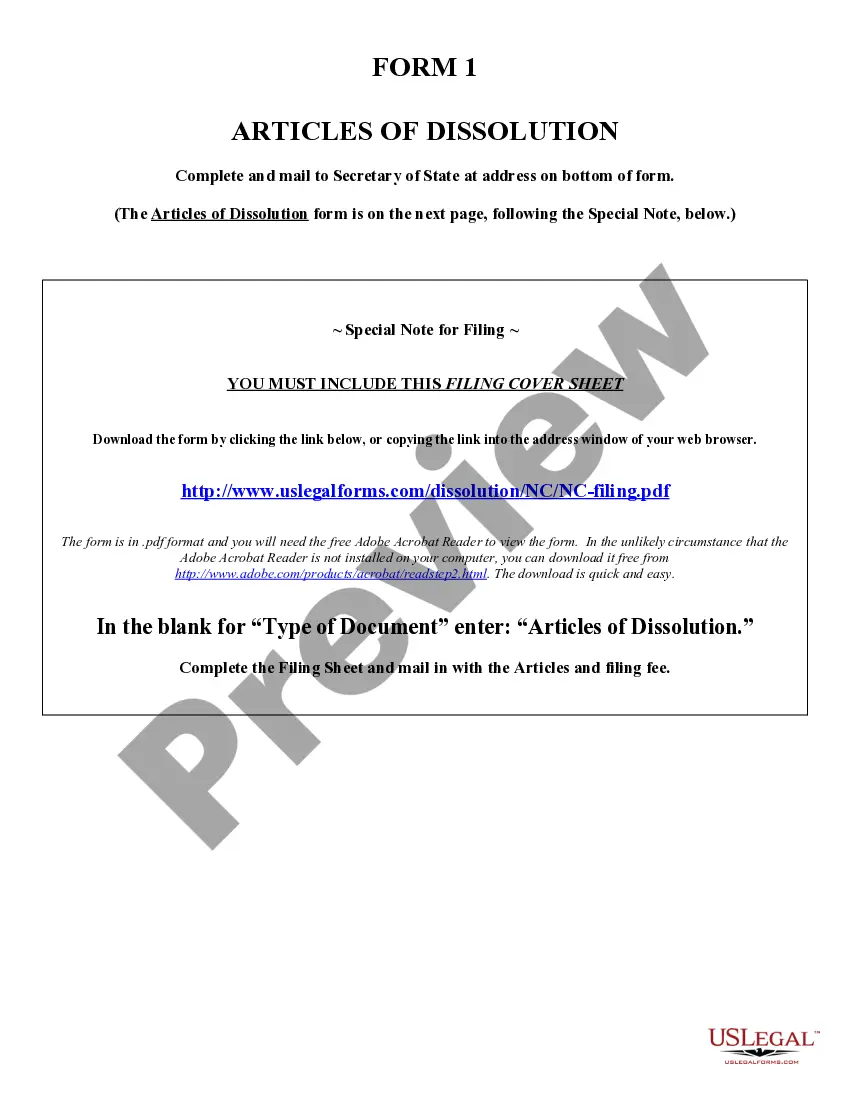

Closing an LLC is manageable as long as you understand the proper steps involved. You must notify all stakeholders and settle accounts first, then file the necessary paperwork with your state. Using resources like US Legal Forms can guide you through each stage, making the process easier and more efficient.

Dissolving an LLC is not inherently hard, but it does require careful attention to detail. You need to follow specific state procedures, which involve filing documents and settling financial obligations. By using a platform like US Legal Forms, you can simplify the dissolution process, ensuring all steps are completed correctly.