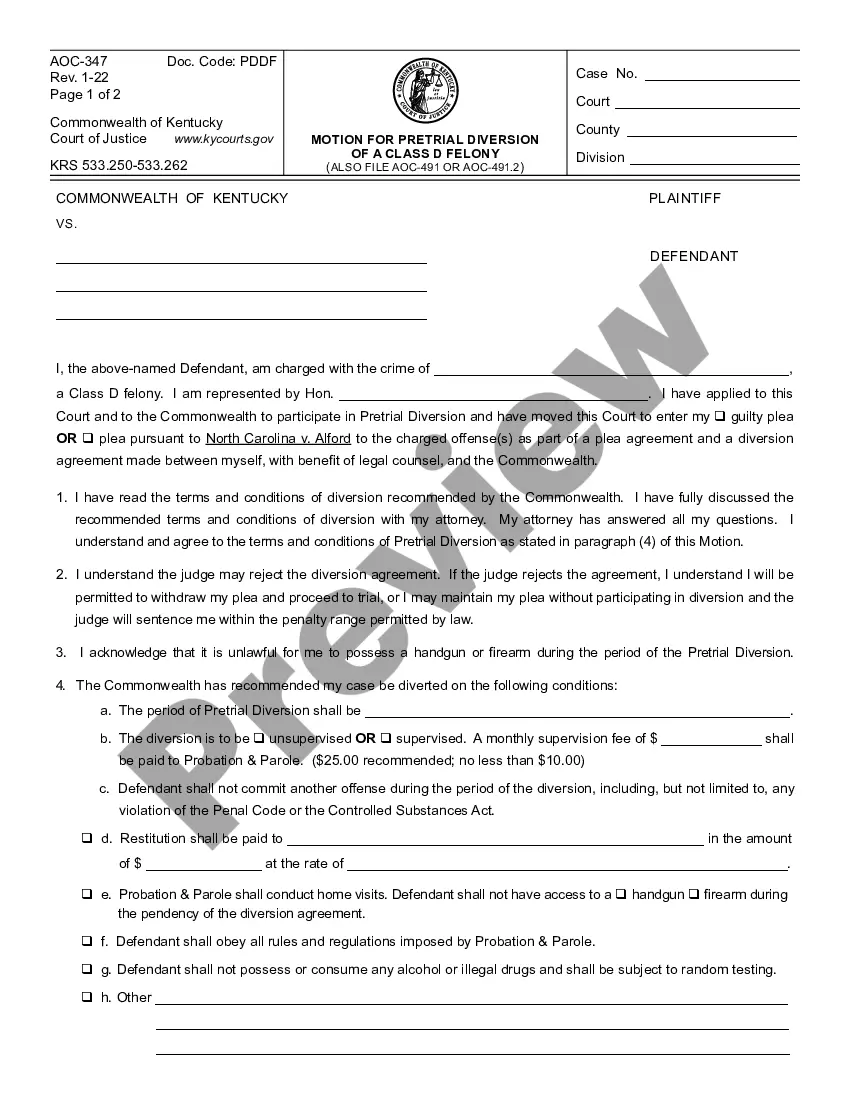

North Carolina Corporation Withholding

Description

How to fill out North Carolina Business Incorporation Package To Incorporate Corporation?

The North Carolina Corporation Withholding displayed on this page is a versatile legal template created by experienced attorneys in line with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 validated, state-specific documents for any business and personal needs. It’s the fastest, easiest, and most reliable method to acquire the forms you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Register with US Legal Forms to have authorized legal templates for all of life's circumstances readily available.

- Search for the document you need and review it.

- Browse through the file you sought and preview it or examine the form description to confirm it fits your requirements. If it doesn't, use the search feature to locate the appropriate one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card for quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

- Select the format you wish for your North Carolina Corporation Withholding (PDF, DOCX, RTF) and save the sample to your device.

- Fill out and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Download your documentation again.

- Utilize the same document whenever necessary. Access the My documents section in your profile to redownload any forms previously downloaded.

Form popularity

FAQ

If the tenancy agreement is silent on this matter, or there is a statutory periodic tenancy, the landlord should give the tenant at least 2 months' written notice of their intention to repossess the property. This is also known as Section 21 Notice.

Tenants may only be able to break a lease without any legal consequences if they meet one of the conditions we'll mention below. Early Termination Clause. Uninhabitable Rental Property. Active Military Duty. Harassment or Privacy Violation.

Ending your tenancy? Duration of TenancyNotice PeriodLess than 6 months28 daysNot less than 6 months but less than 1 year35 daysMore than 1 year but less than 2 years42 daysMore than 2 years but less than 4 years56 days2 more rows

Early Termination Clauses This is normally equivalent of two months rent. Usually, the other condition is that the tenant provide an ample notice prior to moving out. Often, this ranges between a month's- and two months' notice.

You can help the situation a lot by providing as much notice as possible and writing a sincere letter to your landlord explaining why you need to leave early. Ideally you can offer your landlord a qualified replacement tenant, someone with good credit and excellent references, to sign a new lease with your landlord.

How to Write a Letter of Notice to a Tenant Determine the notice period. Before you start writing the notice letter, you first have to determine the notice period. ... Indicate the date of issuance. ... Write complete addresses. ... Write salutation. ... Begin with an introduction. ... Provide more details in the body. ... Conclude the letter.

For a fixed-term lease, the lease terminates automatically at the end of the term unless the landlord or the tenant gives proper notice. The notice period must be at least equal to the interval between rent payments, but not less than 30 days or more than 60 days.

You cannot be forced out of your rental home. You cannot be evicted without notice. The landlord cannot change the locks or shut off your utilities to make you leave. Most of the time, a landlord needs to go to court before evicting you.

Sample Letter One Dear [Landlord], This letter is my written notice of termination of my current lease agreement. This letter meets the [number of days] notice requirement per the lease. As stated in the lease, the end date of this lease agreement is [month, day, year].

A termination clause contains language that could lead to an early end to the swap contract if either party experiences specific, predetermined events or changes in its financial status, or if other specific events outside the party's control will change its ability to legally maintain the contract.