Credit Application Form For New Customer

Description

How to fill out Credit Application Form For New Customer?

There's no longer a requirement to waste time looking for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one place and made them easy to access.

Our platform offers over 85,000 templates for any business and personal legal matters categorized by state and area of use.

To locate another template if the current one isn't suitable, use the Search field above. Click Buy Now next to the template title upon finding the appropriate one. Select the most fitting subscription plan and either create an account or Log In. Complete your subscription payment via credit card or PayPal to proceed. Select your desired file format for the Credit Application Form For New Customer and download it to your device. Print your form to complete it manually or upload the sample if you prefer using an online editor. Preparing legal documents in accordance with federal and state regulations is swift and easy with our platform. Experience US Legal Forms today to maintain your documentation organized!

- All forms are correctly drafted and verified for authenticity, so you can trust in acquiring an updated Credit Application Form For New Customer.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you are a first-time user of our platform, the procedure will require a few additional steps to finalize.

- Follow these steps to find the Credit Application Form For New Customer in our catalog.

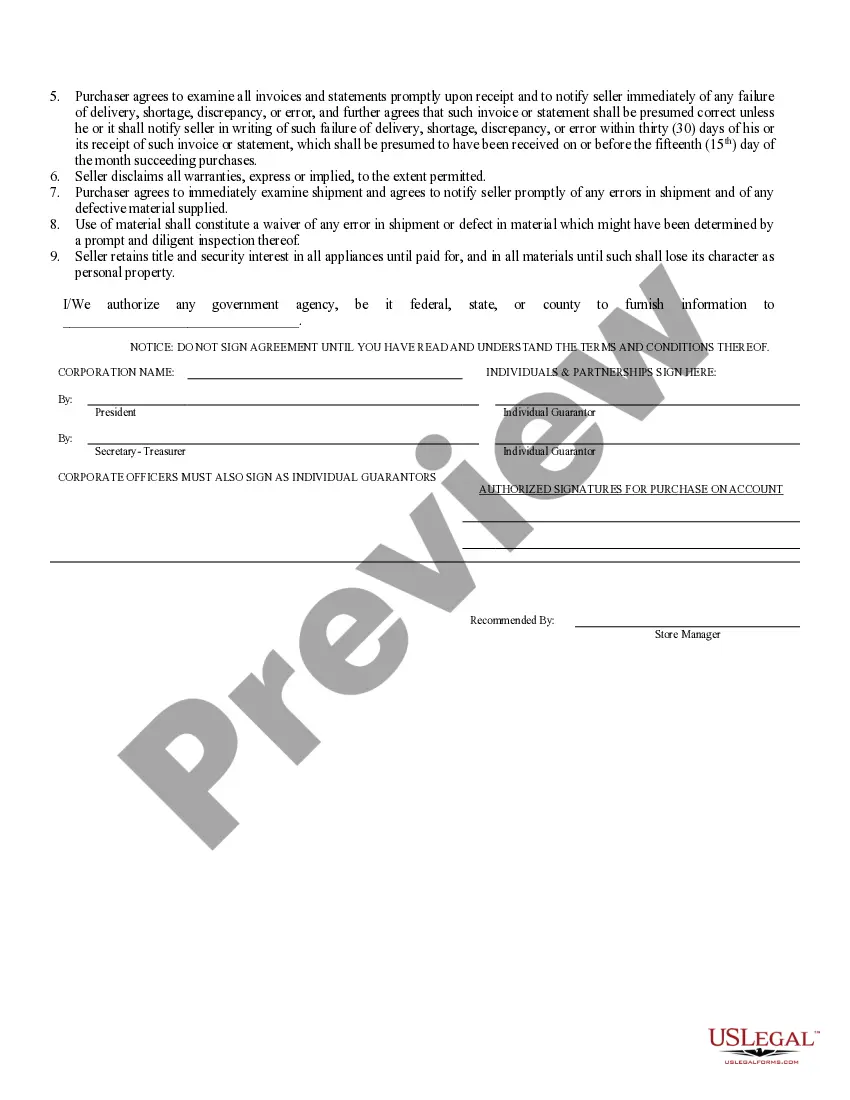

- Review the page content thoroughly to verify it includes the example you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

The lender issues the form, and the information included in it helps the lender determine whether that borrower is a good candidate for a loan. Your lender will either deny or approve your credit application based on this information.

While granting customer credit, the sales associate has to follow certain steps, which include creation of credit policy, obtaining credit application, checking customer references, getting a personal guarantee, run a credit check, setting limits of credit and payment terms.

A credit application is a request for a loan or line of credit. The information included in a credit report helps the lender determine whether the borrower is a good candidate for a loan. You can usually fill out a credit application either online or in person.

Here are four things to consider when preparing your application:Credit purpose. When you apply for credit, the financial institution will want to know how you plan to use the money you borrow.Credit history.Company finances.Application and accurate documentation.

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.