Dissolution Dissolve Company For Sale

Description

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Creating legal documents from the beginning can occasionally be daunting. Some situations may require hours of investigation and substantial financial resources. If you're looking for a more straightforward and cost-effective method of preparing Dissolution Dissolve Company For Sale or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific templates carefully crafted for you by our legal experts.

Utilize our site whenever you require trustworthy and dependable services where you can easily locate and acquire the Dissolution Dissolve Company For Sale. If you’re already familiar with our website and have previously created an account, simply Log In, find the form, and download it or re-download it anytime in the My documents section.

Not registered yet? No problem. It takes minimal time to set it up and browse the catalog. But before proceeding to download Dissolution Dissolve Company For Sale, adhere to these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and transform document completion into a simple and efficient process!

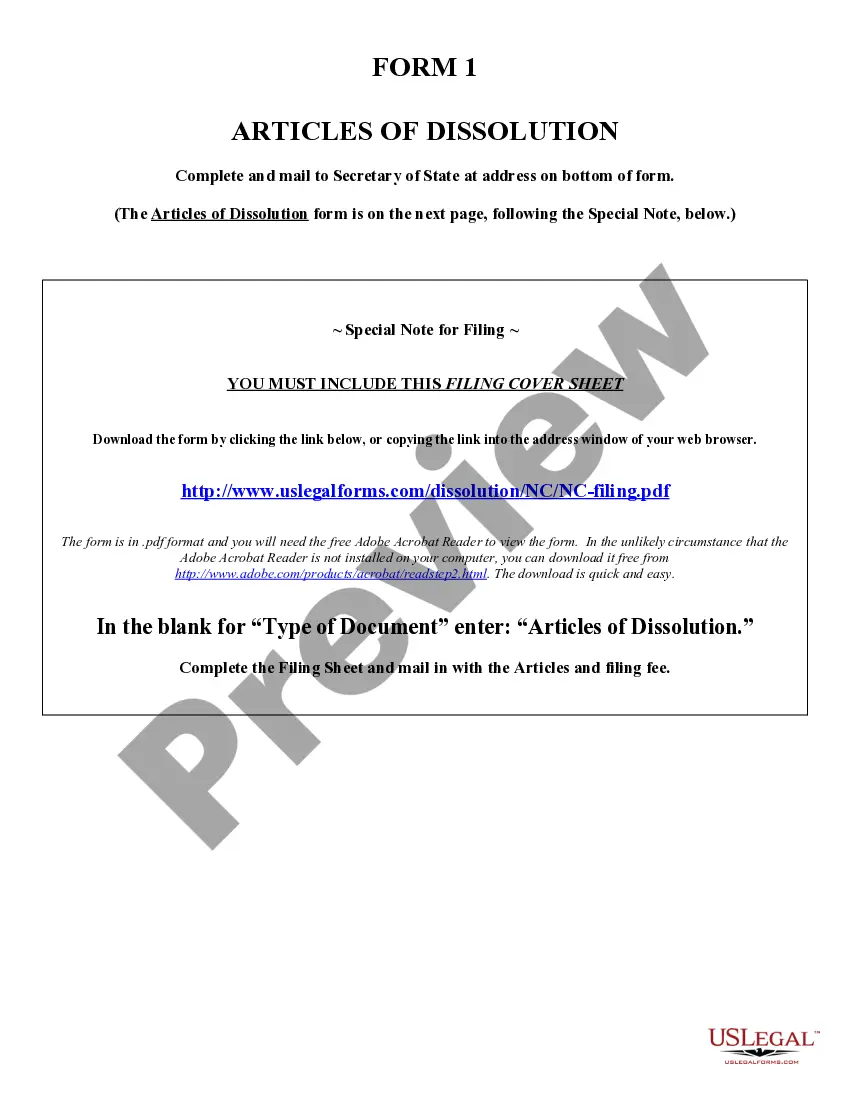

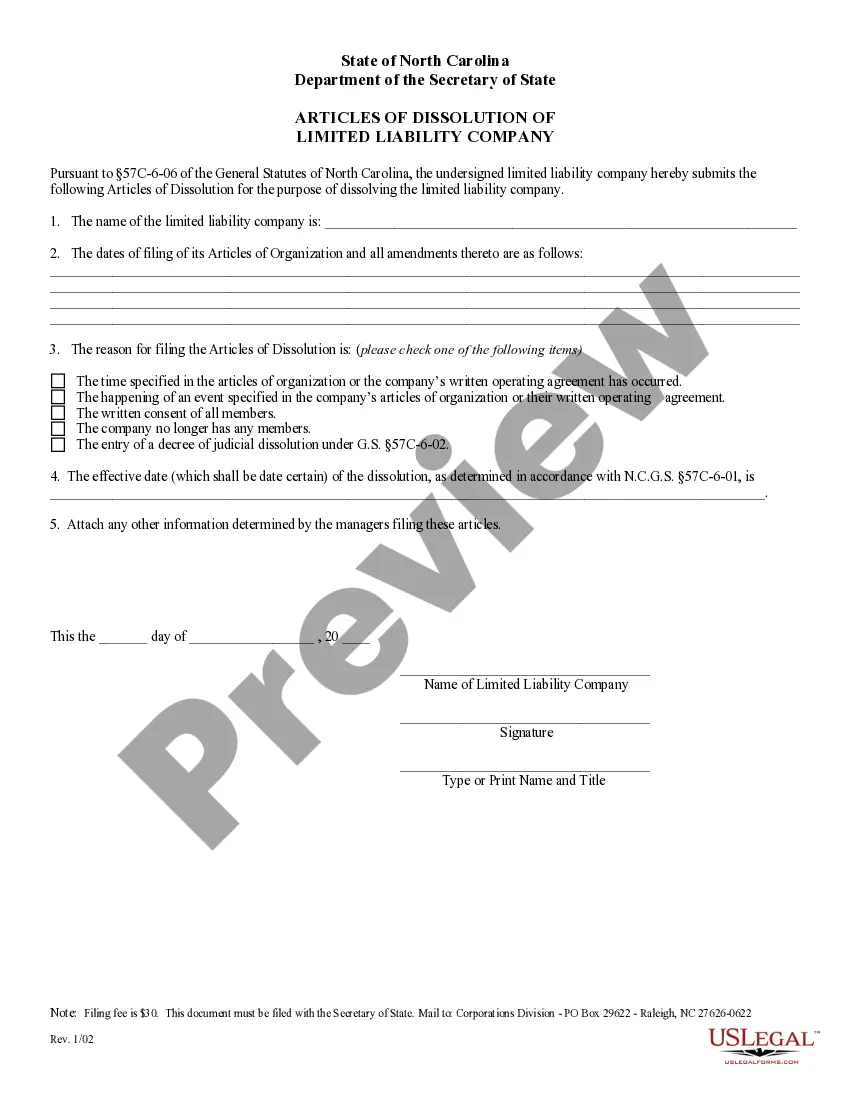

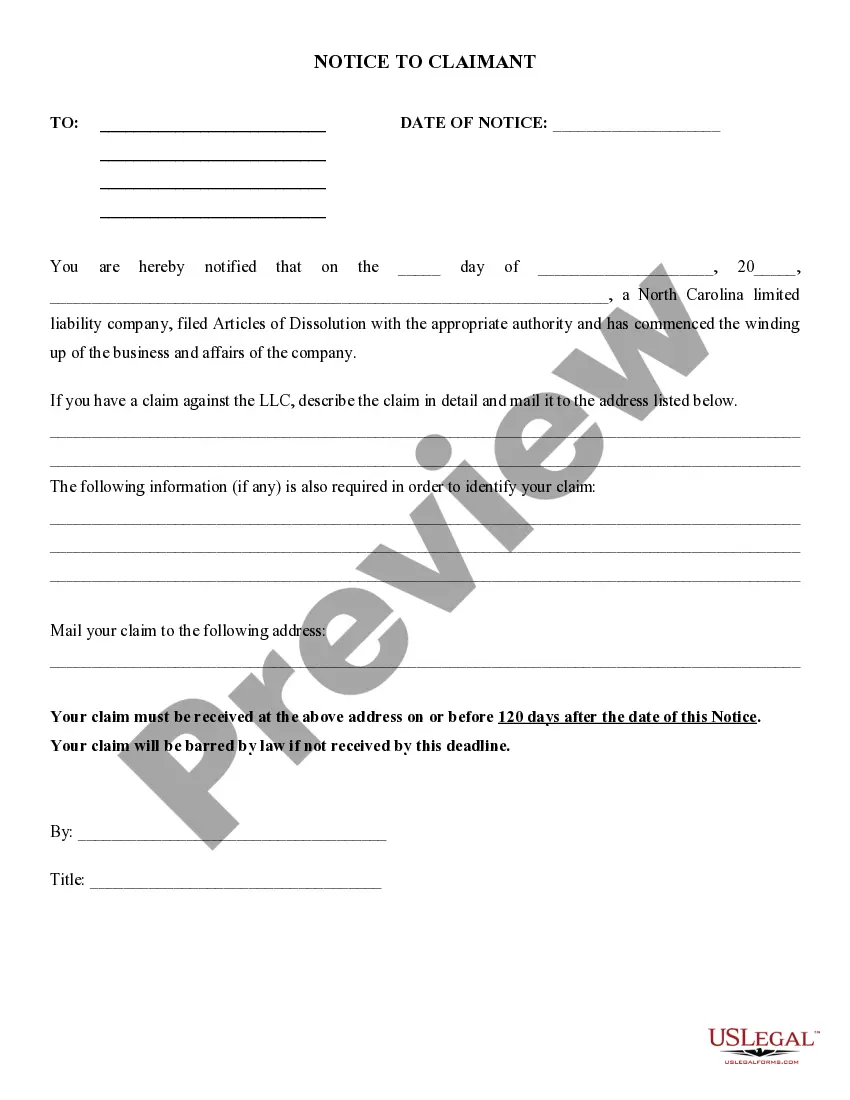

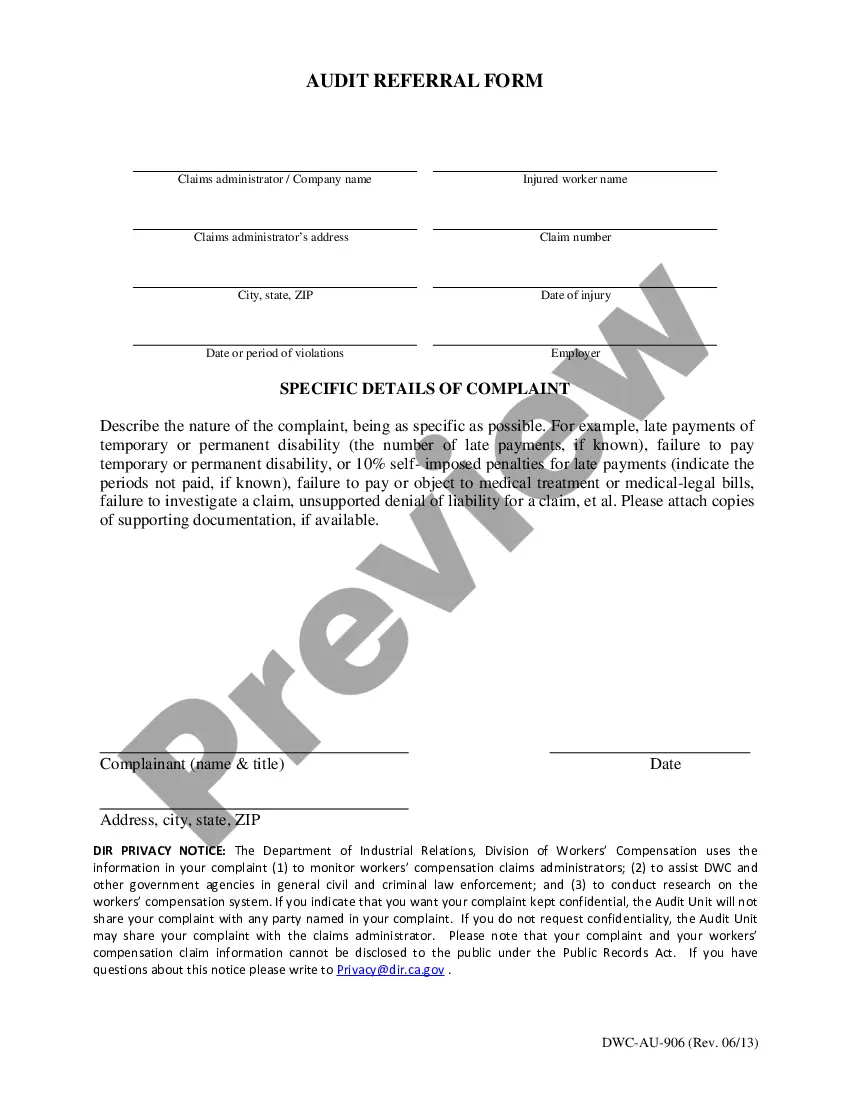

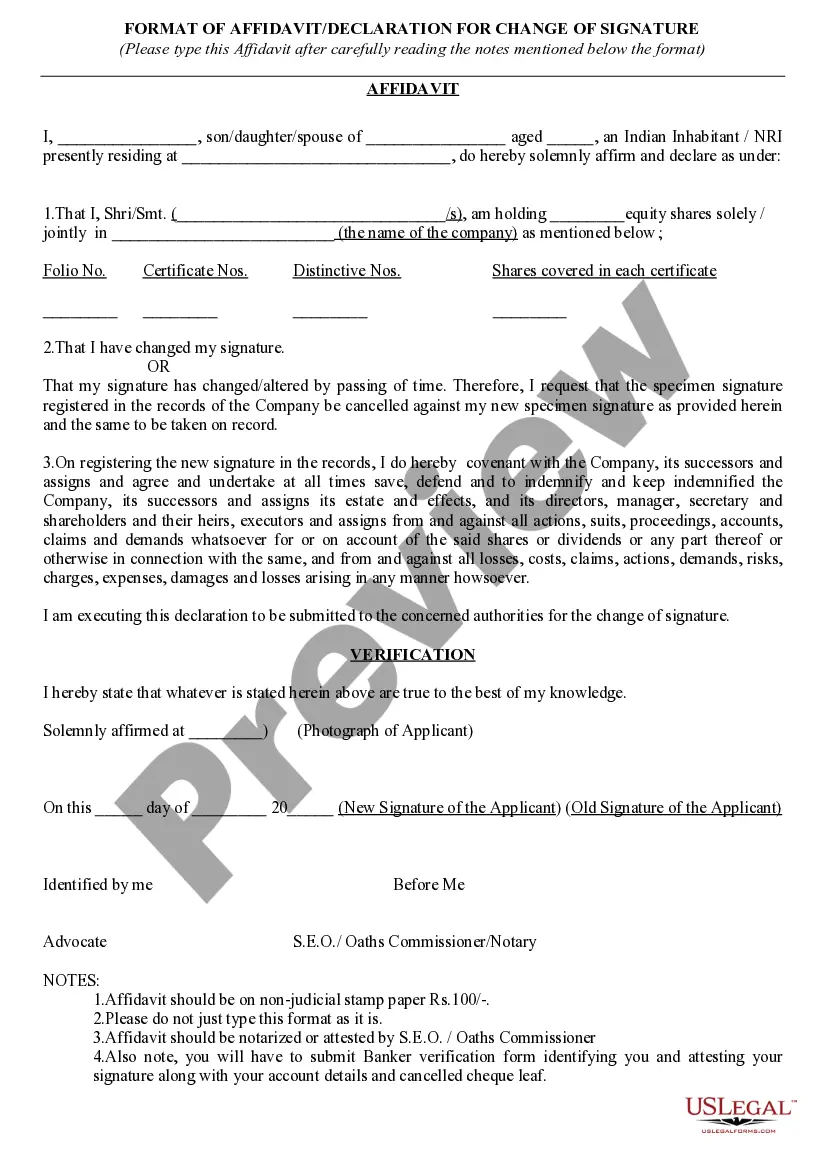

- Examine the document preview and descriptions to confirm that you are on the correct form you are seeking.

- Ensure the template you choose aligns with the statutes and regulations of your state and county.

- Select the most appropriate subscription plan to acquire the Dissolution Dissolve Company For Sale.

- Download the template. Then complete, sign, and print it.

Form popularity

FAQ

To fully dissolve your LLC, start by holding a meeting with the members to vote on dissolution. Next, file the necessary dissolution paperwork with your state, as each state has specific requirements. Additionally, you should settle any outstanding debts and notify creditors to ensure a smooth transition. For a comprehensive guide, consider using US Legal Forms, which can provide the necessary documents and support for the dissolution process, helping you dissolve your company for sale efficiently.

While it's possible to dissolve a corporation without a lawyer, seeking legal advice is often beneficial. A lawyer can help you navigate the complexities of dissolution, ensuring you comply with all legal requirements. This guidance can prevent potential pitfalls and streamline the process. Utilizing resources like uslegalforms can simplify the necessary paperwork for dissolving a corporation.

The steps for dissolving an S corporation include notifying shareholders, settling debts, filing articles of dissolution with the state, and completing IRS Form 966. It’s crucial to follow your state’s specific requirements to avoid legal complications. Platforms like US Legal Forms can provide the necessary forms and guidance to help you through each step of the dissolution process.

Yes, filing Form 966 is typically required when dissolving an S Corp. This form notifies the IRS of the corporation's dissolution and helps prevent future tax issues. To ensure compliance and ease of filing, consider using platforms like US Legal Forms to access the correct documentation.

To officially dissolve a business, you must follow your state's legal procedures, which often include filing articles of dissolution. It’s important to notify creditors and settle any outstanding debts. Utilizing resources like US Legal Forms can provide you with the templates and guidance necessary to complete this process efficiently.

While you don’t necessarily need a lawyer to dissolve a company, it can be beneficial, especially if your business structure is complex. Legal advice can help you navigate the dissolution process and ensure compliance with all regulations. Using services like US Legal Forms can simplify the paperwork, making it easier to handle without a lawyer.

If Form 966 is not filed during the dissolution of an S Corp, the IRS may not recognize the dissolution. This oversight can lead to continued tax obligations, creating complications for the business owners. To avoid such issues, ensure you complete all necessary paperwork, including Form 966, when dissolving your company.

When an S Corp is dissolved, it ceases all business operations and must settle its debts and obligations. The assets may be liquidated and distributed to shareholders, depending on the corporation's bylaws. Understanding these implications is crucial, especially if you plan to dissolve a company for sale.

To close an S Corp online, you need to follow the necessary steps for dissolution. You can typically submit the appropriate forms through your state’s business filing portal. Additionally, consider using a platform like US Legal Forms to access the specific documents required for your state, ensuring a smooth dissolution process for your company.