Credit Application Form For Motorcycle Loan

Description

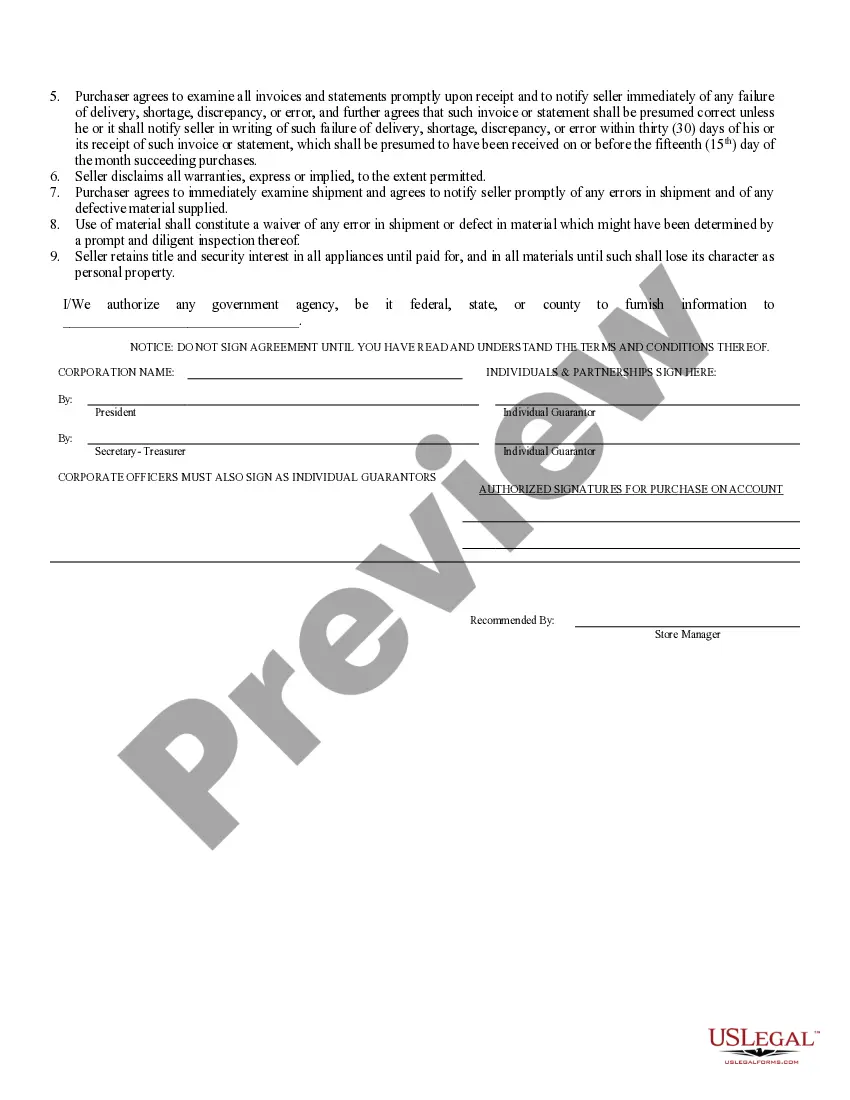

How to fill out North Carolina Business Credit Application?

There’s no further justification to waste time looking for legal documents to adhere to your local state laws.

US Legal Forms has assembled all of them in one location and made their accessibility more efficient.

Our platform offers over 85,000 templates for any enterprise and personal legal matters categorized by state and area of application. All forms are correctly composed and confirmed for authenticity, so you can be confident in acquiring an up-to-date Credit Application Form For Motorcycle Loan.

Click Buy Now next to the template title once you discover the appropriate one. Opt for the most suitable pricing plan and either register for an account or sign in. Complete the payment for your subscription with a credit card or through PayPal to proceed. Choose your preferred file format for your Credit Application Form For Motorcycle Loan and download it onto your device. Print your form to fill it out manually or upload the template if you prefer to use an online editor. Preparing official documents under federal and state laws is quick and easy with our repository. Explore US Legal Forms now to maintain your documentation organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab in your profile.

- If you've never used our platform before, the procedure will require a few additional steps to finalize.

- Here’s how new users can acquire the Credit Application Form For Motorcycle Loan from our catalog.

- Examine the page content meticulously to confirm it includes the sample you require.

- To achieve this, utilize the form description and preview options if available.

- Use the Search field above to look for another template if the prior one did not meet your needs.

Form popularity

FAQ

Creating a business credit application form for motorcycle loans involves gathering specific information related to the business entity. You should include sections for business ownership, financial statements, and contact information. USLegalForms offers templates that simplify this process, allowing you to tailor your form to your business needs and streamline the application process.

A credit application is a form used by potential borrowers to get approval for credit from lenders. Today, many credit applications are filled out electronically and may be improved in only a short amount of time.

Information you need to apply for a credit cardFull legal name.Date of birth.Address.Social Security number.Annual income.

While granting customer credit, the sales associate has to follow certain steps, which include creation of credit policy, obtaining credit application, checking customer references, getting a personal guarantee, run a credit check, setting limits of credit and payment terms.

While granting customer credit, the sales associate has to follow certain steps, which include creation of credit policy, obtaining credit application, checking customer references, getting a personal guarantee, run a credit check, setting limits of credit and payment terms.

The only time you are required to fill out a credit application is if you are seeking financing from the dealership. If it's really worth it for them to walk away from a deal, so be it. Another dealer will surely sell you a car with a 50% down payment and a check from a lender in hand.