This form is an official Montana form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Montana Application For Certificate Of Authority Of Foreign Corporation

Description

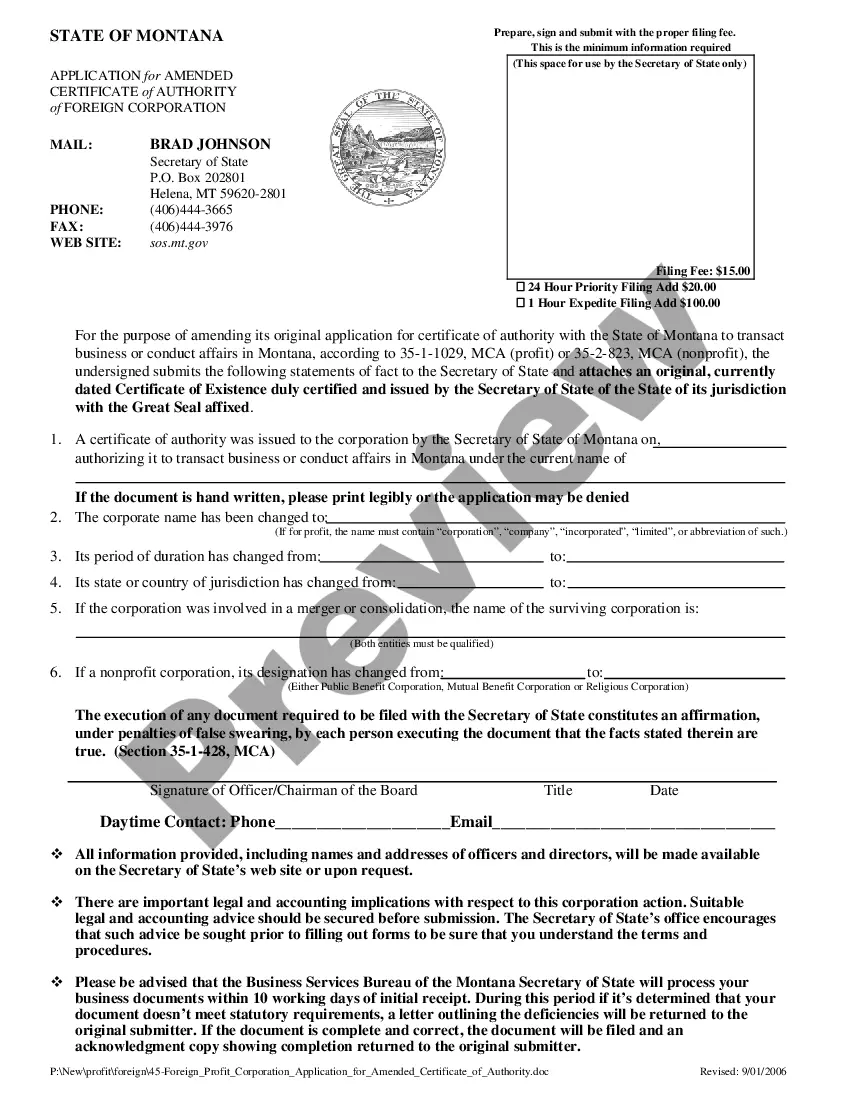

How to fill out Montana Application For Certificate Of Authority Of Foreign Corporation?

Precisely composed formal documents are one of the crucial assurances to prevent complications and legal disputes, but obtaining them without legal counsel can be time-consuming.

Whether you require an immediate access to the current Montana Application For Certificate Of Authority Of Foreign Corporation or any other forms related to employment, family, or business matters, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, simply Log In to your account and click on the Download button beside the chosen document. Furthermore, you can retrieve the Montana Application For Certificate Of Authority Of Foreign Corporation at any time, as all documents previously obtained on the platform remain accessible in the My documents section of your profile. Conserve time and money in preparing official documents. Experience US Legal Forms today!

- Ensure the form aligns with your situation and locality by reviewing the description and preview.

- Search for additional examples (if necessary) using the Search bar located in the page header.

- Hit Buy Now once you locate the suitable template.

- Choose the pricing option, Log In to your account or set up a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Montana Application For Certificate Of Authority Of Foreign Corporation.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

A foreign corporation must file an application for certificate of authority with the secretary of state in Texas before it can legally conduct business there. This document verifies that your Montana application for certificate of authority of foreign corporation is complete and compliant with state regulations. It is essential to understand the specific requirements for this application to avoid unnecessary delays or complications. Using a platform like USLegalForms can streamline the process, ensuring that you have all the necessary forms and guidance at your fingertips.

To form a corporation in Montana, start by choosing a unique and suitable name for your business. Next, file the Articles of Incorporation with the state, which includes essential details about your corporation. If your business is a foreign corporation seeking to operate in Montana, it will require a Montana application for a certificate of authority of foreign corporation. This ensures that you are legally recognized to conduct business in the state.

To register for a DBA in Montana, choose your business name and verify its availability. After confirming that the name is unique, complete the relevant registration forms and submit them to your local county clerk's office. If you are a foreign corporation, ensure to also file a Montana application for a certificate of authority of foreign corporation, which will allow you to operate legally.

Setting up a sole proprietorship in Montana is straightforward. Start by choosing a name for your business and check its availability. You do not need to register your business name unless you plan to operate under a DBA. However, if you are a foreign corporation wanting to operate as a sole proprietorship, it is advisable to file a Montana application for a certificate of authority of foreign corporation to comply with local regulations.

To file for a DBA in Montana, begin by choosing a unique business name. Next, you need to check its availability to avoid any conflicts. You will then fill out the necessary forms and submit them to your local county clerk's office. If your business is a foreign corporation, you might also need to file a Montana application for a certificate of authority of foreign corporation, depending on the nature of your operations.

Yes, a foreign corporation must register in Illinois if it intends to conduct business there. This process ensures compliance with local laws and regulations. You will need to file for a certificate of authority, which may involve submitting a Montana application for a certificate of authority of foreign corporation. This step is crucial for maintaining legal standing and protecting your business interests.

To legally write a DBA, or 'Doing Business As,' you should start by choosing a name that reflects your business's identity. After selecting your preferred name, check for its availability within Montana to ensure that it does not conflict with existing businesses. You then need to prepare and file the appropriate paperwork with the state or local authorities, which may involve submitting a Montana application for a certificate of authority of foreign corporation if your business operates under a different name.

To register a foreign LLC in Montana, start by visiting the Secretary of State's website to access the application form. Fill it out with the required details about your out-of-state LLC and submit it along with the applicable fees. Also, it would be beneficial to include a Certificate of Good Standing from your home state. This process is crucial for compliance and allows you to formally conduct business in Montana through the Montana application for certificate of authority of foreign corporation.

In Montana, to obtain Articles of Organization for your business, you will need to file them with the Secretary of State. This document serves as the official creation of your LLC. You can file online or submit a paper form along with the necessary filing fees. If you are entering Montana as a foreign corporation, ensure that you look into the Montana application for certificate of authority of foreign corporation to comply with state laws.

No, you do not need an LLC to start a corporation. These are distinct business entities with different regulatory requirements. You can directly establish a corporation in Montana without first forming an LLC. If your business is a foreign corporation, you'll need to submit a Montana application for certificate of authority of foreign corporation to operate legally in the state.