Breach Of Promissory Note With Solution

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

What is the most reliable service to obtain the Breach Of Promissory Note With Solution and other current versions of legal documents? US Legal Forms is the answer!

It boasts the largest assortment of legal forms for any application. Each template is expertly crafted and validated for adherence to federal and local laws and regulations.

Form compliance check. Before obtaining any template, ensure it meets your use case requirements and complies with your state or county's rules. Review the form description and use the Preview option if available.

- They are organized by field and state of use, making it simple to find what you need.

- Experienced users of the site just need to Log In, verify if their subscription is active, and click the Download button next to the Breach Of Promissory Note With Solution to access it.

- Once saved, the template is accessible for future use within the My documents section of your account.

- If you don't already have an account with our library, here are the steps you should follow to create one.

Form popularity

FAQ

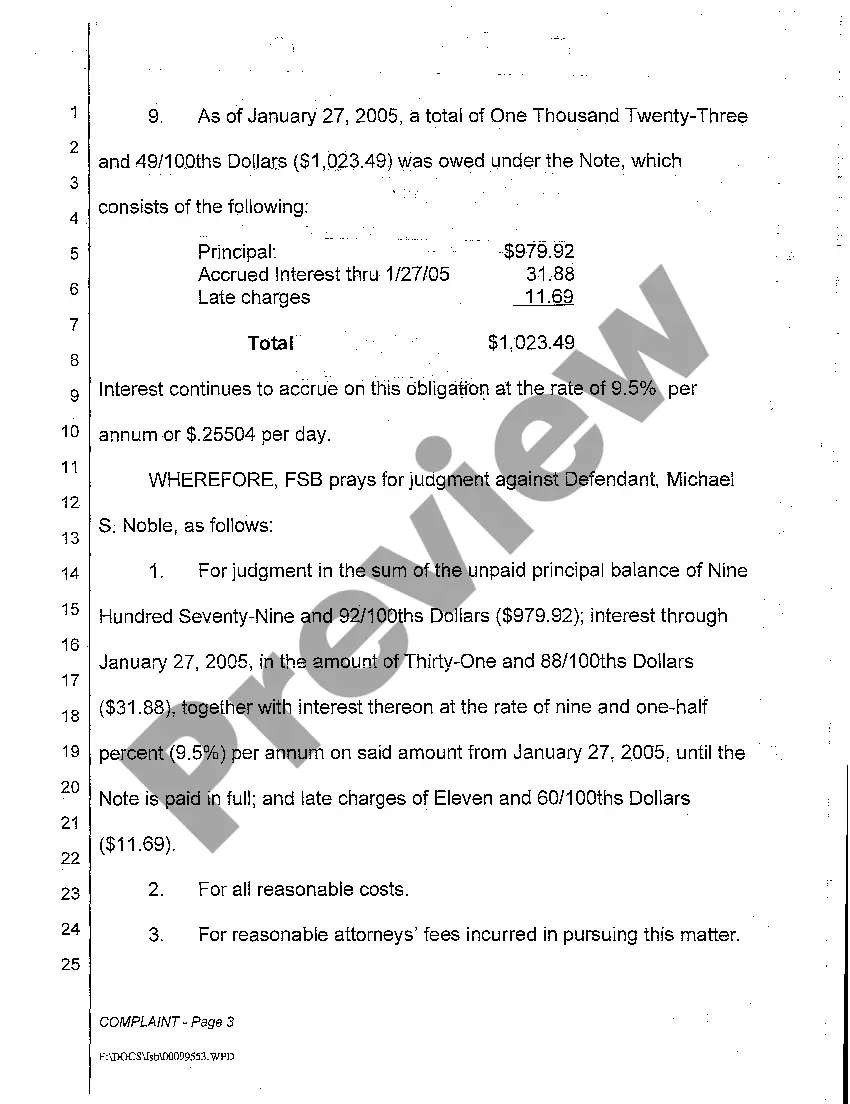

Multiply 750 by 0.75 to equal 562.50. Likewise, for a daily time period, multiply the product by the ratio of days to years. For example, for a 90-day promissory note, divide 90 by 365 (the number of days in a year) to equal 0.25. Multiply 750 by 0.25 to equal 187.50.

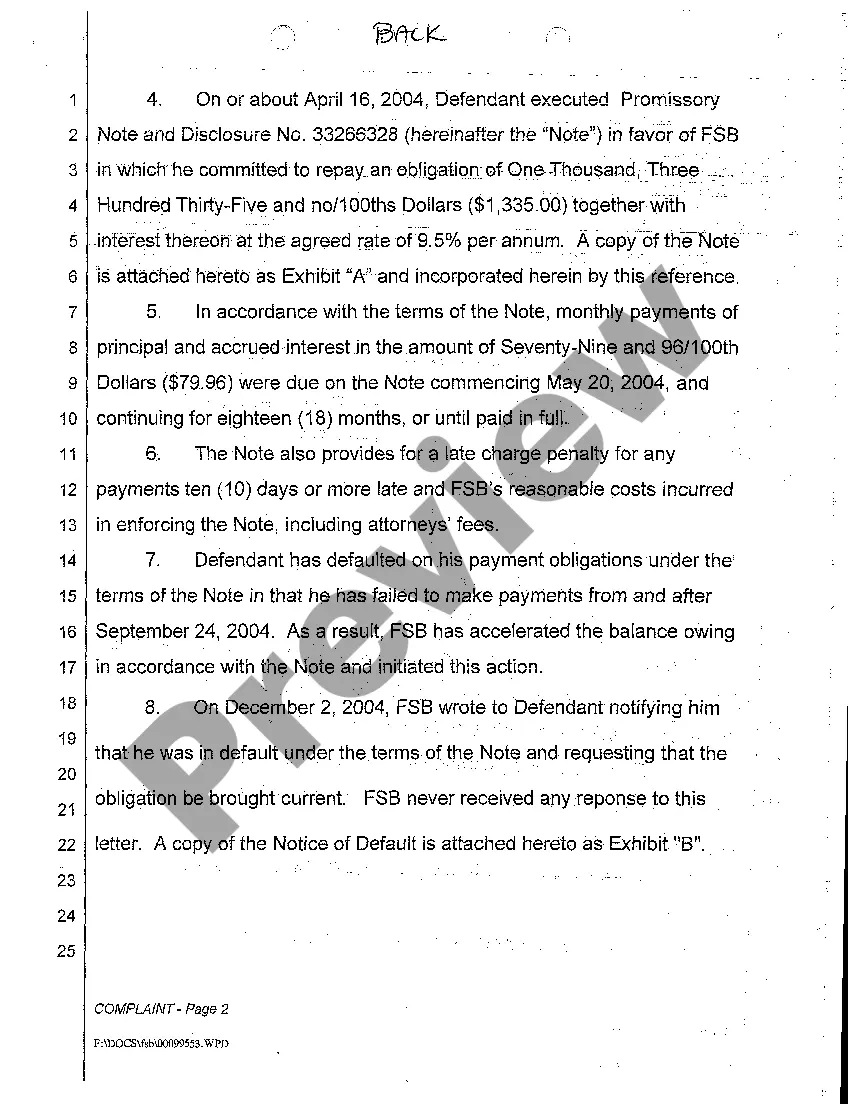

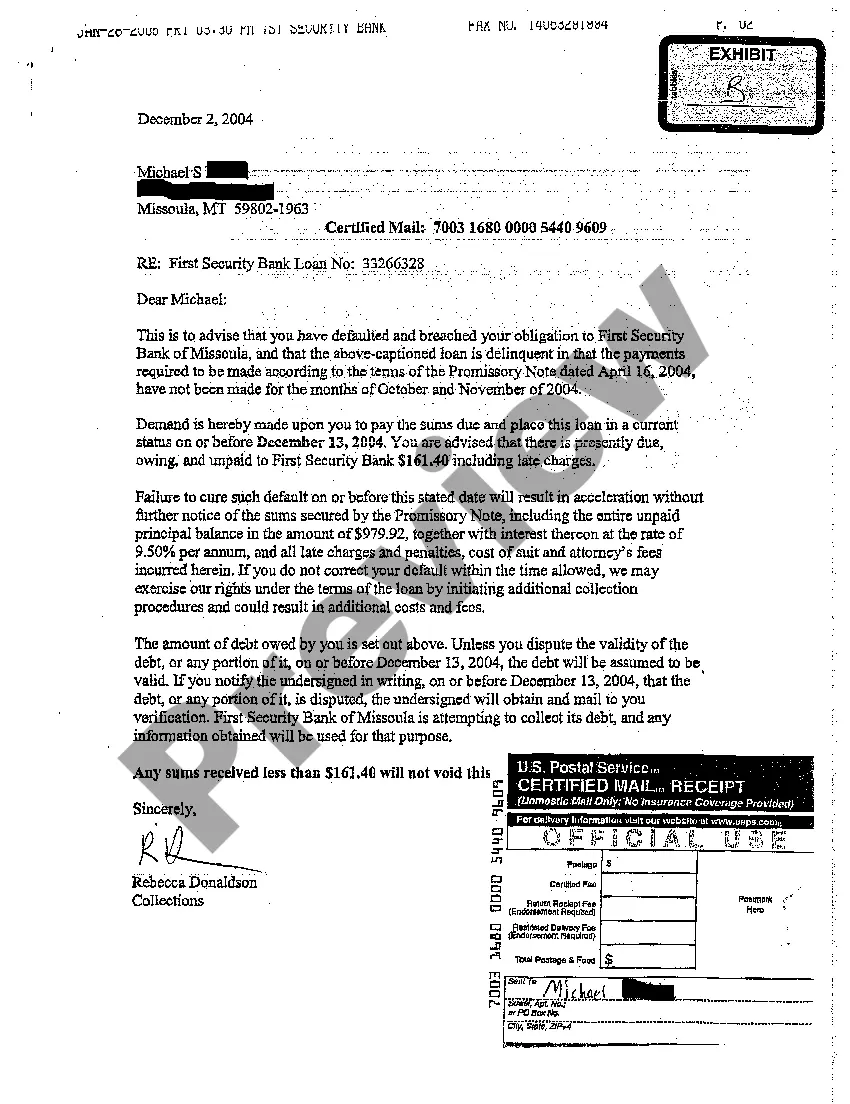

A promissory note is breached when payment due, or properly demanded as per the terms of the note, is not received. If you want to enforce a breached promissory note, you must follow the terms agreed upon when making demands for payment.

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral. If the loan is not secured, the lender may seek legal restitution in court. They may obtain a judgment against the borrower in default.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.