North Carolina Ski

Description

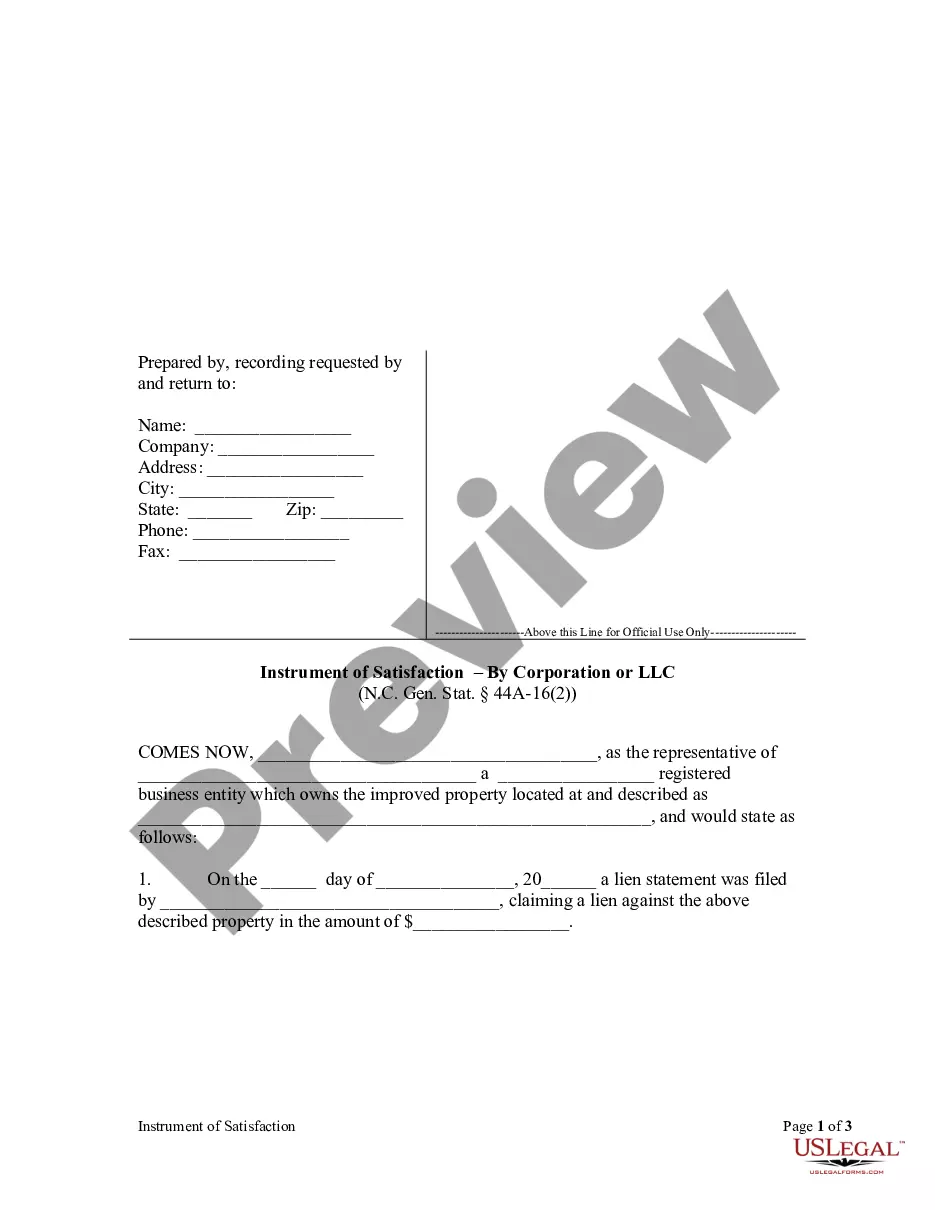

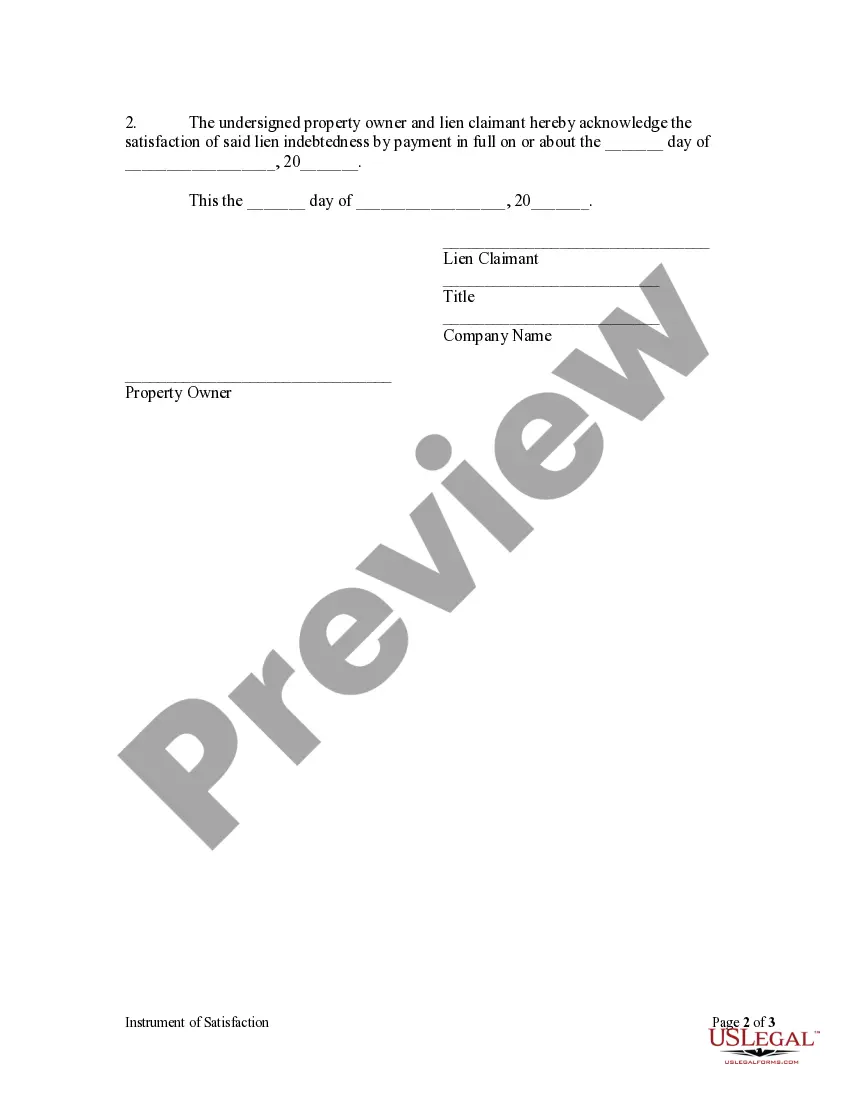

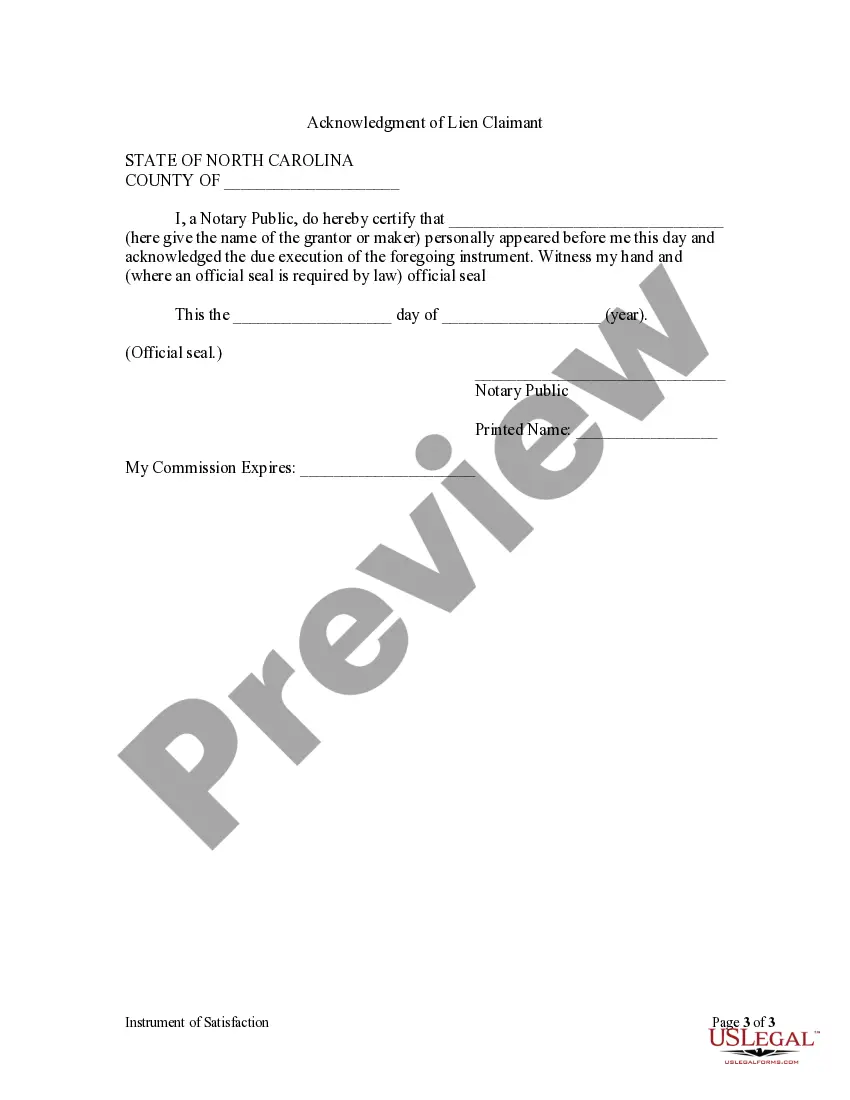

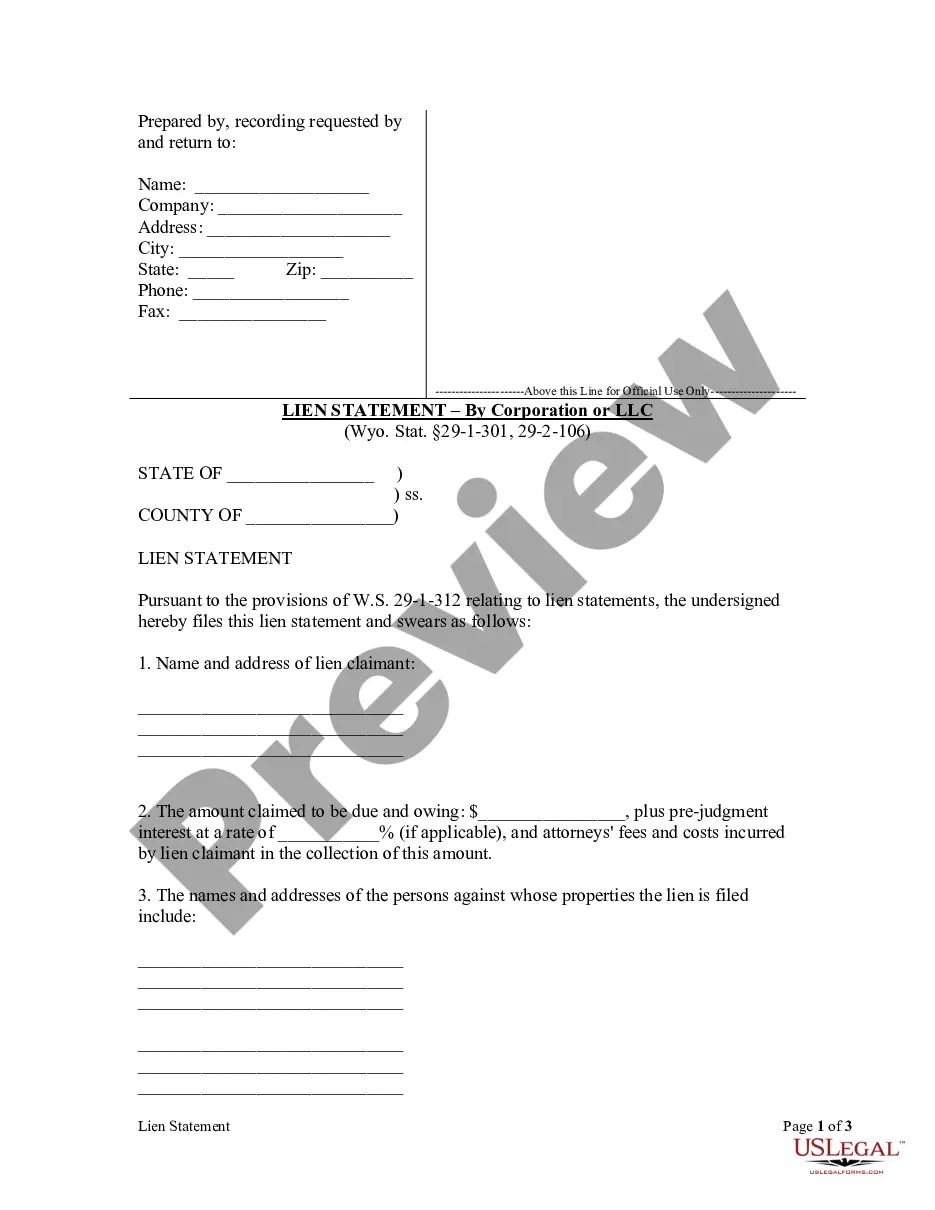

How to fill out North Carolina Instrument Of Satisfaction By Corporation?

- Log in to your account if you're a returning user and check your subscription status. Click the Download button for the required form template.

- If it's your first time, start by exploring the form library. Check the Preview mode to confirm that you’ve selected the right document that meets your needs.

- Utilize the Search tab if you need alternative templates or can't find the right document.

- Proceed to purchase the desired form. After clicking the Buy Now button, choose a subscription plan and create an account if you haven't yet.

- Complete your payment using a credit card or your PayPal account to finalize the purchase.

- Download the form and save it to your device. You can access it anytime in the My Documents section of your profile.

In conclusion, using US Legal Forms streamlines the process of obtaining necessary legal documents in a manner that is efficient and compliant with regulations. By following these simple steps, you can ensure that your paperwork is ready for use.

Start today and unlock the power of legal forms—visit US Legal Forms now!

Form popularity

FAQ

Absolutely, you can file your North Carolina state taxes online. The process is simple, with various online tools to assist you in completing your forms. Online filing helps ensure you meet deadlines and reduces the chance of errors. To make this process even easier, explore the resources available on US Legal Forms.

Yes, you can file your taxes electronically yourself in North Carolina. Many taxpayers prefer this method due to its convenience and the immediate confirmation of submission. If you're looking for a user-friendly way to file, consider using the US Legal Forms platform, which guides you through the process.

Filing requirements for North Carolina depend on your residency status and income level. Residents are required to file if their income exceeds a certain amount, which can change yearly. If you're unsure of your requirements, using US Legal Forms can help clarify your obligations and assist in the filing process.

In North Carolina, businesses must file sales tax returns either monthly, quarterly, or annually, depending on their sales volume. Most small businesses file quarterly, while larger businesses typically file monthly. Staying on top of your sales tax obligations is crucial to avoid penalties. US Legal Forms can provide the forms and information you need to stay compliant.

Yes, direct file is available in North Carolina for certain tax filers. This option allows residents to file their state taxes directly with the state without using a third-party service. Be sure to check eligibility, as it may vary. For those seeking additional support, US Legal Forms offers resources to simplify the process.

Yes, you can file your North Carolina taxes online. The North Carolina Department of Revenue provides several options for electronic filing. This method is not only convenient, but it ensures that your forms are submitted quickly. Utilizing platforms like US Legal Forms can streamline your online filing experience.

No, you cannot register a jet ski in North Carolina without a title. A title proves ownership and is necessary for registration. If you find yourself without a title, consider reaching out to the seller for assistance. US Legal Forms can help you navigate the required documentation.

Yes, North Carolina is now accepting tax returns. This means residents can start filing their state income taxes. Make sure to check for any updates or changes in the tax process this year. To simplify your filing, you can use the US Legal Forms platform for guidance.

The optimal time to go skiing in North Carolina is from late December through early March. During this period, you can enjoy the best snow conditions and the most open trails. Keep an eye on weather forecasts for snow reports, as this can greatly influence your skiing experience. Plan your trip to capture the best of the North Carolina ski season.

Absolutely, North Carolina has noteworthy skiing opportunities. The state features picturesque mountains and several ski resorts that cater to various skill levels, making it a great destination for skiing enthusiasts. Whether you are a beginner or an expert, you will find terrain that suits your needs, ensuring an exciting adventure on the slopes.