North Carolina Deed In Lieu Of Foreclosure Form

Description

How to fill out North Carolina Deed In Lieu Of Foreclosure Form?

There is no longer a requirement to squander time looking for legal documents to comply with your local state statutes. US Legal Forms has consolidated all of them in a single location and enhanced their availability.

Our website offers over 85,000 templates for any business and personal legal situations organized by state and area of application. All documents are expertly crafted and validated for accuracy, allowing you to trust that you are getting a current North Carolina Deed In Lieu Of Foreclosure Form.

If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all previously obtained documents whenever necessary by navigating to the My documents section in your profile.

Print your form to fill it out manually or upload the sample if you prefer working with an online editor. Crafting legal documents under federal and state regulations is quick and simple with our platform. Experience US Legal Forms today to keep your documentation organized!

- If you have not interacted with our platform before, additional steps will be required to complete the process.

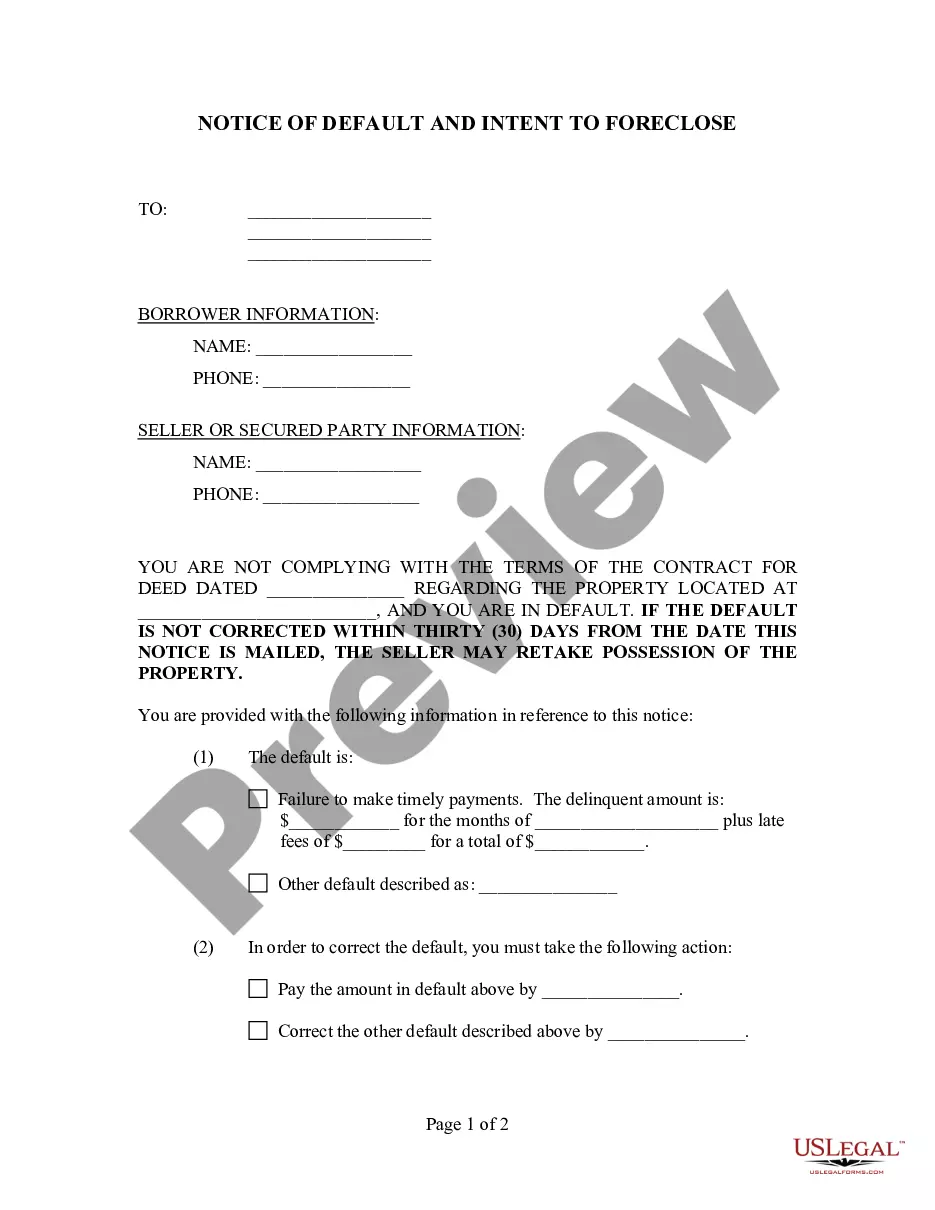

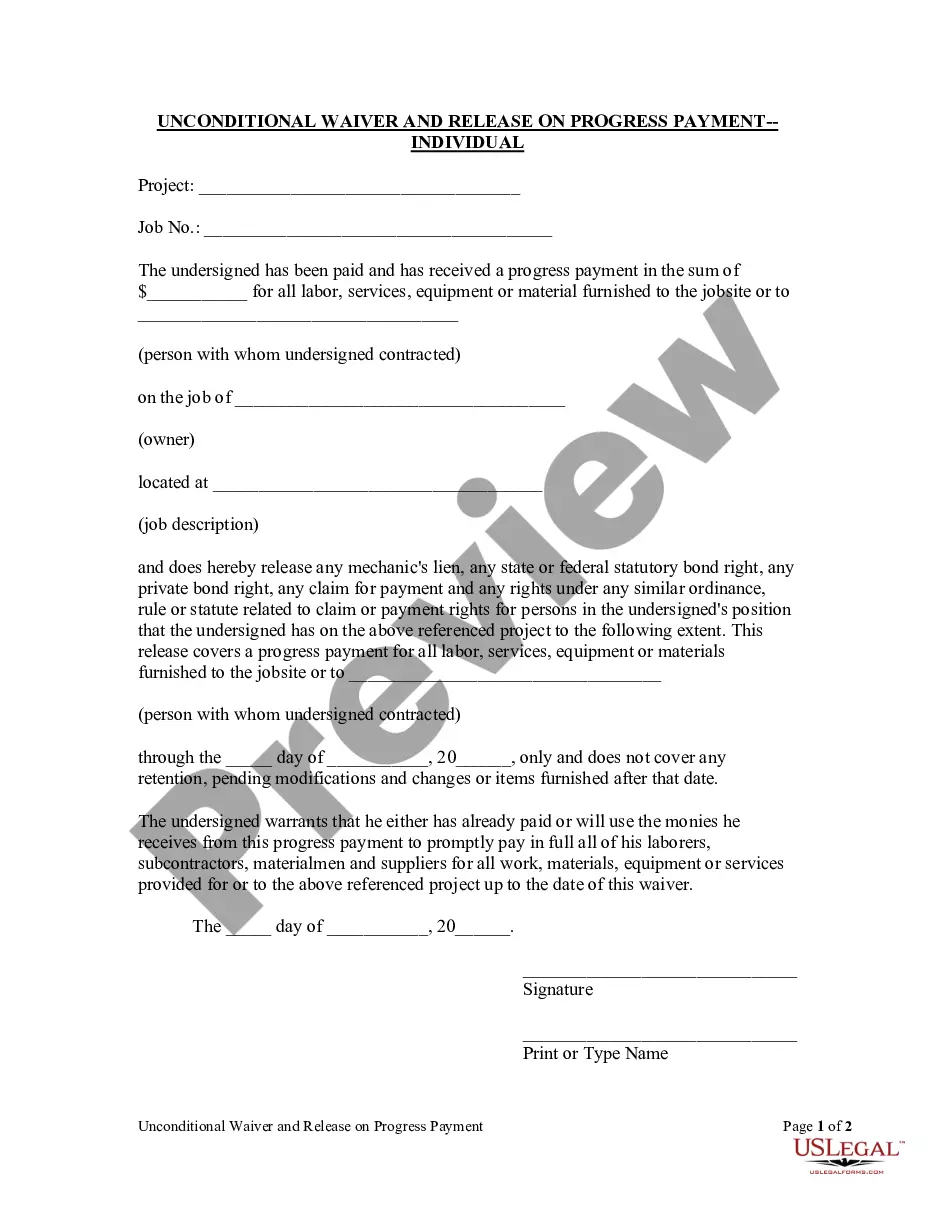

- Carefully read the page content to ensure it includes the sample you need.

- To achieve this, utilize the form description and preview options if available.

- Use the Search field above to find another template if the current one is not suitable.

- Click Buy Now next to the template title once you locate the right one.

- Select the most appropriate subscription plan and either register for an account or Log In.

- Complete the payment for your subscription using a credit card or via PayPal to proceed.

- Choose the file format for your North Carolina Deed In Lieu Of Foreclosure Form and download it to your device.

Form popularity

FAQ

To fill out a quit claim deed in North Carolina, start by entering the names of the grantor and grantee, followed by a clear description of the property. Next, include the date of the transfer and ensure that both parties sign the document. For those unfamiliar with the process, utilizing a North Carolina deed in lieu of foreclosure form from UsLegalForms provides an easy, step-by-step guide that ensures all necessary information is captured.

While it is not legally required to have an attorney when executing a quit claim deed in North Carolina, it is highly recommended. An attorney can guide you through the process and help you understand the implications of transferring property. You may also refer to the North Carolina deed in lieu of foreclosure form on UsLegalForms for a structured way to document the transfer.

The foreclosure process in North Carolina typically takes around 90 to 120 days, depending on various factors such as court schedules and homeowner actions. During this time, homeowners may explore alternatives like a North Carolina deed in lieu of foreclosure form. Understanding the timeline can help you make informed decisions about your property and financial status.

Filling out a North Carolina quit claim deed requires you to provide essential information like the names of the parties involved, a description of the property, and the date of the transfer. You must ensure all fields are accurately completed to avoid legal issues later. For detailed assistance, consider using the North Carolina deed in lieu of foreclosure form available on UsLegalForms, which simplifies the process.

In North Carolina, a quit claim deed cannot be reversed once it has been executed. This type of deed transfers ownership rights without any warranty, leaving the grantee with the title as given. Therefore, if you are considering a North Carolina deed in lieu of foreclosure form, it is crucial to understand that the transaction is generally irreversible and may affect your property rights.

The biggest disadvantage for a lender regarding a deed in lieu of foreclosure is the potential loss of property value. When a lender accepts a North Carolina deed in lieu of foreclosure form, they may inherit a property that has decreased in worth, particularly if it requires significant repairs. Furthermore, lenders face the risk of legal complications if the property has other liens or claims against it. Understanding these risks is essential for lenders to make informed decisions.

A deed in lieu of foreclosure in North Carolina is a legal agreement where a homeowner voluntarily transfers their property title back to the lender to avoid foreclosure. This process often provides a quicker way for homeowners to handle distress and often entails less financial burden compared to a lengthy foreclosure. It can also help preserve the homeowner’s credit score compared to other more damaging foreclosure options. Understanding this option may guide you toward a more manageable solution for your situation.

You can obtain a blank North Carolina deed in lieu of foreclosure form through various legal service websites, including UsLegalForms. This platform offers easy access to downloadable forms and ensures they meet state requirements. Additionally, you might find these forms available at local law offices or online legal document providers. Always ensure that the form you choose is specifically tailored for North Carolina.

The foreclosure process in North Carolina includes several steps. First, the lender files a Notice of Default after a borrower misses payments. Then, after 20 days, the lender can begin the foreclosure schedule, which includes a public sale of the property. Homeowners should remain proactive and consider alternatives like the North Carolina deed in lieu of foreclosure form to potentially mitigate the negative effects of foreclosure.

The 120-day rule refers to the federal requirement that a lender must wait 120 days after a borrower misses their first payment to begin foreclosure proceedings. This timeline gives homeowners an opportunity to work out alternatives, such as the North Carolina deed in lieu of foreclosure form. Taking advantage of this period can be crucial for those seeking to avoid foreclosure. Always consider exploring your options before reaching this stage.