Limited Liability Company With The Ability To Establish Series

Description

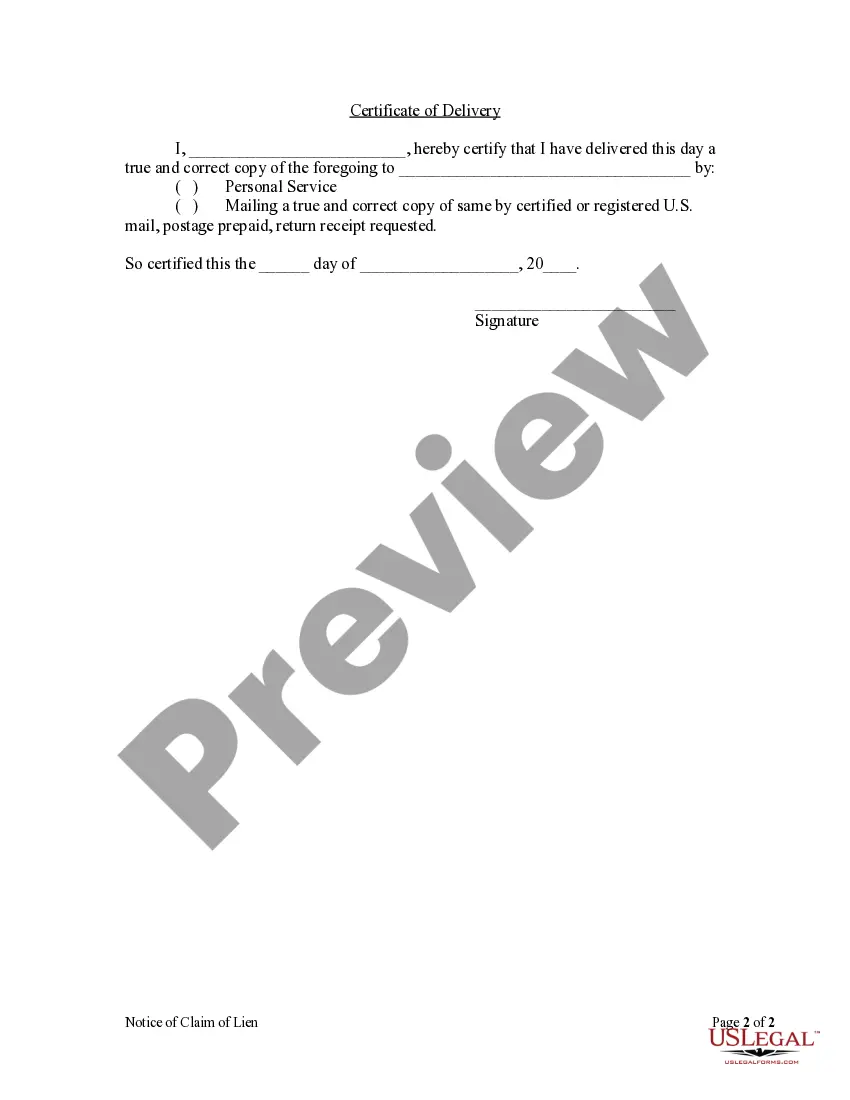

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

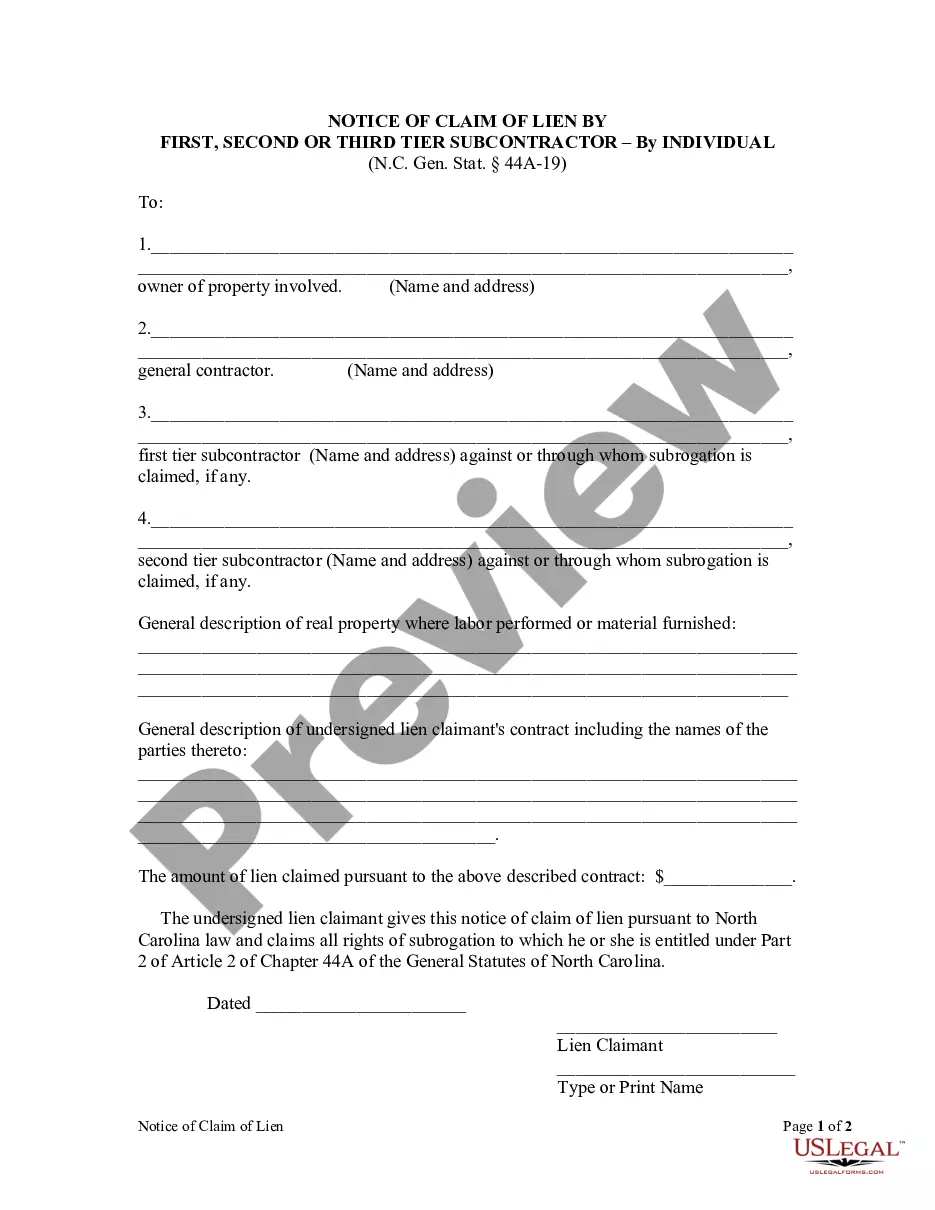

- If you're an existing user, log in to your account and access the required template by hitting the Download button. Ensure your subscription is active; if not, renew it per your payment plan.

- For first-time users, begin by previewing the form descriptions. Verify you select a document that aligns with your requirements and complies with local regulations.

- If necessary, utilize the Search tab to find additional templates that might better suit your needs.

- After finding the correct document, click on the Buy Now button and choose your preferred subscription plan. Registration is required to access our extensive library.

- Complete your purchase by entering your credit card information or using a PayPal account to finalize the subscription.

- Finally, download the form. Save it to your device for easy completion, and access it anytime in the My Forms section of your profile.

With over 85,000 fillable and editable legal forms, US Legal Forms stands out by empowering users to complete their legal documentation effortlessly.

Start simplifying your legal processes today! Visit US Legal Forms to explore your options.

Form popularity

FAQ

Yes, each series in a series LLC typically requires its own Employer Identification Number (EIN) if it has employees or is taxed separately. This ensures compliance with tax regulations and simplifies financial tracking for each series. It is important to consult with tax professionals or utilize resources like uslegalforms to obtain the correct EINs and stay updated on requirements for your Limited Liability Company with the ability to establish series.

The primary difference between a single member LLC and a series LLC lies in their structure and liability protection. A single member LLC consists of one owner and provides liability protection for that owner’s personal assets. On the other hand, a series LLC allows for multiple series under one entity, each with its own liability protection. This arrangement can benefit business owners with diverse interests, enabling better management while safeguarding each series against liabilities connected to the others.

Converting an LLC to a series LLC involves specific steps, which may vary by state. First, check your state’s laws regarding series LLCs to ensure compliance. Then, draft an operating agreement that outlines the multiple series and their operational parameters. You might also need to file specific documents with the state. Platforms like uslegalforms can guide you through this process and provide the necessary forms to make your conversion smooth and compliant.

To establish a series LLC means to create a framework within a standard LLC that allows for multiple series to function. Each series can have its own members, assets, and liabilities while being connected to the parent LLC. This approach streamlines business management by providing legal separation among the series, making it easier to manage risks and protect assets. By utilizing a Limited Liability Company with the ability to establish series, entrepreneurs can optimize their business structure.

A Limited Liability Company (LLC) with the ability to establish series is a distinct type of LLC. This structure allows for the creation of separate divisions, or 'series,' within the same legal entity. Each series operates independently and can hold its own assets, liabilities, and operations. This feature offers flexibility and protection for business owners who want to manage multiple ventures under one umbrella.

Yes, a single member LLC can be a series LLC. This means that as the sole owner, you can create multiple series under your LLC without additional members. Each series can function separately, offering liability protection and organizational benefits. This flexibility makes it an attractive option for solo entrepreneurs looking to manage various projects effectively.

A series LLC can be a good idea depending on your business needs. It offers liability protection for each series, meaning risks in one series do not impact the others. This structure also allows for easier management of different ventures under one umbrella, which can simplify administrative tasks. Evaluating your specific situation and consulting with experts can help you determine if a limited liability company with the ability to establish series is right for you.

A limited liability company with the ability to establish series is a business structure that allows you to create multiple divisions or 'series' under a single LLC. Each series can have its own assets, liabilities, and operations, providing flexibility and protection. This structure is beneficial for entrepreneurs managing different projects or investments without needing multiple LLCs. Understanding this concept can help you make informed decisions for your business.

Yes, you can change your LLC to a series LLC. This change requires filing the appropriate forms with your state and updating your operating agreement. It's crucial to ensure compliance with state regulations governing a limited liability company with the ability to establish series. Consider using US Legal Forms to access the relevant paperwork easily.

To make your LLC a series LLC, you first need to check your state laws regarding series LLC formation. Typically, this involves amending your existing operating agreement to include series provisions. You may also need to file specific forms with your state government to recognize your business as a limited liability company with the ability to establish series. Using US Legal Forms can streamline this process, offering templates tailored for your state.