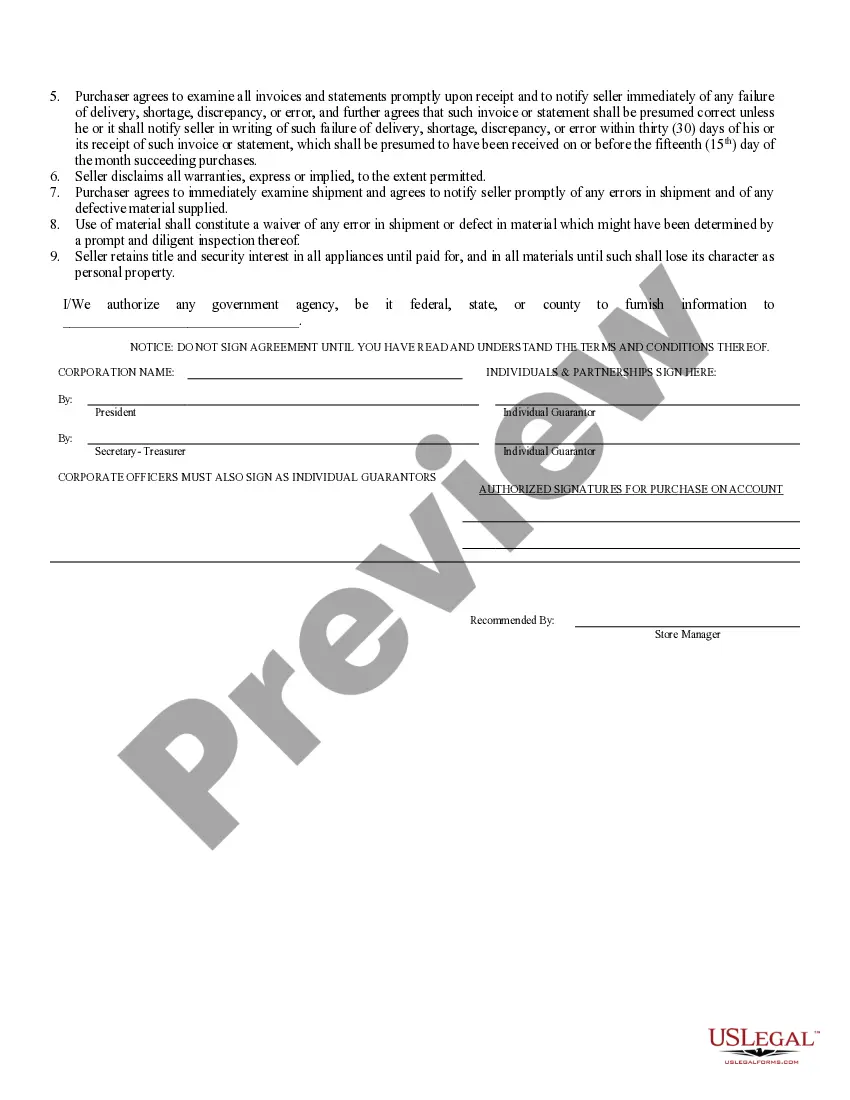

Credit Application Form For Clients

Description

How to fill out North Carolina Business Credit Application?

When it is necessary to file a Credit Application Form for Clients that adheres to your local state's regulations and laws, there may be several alternatives to choose from.

There is no requirement to examine each form to guarantee it meets all the legal standards if you are a subscriber of US Legal Forms.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Browse through the suggested page and check it for alignment with your needs.

- US Legal Forms is the most extensive online library featuring an archive of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with the laws of each state.

- Therefore, when downloading the Credit Application Form for Clients from our platform, you can be assured that you possess a legitimate and up-to-date document.

- Retrieving the necessary template from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is valid, and save the selected file.

- Later, you can access the My documents section in your profile and retrieve the Credit Application Form for Clients at any time.

- If it is your first time using our library, please adhere to the instructions below.

Form popularity

FAQ

Creating a credit file involves collecting and organizing relevant client information from the credit application form for clients. Start by compiling personal details, credit history, and supporting documents. This organized file will help evaluate credit applications accurately and make informed lending decisions. Using software solutions from US Legal Forms can enhance the organization and accessibility of these files.

To create a credit form, you need to outline the information you want to gather from clients, such as income, expenses, and credit references. Use an online form builder that allows for customization and ensures compliance with applicable laws. Incorporating a credit application form for clients features can streamline the approval process and improve client service. Consider exploring options on platforms like US Legal Forms for templates.

A customer credit application form is a document that clients fill out to request credit from a business. This form collects essential information about the client, including their personal details, financial history, and credit references. By utilizing a well-designed credit application form for clients, businesses can assess creditworthiness efficiently. You can find various templates to suit your business needs at US Legal Forms.

Creating a credit application form for clients begins with choosing a user-friendly online form builder. You can customize fields to collect necessary information such as contact details and financial data. Additionally, ensure that your form complies with legal requirements and integrates with payment processing systems if needed. Platforms like US Legal Forms offer templates that simplify this process.

A credit application from a vendor is a document that vendors use to evaluate a buyer's creditworthiness before providing goods or services on credit. This application typically includes vital details about the buyer's financial background and payment history. By utilizing a robust credit application form for clients, vendors can enhance their evaluation process and mitigate potential risks.

Creating a credit proposal begins with outlining the terms and conditions under which you are willing to extend credit to a client. Ensure you include relevant details like repayment terms, interest rates, and the total credit amount. Leveraging a credit application form for clients helps you gather vital information that can shape your proposal effectively.

A credit application form is a document that businesses use to request credit from clients or potential customers. It collects crucial information that helps assess the creditworthiness and financial reliability of the applicant. By providing a well-structured credit application form for clients, businesses can make informed decisions regarding credit limits and terms.

To ask for a credit application from clients, you can provide clear instructions and explain the benefits of completing the form. Highlight how a credit application form for clients helps streamline transactions and establish trust. You might consider sending a formal request via email or presenting the form during your initial meetings to enhance your professional approach and relationship.

Creating a business credit application form for clients involves gathering essential information such as company details, financial history, and payment preferences. You can start by outlining the sections you want to include, such as business identification and credit references. Utilizing platforms like USLegalForms can simplify this process by offering customizable templates that ensure you cover all important aspects efficiently.

To fill a letter of credit application form, begin by entering all required identifying information about the buyer and seller. Specify the amount of credit and the purpose of the letter of credit while detailing any conditions or requirements. Also, include any necessary documentation you plan to provide. A credit application form for clients makes this task straightforward, ensuring no crucial details are overlooked.