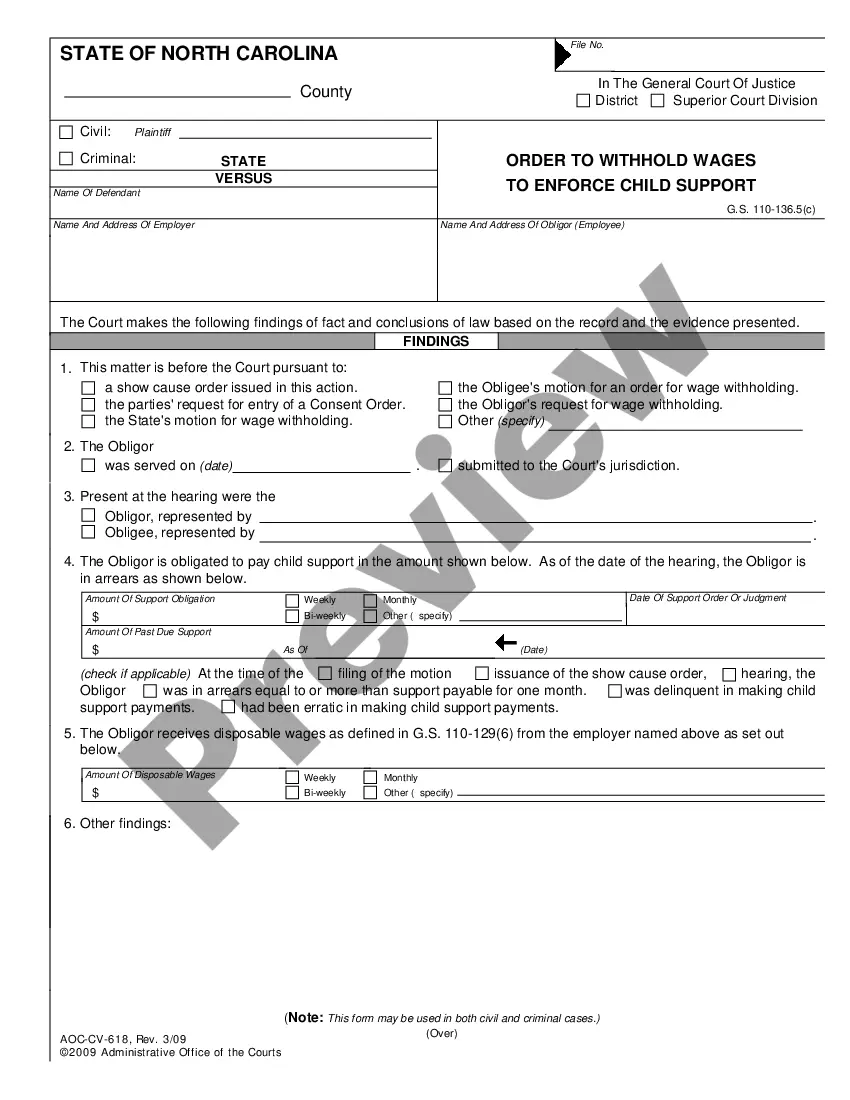

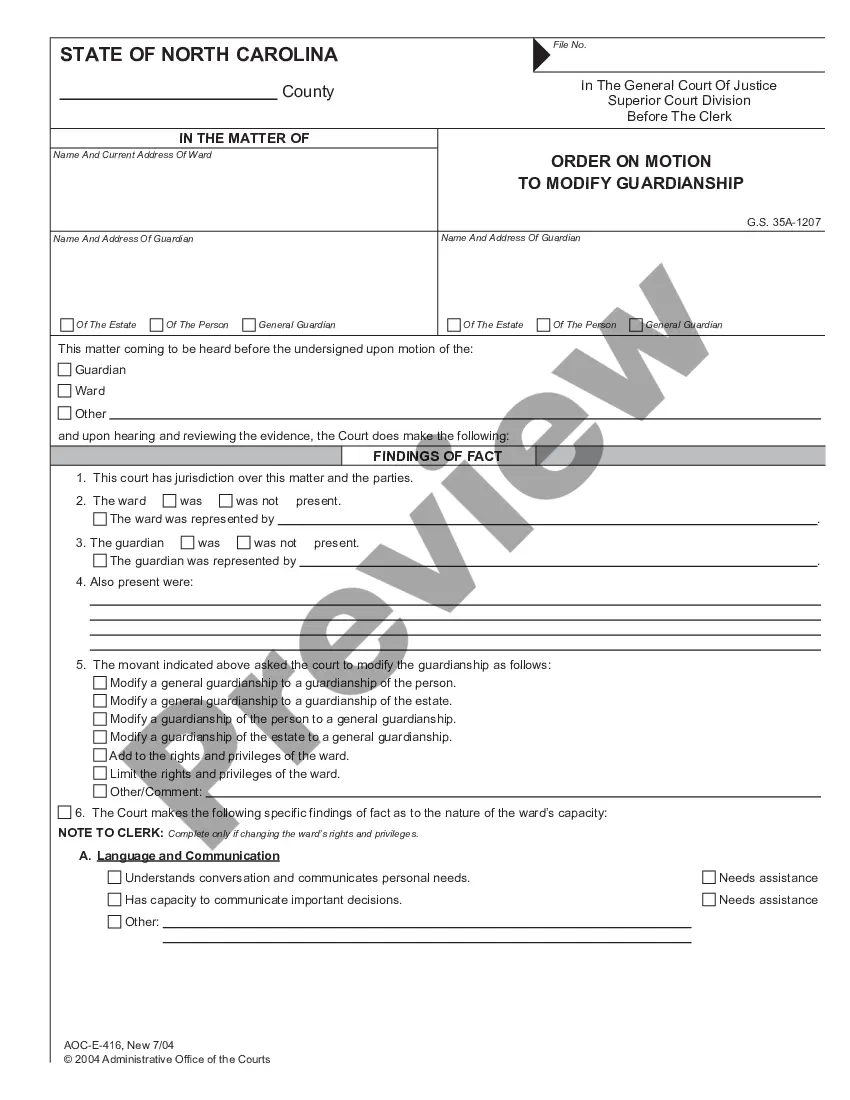

Order to Withhold from Income Other than Wages to Enforce Child Support Order: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Child Support Income Withholding Form

Description

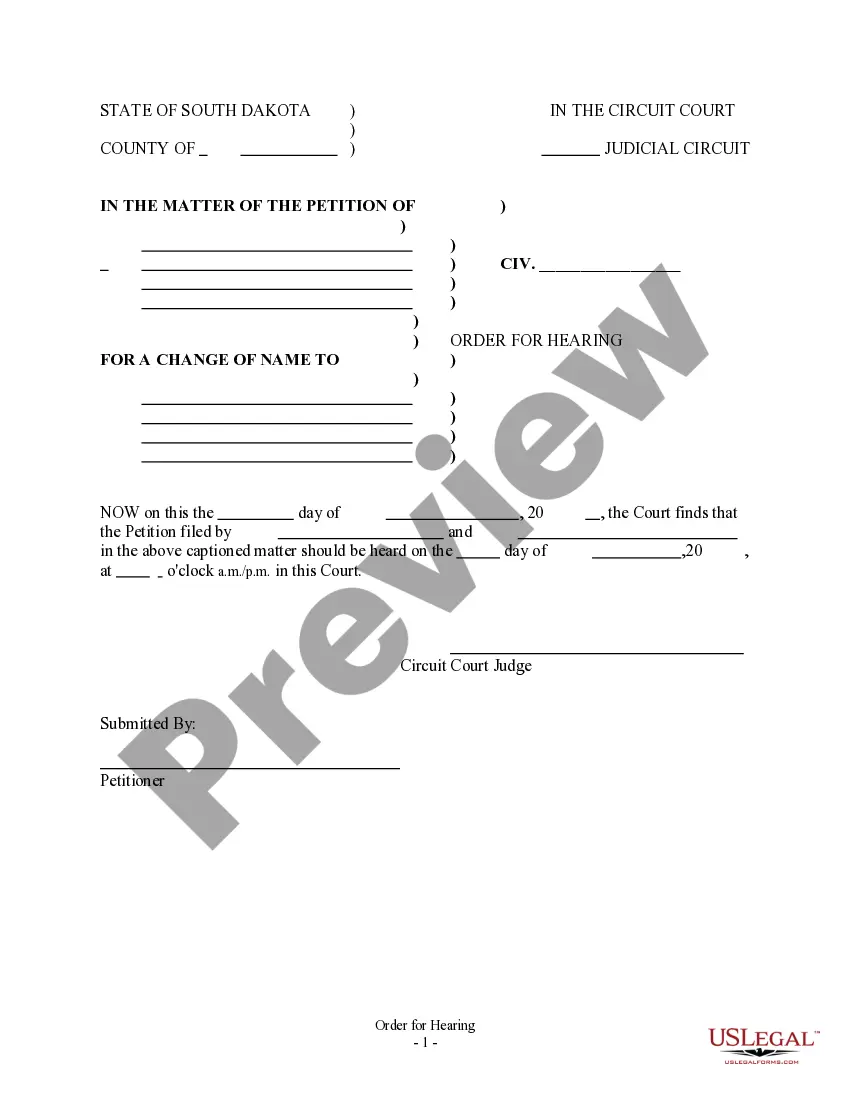

How to fill out North Carolina Order To Withhold From Income Other Than Wages To Enforce Child Support Order?

No matter if you frequently manage papers or occasionally need to submit a legal document, it is crucial to find a resource where all the samples are pertinent and current.

The first step you should take with a Child Support Income Withholding Form is to verify that it is indeed the most recent version, as it determines its eligibility for submission.

If you wish to streamline your quest for the most recent document examples, look for them on US Legal Forms.

To acquire a form without creating an account, follow these steps: Use the search menu to locate the form you need. Review the Child Support Income Withholding Form preview and description to confirm it is exactly what you are seeking. After double-checking the form, just click Buy Now. Choose a subscription plan that suits you. Create a new account or Log In to your existing one. Use your credit card details or PayPal account to finalize the transaction. Select the file format for download and confirm it. Eliminate confusion while handling legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every type of document template you might require.

- Search for the templates you need, immediately check their relevance, and learn more about their application.

- With US Legal Forms, you have access to over 85,000 document templates across various fields.

- Obtain the Child Support Income Withholding Form examples in just a few clicks and store them any time in your account.

- Having a US Legal Forms account enables you to easily access all the samples you need with added convenience and minimal hassle.

- Simply click Log In in the website header and open the My documents section with all the forms you require at your fingertips.

- You won’t need to waste time searching for the right template or verifying its authenticity.

Form popularity

FAQ

Filing taxes for child support requires understanding that child support payments are generally not taxable income for the recipient. However, if you rely on income from a child support income withholding form, it can impact your overall financial picture. It's essential to keep accurate records of payments made and received to simplify the process. If you need additional guidance, consider utilizing resources from UsLegalForms to help you manage this aspect effectively.

You do not enter child support on your tax return, as it is not considered taxable income. If you're looking to maximize your financial planning, focusing on completing the child support income withholding form accurately can streamline payments and impact your financial situation positively when filing taxes.

Typically, you do not need to report your child's income if they are under your care. However, if your child files a tax return independently or if they earn enough to require filing, you may need to provide information. Using the child support income withholding form can clarify your situation and help ensure you comply with tax regulations.

Child support payments generally do not impact your tax refund, as they are not viewed as taxable income. However, if you fall behind on payments, certain collection processes can seize tax refunds. Understanding your responsibilities and taking advantage of the child support income withholding form can help prevent issues that may arise during tax season.

The maximum amount that can be withheld for child support typically depends on your income and state regulations. Generally, states set a cap on the percentage of your disposable income that can be withheld. It's important to consult guidelines specific to your state, as they will direct you on how to properly complete the child support income withholding form.

In Florida, employers are required to withhold child support payments from an employee's paycheck when they receive a valid child support income withholding form. This legal document mandates the employer to deduct a specified amount directly from the employee's wages. By complying with this requirement, employers help ensure that the child receives necessary financial support. If you need assistance with completing the child support income withholding form, US Legal Forms offers useful resources and templates to make the process easier.

Kansas child support laws establish a framework for financial support based on the incomes of both parents and the needs of the child. A child support income withholding form can facilitate timely deductions from wages, ensuring that support payments are made consistently. Parents should be aware of their obligations and rights under Kansas law to prevent disputes. Utilizing the resources from US Legal Forms can clarify specific requirements for your circumstances.

Withholding a child from one parent for non-payment of child support is generally not permitted under the law. Courts view this act as interference with visitation rights. It is more effective to address unpaid child support through formal legal channels, including the completion of a child support income withholding form. US Legal Forms can help provide the necessary documentation to resolve these issues in a lawful manner.

Withholding your child from their parent due to non-payment of child support is not legally advised. Courts typically consider this as a violation of custody arrangements, which can lead to legal issues for the withholding parent. Instead, it is vital to document missed payments and address the matter legally, possibly with the assistance of a child support income withholding form. For further clarity, US Legal Forms offers resources on navigating parental rights and responsibilities.

To get child support automatically deducted from income, you must submit a child support income withholding form to the court and your employer. This form allows courts to instruct employers to withhold specific amounts from your paycheck. The process ensures that payments are made consistently and timely, reducing the risk of missed or late payments. Using US Legal Forms can guide you through the necessary steps to achieve automatic deductions.