North Carolina Inspection Checklist For Drivers License

Description

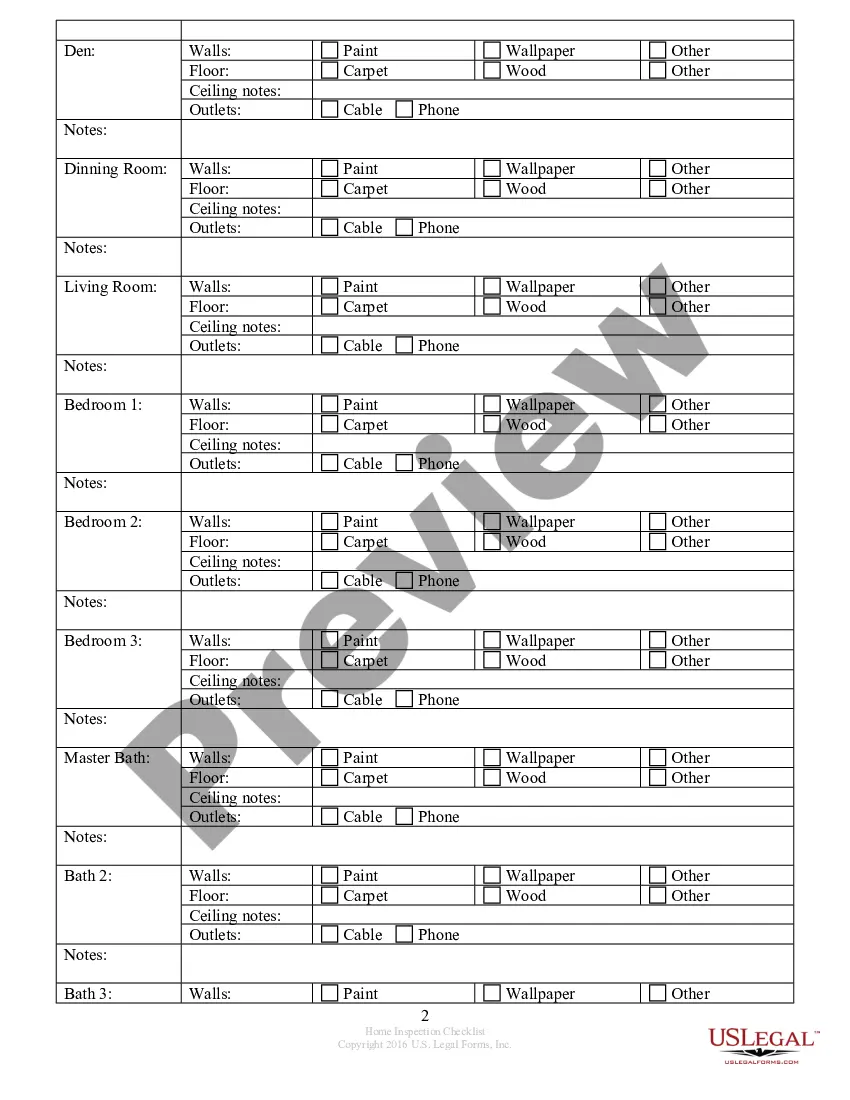

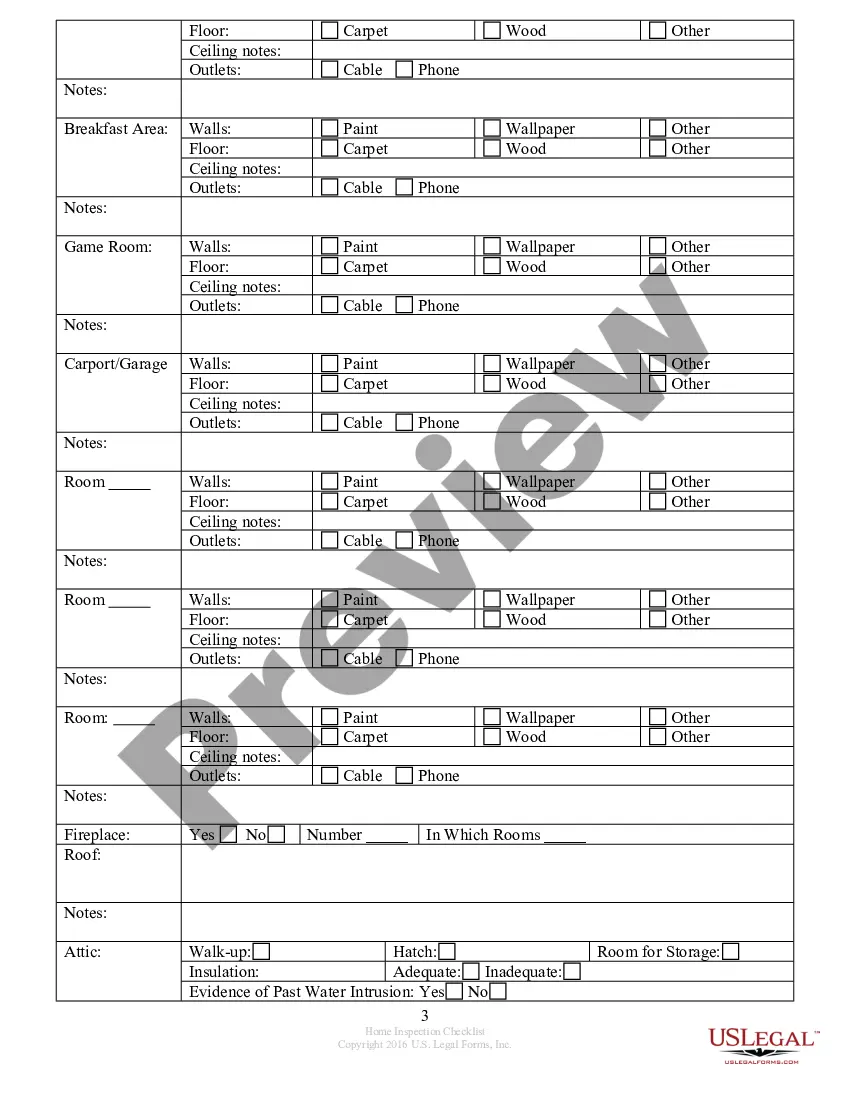

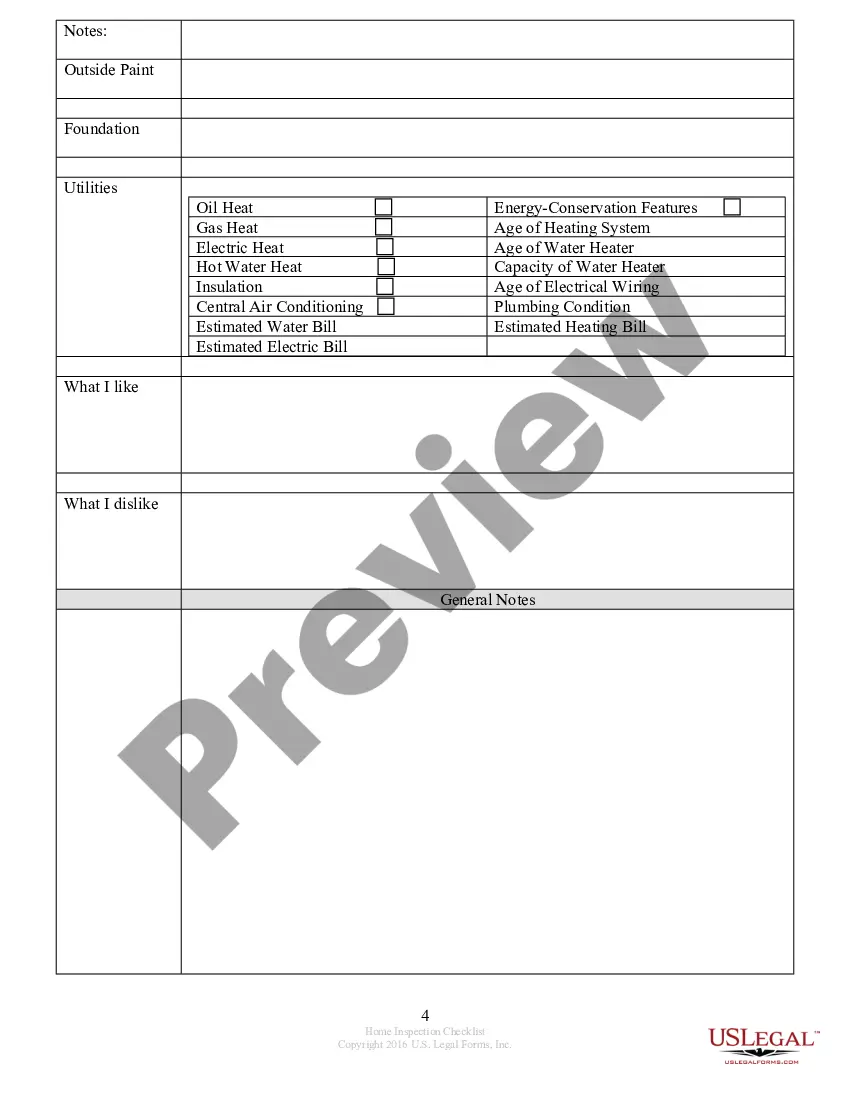

How to fill out North Carolina Buyer's Home Inspection Checklist?

Whether for commercial reasons or personal issues, everyone eventually has to navigate legal circumstances at some point in their lives.

Completing legal documents requires meticulous care, beginning with selecting the appropriate form template. For instance, if you choose an incorrect version of the North Carolina Inspection Checklist For Drivers License, it will be rejected upon submission.

With a vast catalog from US Legal Forms available, you do not need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate template for any situation.

- Obtain the template you require using the search box or catalog navigation.

- Review the form’s details to ensure it corresponds with your circumstances, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search feature to find the North Carolina Inspection Checklist For Drivers License example you need.

- Acquire the template when it fits your requirements.

- If you already have a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the file format you desire and download the North Carolina Inspection Checklist For Drivers License.

- Once saved, you can fill out the form using editing software or print it for manual completion.

Form popularity

FAQ

You may determine if you need to pay estimated tax to North Dakota using Form ND-1ES Estimated Income Tax ? Individuals. If you are required to pay estimated income tax to North Dakota, and fail to pay at least the required minimum amount, you will be charged interest on any underpayment.

A North Dakota tax power of attorney (Form 500), otherwise known as the ?Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,? is used to designate a person as a representative of your interests in tax matters before the concerned tax authority.

The Form 306, North Dakota Income Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return. Form 306 and the tax due on it must be submitted electronically if the amount withheld during the previous calendar year was $1,000 or more.

North Dakota considers a seller to have physical nexus if you have any of the following in the state: A temporary or permanent office or place of business. An employee or agent. Leasing or renting tangible personal property.

If you are not required to file electronically, complete Form 306 ? Income Tax Withholding Return. Form 306 ? Income Tax Withholding Return must be filed even if an employer did not pay any wages during the period covered by the return.

Some goods are exempt from sales tax under North Dakota law. Examples include most non-prepared food items, food stamps, prescription medications, and medical supplies.

State Sales Tax ? The North Dakota sales tax rate is 5% for most retail sales. Gross receipts tax is applied to sales of: Alcohol at 7% New farm machinery used exclusively for agriculture production at 3%

Form 307 - North Dakota Transmittal of Wage and Tax Statement 2022.