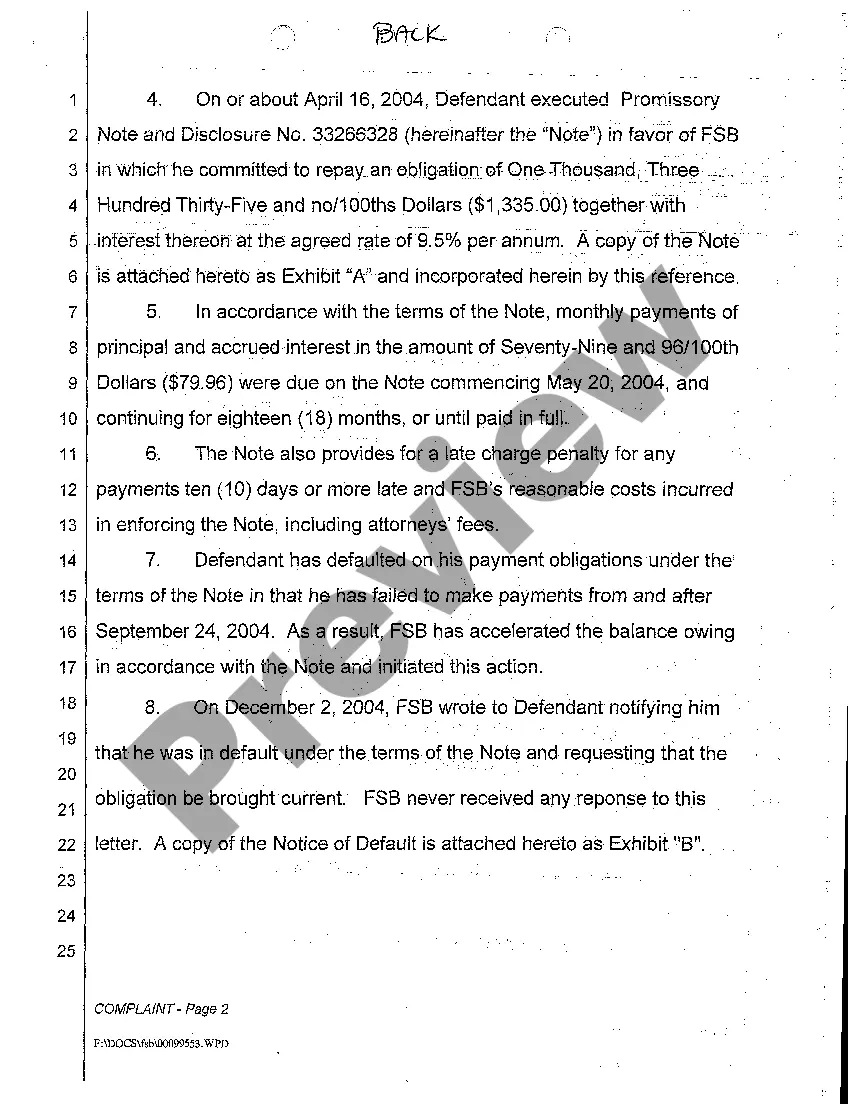

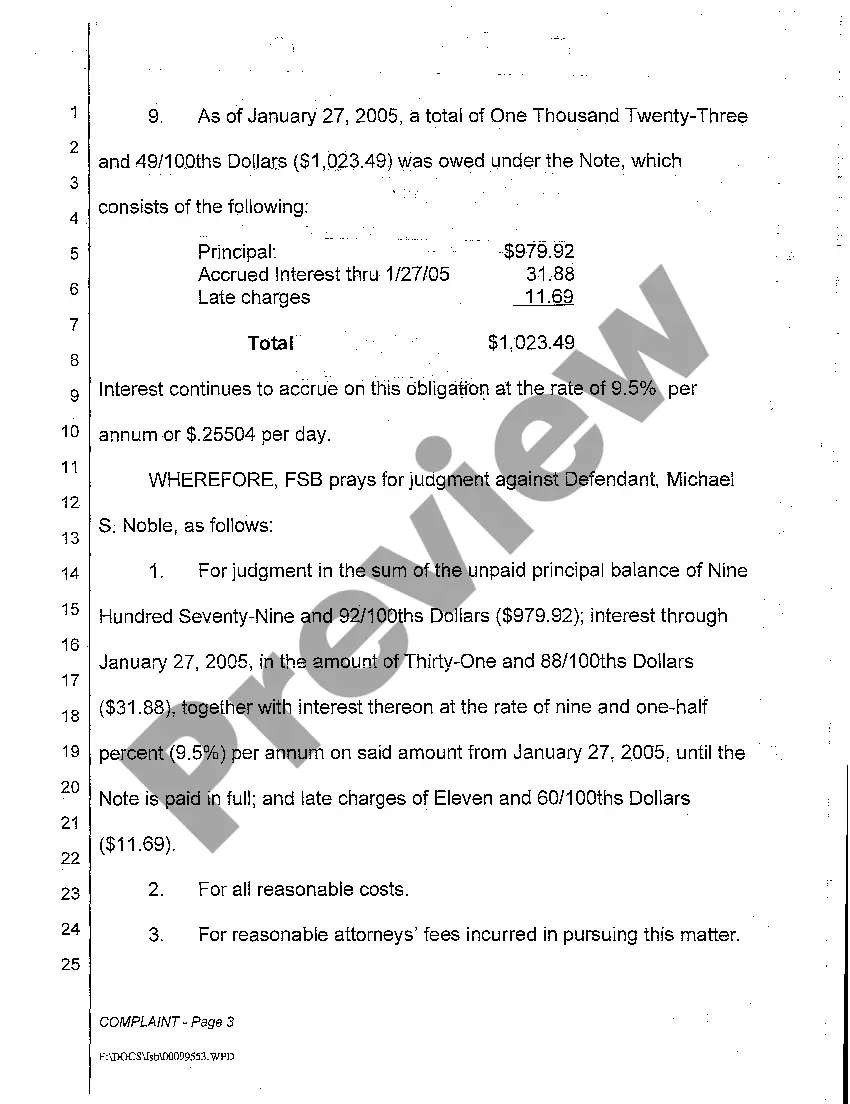

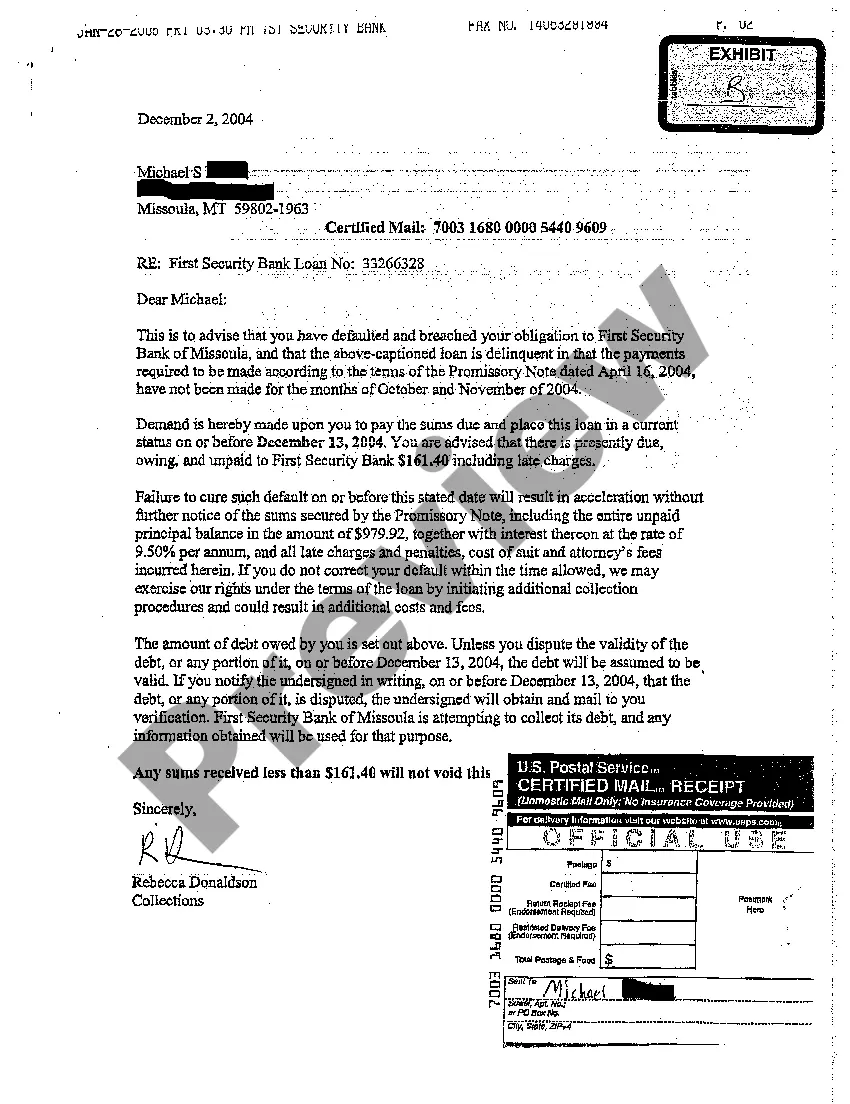

Breach Of Promissory Note With Chattel Mortgage

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

Red tape necessitates exactness and correctness.

If you do not handle the completion of documentation like Breach Of Promissory Note With Chattel Mortgage regularly, it may lead to some misunderstanding.

Choosing the correct template from the outset will ensure that your document submission proceeds smoothly and avert any troubles from re-sending a file or starting the same task entirely from zero.

If you are not a subscribed user, locating the needed template would require a few extra steps.

- You can always acquire the right template for your documentation at US Legal Forms.

- US Legal Forms is the largest digital forms repository that hosts over 85 thousand templates for various fields.

- You can obtain the latest and most suitable edition of the Breach Of Promissory Note With Chattel Mortgage by simply navigating through the site.

- Discover, store, and save templates in your profile or consult the description to confirm you have the correct one available.

- With a user account at US Legal Forms, you can conveniently gather, keep in one place, and browse the templates you save for easy access.

- When visiting the site, click the Log In button to authenticate.

- Next, go to the My documents page, where your form history is maintained.

- Review the form descriptions and save the ones you need at any time.

Form popularity

FAQ

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Not signed by the borrowerIn order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized.